Altcoin Market Update

Features analysis on Altcoins such as DOGE APT VIRTUAL CPOOL POPCAT PHA AVAX

Announcement - Easter Holiday Content Schedule

With the Easter holiday period just around the corner, I’d like to briefly talk about how this will affect content on the Rekt Capital Newsletter.

Here is the Easter Holiday schedule:

- Friday 18th of April, 2025 = No Coverage (Good Friday)

- Monday 21st of April, 2025 = No Coverage (Easter Monday)

- Wednesday 23rd of April, 2025 = Everything goes back to normal

Therefore please be advised that there will be no newsletter coverage on the 18.04 and 21.04.

Wishing you a restful, peaceful Holiday season

~ Rekt Capital

Hello and welcome back to the Rekt Capital Newsletter.

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Aptos (APT)

- Dogecoin (DOGE)

- Virtuals Protocol (VIRTUAL)

- Clearpool (CPOOL)

- Popcat (POPCAT)

- Phala (PHA)

- Avalanche (AVAX)

Let's dive in to today's Altcoin Market Update.

Aptos - APT/USDT

A few weeks we spoke about the dangers of a higher timeframe bearish retest for APT, even though price was showcasing initial signs of trying to form a lower timeframe bullish divergence:

Ultimately, APT has followed through on that bearish retest and rejected from the previous Macro Range Low, treating it as resistance:

However, it hasn't been all downside since rejection from the black $5.44 resistance.

APT has found some liquidity in the $3.90 level, as evidenced by the downside wick.

However, still, the confirmation for a trend reversal isn't there just yet.

APT needs to reclaim the $5.44 Range Low level as support to confirm that it is ready to resynchronise with its prior range and try to position itself to challenge for higher prices.

Without that confirmation, the risk is a little bit too steep because APT is in the middle of no man's land.

So that green arrowed confirmation is needed to confirm that price downside deviated below said level to grab necessary liquidity and is ready to end the downside deviation period overall.

Until then, it will be important to watch out for signs of mounting strength in the meantime:

APT has revisited the 35 RSI level (green) which has historically been a key region in facilitating basing periods from which price would reverse to the upside over time.

With APT at this RSI level right now, the RSI would need to break its multi-week RSI Downtrend (red) to confirm a sign of emerging strength in price building out a bottoming out area here.

Until then, it is a waiting game for the most part.

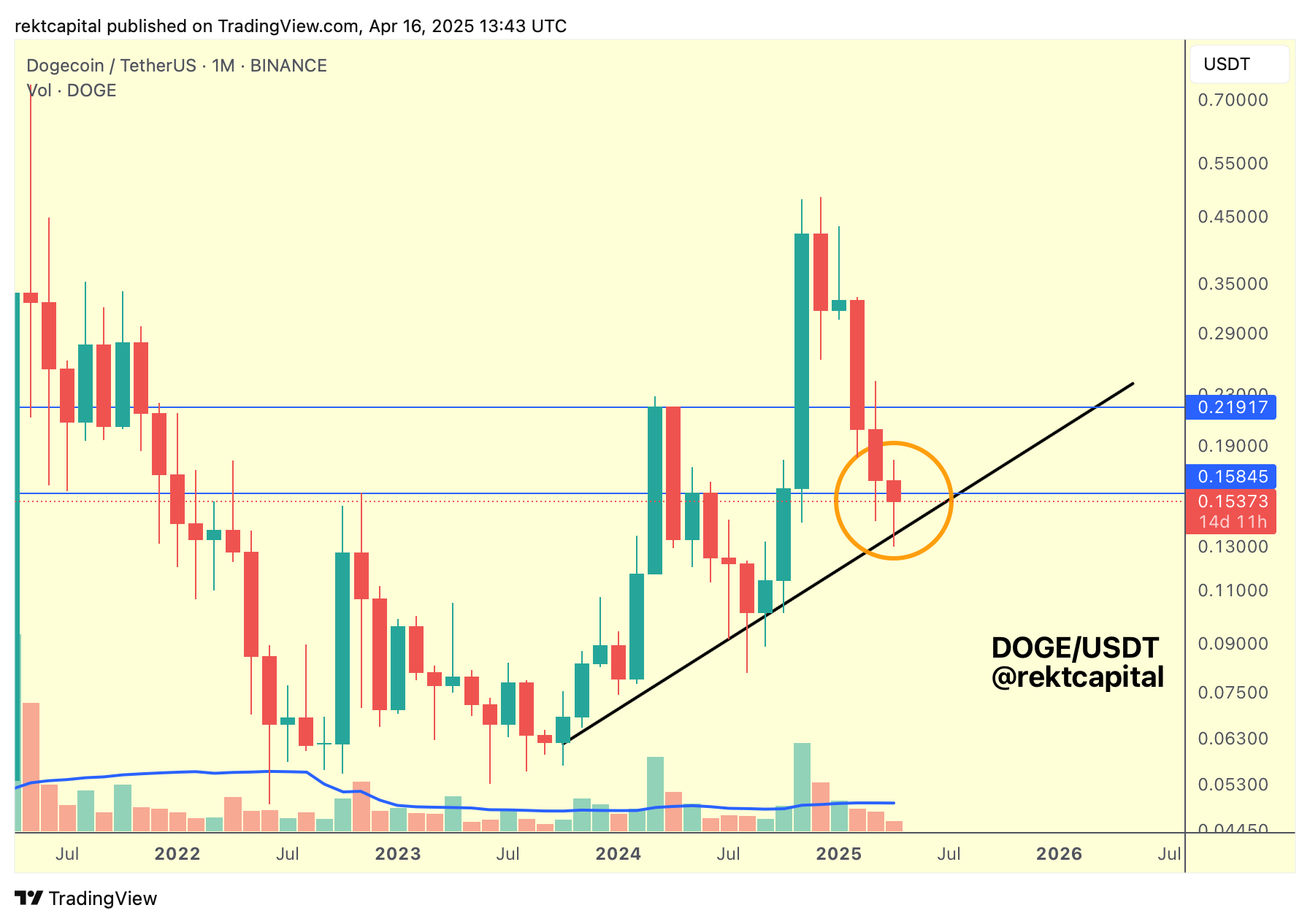

Dogecoin - DOGE/USDT

There are three key things to note about DOGE's price action.

Firstly, price is retesting a multi-month Higher Low trendline dating back to late 2023 as support (black).

Secondly, DOGE is trying to reclaim May 2024 highs (which turned into mid-2024 support) back into a demand area; price is teetering around this level for the moment.

And thirdly, the retesting of this general potential confluent area of support is occurring in the context of declining sell-side volume; seller volume has been in a downtrend for the past 2.5 months.

So if this declining seller volume continues and DOGE manages to Monthly Close both above the Higher Low and the blue ~$0.16 horizontal level, then a case could be made for slowing down in the sell-side momentum against a prominent confluent support area.

The retest is in progress and if the sellers demonstrate that they are exhausted, it will be easier for buyers to move price to the upside once that buyer volume comes in at support.