Altcoin Newsletter #196

Features STX WIF TON SUI AR DOT JUP AIOZ

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Stacks (STX)

- Current Phase: Successful Post-Breakout Retest, +17% since covered two weeks ago

- dogwifhat (WIF)

- Current Phase: Macro Downtrend Breakout, Possible Re-Accumulation at Highs +17% since covered two weeks ago

- Toncoin (TON)

- Current Phase: Retest In Progress

- Sui (SUI)

- Current Phase: Re-Accumulation In Progress, Scope For Deeper Downside

- Arweave (AR)

- Current Phase: Potential Bearish Confirmation

- Polkadot (DOT)

- Current Phase: Seeking Price Stability

- Jupiter (JUP)

- Current Phase: Retest In Progress

- Aioz Network (AIOZ)

- Current Phase: On The Cusp Of a Macro Trend Shift

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

Stacks - STX/USDT

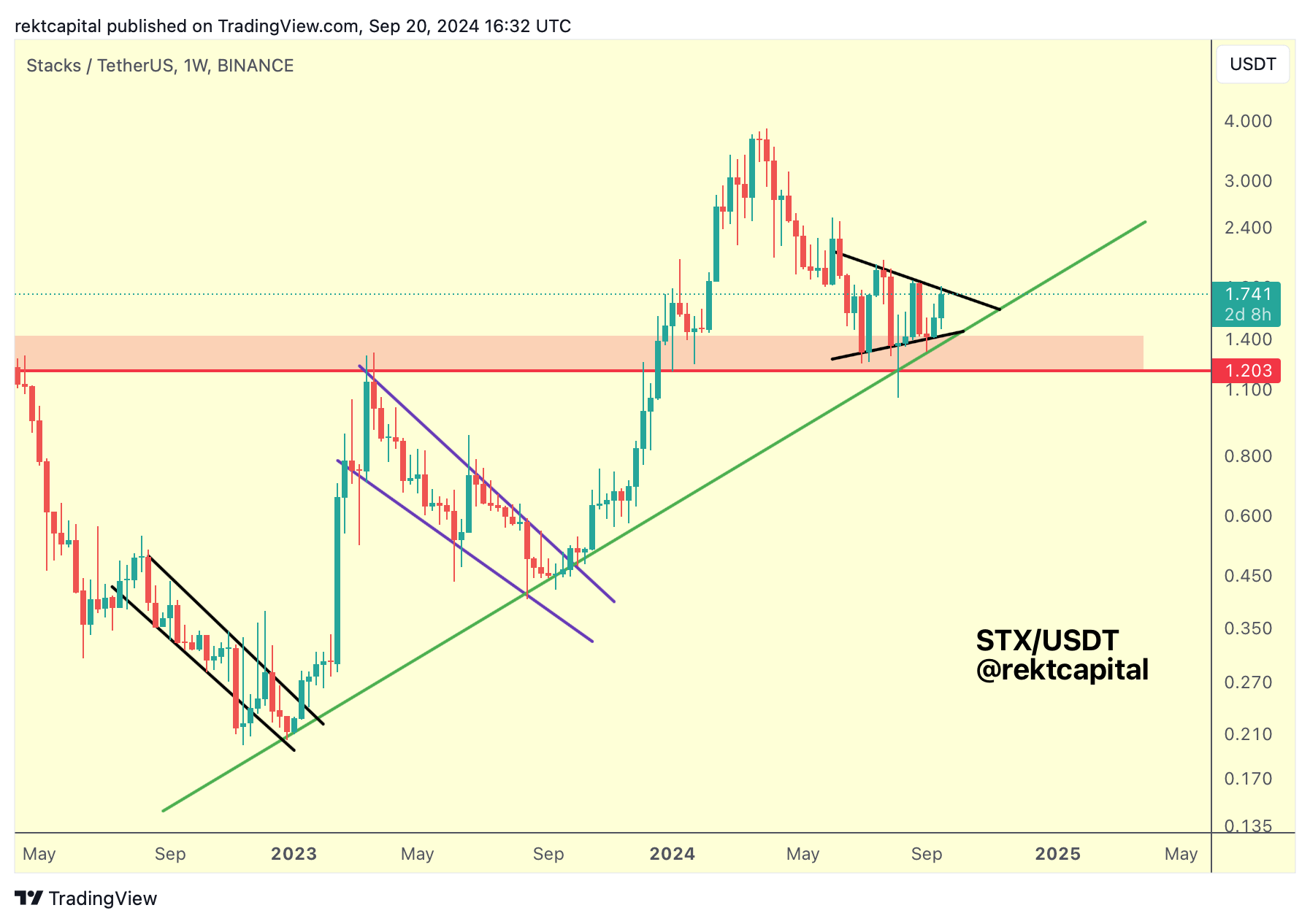

Two weeks ago, we spoke about how STX tends to develop market structures at its Macro Higher Low:

In a nutshell, STX tends to form key macro market structure against its now more than 1.5 year long Macro Higher Low (green).

This time was no different.

More, whenever STX breaks out from its main pattern, it goes on to retest the top of it for a post-breakout retest to fully confirm the breakout overall (blue circles):

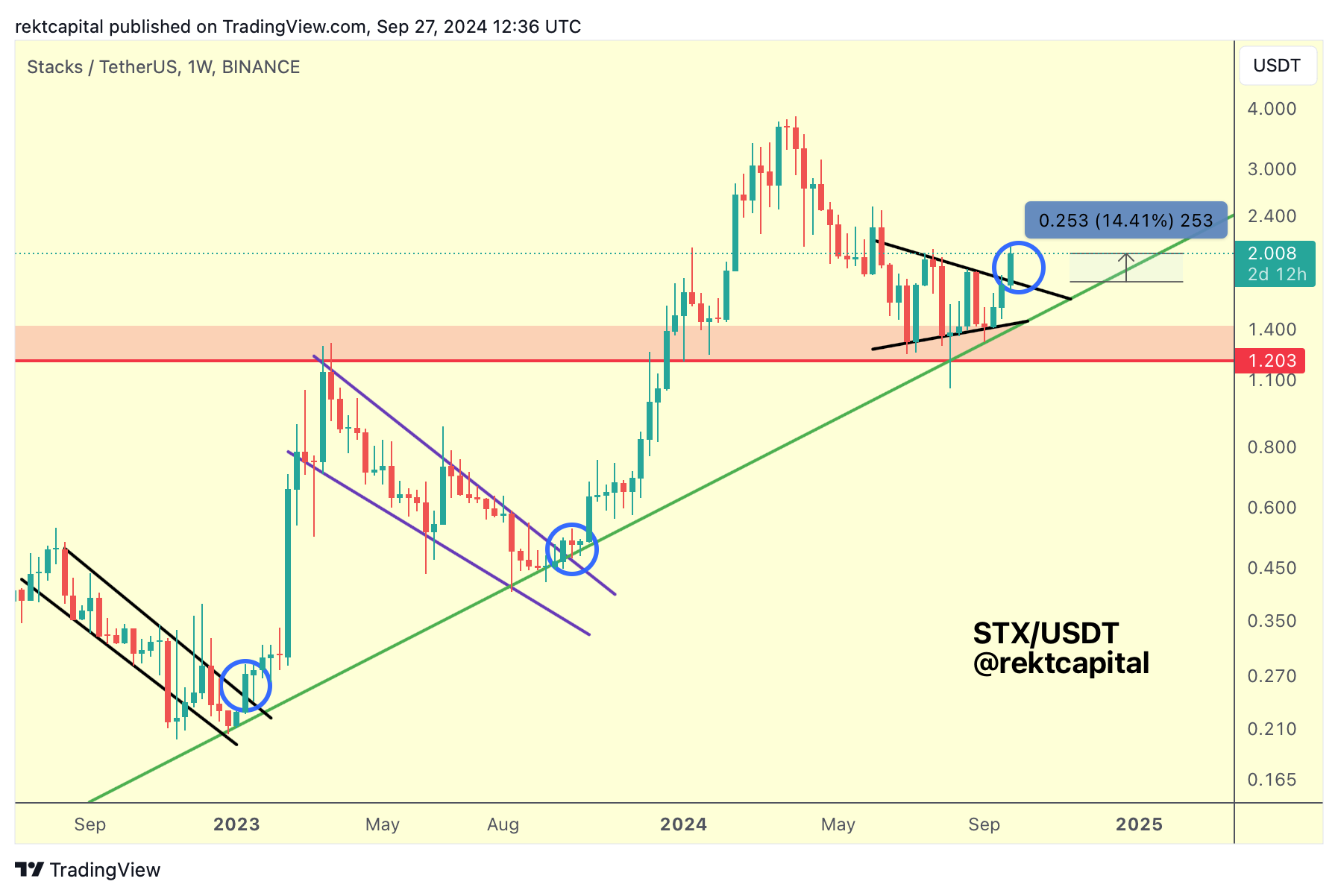

Last week, we covered the breakout that ensued:

But based on history, we also expected a pullback for that crucial post-breakout retest.

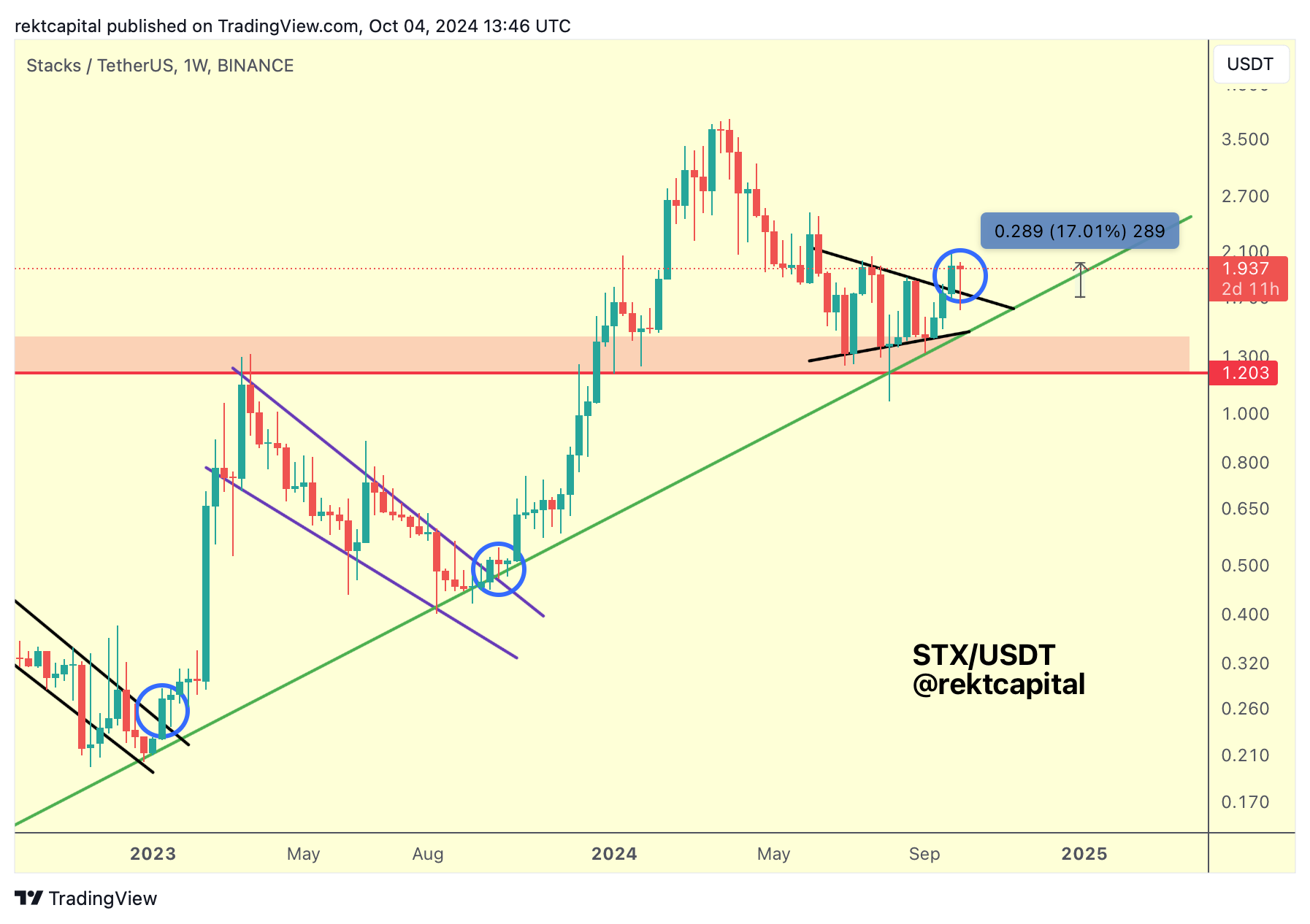

Fast forward to now and STX has finally not just broken out but also confirmed that breakout with a successful retest:

Not only did STX offer a +14% breakout move but it has since also offered a +14% retest rebound as well.

Nonetheless, as long as this continues then STX looks well-positioned for trend continuation to the upside over time.

dogwifhat - WIF/USDT

Two weeks ago, we covered how WIF was preparing for a breakout from its Macro Market Structure, with the red resistance of $2.52 a key first resistance for WIF:

Here is today's update:

WIF broke out from its main pattern, ending the Macro Downtrend and rallying +26% towards that key $2.52 resistance above.

This is where price rejected from and has since pulled back into the 21-week EMA (green) which is a valuable short-tern momentum indicator for WIF.

In fact, this EMA has acted as resistance in late June and then again in late August and now WIF is trying to test it as support so as to confirm a trend shift altogether.

Thus far, the retest is successful.

Going forward therefore, WIF could now form a base at the EMA and it will be important for WIF to Weekly Close above the $2.52 red resistance (blue circle) so that it has a chance at rallying to $3.22 over time.