Altcoin Market Update

Features analysis on Altcoins such as APT POPCAT VIRTUAL PHA TAO

Hello and welcome back to the Rekt Capital Newsletter.

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Aptos (APT)

- Popcat (POPCAT)

- Virtuals Protocol (VIRTUAL)

- Phala (PHA)

- Bittensor (TAO)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

Aptos - APT/USDT

Last week, we spoke about how APT had confirmed a breakdown on the Monthly timeframe:

But in saying that, we mentioned how price needed to reclaim the $5.44 level back into support (green path) so as to end this period of downside below the Macro Range Low as a downside deviation.

We spoke about the previous clusters of price action below or in and around the Macro Range Low of $5.44, highlighting how the RSI needed to break its red Downtrend to enable some strength:

Since then, that RSI Downtrend has broken and price has retaliated with some upside:

And so APT will now need to Weekly Close above the black $5.44 to reclaim the Macro Range Low as support to end this cluster of price action/downside deviation.

Successfully reclaiming the Macro Range Low (black) as support via the green path would likely set APT up for a move across its Macro Range altogether and end its 2025 downtrend.

But that's a story for another day - that reclaim of the Macro Range Low is the most important technical step right now.

Popcat - POPCAT/USDT

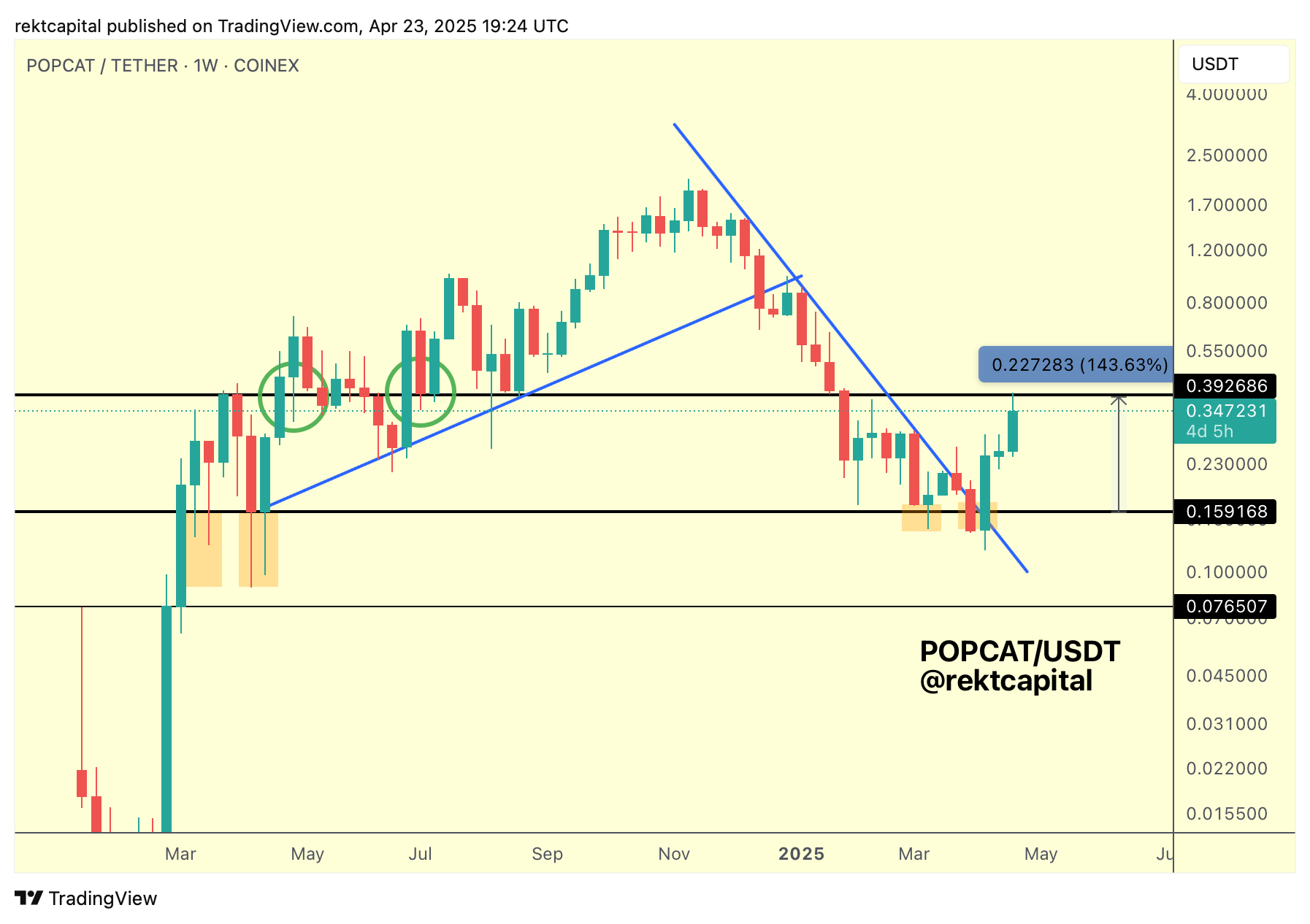

Over the past few weeks, we've been covering POPCAT because of how close it was to breaching its Downtrend:

Ever since POPCAT broke its Downtrend, it rallied more than +140%, rallying across its black-black range:

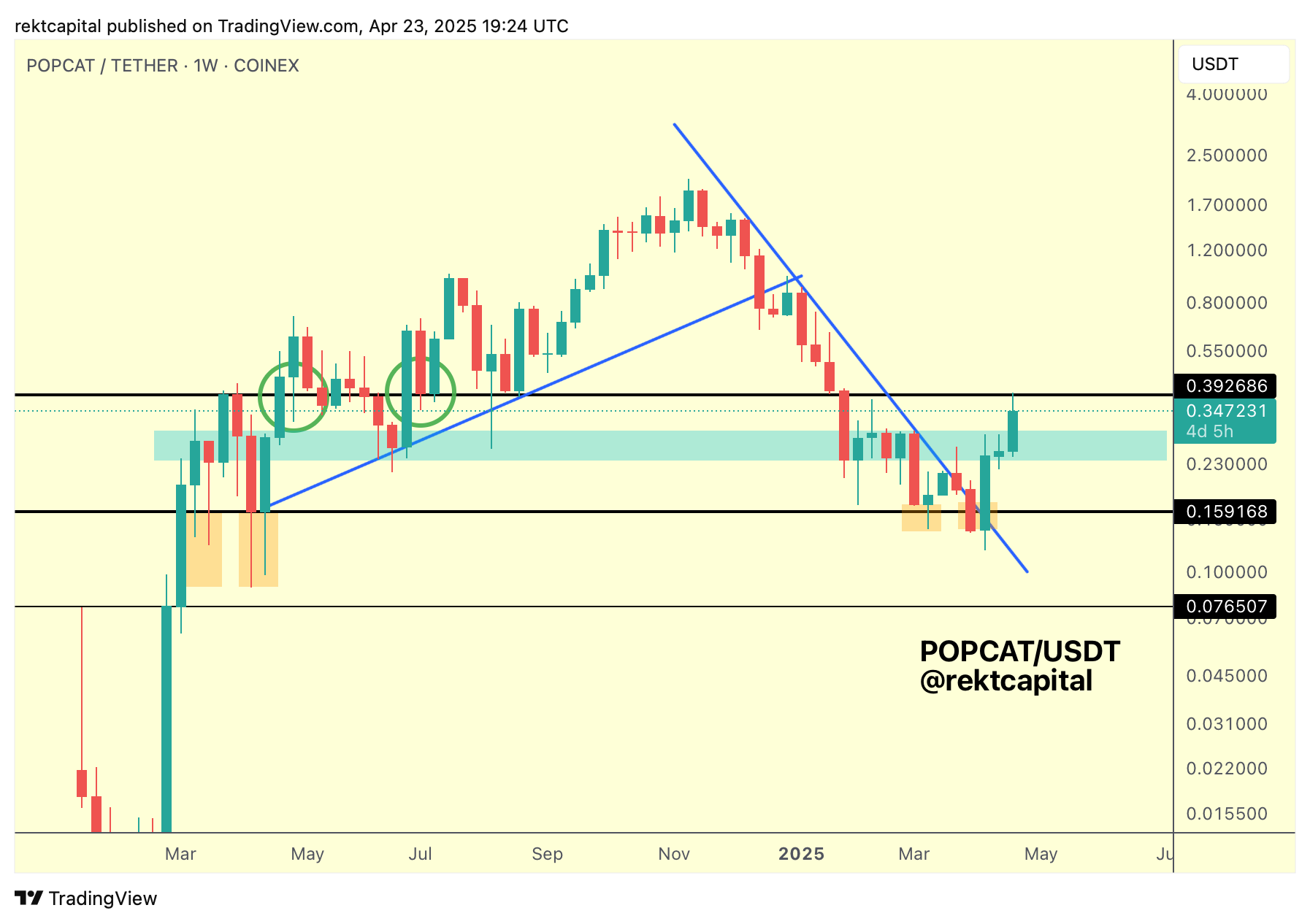

But going forward it will be important for price to either Weekly Close above the Range High (black), as per previous historical green circles, because that would position price for a post-breakout retest...

Or to hold the light blue area as support on a stronger rejection from current levels:

So in the absence of a Weekly Close above the black Range High, POPCAT could indeed drop into the light blue area in which case it would be important that price rebounds quickly from that region of support.

Because this light blue area acts really well as a direct rebound area but seldom as a firm support to build a base at.

With the Weekly Close just around the corner, we'll know soon enough how that Range High resistance will be treated.