Altcoin Market Update

Features analysis on Altcoins such as ETH DOGE UNI DOT VET CRO KNC RUNE

Welcome back to the Rekt Capital Newsletter.

In today’s edition of the Rekt Capital Newsletter, the following cryptocurrencies will be analysed & discussed:

- Ethereum (ETH)

- Dogecoin (DOGE)

- UniSwap (UNI)

- Polkadot (DOT)

- VeChain (VET)

- Crypto Com (CRO)

- Kyber Network (KNC)

- Thorchain (RUNE)

Ethereum - ETH/USD

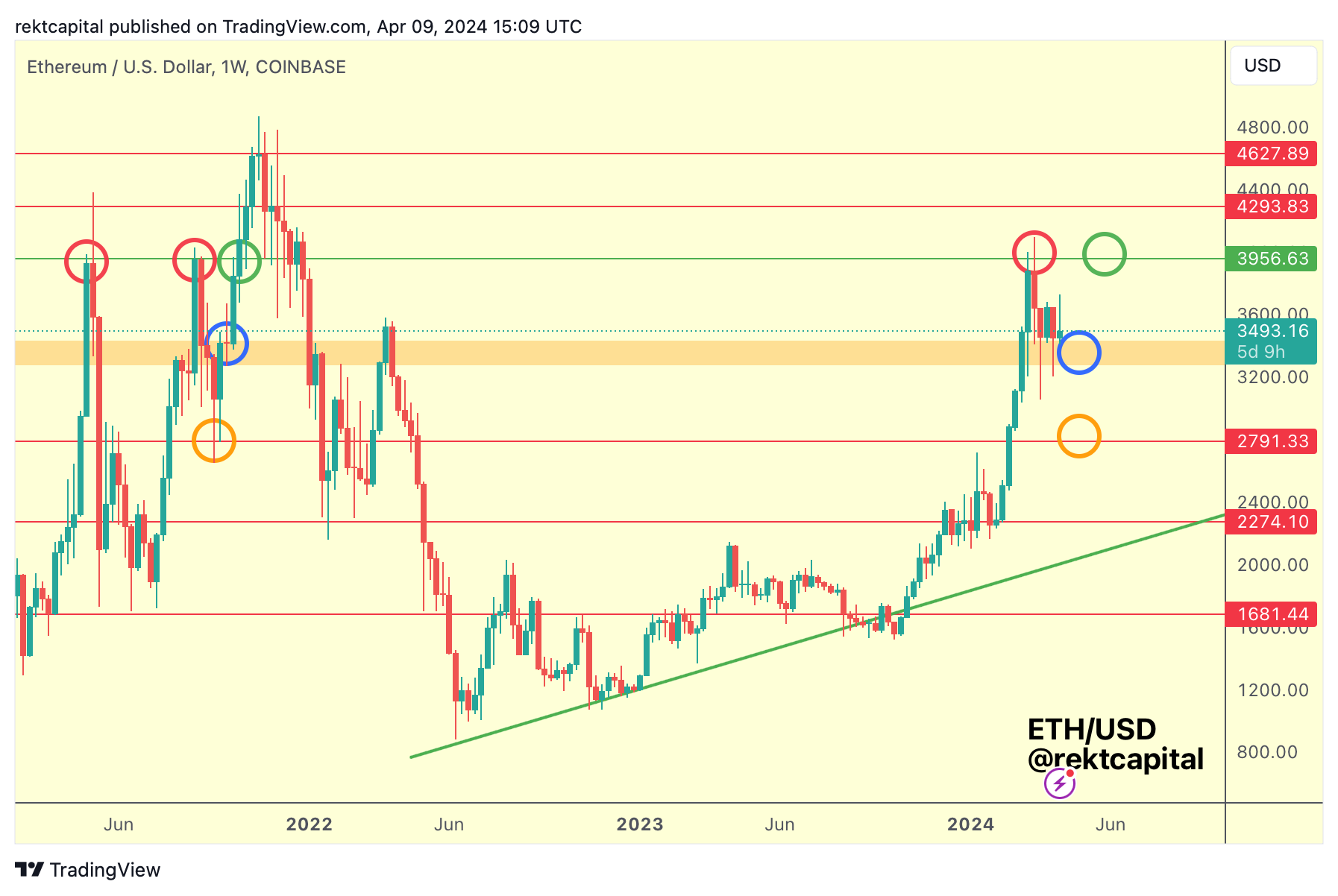

Last week, we spoke about scenarios for Etheneum's price action:

In short, it was all about whether price could hold the blue circled retest because if not, ETH would probably downside wick into the $2800 level (orange circle).

Here's today's update:

ETH downside wicked towards this orange circled region last week, Weekly Closed below the orange area, and this week ETH upside wicked into this same orange area, seemingly flipping it into new resistance.

ETH is as a result positioned for downside continuation; the only thing missing now is that follow-through for price to drop lower and closer to the orange circled area once again.

Generally though, ETH is now located in the $2800-$3300 range until further notice, with scope for downside within this range.

Until ETH is able to reclaim the orange area as support (blue circle), a bearish stance is a more reasonable one to adopt in the interim.

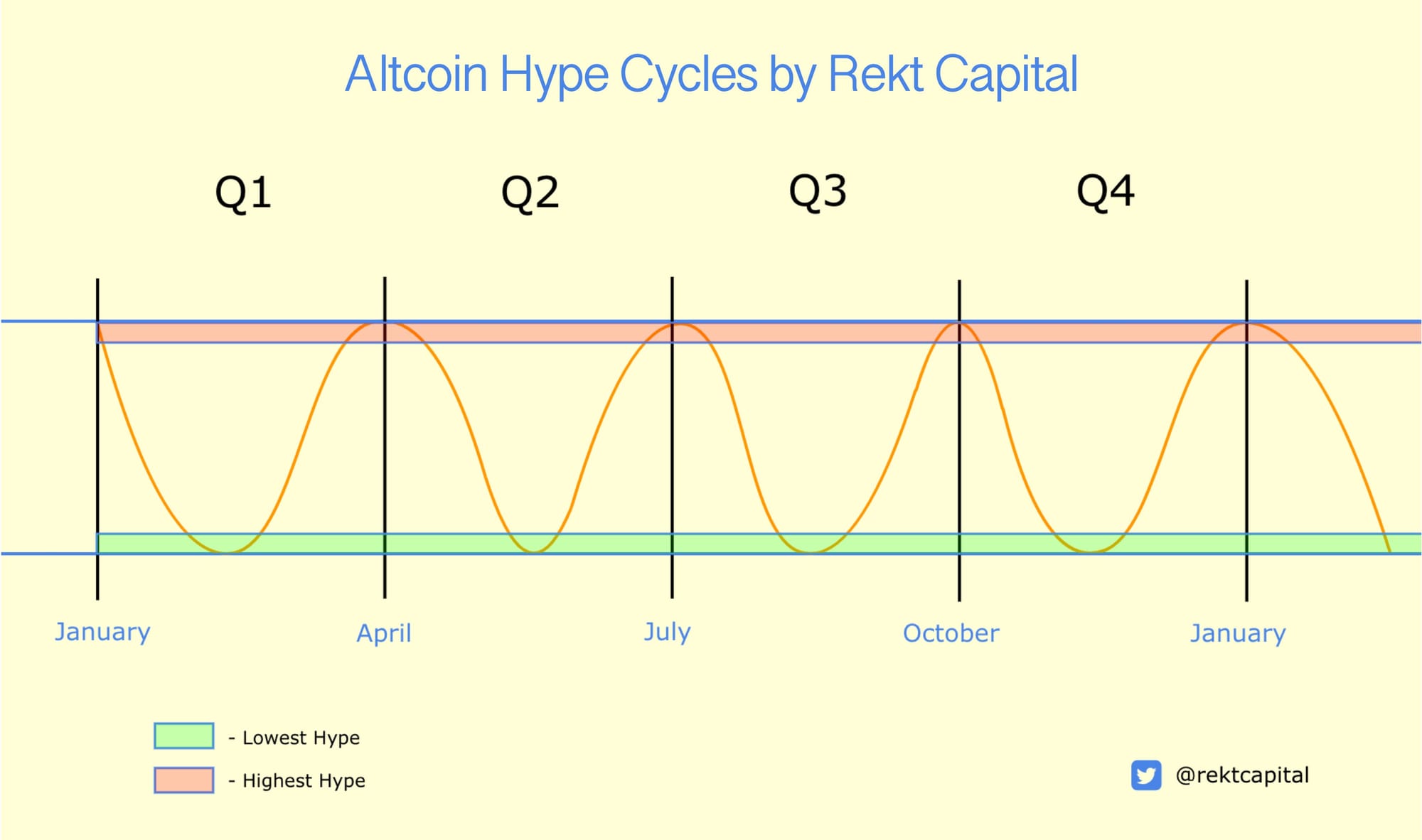

That being said, it's important to underscore how Altcoins tend to generally behave around the Halving event and it's historically been bearish, especially since this Halving event also coincides with the end of the Q1 Altcoin Hype Cycle:

Altcoins have followed this graphic to perfection in this Bull Market and I expect the same going forward.

Which means that Altcoins should bottom out on their retraces in the coming several weeks in preparation for the new Q2 Altcoin Hype Cycle.

This would translate into Altcoin bottoming in as early as mid-May, more realistically end of May, early June.

Dogecoin - DOGE/USDT

The goal for DOGE is to perform a retest of the red $0.20 level as new support following a positive Monthly Close above that same level in March.

Technically, there was scope for downside volatility as part of that retrace - and we got that - but DOGE actually retraced even deeper than was occurred in mid-2021 on a similar retrace (green circle).

In fact, DOGE dropped closer to the black $0.12 Range Low, as if breaking back down into the black-red range ($0.12-$0.20) despite briefly breaking out from it.

In addition, this downside volatility actually got DOGE very close to retesting the Macro Downtrend it broke out from last month, in a way turning an old multi-year resistance into new multi-year support.

Essentially, in performing this retest, DOGE has fully confirmed its new Macro Uptrend.

And technically, DOGE could still recover in time for the April Monthly Close to occur above the $0.20 level.

However, if this doesn't occur, DOGE will likely continue to behave between this black-red range ($0.12-$0.20) until it is ready to breakout from it again.

In any case, it's this confluent support of the Range Low at $0.12 and the Macro Downtrend is the absolute crucial support to supporting a new Macro Uptrend and DOGE is successful in retesting this area thus far.

And with plenty of time left in the current Monthly Candle, perhaps there's still a chance DOGE will manage to reclaim the $0.20 level as support before the month is done.