Altcoin Newsletter #195

Features STX WIF TON SUI VANRY EDU

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Stacks (STX)

- Current Phase: Breaking Out, +14% since covered last week

- dogwifhat (WIF)

- Current Phase: Macro Downtrend Breakout, +17% since covered last week

- Toncoin (TON)

- Current Phase: Breakout Confirmed, +10% since covered last week

- Sui (SUI)

- Current Phase: Potential for Re-Accumulation

- Vanar Chain (VANRY)

- Current Phase: Micro Breakout Confirmed, +30% since covered two weeks ago. On the cusp of a Macro Downtrend Breakout.

- Open Campus (EDU)

- Current Phase: Breakout Confirmed, +23% since covered two weeks ago. Now seeking confirmation for trend continuation.

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

Stacks - STX/USDT

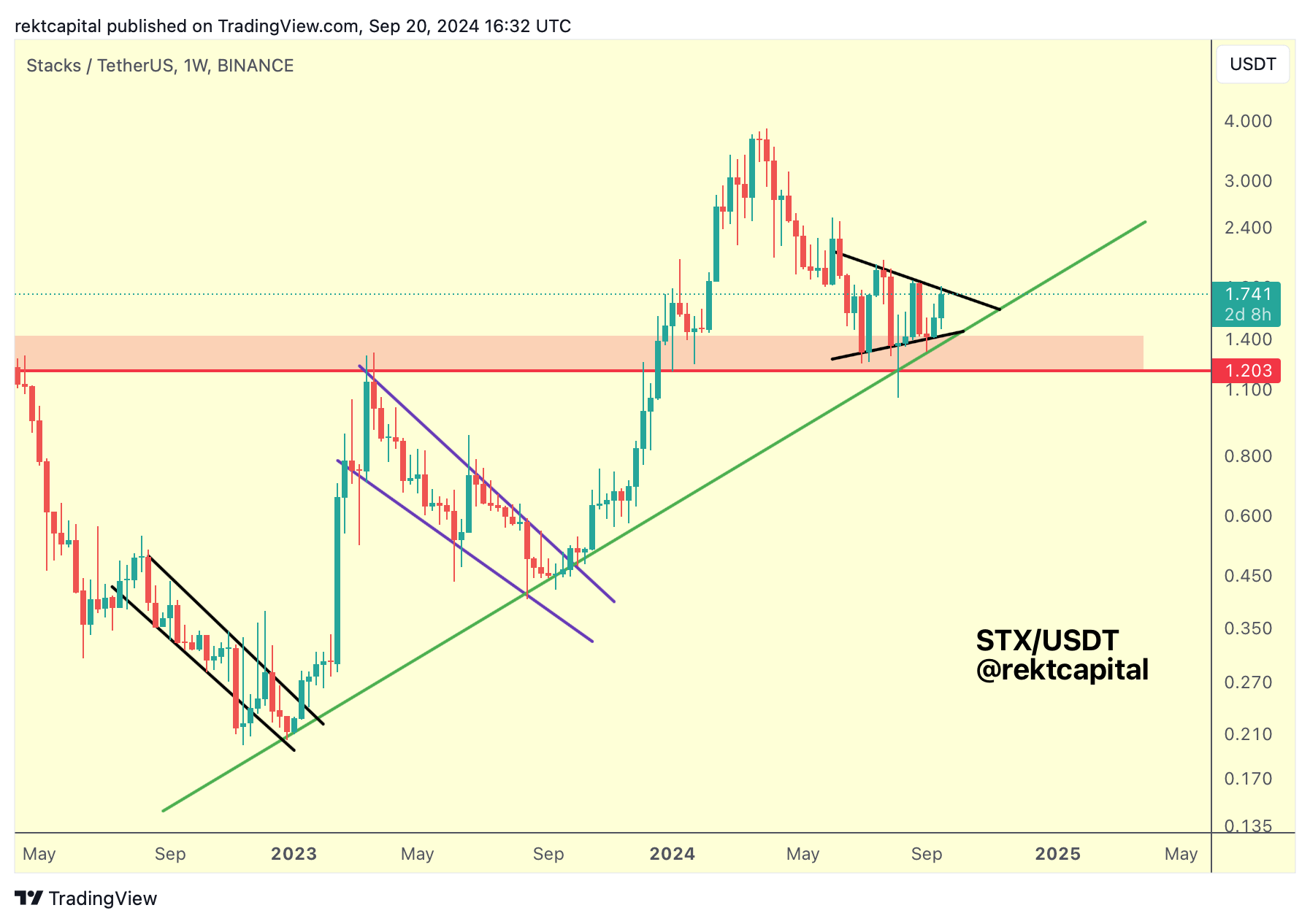

Last week, we spoke about how STX tends to develop market structures at its Macro Higher Low:

The general tendency for STX is that price tends to consolidate within the confines of its major pattern and this consolidation sees STX coil into the apex of the structure, getting increasingly closer to the more that 1.5 year old Macro Higher Low trendline in an effort to find support.

After finding support at the Macro Higher Low, STX is then ready to breakout from its main market structure.

This year, STX downside wicked into the Macro Higher Low before further developing its current bullish pennant formation.

Last week we also mentioned the recurring tendency that STX showcases upon breakout from a pattern:

In short, STX tends to Weekly Close above the top of the pattern, dips into the top of the pattern to retest it as support, before fully confirming the breakout to enjoy trend continuation towards the upside going forward.

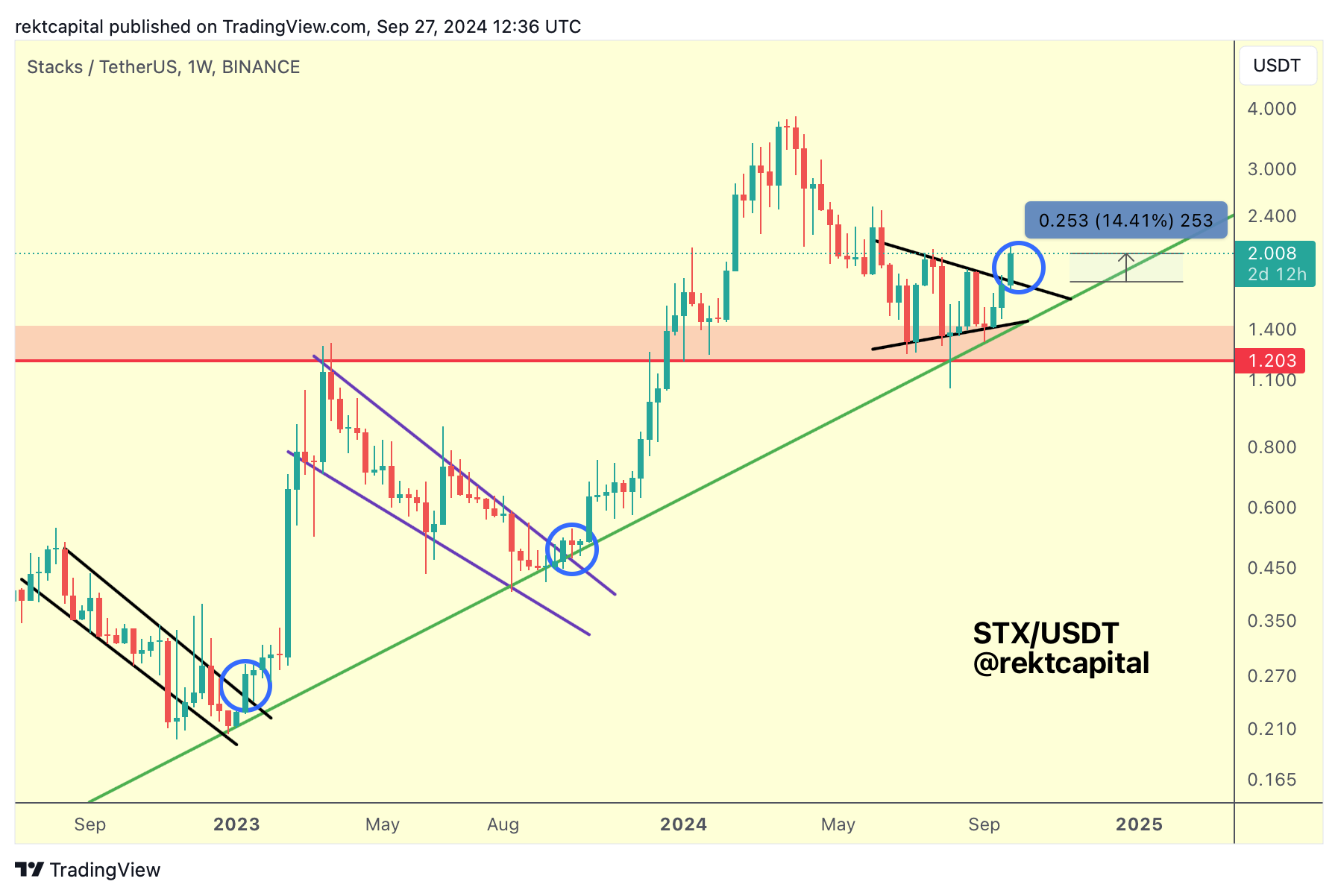

Here's today's update:

STX has broken out +14% to the upside.

However, based on historical price tendencies, there's a possibility for STX to dip into the top of its recent pennant to fully confirm the breakout, after which price would ascend into trend continuation to the upside.

This sort of retest doesn't need to happen but in similar post-breakout contexts, it is exactly what happened, especially via downside wicking price action which would quickly be bought up before further uptrending.

dogwifhat - WIF/USDT

Last week, we discussed how WIF was coiling into the apex of its macro market structure, getting close to the main resistance price needed to breach to end the Macro Downtrend and kickstart a new Macro Uptrend:

Here is today's update:

WIF has broken out from its macro market structure and is on the cusp of confirming a new Macro Uptrend.

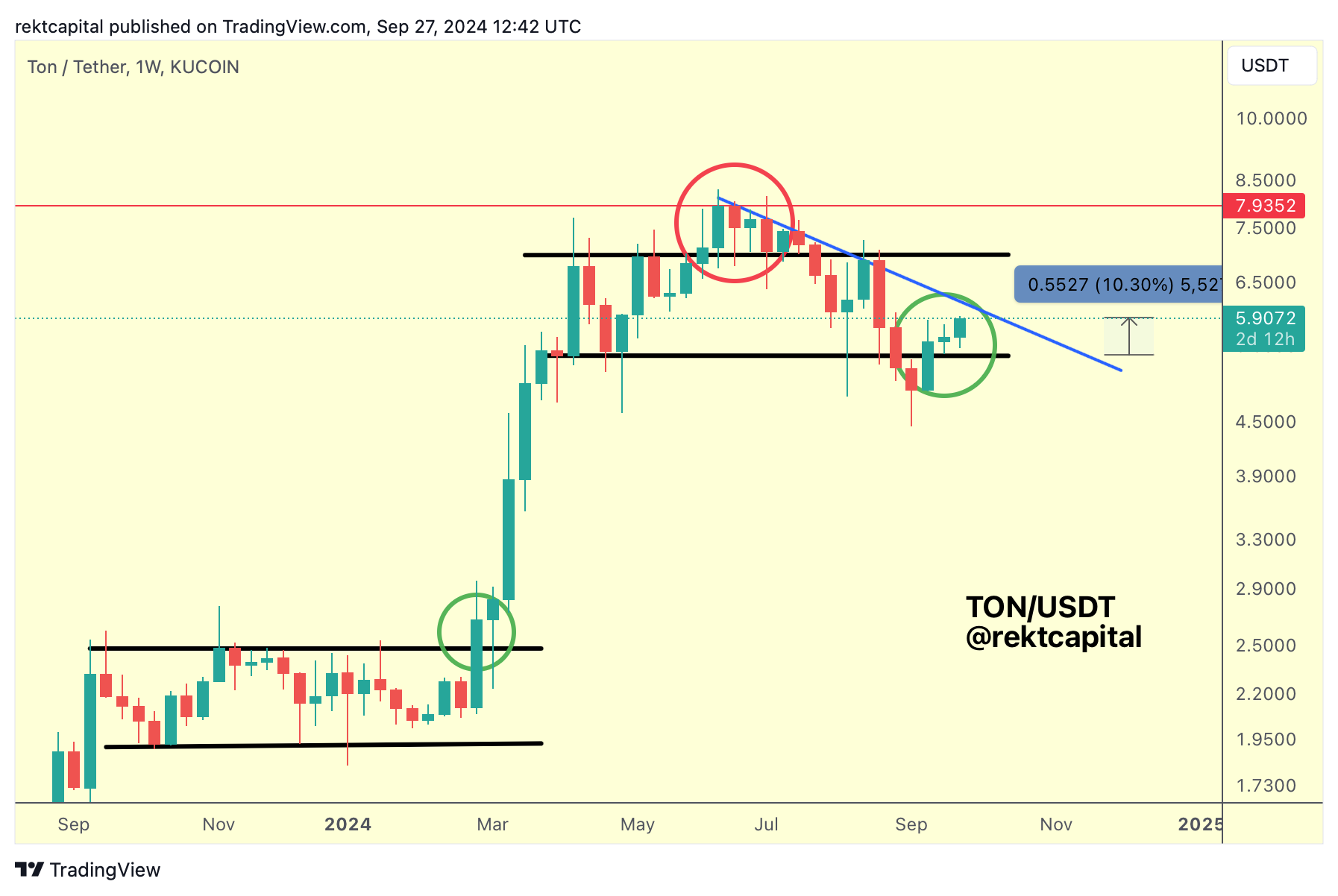

Toncoin - TON/USDT

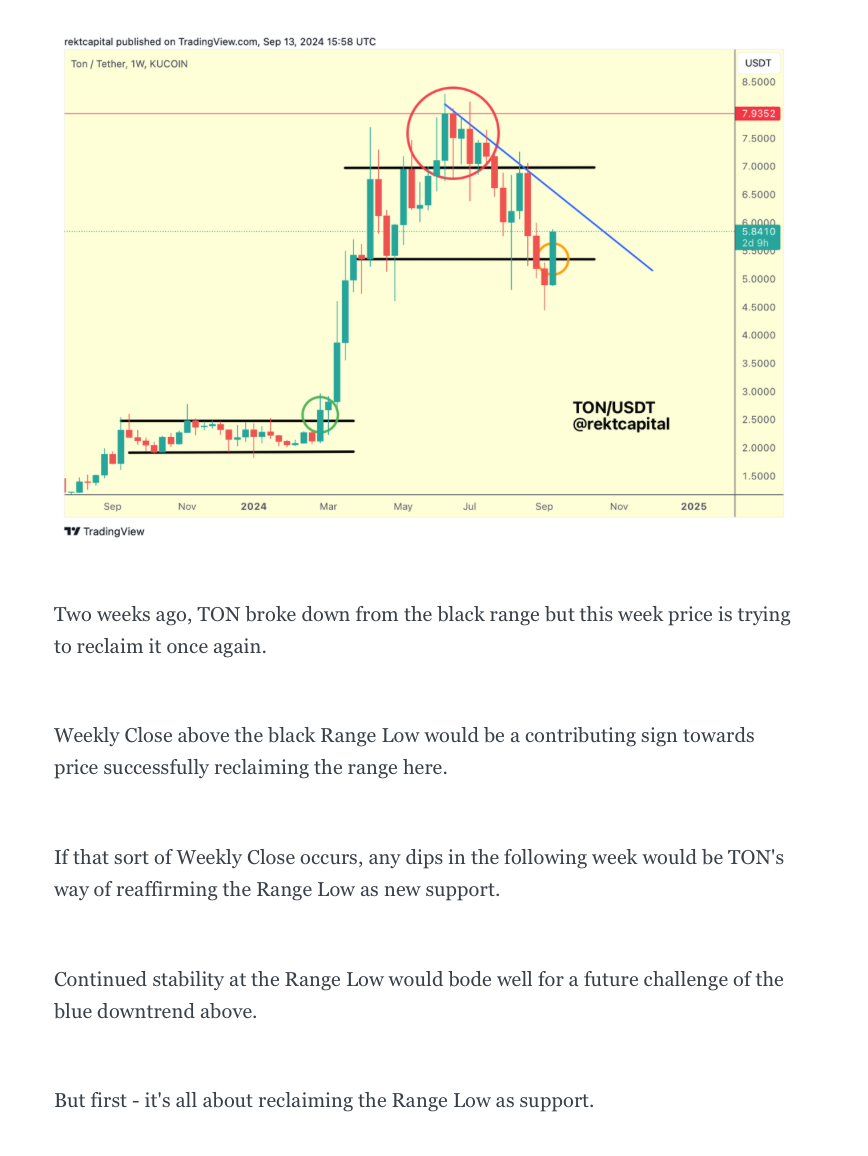

As a preface to today's update on TON, two weeks ago I shared the following analysis:

Last week, that analysis slowly but surely started to play out, whereby TON Weekly Closed above the Range Low and set itself up for a retest:

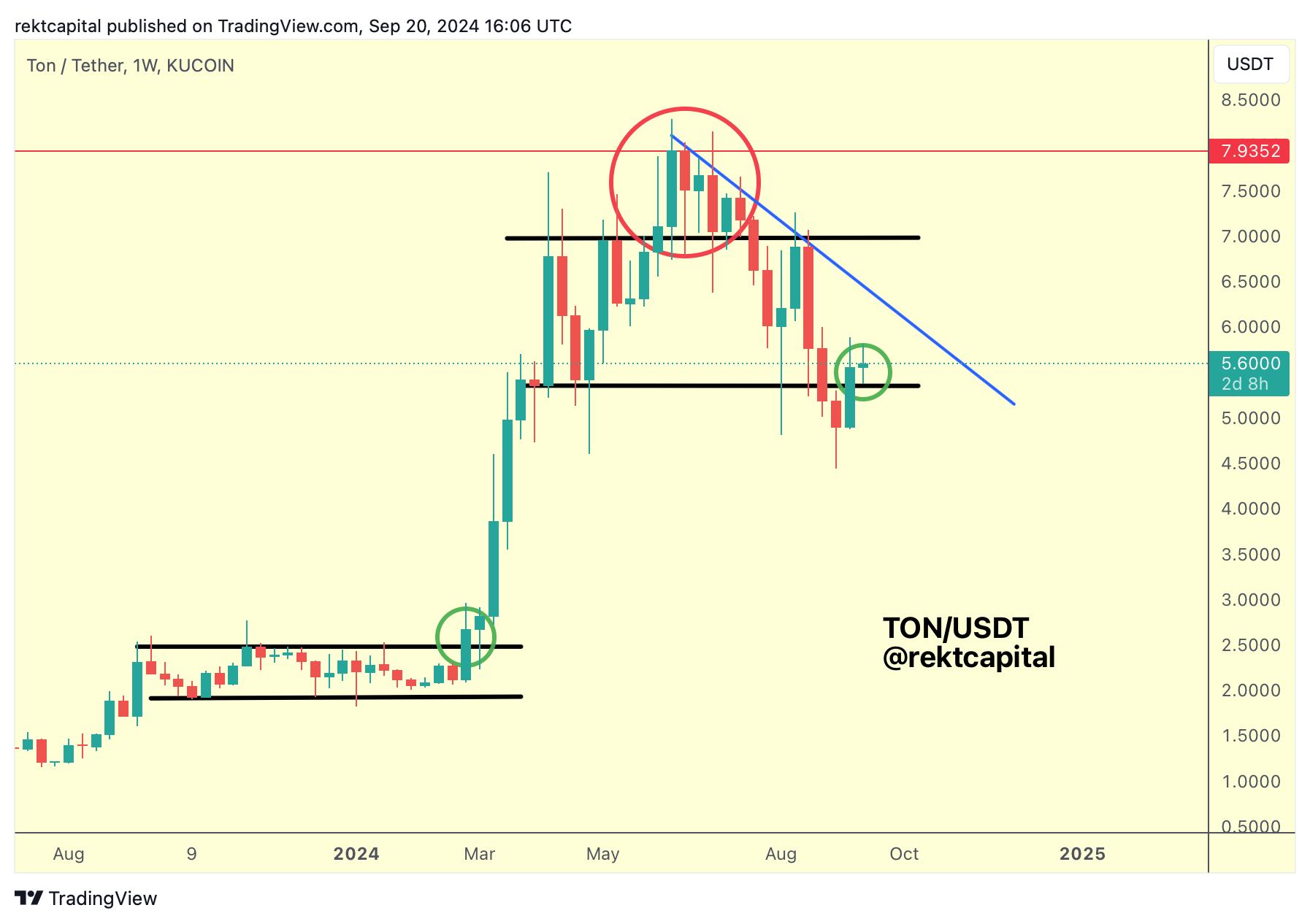

Here's today's update:

TON has successfully confirmed a break-back into its Macro Range, having successfully reclaimed the Range Low as new support to springboard price into a +10% rally.

In the short-term, TON could find some initial resistance at the series of Lower Highs ahead (blue).

However, given market conditions, there's a good chance that TON could finally break this Downtrend, especially since coins like FET, INJ, TAO, PEPE, and WIF have managed to do this successfully recently.

As a result, TON could be playing the role of a laggard which is finally following the leaders in their footsteps.

Breaking the blue diagonal resistance would see TON revisit the black Range Highs over time.