Altcoin Newsletter #200

Features SOL INJ ONDO OP SUI DOGE

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Solana (SOL)

- Injective (INJ)

- Ondo (ONDO)

- Optimism (OP)

- Sui (SUI)

- Dogecoin (DOGE)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

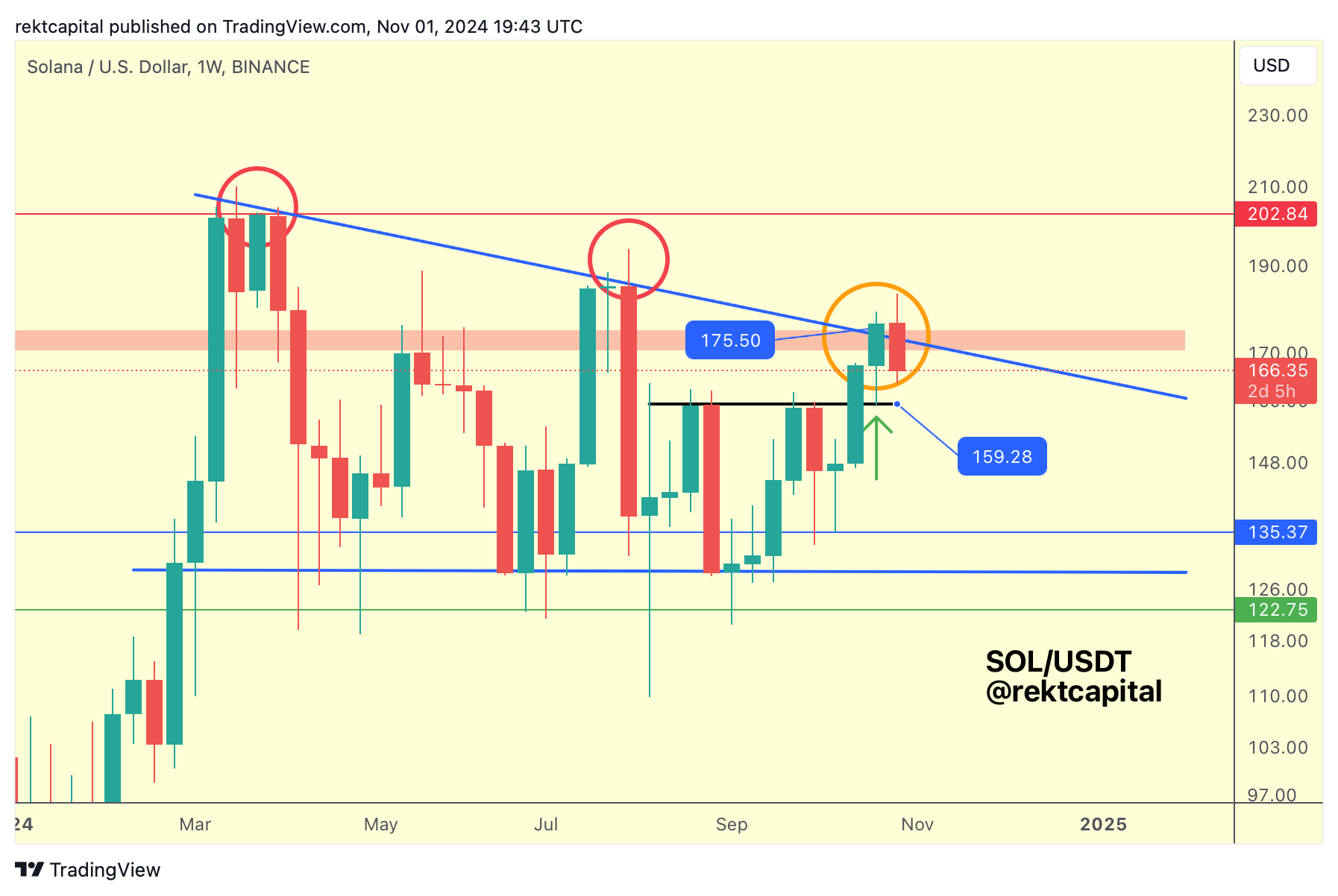

Solana - SOL/USDT

The blue diagonal trendline resistance has been a point of rejection for Solana over these past several months.

Every time price would revisit the blue diagonal, SOL would upside wicked beyond it but ultimately Weekly Close below it and reject from there.

However, on this recent run up, SOL actually Weekly Closed above the blue diagonal resistance, technically positioning price for a post-breakout retest of that area.

However, SOL has retraced much deeper on this pullback, going below the blue diagonal trendline itself.

The question is - is this current retrace a volatile retest of the confluent area of old resistance that is the blue diagonal trendline and red box region?

Or was the Weekly Close above said area a fake-breakout?

We'll know the answer after the weekend because if SOL Weekly Closes above the blue diagonal and red area, then it will have been a volatile retest.

Conversely, Weekly Close just like this could set price up for a pullback right into $159 (black) again.

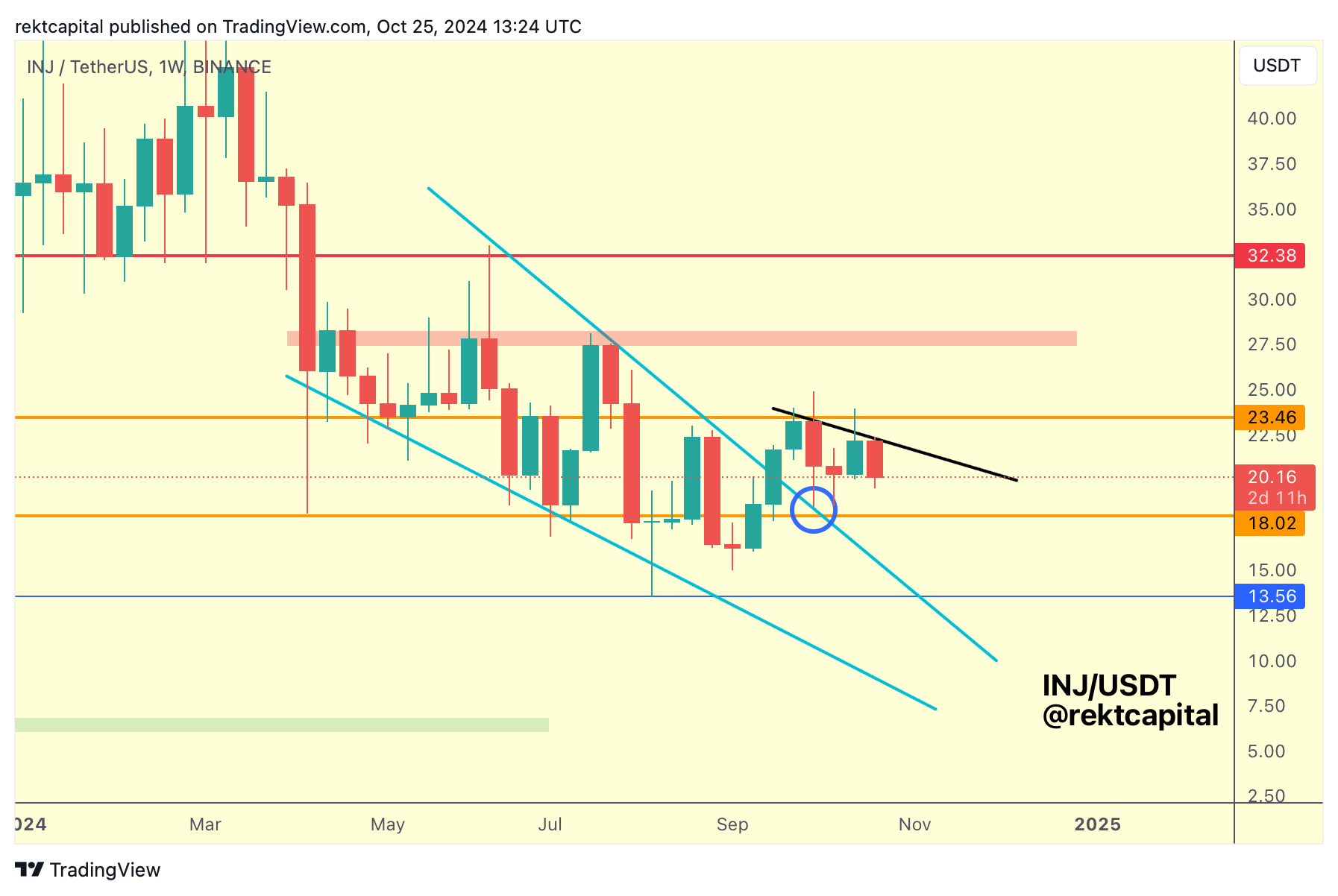

Injective - INJ/USDT

In last week's Altcoin Newsletter, we spoke about how INJ may continue its consolidation inside the orange-orange range, which could spell downside into the Range Low:

And this was because INJ wasn't yet close to its RSI Higher Low, which would potentially get tagged at a price bottom:

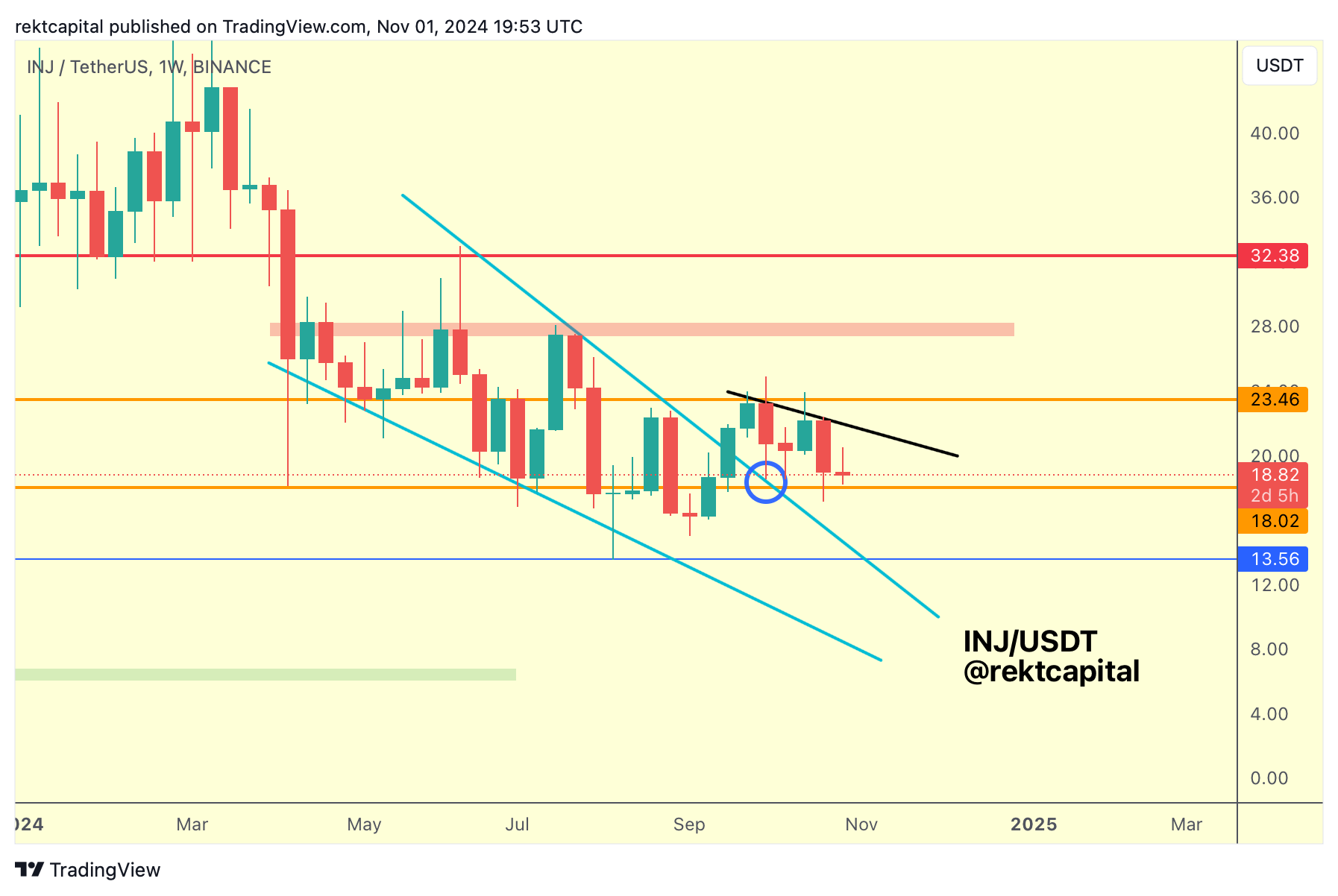

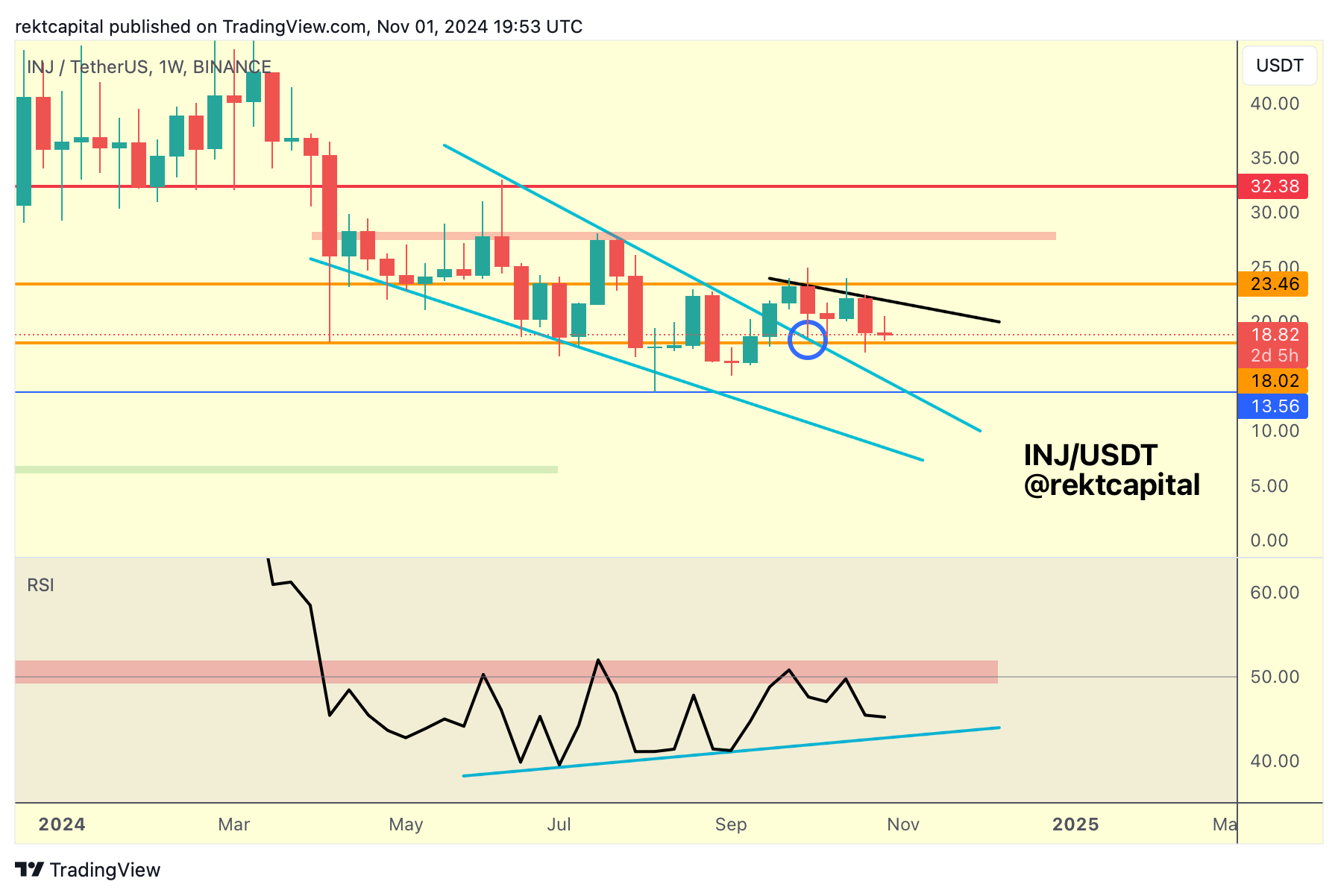

Here's today's update:

First of all, INJ indeed pulled back more, dropping into the Range Low (orange, $18.02).

However, the RSI is still nowhere close to the Higher Low:

Does the INJ RSI need to drop into the Higher Low?

Over the past months, dropping into the RSI Higher Low has preceded local bottoms and/or price reversals to the upside.

So the closer the INJ RSI is to the Higher Low, the greater the chance of a local bottom developing.

In this case, the INJ price action needs to Weekly Close above the Range Low of $18.02 (orange) to maintain its range and if INJ can continue maintaining stability above this level while the RSI drops into the Higher Low, then maybe price doesn't need to drop in tandem and lose the current range.

But once INJ Weekly Closes below the Range Low and turns it into new resistance, then additional downside could take place until that RSI Higher Low is tagged.