Altcoin Market Update

Features analysis on Altcoins such as STX VANRY SUI TAO AERO WU

Hello and welcome back to the Rekt Capital Newsletter.

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Stacks (STX)

- Vanar Chain (VANRY)

- Sui (SUI)

- Bittensor (TAO)

- Aerodrome Finance (AERO)

- Wormhole (WU)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

Stacks - STX/USDT

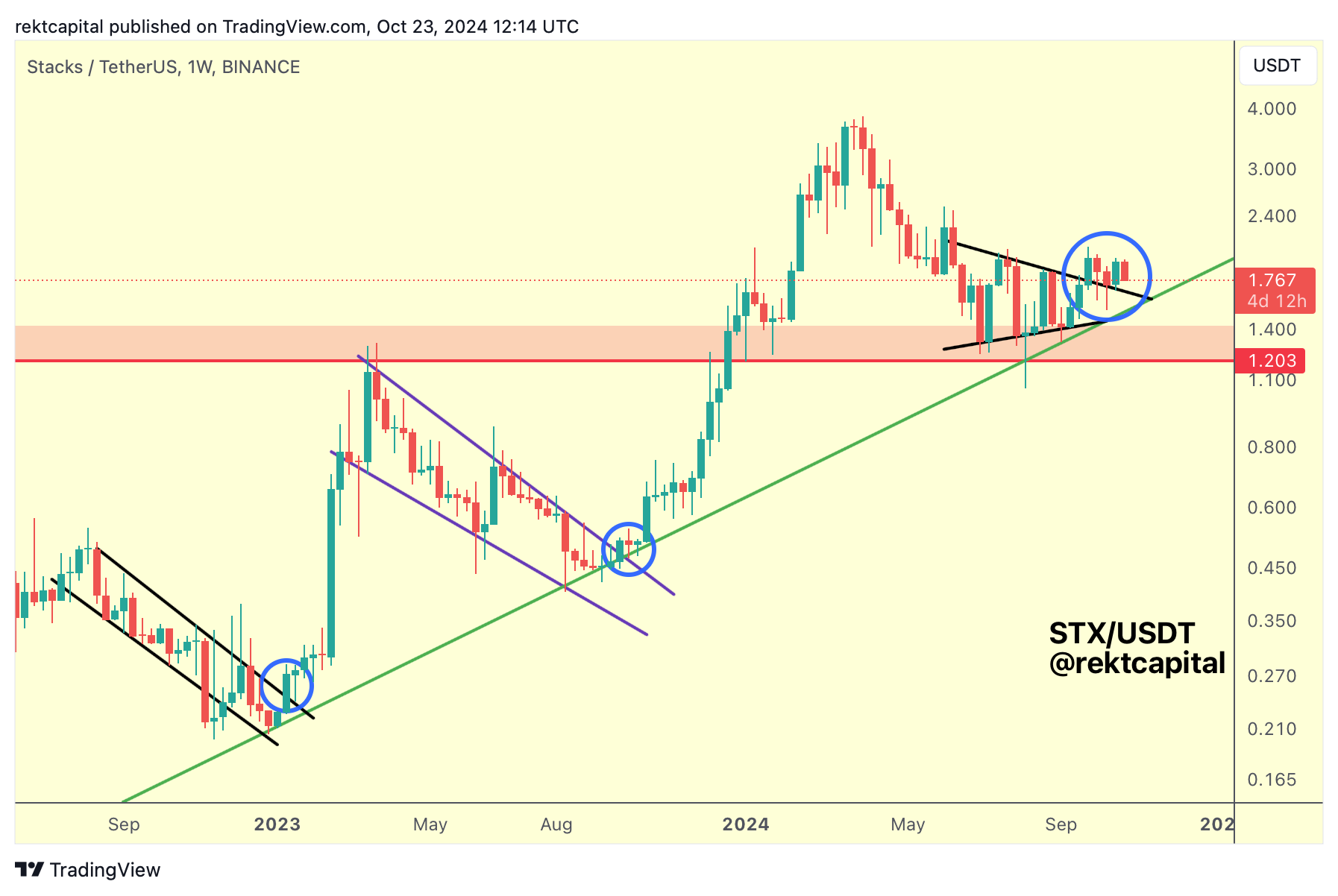

In recent weeks, STX has been repeating history to a certain extent by developing a macro market structure (black) near the macro Higher Low (green) and then breaking out from it and retesting the top of the pattern into new support (blue circle).

In the past, this breakout-retest-continuation process has varied in terms of the amount of time that it took to complete.

In early 2023, this process in its entirety took 2 weeks whereas in late 2023 it took 3-4 weeks before continuation took effect.

Right now, STX is in its 5th week.

It's clear that this breakout-retest-continuation process is taking longer and longer to come to fruition over time.

However, it's key to note that this breakout-retest-continuation process is still underway, despite extending in terms of how long it is taking to come to fruition; in other words, the fact that it is taking longer than usual doesn't mean that the tendency is invalidated altogether.

STX is still successfully retesting the top of the macro pattern (black) as support, likely forming a multi-week re-accumulation structure on top of that aforementioned pattern.

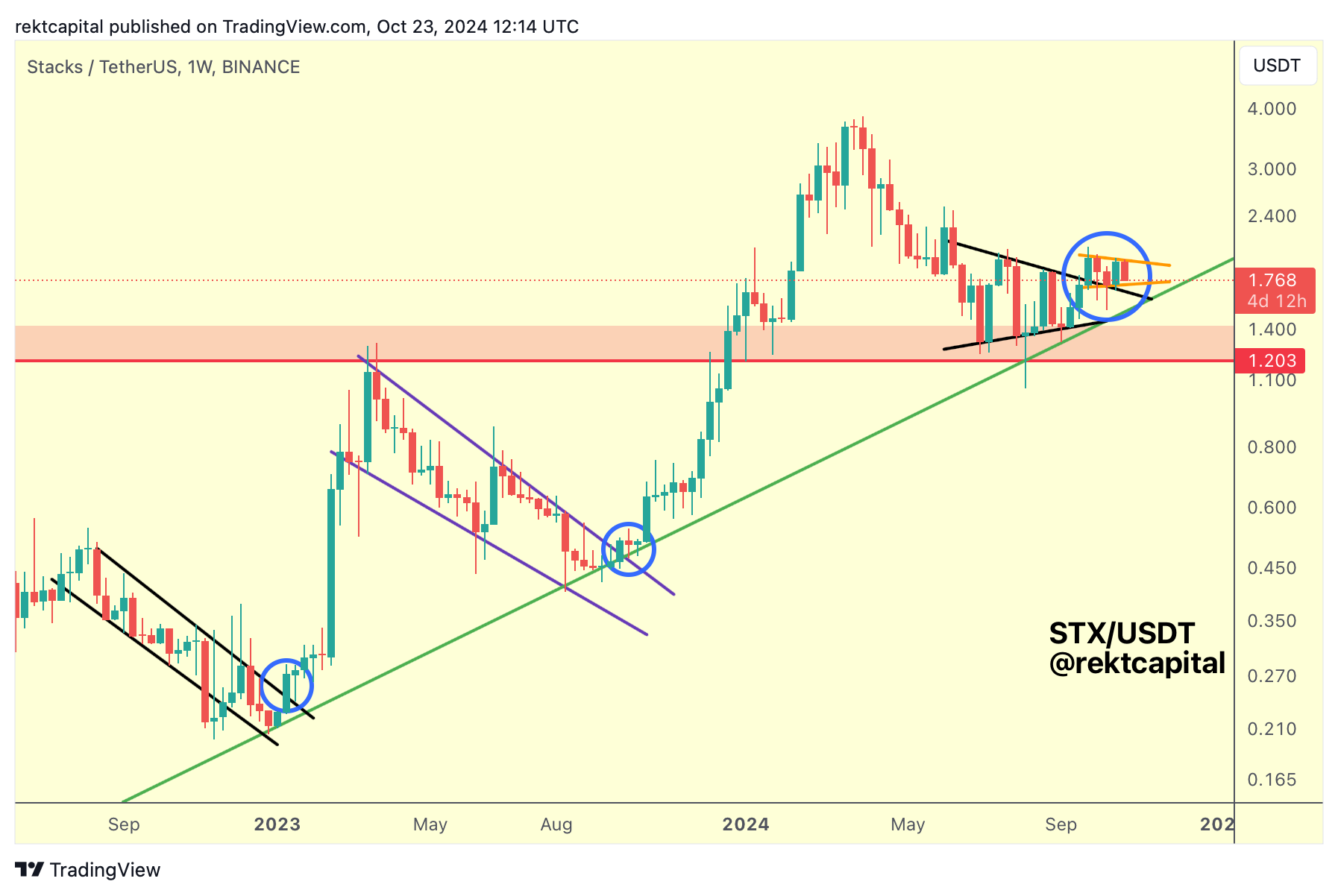

More, a new Lower High has developed for STX and it will be crucial to investigate whether a new Higher Low will develop to form a potential continuation structure on top of the black macro wedge:

This orange pattern is a provisional structure based on the fact that we already know there is a new Lower High developing but we don't yet know where the bottom of that emerging pattern is, though we can suspect it may be a new Higher Low.

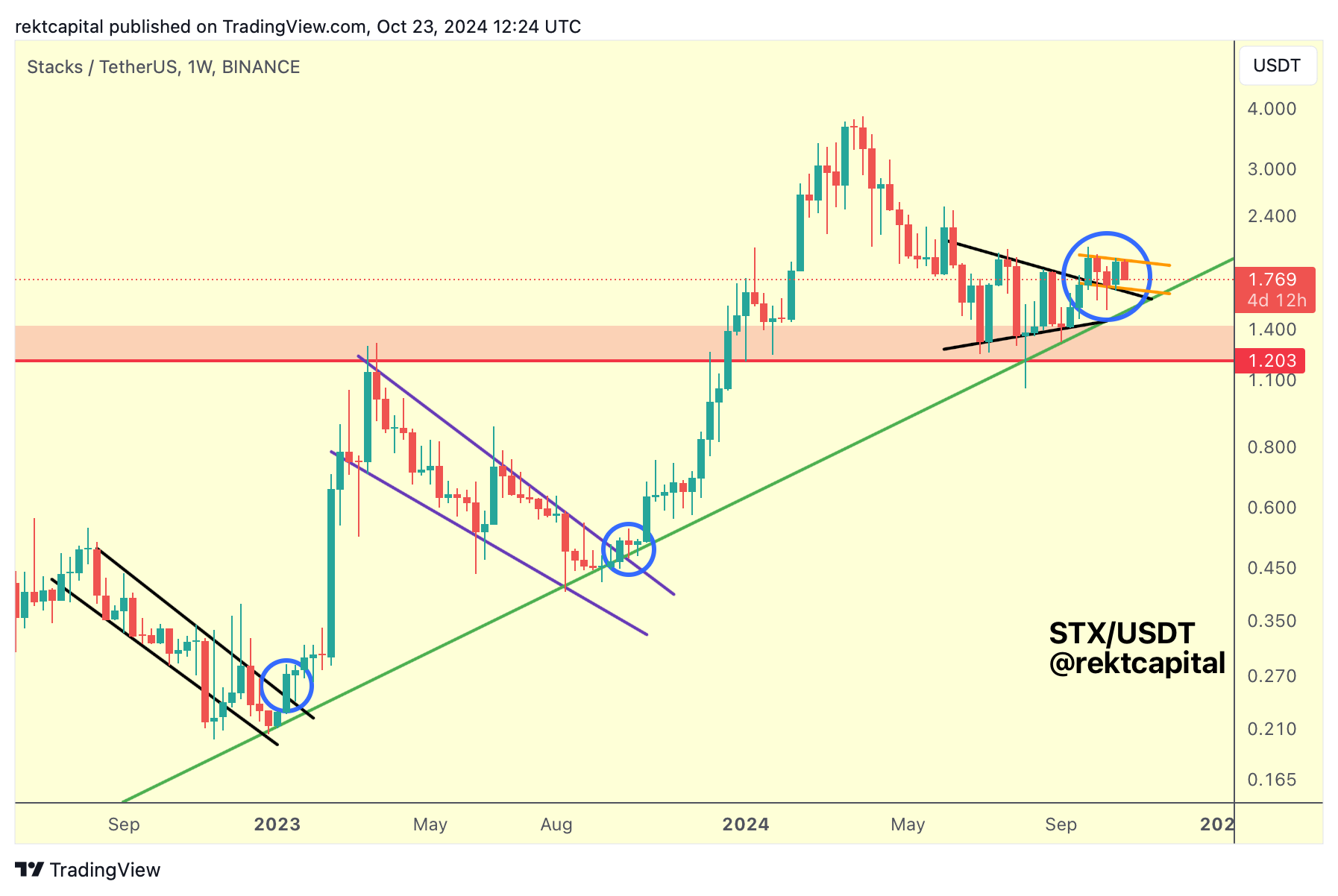

Generally, the top of the black wedging structure will continue to figure as a key support and there is scope technically for that support to even become a confluent support with a potential Falling Wedge bottom:

We'll be monitoring how this current emerging structure (orange) plays out but it is clear for the moment that STX is forming a new continuation pattern (orange) on top of the macro wedging structure (black) as part of its post-breakout retesting phase.

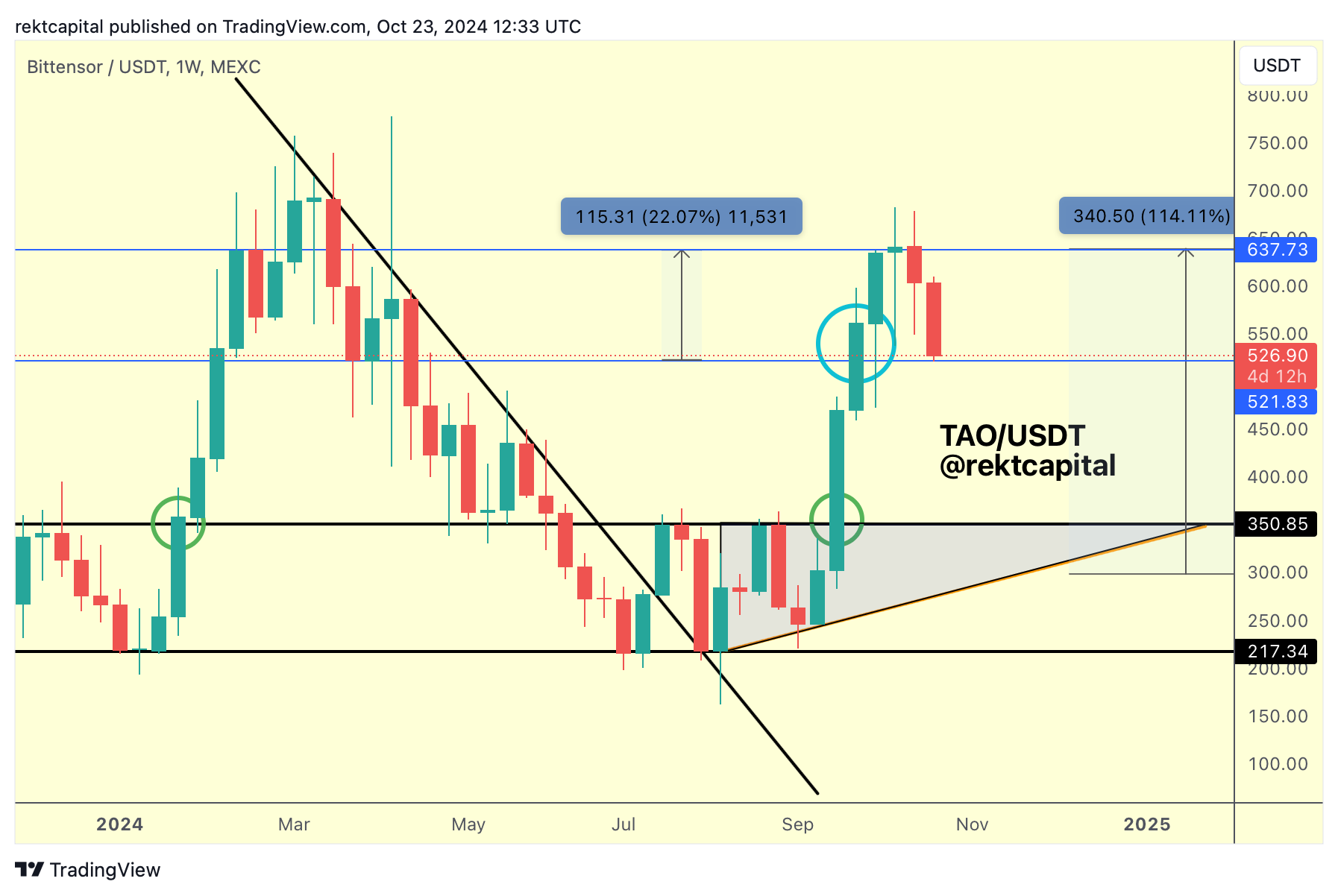

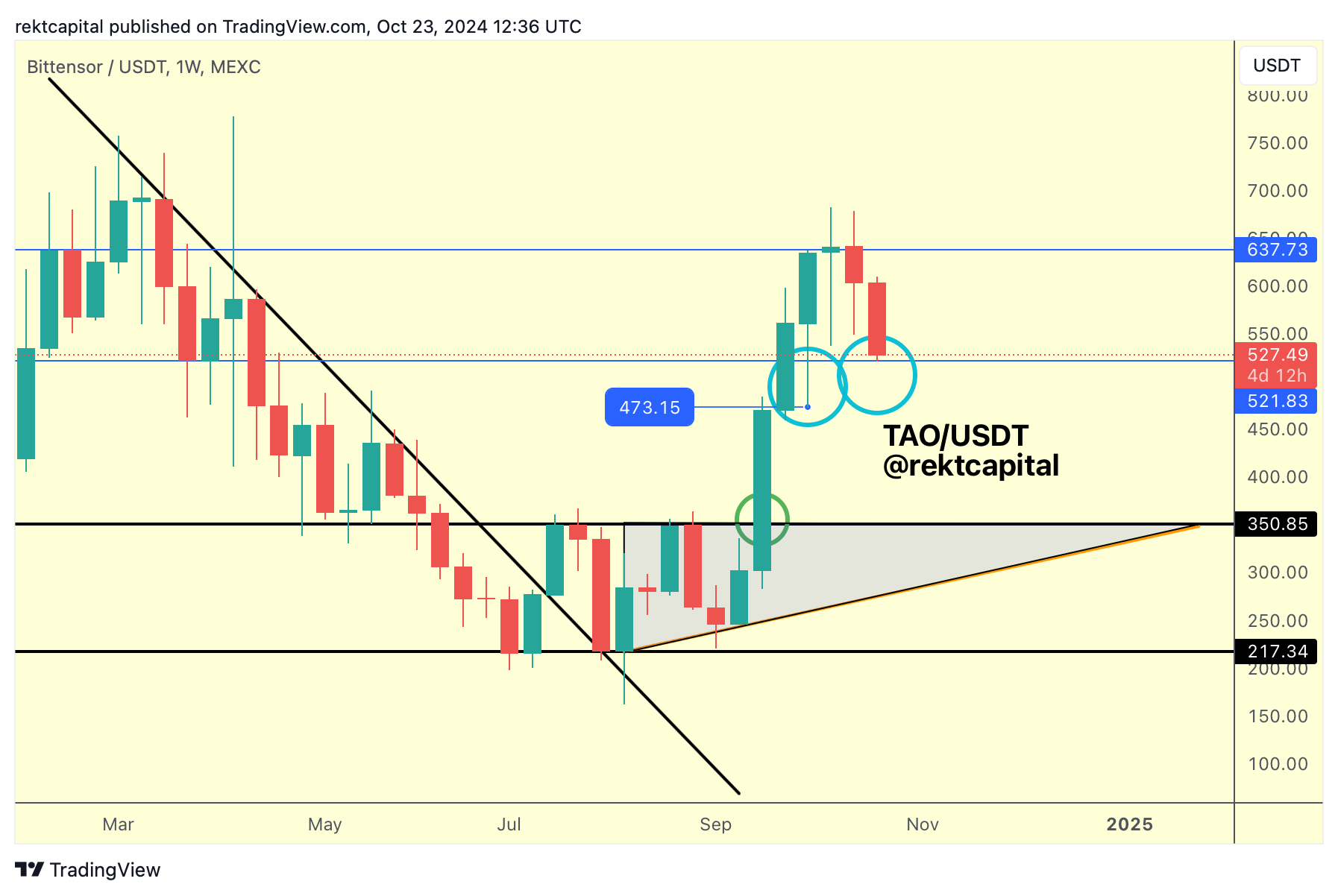

Bittensor - TAO/USDT

Over the past few weeks, we've been covering TAO in a lot of detail.

Earlier this month for example, I shared how TAO was hovering below key Range High resistance, while struggling with a Bearish Divergence on the Daily:

And last week, that Bearish Divergence started already playing out:

To reiterate, if this Bear Div were to continue, then the expectation was that TAO could see price drop into as low as the blue $521 Range Low support.

And that's exactly what has happened since:

TAO has dropped in to the Range Low support on the Weekly timeframe.

But the Daily Bearish Divergence is still strong for the moment:

Because the RSI is still in a Downtrend (blue).

TAO would need to break this RSI Downtrend (blue) for price to reverse to the upside.

Until TAO is able to do that, it may struggle to keep this Weekly Range.

However, ultimately, TAO needs to continue Weekly Closing above the Range Low of $521 (blue) to maintain itself here.

But there is a distinct possibility for TAO to downside wick below this $521 level, like it has done so in the past:

The last time TAO downside wicked as part of a volatile retest of the blue $521 Range Low, price wicked into $473 before Weekly Closing above the $521 level.

TAO could downside wick this week below $521 but price would need to Weekly Close above $521 to preserve the Range Low of $521 as support.

One idea is that perhaps TAO could downside wick below $521 into the high $400s and maybe that would be enough for the RSI to finally break its RSI Downtrend?

Overall, what bullish investors on TAO don't want to see is bearish confirmation (red circle):

That is, they wouldn't want to see a Weekly Close below $521 followed by an upside wick into that same level to flip it into new resistance before entering downside continuation.

To avoid this scenario, TAO needs to hold the Weekly $521 level as support (blue), perhaps downside wick as part of a volatile retest, and do everything it can to invalidate that Daily RSI Downtrend in the meantime so as to invalidate that weakness in the RSI so that it can ultimately start building some emerging strength at the $521 support.