Altcoin Market Update

Features analysis on Altcoins such as TAO APT KAS THETA PYTH XRP

Hello and welcome back to the Rekt Capital Newsletter.

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Bittensor (TAO)

- Aptos (APT)

- Kaspa (KAS)

- Theta Token (THETA)

- Pyth Network (PYTH)

- Ripple (XRP)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

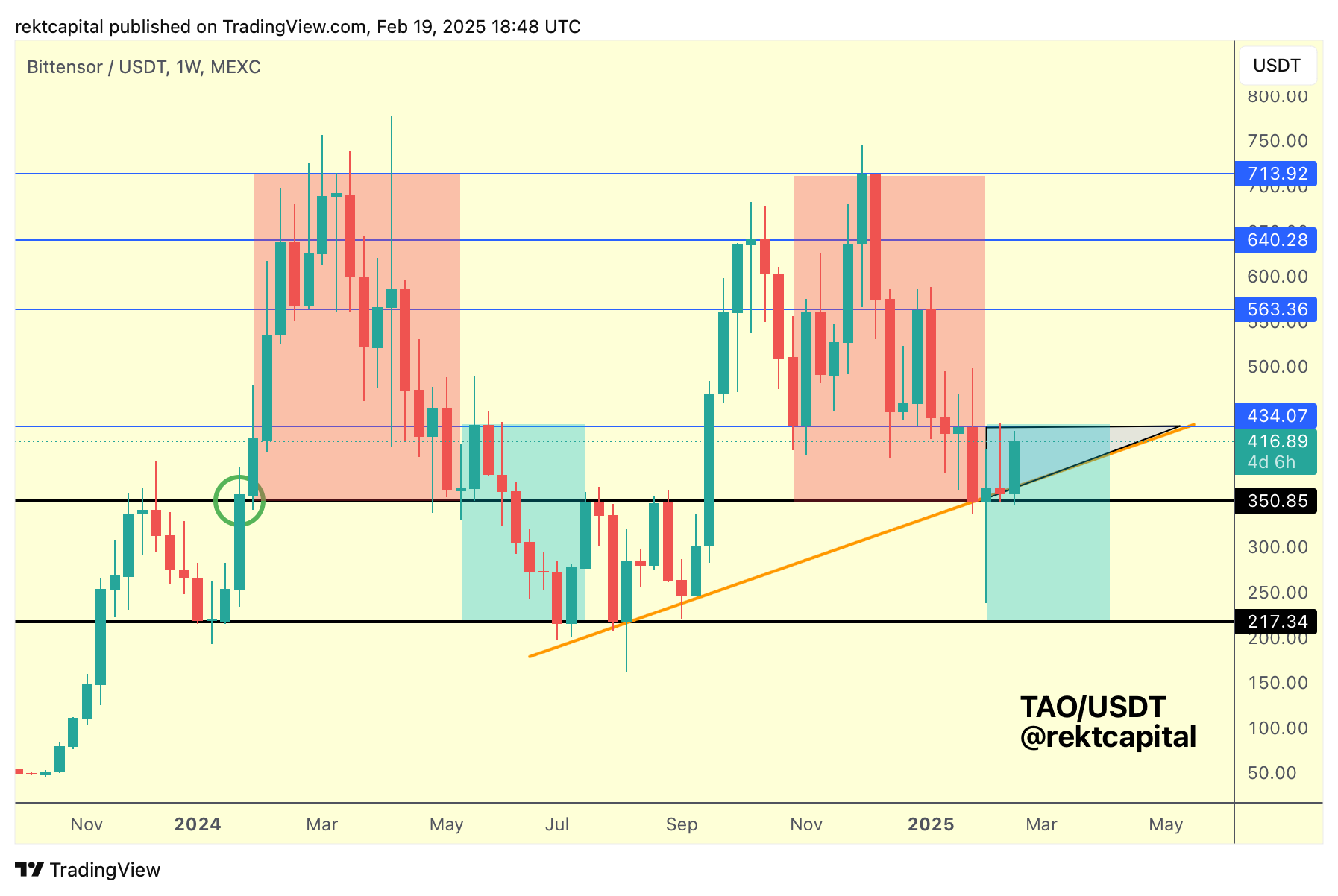

Bittensor - TAO/USDT

Last week we spoke about TAO in a lot of detail so today we'll just focus on the update:

Last week, TAO upside wicked into the top of the Ascending Triangle and rejected right back into the base of the pattern.

But this is where this week's rally originated from and price has rallied to the top of the Ascending Triangle once again.

Ultimately, TAO is just merely consolidating inside this structure but will need to produce a Weekly Close above the top of the pattern followed by a post-breakout retest to kickstart a breakout.

Because history shows that in the absence of such breakout confirmation, TAO can reject from the $434 resistance to continue its downtrend:

It's very simple - TAO just needs to Weekly Close above the $434 to invalidate that more bearish scenario (even though technically, two weeks ago TAO downside wicked to those low levels already).

And to position itself for such a Weekly Close, TAO needs to continue holding the orange technical uptrend support dating to mid-2024.

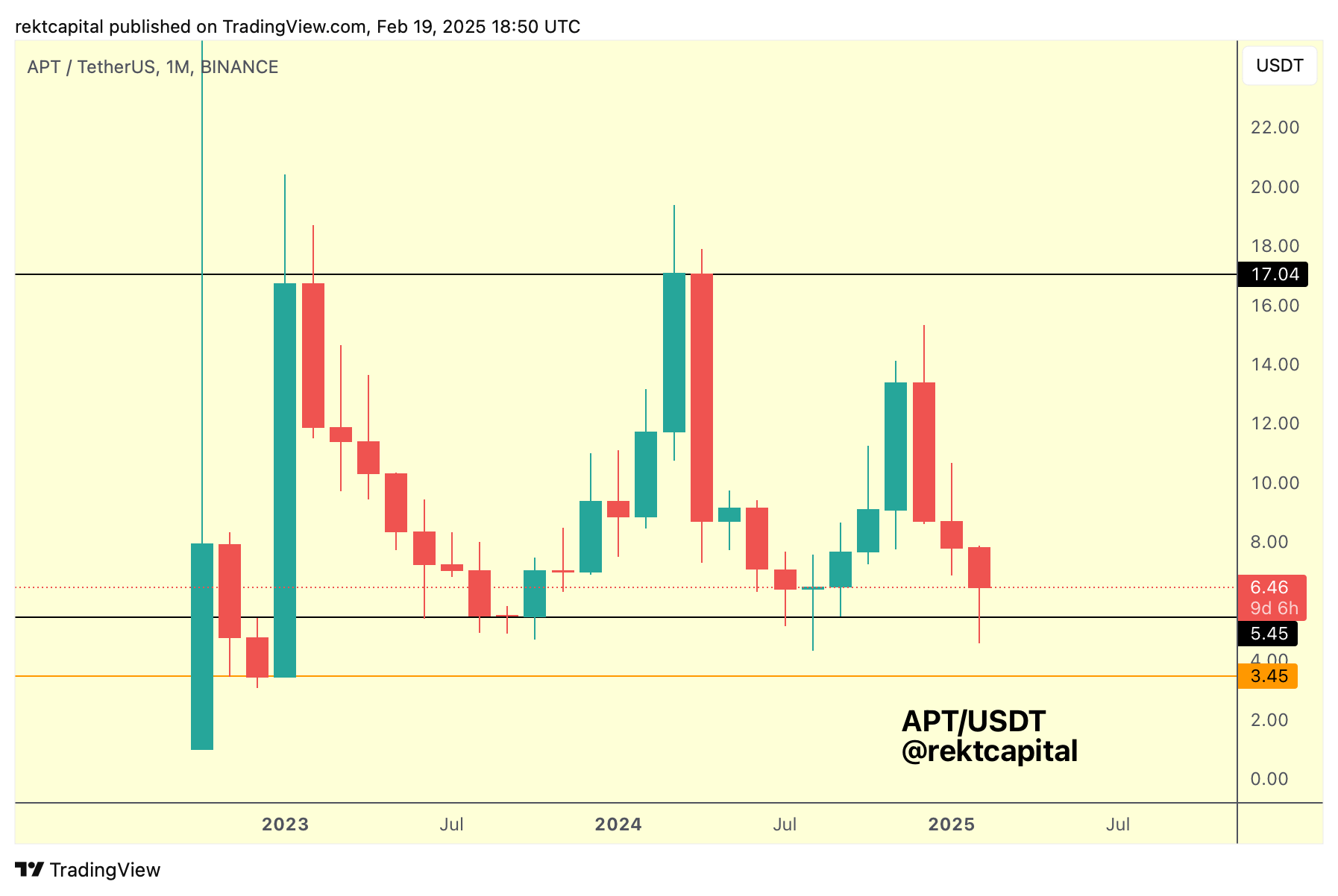

Aptos - APT/USDT

APT is finding support at the Monthly Range Low (black), producing a downside wick below said support much like it did in mid-2024.

This is the Range Low that price needs to continue to hold to position itself for a move across the range:

For the past three weeks, APT has been holding well here.

And if there is a diminishing return from the Monthly Range Low (which is unlikely to be the case if we are transitioning into the more parabolic stages of the cycle), then that would still mean that APT could revisit the blue multi-month Downtrend at least over time.

APT just needs to continue enjoying price stability here and if it does, then it is likely to cluster here much in the same vein to the previous clusters at this Monthly Range Low that preceded upside across the entire range.