Altcoin Newsletter #169

Features SOL DOT PEPE ETH MATIC INJ SNX

In today’s Altcoin newsletter I cover the following Altcoins - specifically:

- Ethereum (ETH)

- Solana (SOL)

- Polkadot (DOT)

- Pepe (PEPE)

- Polygon (MATIC)

- Injective (INJ)

- Synthetix (SNX)

These Altcoin TA requests are made by valued readers of the Rekt Capital Premium Newsletter.

Let’s dive in...

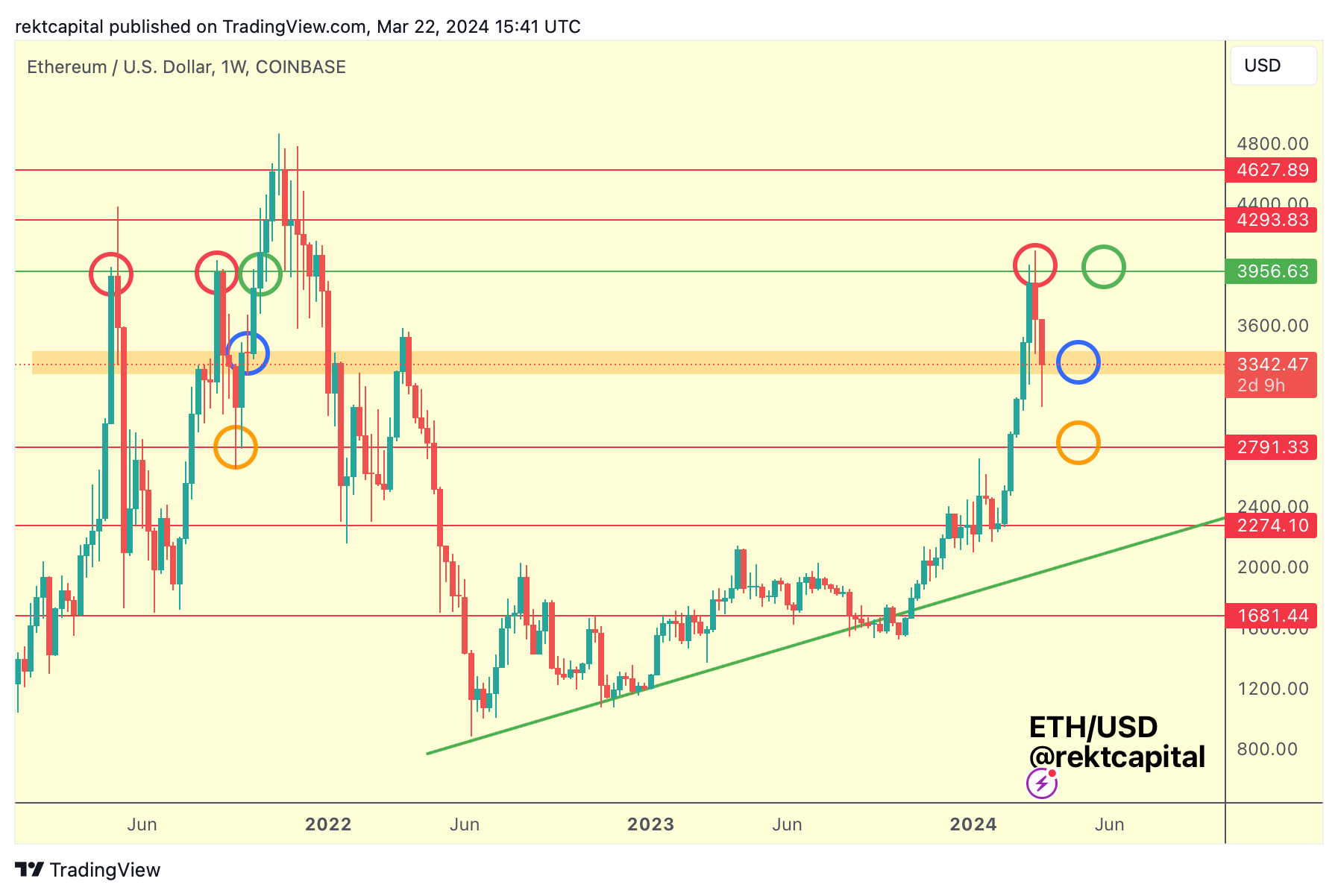

Ethereum - ETH/USD

Ethereum is in a complicated spot.

Because it has rejected from the green $3956 resistance, similarly as in the past (red circles).

I don't expect as crash like in early 2021 where price dropped to $1681; this current pullback is due to the ETF being delayed but there's a good chance it would be approved in the future and with that narrative it's difficult to envision a steeper correction.

The more likely event however is as follows:

In the second half of 2021, when ETH rejected from the green $3956 resistance (red circle), price dropped to as low as the $2791 (orange circle) before rebounding and then reclaiming the orange boxed area as support (blue circle) before rallying and breaking beyond the green $3956 resistance for good (green circle).

In short, if ETH isn't able to hold this current orange area as support, the next level for tagging would be that orange circled $2791 support.

Whatever the scenario, ETH needs to reclaim this orange boxed area as support (blue circle) to enable uptrend continuation.

So whether ETH does that now to precede a rally to ~$4000 or whether it needs to first drop into the ~$2700s before doing so doesn't make much of a difference in the long-term because macro uptrend is bullish, but offers dollar-cost-averaging opportunities in the short-term.

A Weekly Close below the orange box would likely trigger a breakdown whereas consistent holding of the orange box as support should be enough in building momentum for the next leg up.

It's a matter of time before this orange boxed area is successfully reclaimed as support; the only question is whether there'll be a final flush-out before then or not.

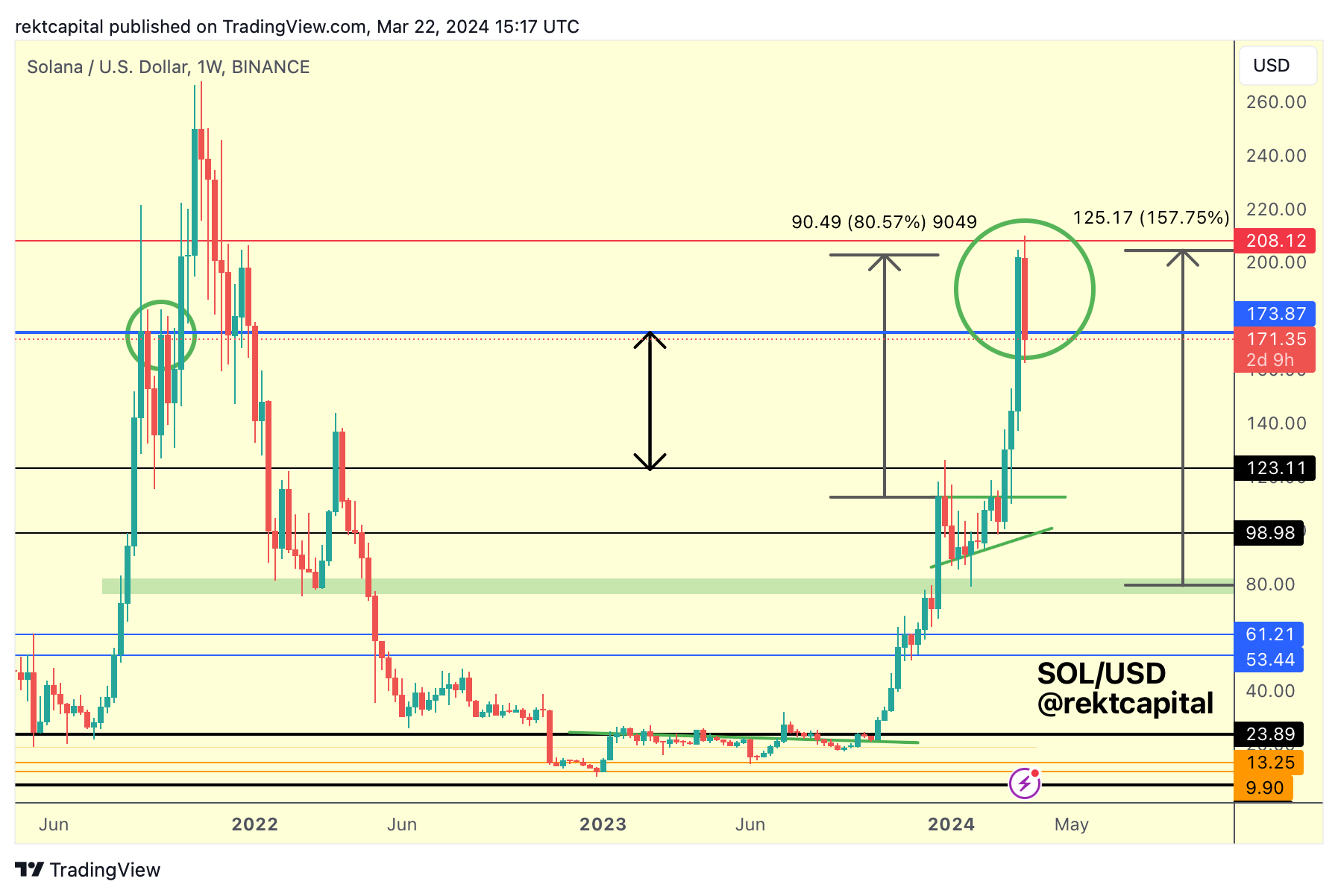

Solana - SOL/USD

Last week, Solana broke the blue resistance of $173 and this week is in the process of retesting it in an effort to turn it into new support.

But let's go back to an earlier move, the breakout move from the green Ascending Triangle.

When SOL broke out from this pattern, price Weekly Close above the black $123 level and retest it as support in the following week.

In doing so, SOL confirmed the $123 level as a new Range Low that would enable a move across the range towards the Range High of $173 (blue).

That's exactly what happened and in fact this move was stronger as it broke beyond the blue $173 resistance on the first time of asking, as opposed to rejecting from there as was the case in 2021 (green circle).

Now, SOL is trying to retest the $173 blue level as new support in an effort to position itself for another move across a whole range, this time across the $173-$208 range.

Retest is in progress and price needs a Weekly Close above this $173 level to bring SOL one step closer to a successful retest.