Altcoin Newsletter #186

Features BLUR PEPE FLOKI RNDR CRO ZRO IO

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Blur (BLUR)

- Pepe (PEPE)

- Floki (FLOKI)

- Render Token (RNDR)

- Crypto Com (CRO)

- LayerZero (ZRO)

- IO.net (IO)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

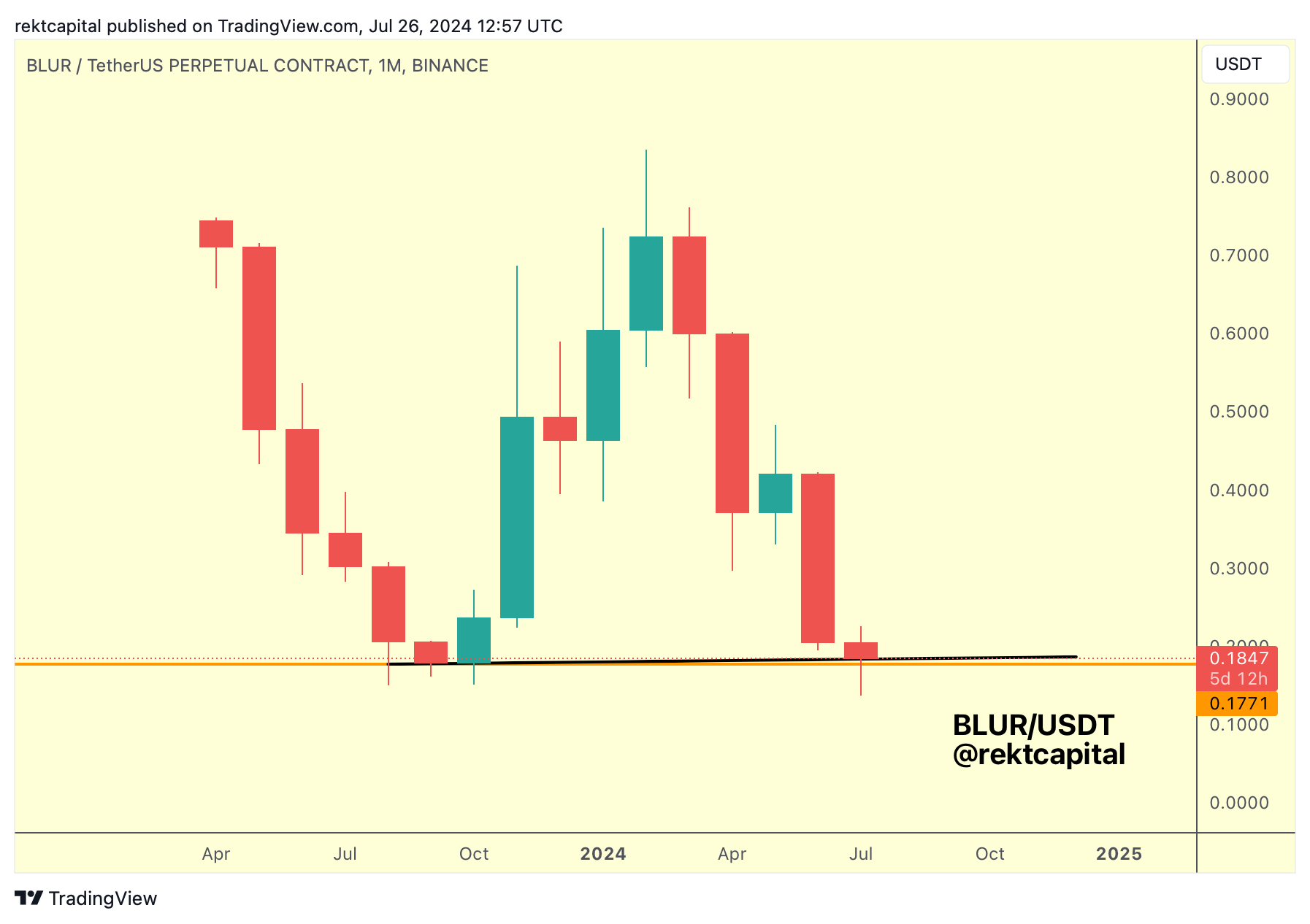

Blur - BLUR/USDT

BLUR is currently in the process of retesting the top of a historical demand zone as new support, following a brief deviation below it a few weeks ago.

Weekly Close above the top of the red box and the retest will be successful, which could enable a move to the Macro Downtrend, for a challenge at a breakout.

This Downtrend has plagued BLUR since late February and so a breakout beyond the Downtrend would enable a multi-month Uptrend, with the blue level at $0.34 likely being the first major resistance in the new trend.

This overall view would be further supported should BLUR indeed Monthly Close above $0.17 (orange):

If BLUR Monthly Closes above orange, that would mean that a historical Monthly support has continued to act as support and perhaps even at a delicate Higher Low (black), which would be a sign of premium-buying behaviour.

Such Higher Lows are good initial indications of a price reversal to the upside and so while a Monthly Close above orange would be positive, a Monthly Close just like this would be even better - even though the difference between the respective Closes are very small, they have great meaning for the future trend.

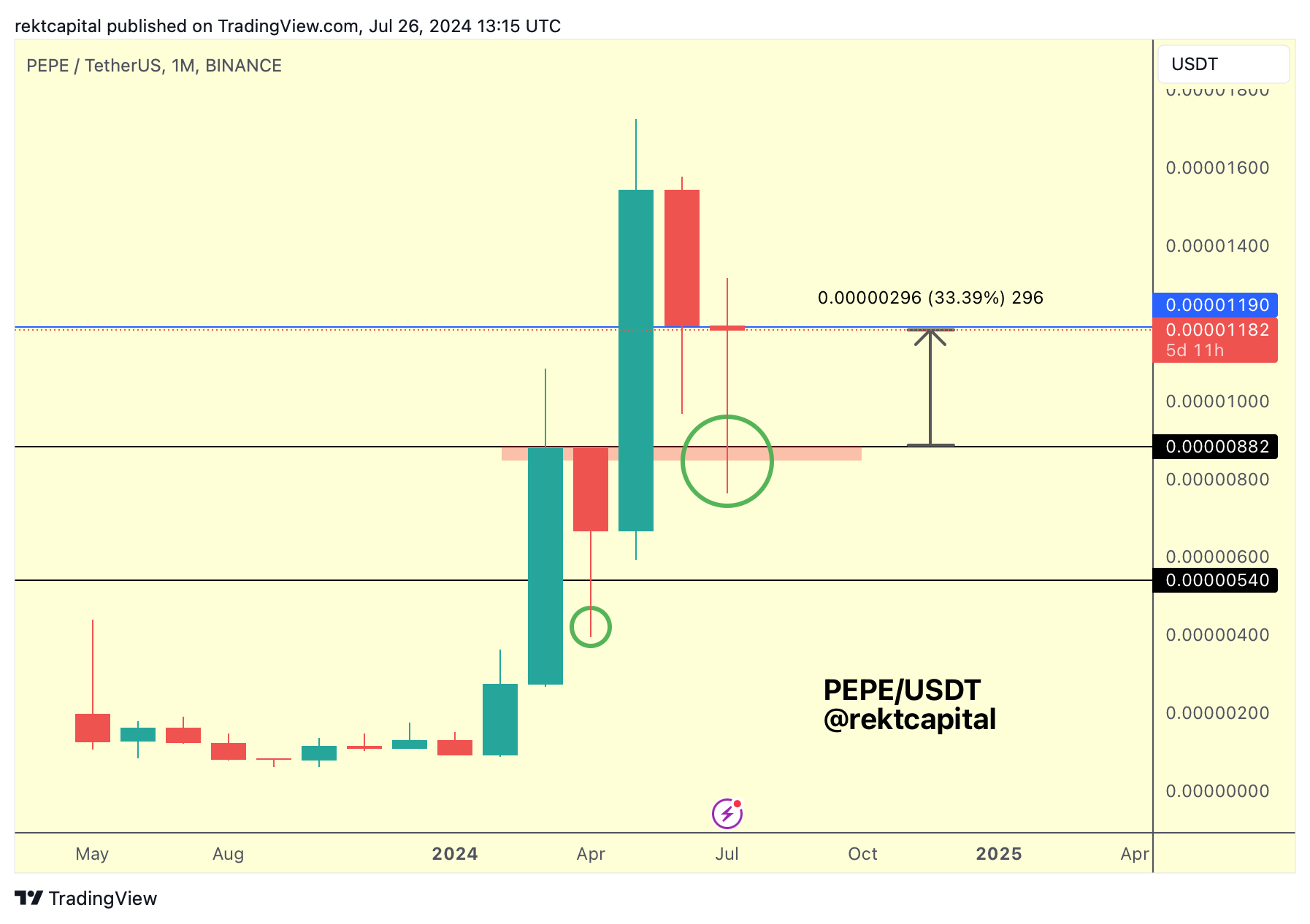

PEPE - PEPE/USDT

In late May, I shared my analysis on PEPE, anticipating a potential retrace in an effort to retest its post-breakout range:

Here is today's update:

Almost two months later, PEPE pulled back to retest the top of that post-breakout range as new support to enjoy a successful retest and by the same token fully confirm the breakout from this range, rallying over +30% in the process.

Now, with the Monthly Close just around the corner, here is what PEPE needs to do to continue building on its newfound bullish momentum:

The Monthly timeframe also shows alignment in the recent bottom marking a key retesting area (i.e. the red box represents an old Monthly resistance which is this month acting as support).

But what PEPE needs to do now is try to Monthly Close above the blue level, which represents last month's price low.

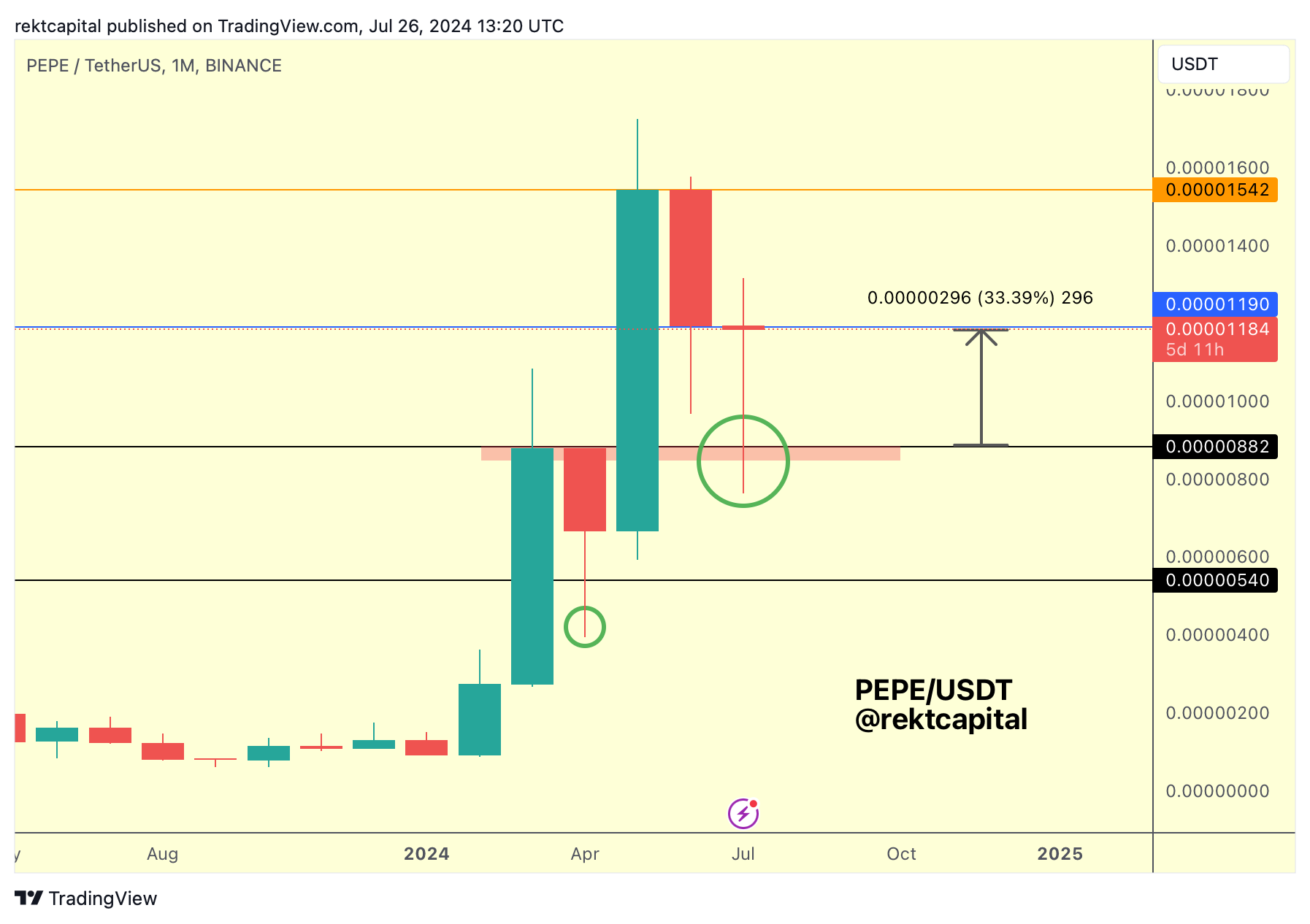

A Monthly Close like this would mean that PEPE may be ready to form a base at the June lows, despite July's downside wicking deviation, which could then improve PEPE's chances of revisiting the orange highs over time:

In short, if PEPE Monthly Closes above the blue level, it would likely establish a range between the blue and orange levels.

Of course, PEPE has shown that downside volatility below the blue level could still occur, but it's important the candle-body itself closes above the blue level.

Monthly Close below the blue level however would not necessarily be a bearish event unless price is able to reclaim the blue level early in August; but turn blue into resistance in August and we could reasonably expect another drop down closer to the red boxed retesting region once again, even if for just to form a new Higher Low there relative to July lows.

Watching the Monthly Close to help us better understand PEPE's possibilities going forward.