Altcoin Market Update

Features analysis on Altcoins such as FARTCOIN APT TAO PEPE XMR AVAX

Hello and welcome back to the Rekt Capital Newsletter.

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Fartcoin (FARTCOIN)

- Aptos (APT)

- Bittensor (TAO)

- Pepe (PEPE)

- Monero (XMR)

- Avalanche (AVAX)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

Fartcoin - FARTCOIN/USDT

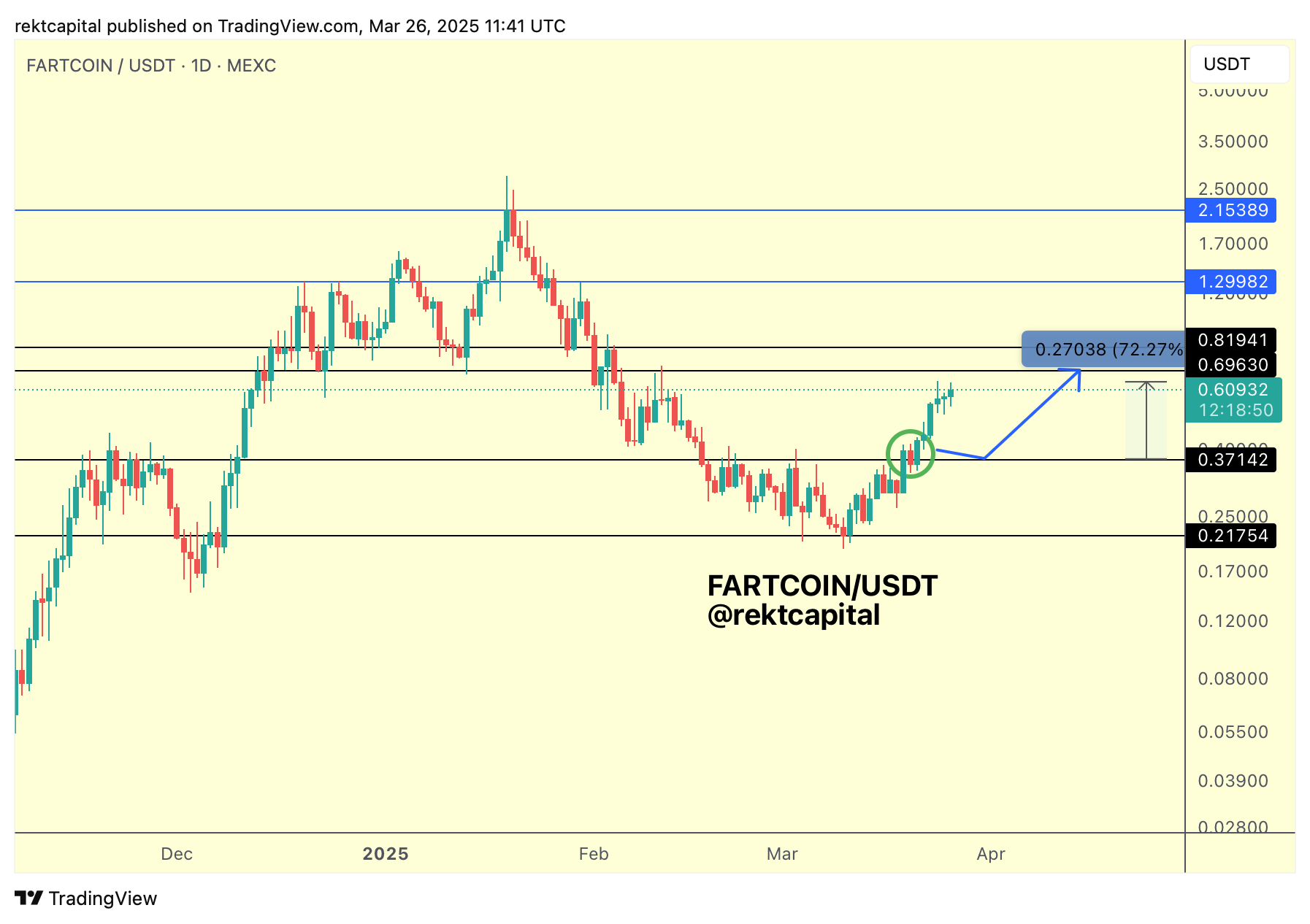

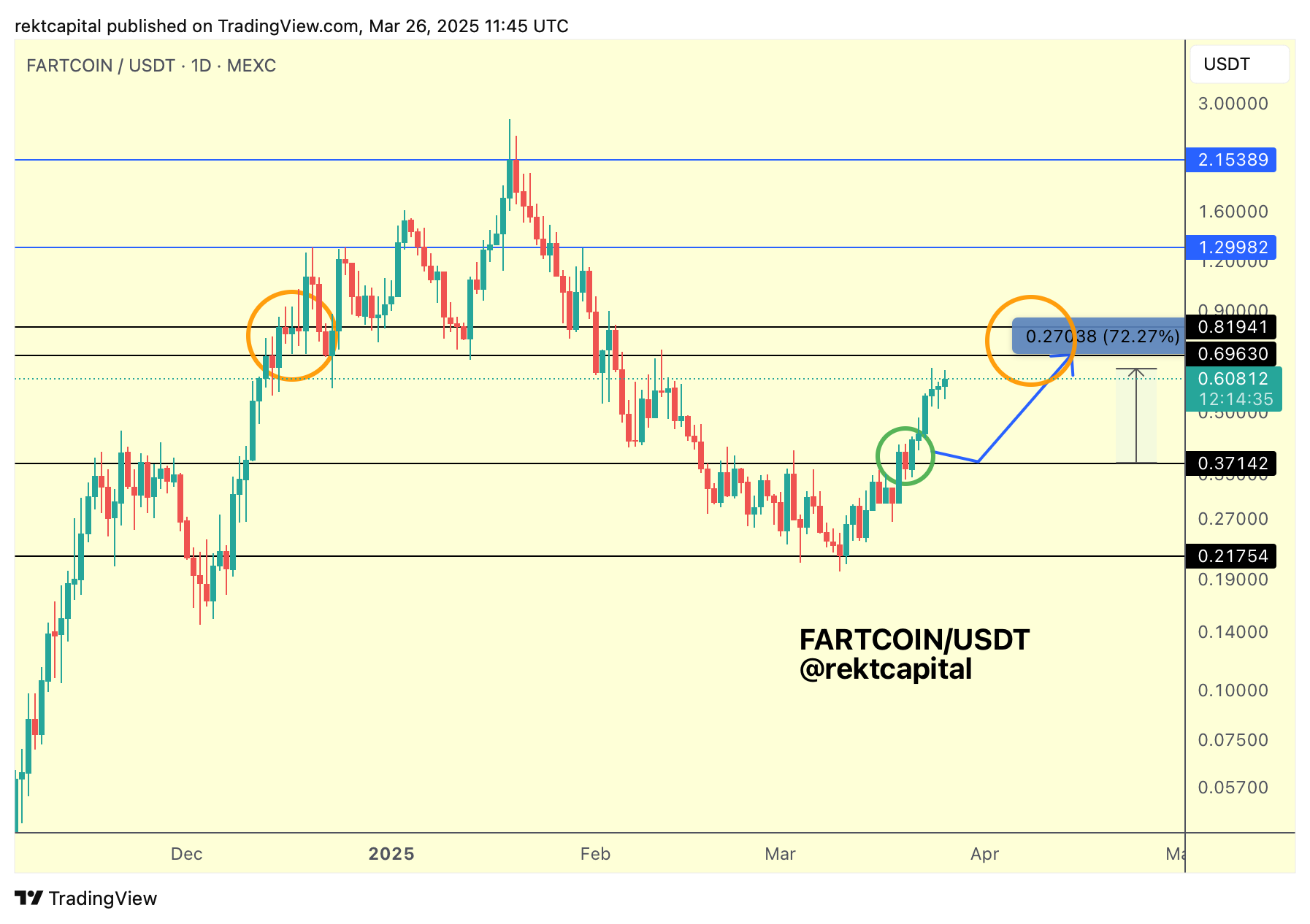

Last week, we discussed how FARTCOIN was on the cusp of breaking out from an old ReAccumulation Range:

And since that time, FARTCOIN indeed provided the necessary breakout confirmation to exit its ReAccumulation Range:

Indeed, FARTCOIN Daily Closed above the Range High of $0.37 and post-breakout retested it as support to fully confirm the breakout.

FARTCOIN has since rallied +72%, following the blue path perfectly.

What's worth looking out for going forward for this coin?

Price will need to Daily Close above $0.69 to potentially position itself for further upside continuation (orange circle).

After all, Daily Close above $0.69 and successfully retesting of it into new support has been a key signal in enable a FARTCOIN move to even as high as $1.29 over time.

In the event that price isn't able to reclaim that $0.69 level as support, it will continue to remain in the $0.37-$0.69 range.

Aptos - APT/USDT

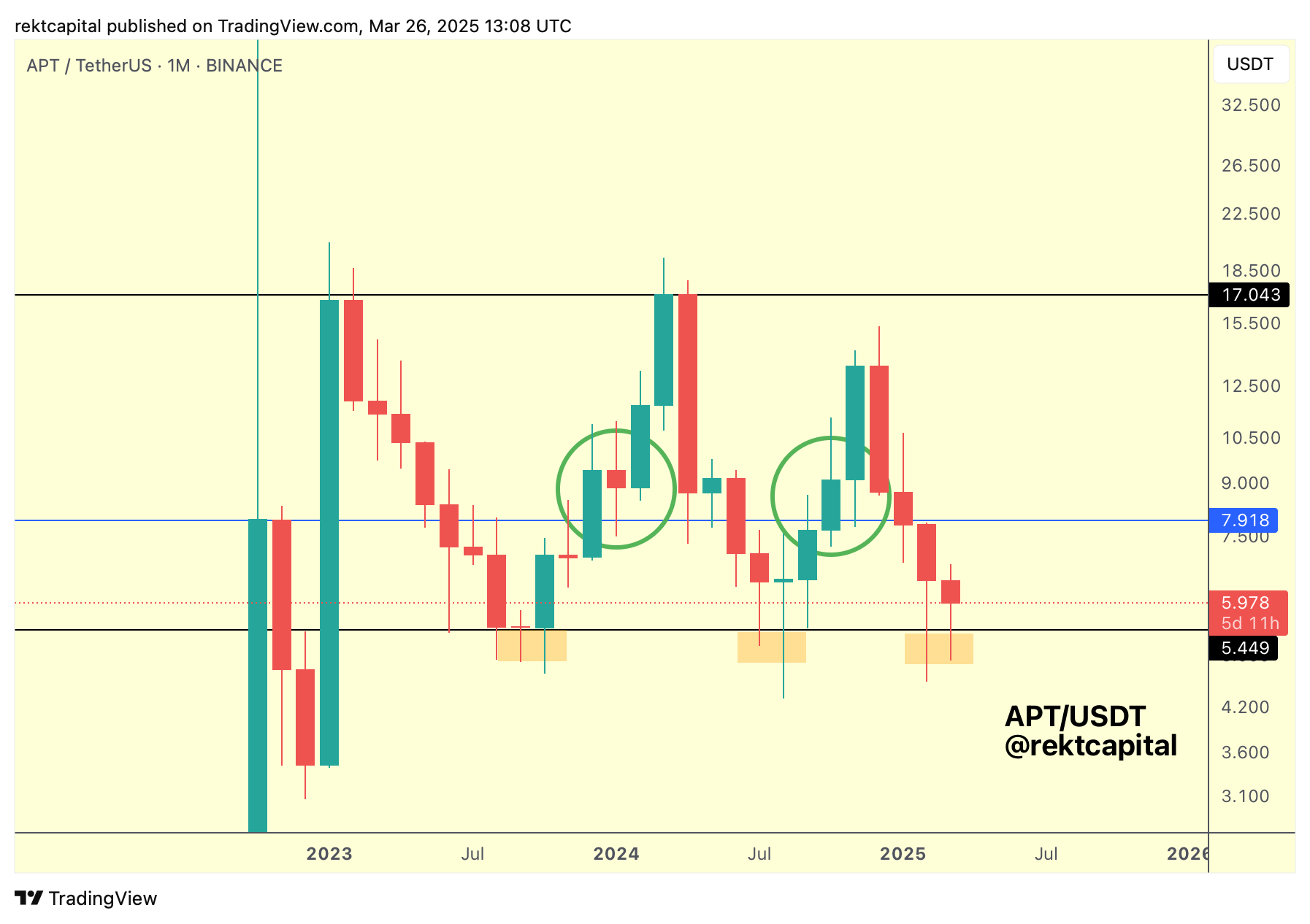

Earlier this month, we discussed APT's downside deviation below the Macro Range Low as part of a volatile retest.

Here's the analysis from mid-March:

Here is today's update:

APT has rebounded some +15% to the upside from the Macro Range Low support, enjoying a successful retest that is in line with historical tendencies and preserving the Macro Range in the process.

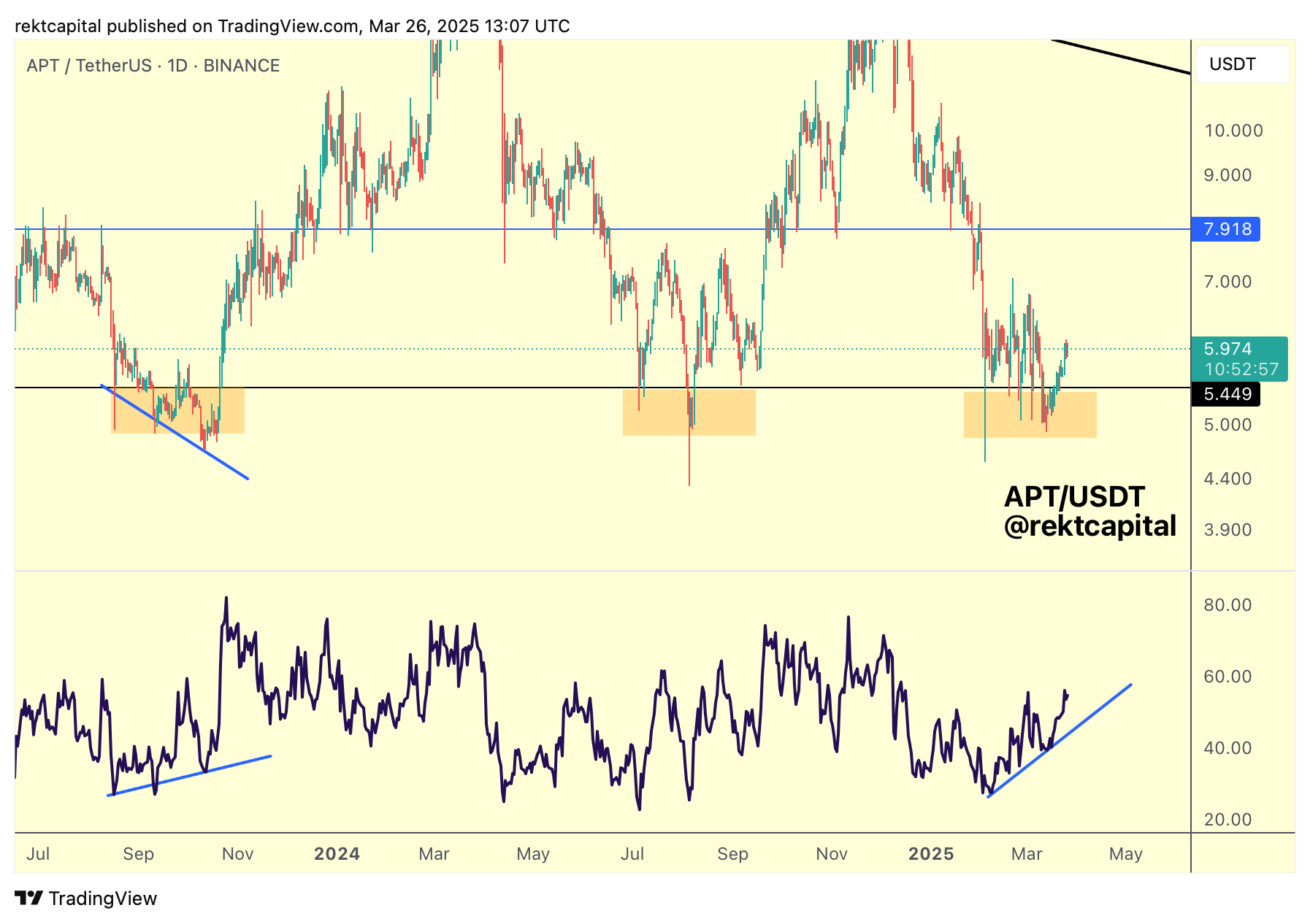

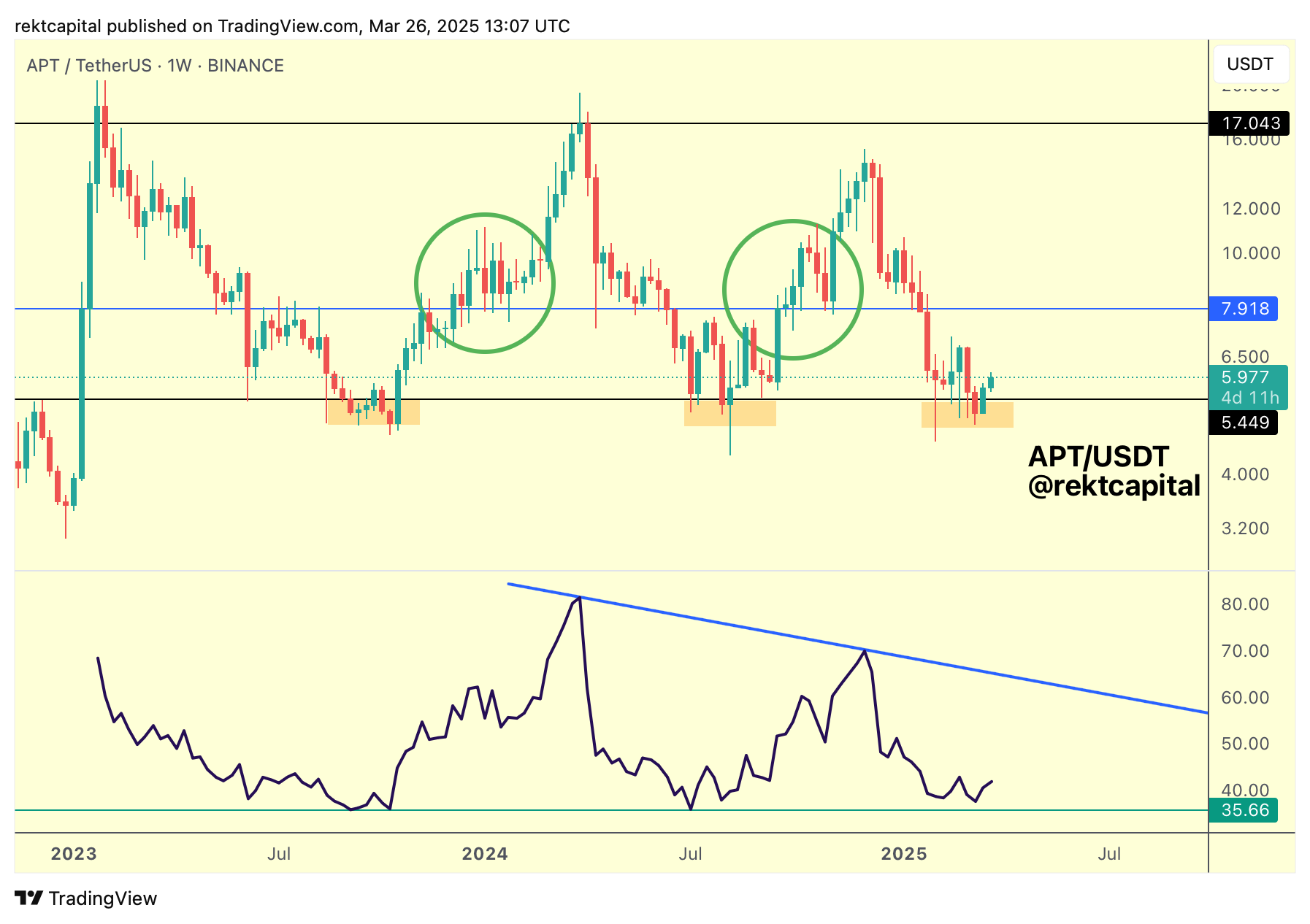

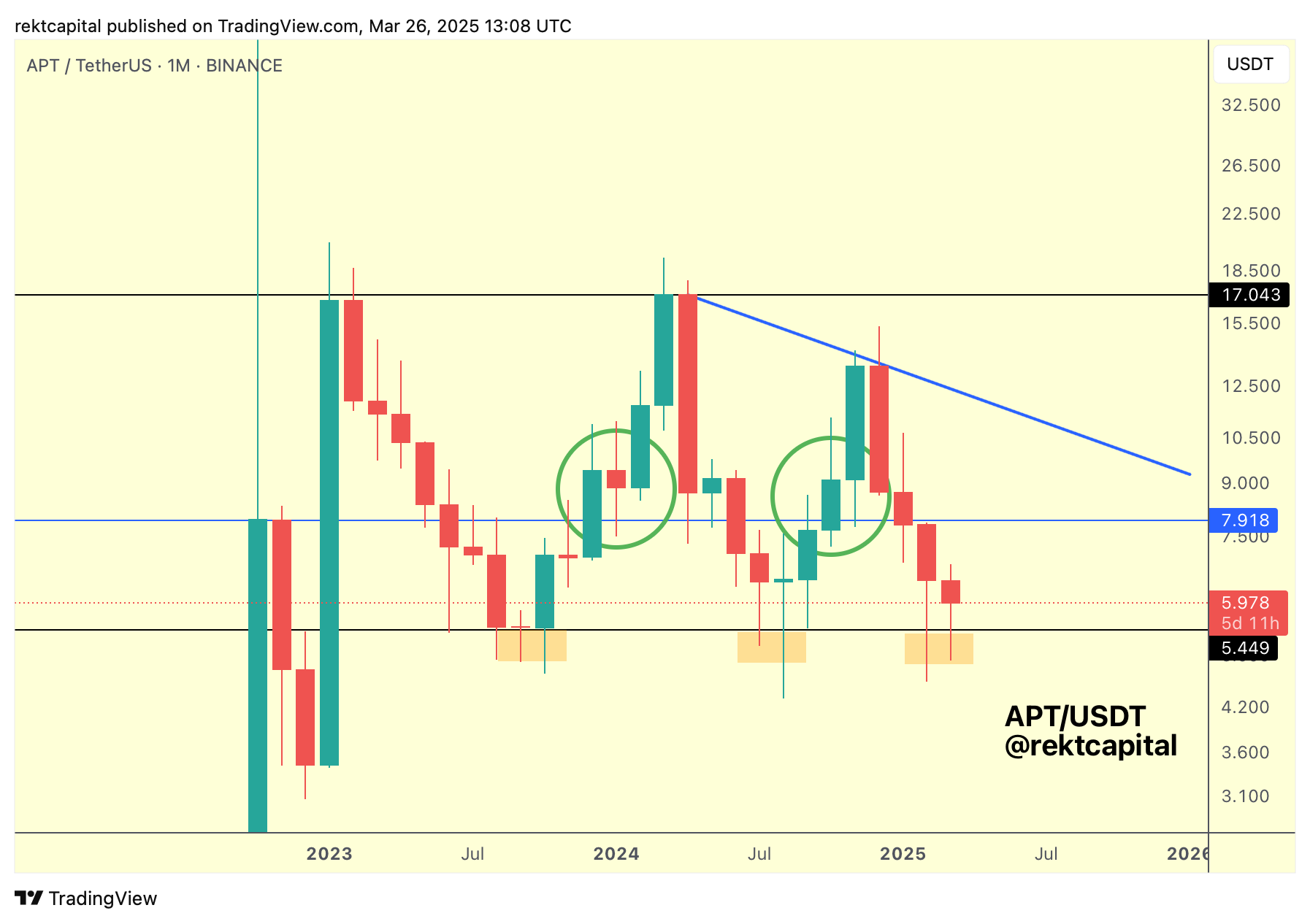

Zooming into the Daily timeframe, we'll notice that Aptos is repeating history not just via its retest on the Macro Range Low but also the style in which it has done so:

That is, on the Daily, APT has a history of developing Lower Lows in the price action against the Macro Range Low and Higher Lows in the RSI, to bring about a Bullish Divergence.

Out of the three macro bottoms at this Macro Range Low dating to September 2023, APT has produced two Bullish Divergences which preceded reversal to the upside across the Macro Range; this is looking like the second time a Bull Div is preceding a bullish trend reversal from this historical demand area (orange box).

So we see there is confluence with Macro Range Low on the Monthly timeframe and the Daily Bullish Divergences around this Macro Range Low on the Daily timeframe.

The Weekly timeframe also offers some confluence as well:

On the Weekly RSI, APT is very close to the 35.66 RSI level (green) which has been a Macro reversal area for the RSI and price as well.

Going forward, a Monthly Close just like this would confirm that APT has successfully retested the Macro Range Low as support:

Historically, APT tends to produce retesting events at the Macro Range Low, events that have lasted three months at a time.

As a result, while it looks like the retest of the Macro Range Low is becoming successful, it wouldn't be out of the ordinary if APT downside wicks into the Macro Range Low area (black level of $5.44, orange box) as part of that third month of consecutive retesting here, all in an effort to build out a solid base from which APT could spring from over time.