Altcoin Market Update

Features analysis on Altcoins such as INJ AERO VIRTUAL POPCAT FARTCOIN APT TAO

Hello and welcome back to the Rekt Capital Newsletter.

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Injective (INJ)

- Aerodrome Finance (AERO)

- Virtuals Protocol (VIRTUAL)

- Popcat (POPCAT)

- Fartcoin (FARTCOIN)

- Aptos (APT)

- Bittensor (TAO)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

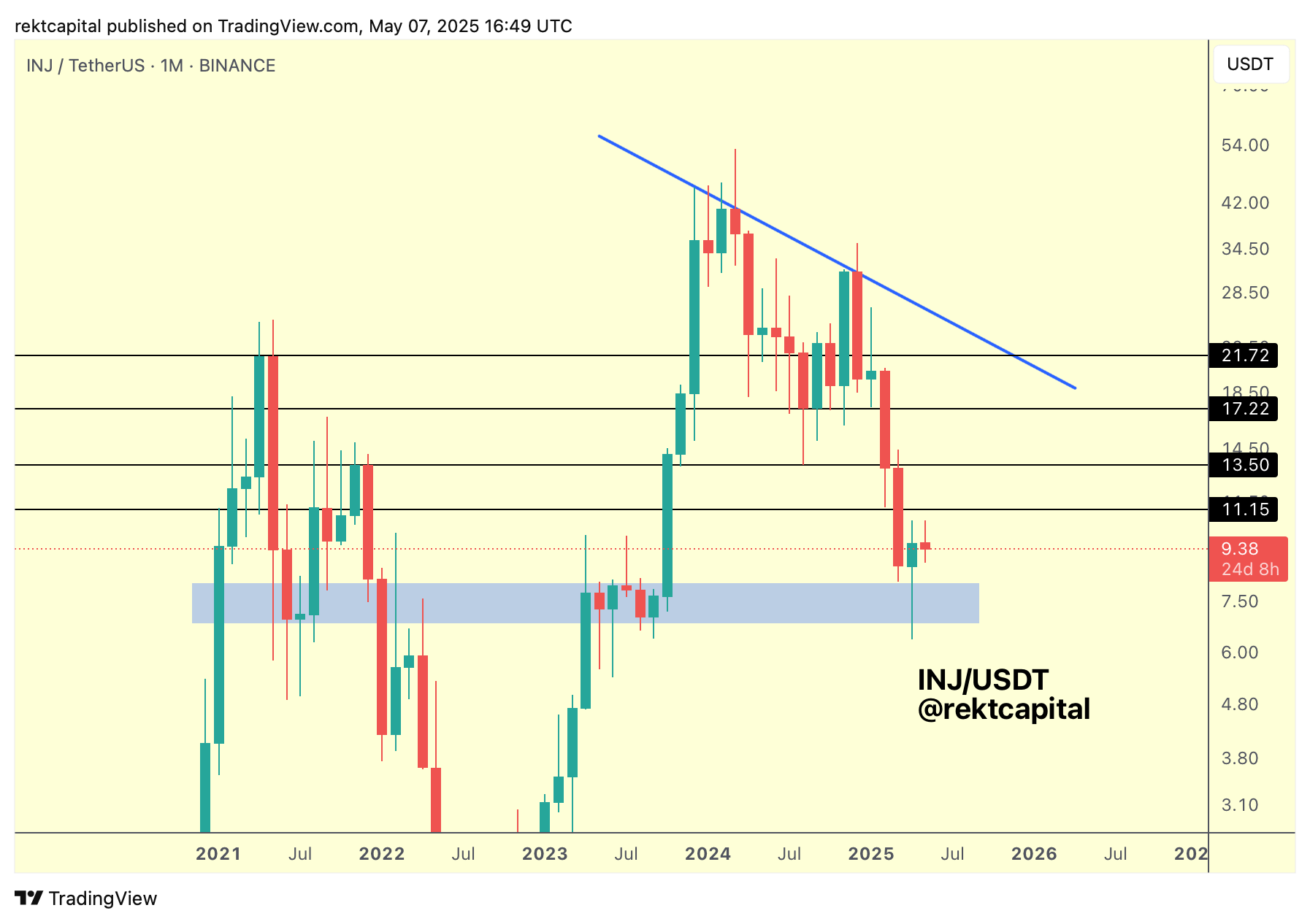

Injective - INJ/USDT

In recent months, INJ dropped right into a historical demand area (blue).

This is where INJ has found support via a downside wick last month.

And since that time, INJ has rebounded into a Downtrend-breaking effort:

Two weeks ago, INJ Weekly Closed above the red multi-month Downtrend.

Last week, INJ post-breakout retested it into new support.

And this week, price has shown similar intention, downside wicking into the direction of the Downtrend but not actually retesting it again.

Generally, INJ needs to hold this general area if it wants to develop some momentum going forward with the first level to reclaim being the black $11.15 resistance above.

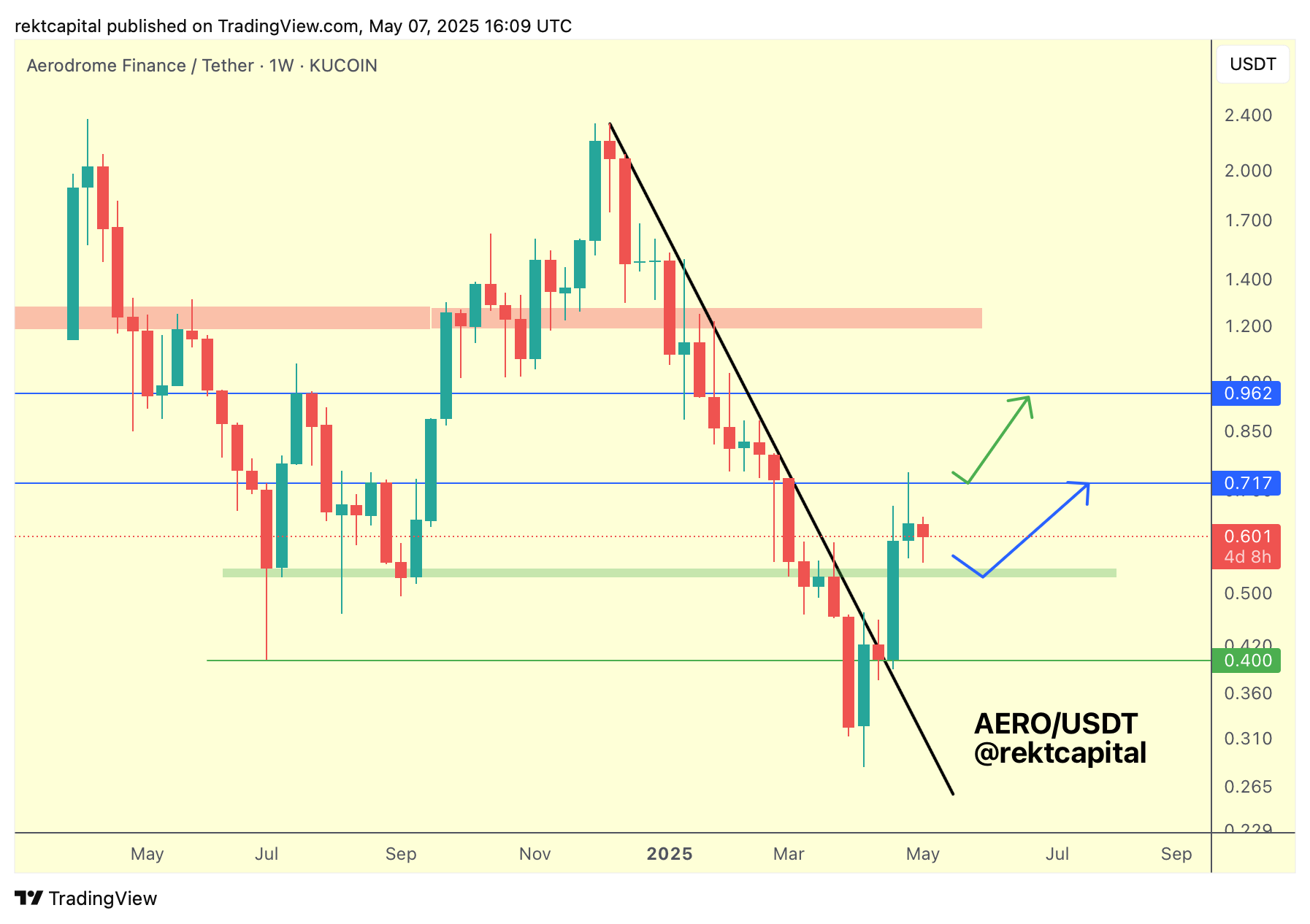

Aerodrome Finance - AERO/USDT

AERO has rallied substantially since breaking its black Downtrend.

And in rallying this much, it has managed to break back above the Q2 and Q3 2024 lows (green), effectively ending the previous multi-week downside deviation below green.

Seeing as AERO Weekly Closed above the green area two weeks ago and rejected from the blue $0.71 resistance last week, AERO has defined a new range here between green and blue.

And in breaking back above the green area, AERO has shown intent to try to successfully retest the green area back into official support.

Doing so successfully would enable AERO to follow the blue path over time.

In the future, AERO would need to Weekly Close above the $0.71 blue resistance if price would like to break back into the $0.71-$0.96 blue-blue range.

That's the Weekly view.

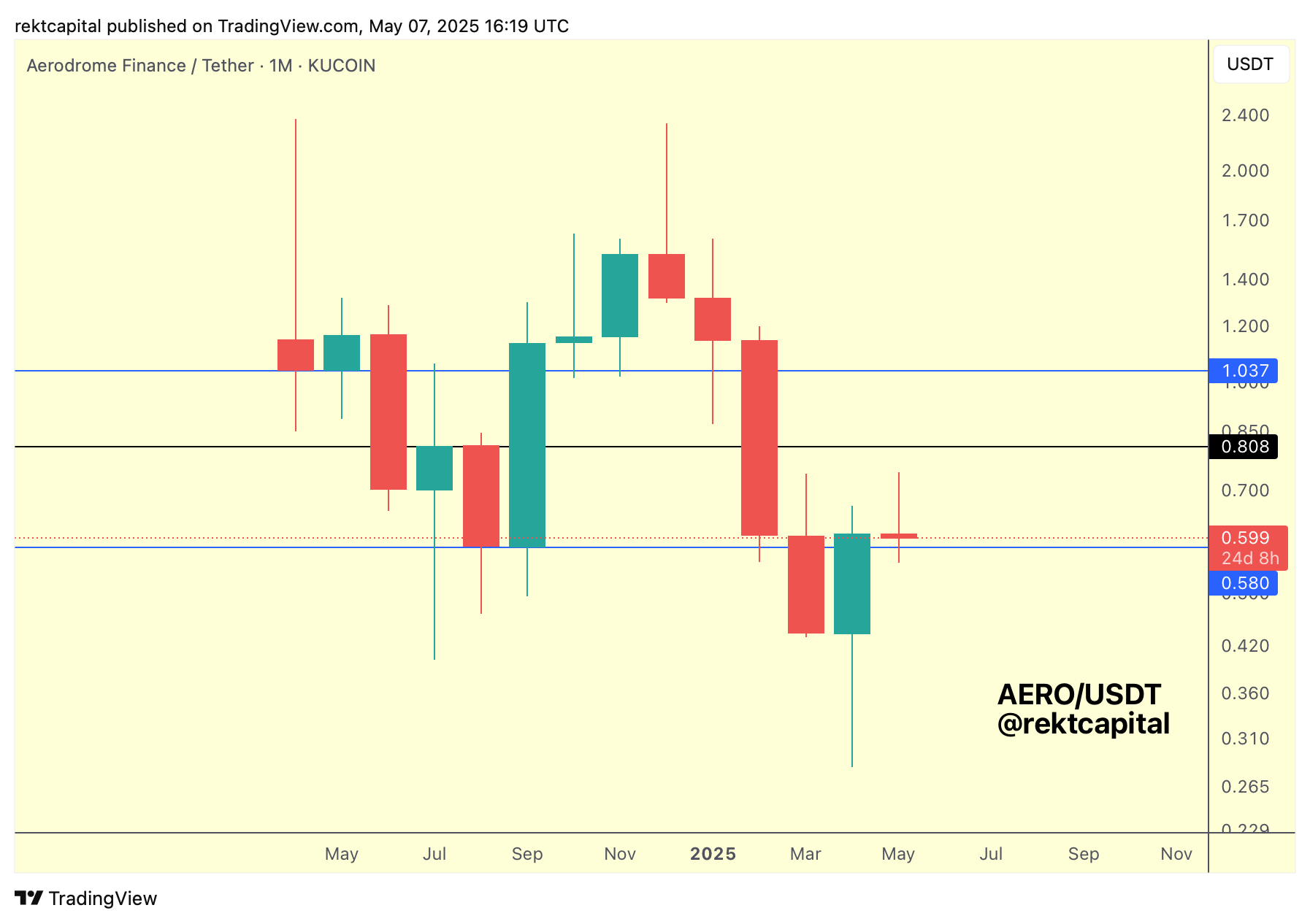

Here's the Monthly view which looks even simpler:

AERO Monthly Close above the blue $0.58 level last month and is now trying to reclaim this previously lost level as support; in fact, this level acted as support earlier this year and throughout Q2/Q3 of 2024.

Thus on the Monthly view, AERO is in the process of retesting $0.58 as support.

Of course, history suggests this could become a volatile retest, 2024 price action around this level alone shows that with long downside wicks.

However, a successful retest here at the $0.58 would position price for a move across the range to the black $0.80 resistance; but to get there, AERO would need to first Weekly Close above $0.71 as mentioned before.

The Monthly retest is in progress for AERO here and the retest must be successful to position price for upside over time.