Altcoin Newsletter #199

Features SOL INJ RUNE MOV BEPRO RENDER

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Solana (SOL)

- Injective (INJ)

- Thorchain (RUNE)

- Moonriver (MOVR)

- Bepro (BEPRO)

- Render (RENDER)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

Solana - SOL/USDT

Solana has been consolidating inside this macro triangular market structure (blue) for several months now.

Right now, SOL has revisited the blue diagonal trendline (which represents the top of this pattern) and this is a confluent resistance with the red box.

Generally, SOL needs to Weekly Close above this confluent resistance to enable a breakout to $202 (red).

After all, SOL has rejected at this blue diagonal resistance on two separate occasions dating back to mid-March.

Given how SOL has revisited this diagonal for the third time, there is scope for rejection from here, especially since there is confluent resistance here.

However, this rejection will likely result in a shallower retrace to demonstrate that the resistance is weakening as a point of rejection.

Of course, if SOL were to Weekly Close above the blue diagonal, then price wouldn't need a rejection and instead SOL would position itself for a breakout to $202 by first retesting the red boxed region as support.

The upcoming Weekly Close will be important but at the moment, price faces stiff resistance which could reject price into the black level for a retest of $159.

Injective - INJ/USDT

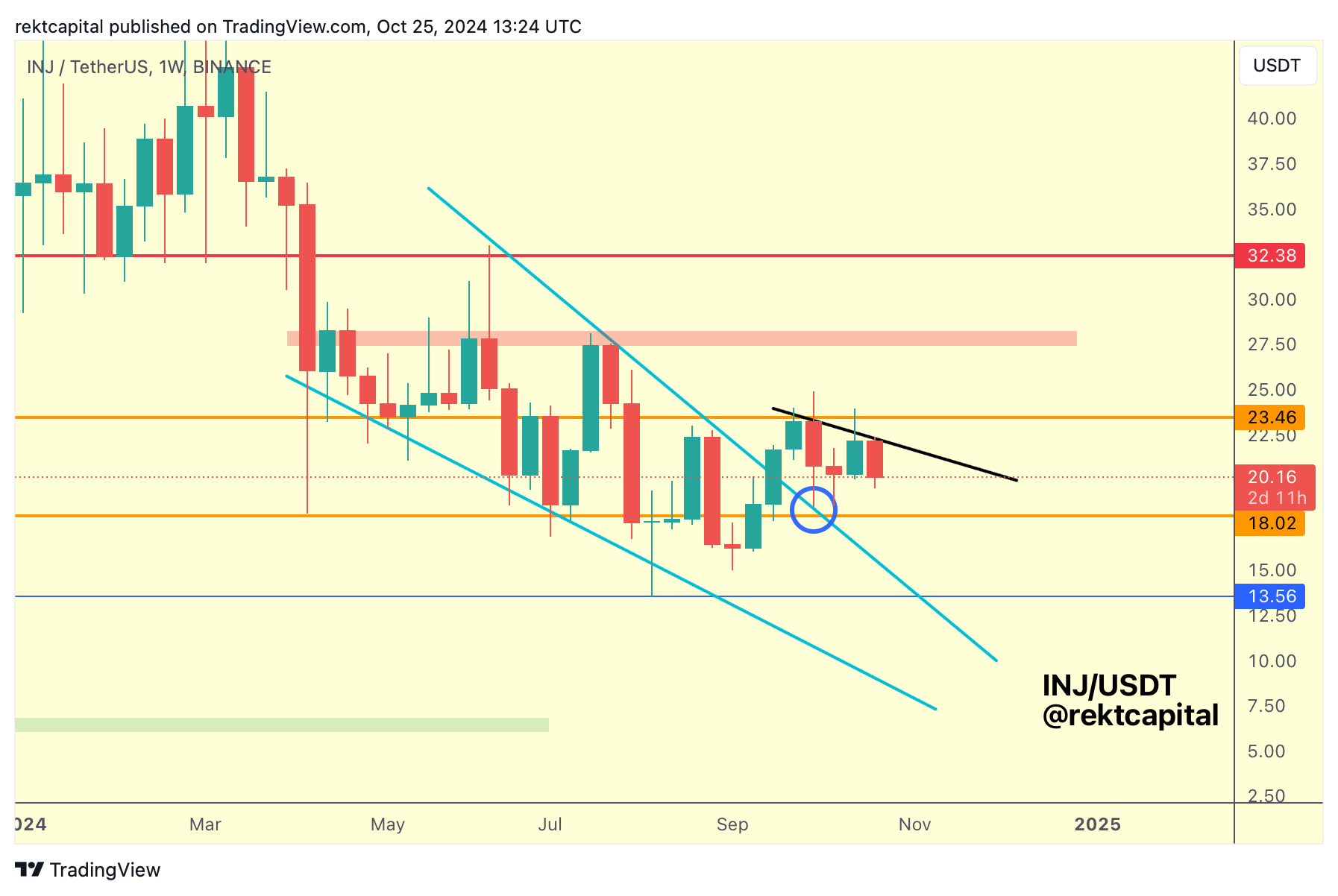

INJ broken out from its macro Falling Wedge (light blue) a few weeks ago.

On the breakout, INJ successfully retested the top of that pattern as support.

However, by breaking out from this Falling Wedge, INJ transitioned into a mid-term post-breakout re-accumulation range (orange-orange; $18.02-$23.46).

Since the transition into the range, INJ has continued to reject from the orange Range high of $23.46 and in fact, price has formed a Lower High (black) on these rejections.

If these Lower Highs persist, then INJ could see further consolidation within the existing range and may drop into the Range Low over time, as part of normal range-bound price behaviour.

But a key indicator to keep an eye on will be the RSI:

The RSI is forming an Ascending Triangle with the red box being the top of the pattern and figuring as a resistance and the light blue Higher Low acting as a the base of it.

If the RSI continues to reject from the Ascending Triangle, then indeed a period of downside could be on the cards for INJ.

Generally, when the RSI breaks its red resistance, that would be a sign of emerging strength and price would follow suit.

Conversely, if the RSI were to drop into its light blue Higher Low, then that's were price would respond with forming a potential bottom before reversing to the upside.

The RSI gives clear levels of understanding and INJ's price action will continue to consolidation within the orange-orange range until the RSI offers a signal for a trend-shift relative to those aforementioned key levels.