Altcoin Market Update

Features analysis on Altcoins such as DOGE SOL ALGO APT CPOOL ETH HBAR XRP

Hello and welcome back to the Rekt Capital Newsletter.

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Dogecoin (DOGE), Solana (SOL) and Algorand (ALGO

- Aptos (APT)

- Clearpool (CPOOL)

- Ethereum (ETH)

- Hedera Hashgraph (HBAR)

- Ripple (XRP)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

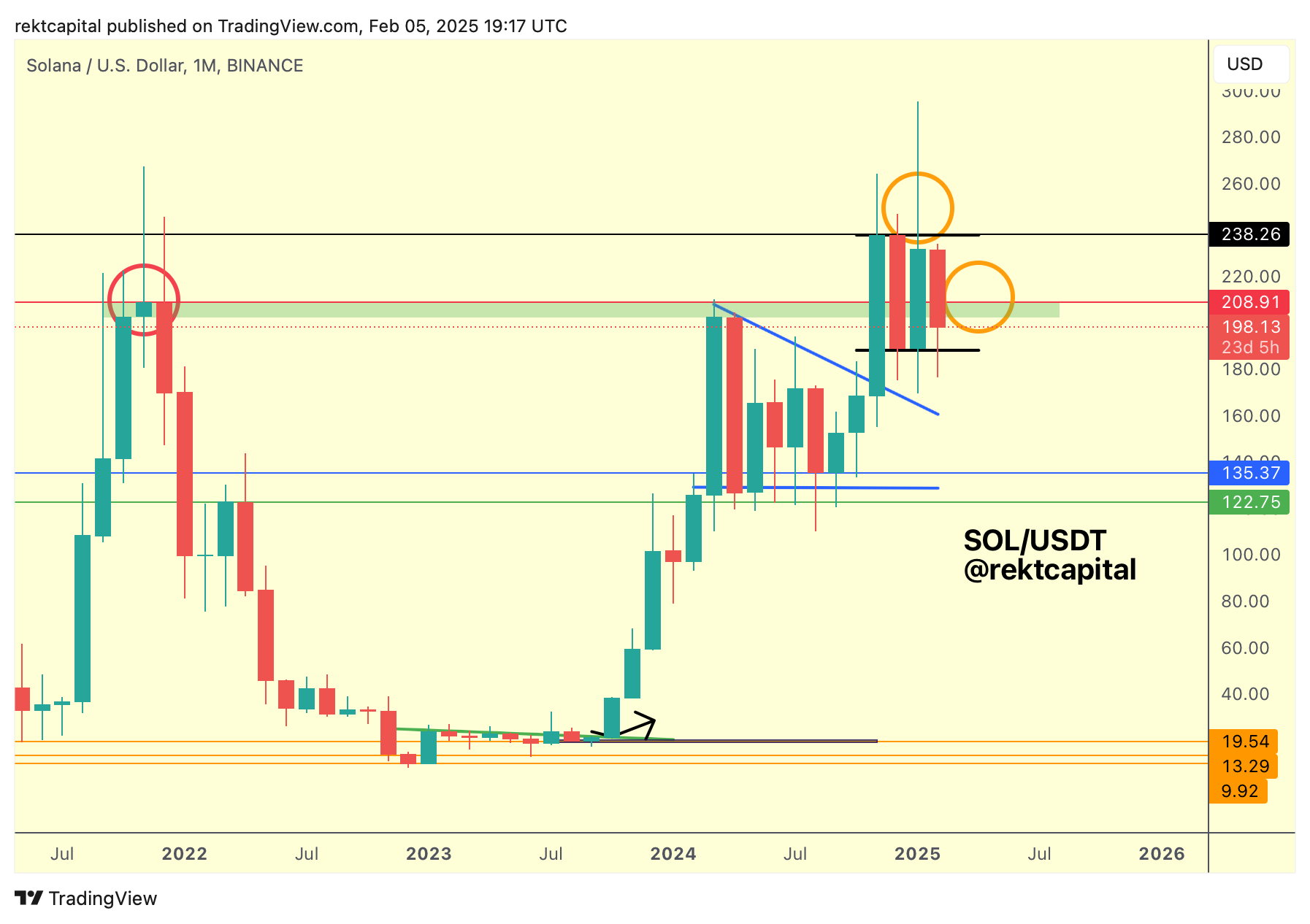

Solana, Dogecoin, Algorand (SOL, DOGE, ALGO)

With the new Monthly Close officially in, Solana has performed it just below the $238 Monthly level, confirming it once more as a resistance.

In fact, price has developed a new Lower High as a result but SOL continues to maintain this Flagging structure (black) nonetheless.

That Bull Flag bottom is essential to be held by SOL for the structure to remain intact.

But because it is so early in the month, whatever downside deviations that occur for the moment may not be set in stone.

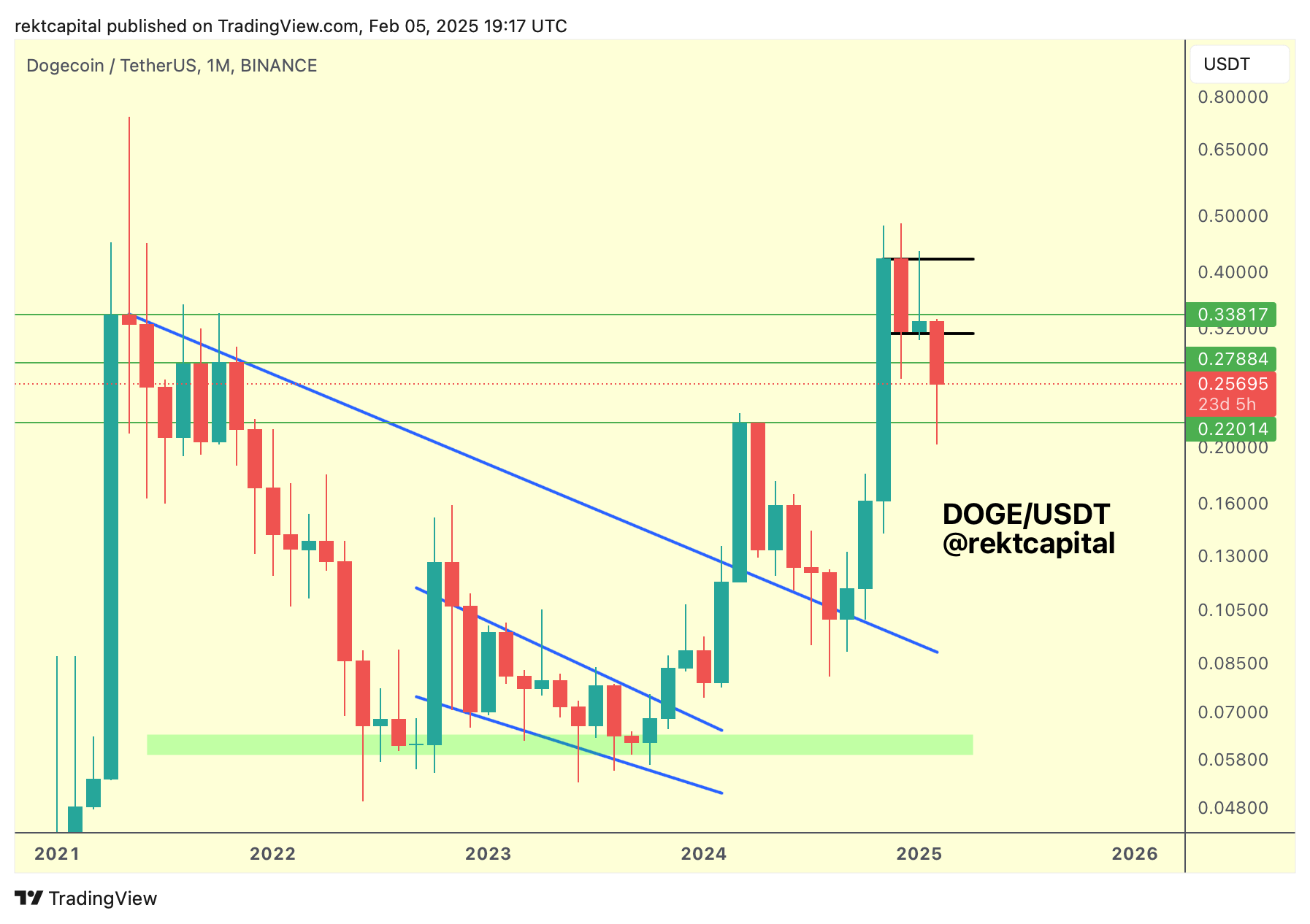

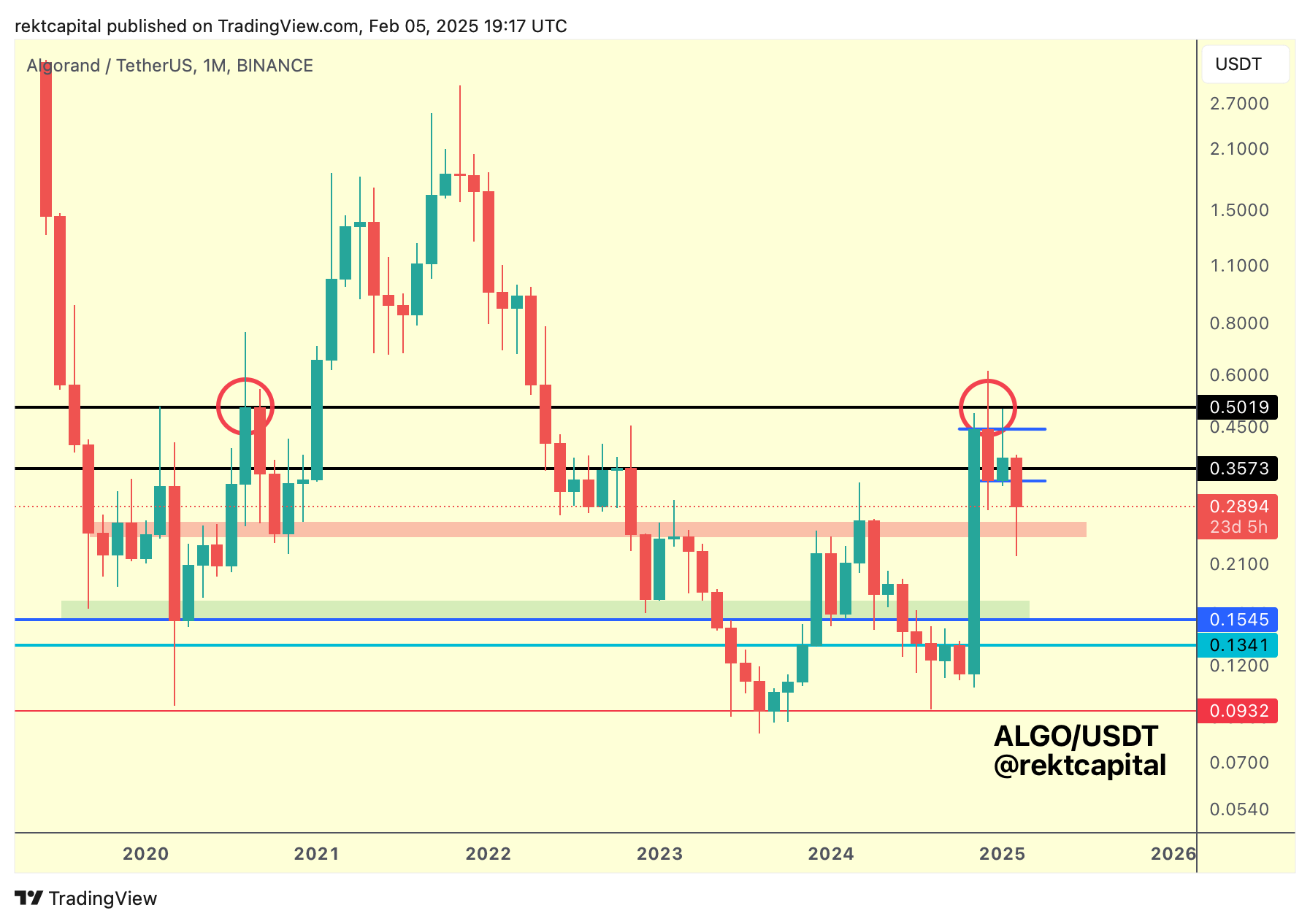

While SOL continue to maintain its Flagging structure, DOGE and ALGO for example are downside deviating below their analogous patterns:

ALGO is similar, producing a downside deviation below the structure:

Much like DOGE, ALGO has also dropped into an old major Monthly resistance (red) which is acting as support.

So while these patterns appear to be failing, the downside deviations below them are seeing price action drop into old major resistances which are demonstrating a market progression and evolution to be figuring as newfound supports.

It's early in the month so what if these downside deviations end up as wicks by month end?

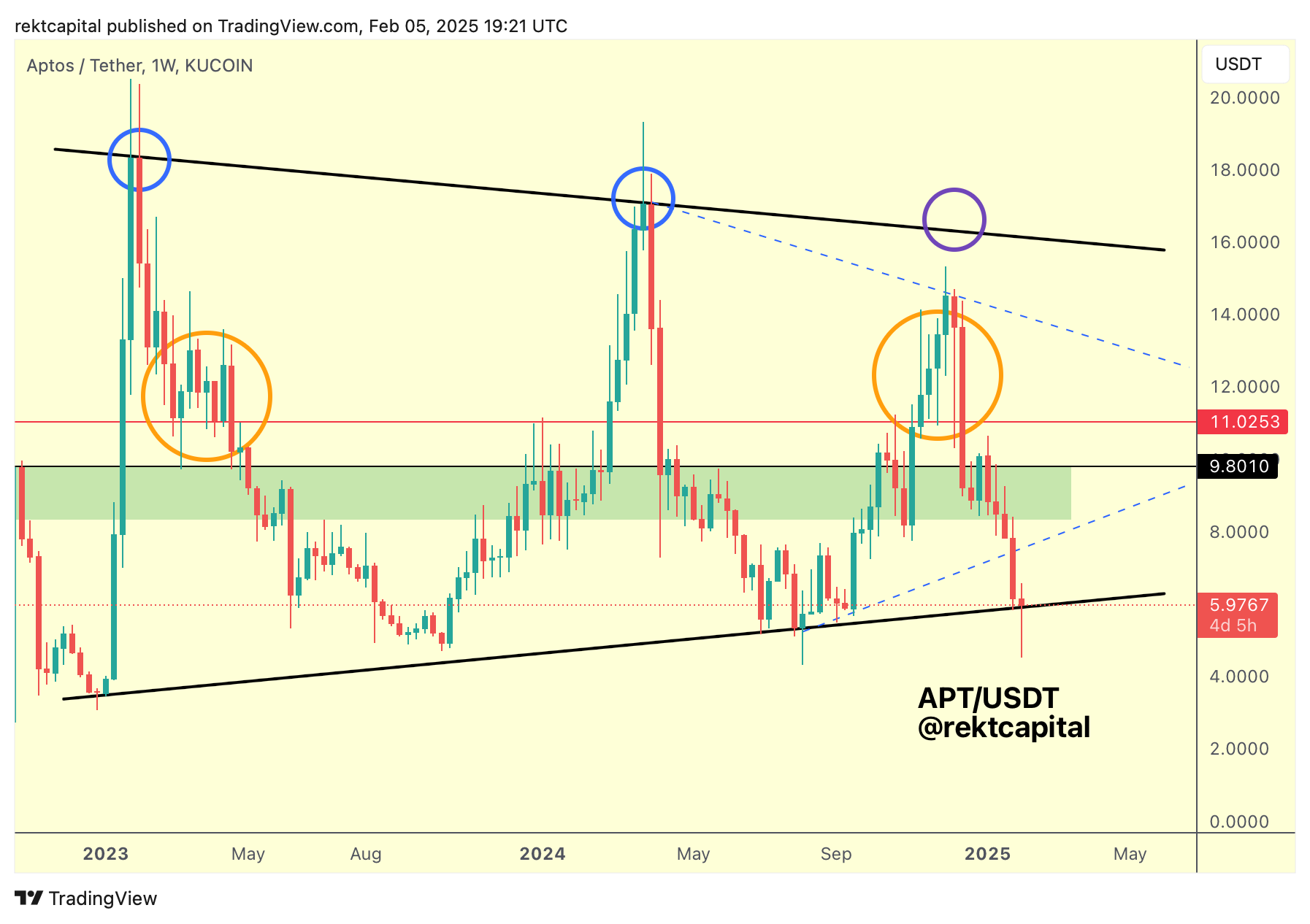

Aptos - APT/USDT

APT has now dropped into the Macro Wedge Bottom, holding support there while producing downside wicking below it.

This Macro Wedge Bottom also happens to be the technical uptrend line dating to early 2023.

This trendline certainly has some substance as a result and needs to see price print Weekly Closes above it to not just maintain the technical uptrend but also maintain the macro market structure in general.

Zooming out to the Monthly, another view on APT is that it is merely in a Macro Range:

This is now the third cluster that may be developing here at the Macro Range Low for APT; price needs to hold $5.45 (black) as support or at least Monthly Close above it to maintain the range.

Continued stability here and APT could reverse from here over time (previous clusters saw several after three monthly candles at the Range Low, not without downside wicking below support in the meantime however).

And should APT indeed reverse from here, it would be vital for price to break the blue Downtrend.

Because a rejection there followed by a drop back down to the Range Low in the future could spell that the rebounds from the Macro Range Low are getting weaker, signalling weakening support there.

To illustrate...

APT needs a strong rebound from this Macro Range Low to go against the diminishing returns from the Macro Range Low that may be developing.

And rebound from here to the Macro Downtrend would signify +95% rally and so a rejection at the Downtrend would indeed satisfy that "weakening support" theory.

However that's a story for another day - APT needs to react from this Range Low now.

And if the first rebound from the Macro Range Low was +211%, then the second rebound was +145%... yes there is a potential diminishing in return from the Range Low but does that mean that this next third rebound would suddenly not work out at all?

Price stability at $5.45 is essential and so is Monthly Close above it for price to reverse from here.