Altcoin Market Update

Features analysis on Altcoins such as TAO KDA LTC ETH XLM XMR

Hello and welcome back to the Rekt Capital Newsletter.

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Bittensor (TAO)

- Kadena (KDA)

- Litecoin (LTC)

- Ethereum (ETH)

- Stellar (XLM)

- Monero (XMR)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

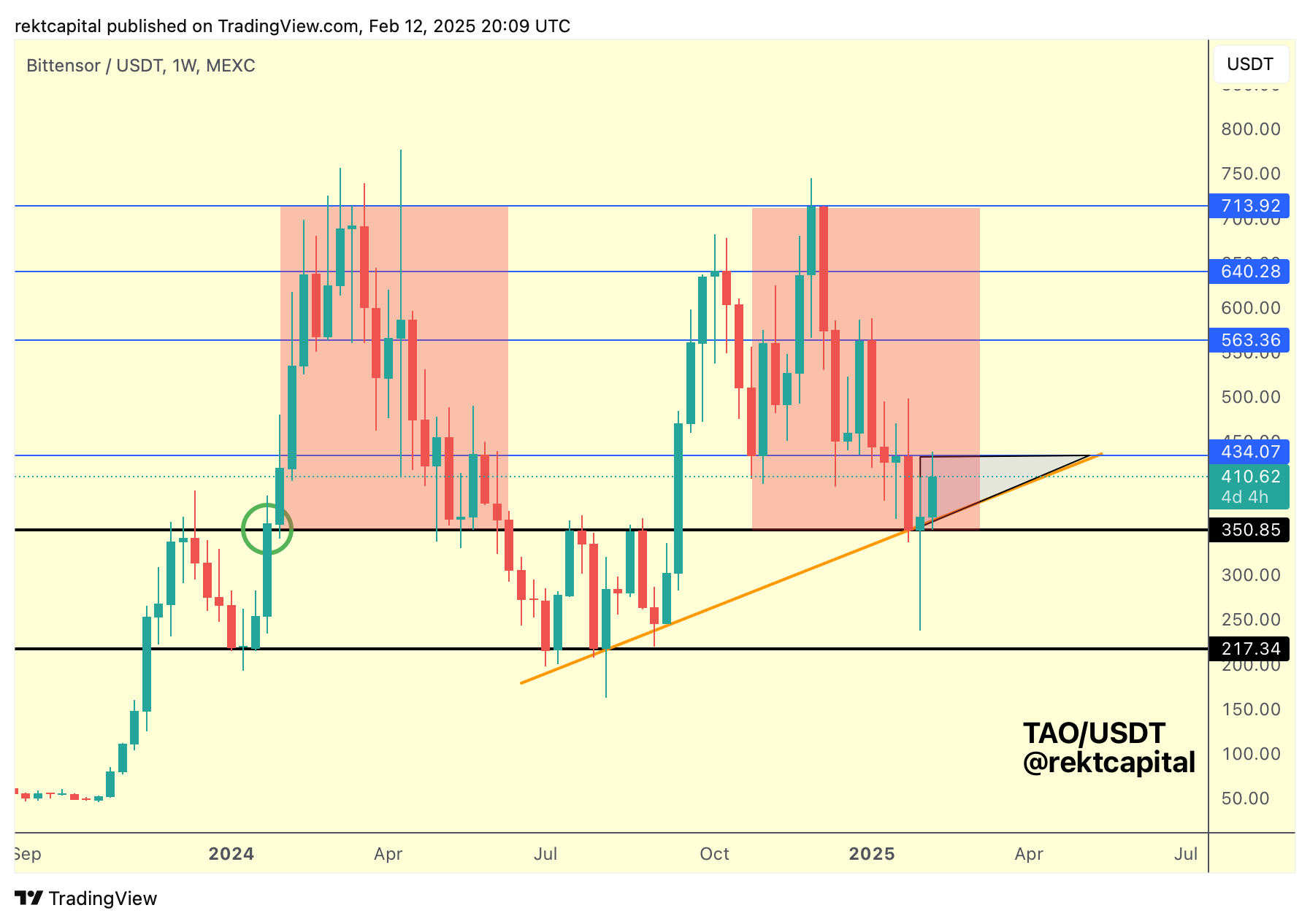

Bittensor - TAO/USDT

Technically, TAO has performed a successful mid-term post-breakout retest of its Macro Accumulation Range (black-black).

Interestingly, the old Range High resistance is a confluent support with the Macro Higher Low for TAO:

At the moment, the retest has been successful of this confluent support area.

But in recent months, we've learned a great deal about the key pivot levels for TAO (blue):

And if TAO is to build on this recently successful retest, it will need to continue developing this prospective Ascending Triangle and Weekly Close above the top of it to breakout and confirm the trend continuation on this recently successful retest.

This Ascending Triangle breakout is pivotal for TAO to go against the grain of its historical fractal (red box):

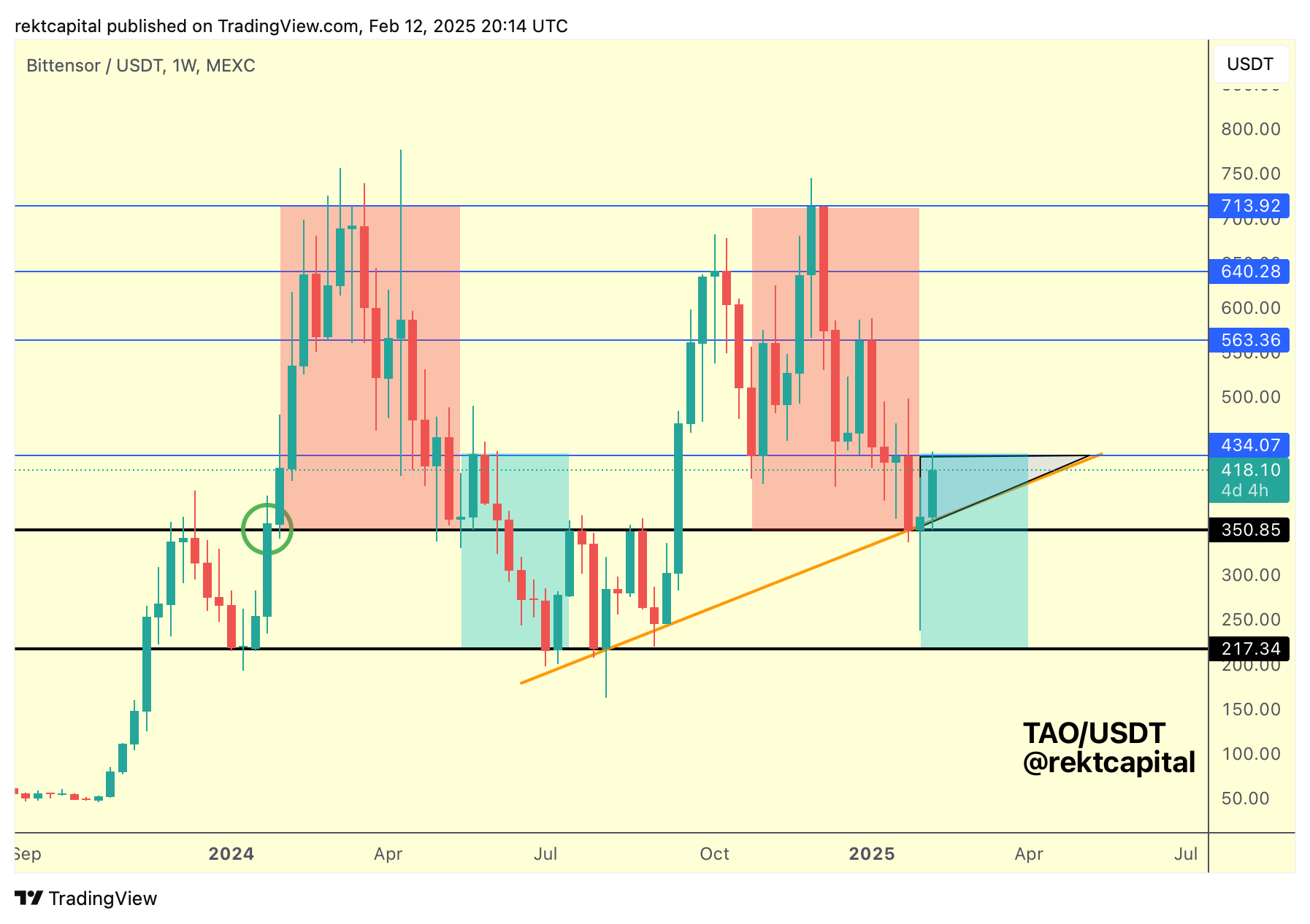

After all, TAO consolidated between the black-black Macro Accumulation Range between late 2023 and early 2024, before breaking out to $713 before rejecting into the Macro Accumulation Range High region for what became a successful post-breakout retest in this short-term, only for price to reject from $434 resistance (blue) before slinking back into the Macro Accumulation Range once again for a bout of extended consolidation.

Here's a chart to illustrate that thinking visually:

Interestingly, the blue $434 resistance is yet again the very important level that needs to be broken.

It's absolutely critical that TAO Weekly Closes above $434 and/or retests it as support to confirm a break of $434 as resistance.

Breaking $434 activates the bullish case, essentially, and confirms that price will go against the grain of its historical price tendencies.

Kadena - KDA/USDT

It's do or die for Kadena, with price resting on the multi-year Higher Low, dating back to 2021.

Since 2021, time and again, KDA has been able to hold this technical uptrend as support, often producing downside wicks below the support but ultimately Monthly Closing above it to preserve the support overall.

KDA has once again downside wicked below the Higher Low and is positioning itself for a Monthly Close above it.

KDA needs to hold just like this for the next few weeks to keep the technical uptrend alive and to keep its chances for a revisit of the Lower High alive too.