Altcoin Market Update

Features analysis on Altcoins such as STX VANRY SUI TAO AERO OP WU

Hello and welcome back to the Rekt Capital Newsletter.

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Stacks (STX)

- Vanar Chain (VANRY)

- Sui (SUI)

- Bittensor (TAO)

- Aerodrome Finance (AERO)

- Optimism (OP)

- Wormhole (WU)

Stacks - STX/USDT

STX is an Altcoin we've been regularly covering here in the newsletter and a big part of why is its compelling repetition of historical price tendencies.

Historically, STX tends to develop macro market structures against a Macro Higher Low (green), breaks out from them, retests the top of them into new support (blue circles) before ultimately rallying into trend continuation.

This time has been no different thus far, thought it has been a slightly extended process compared to the past.

Nonetheless, STX has broken out from its macro triangular market structure (black), it has retested the top of it as support in a volatile fashion via downside wicks, and is as a result technically positioned for uptrend continuation.

Continued stability here would only facilitate the emerging bullish bias that STX is presenting right now.

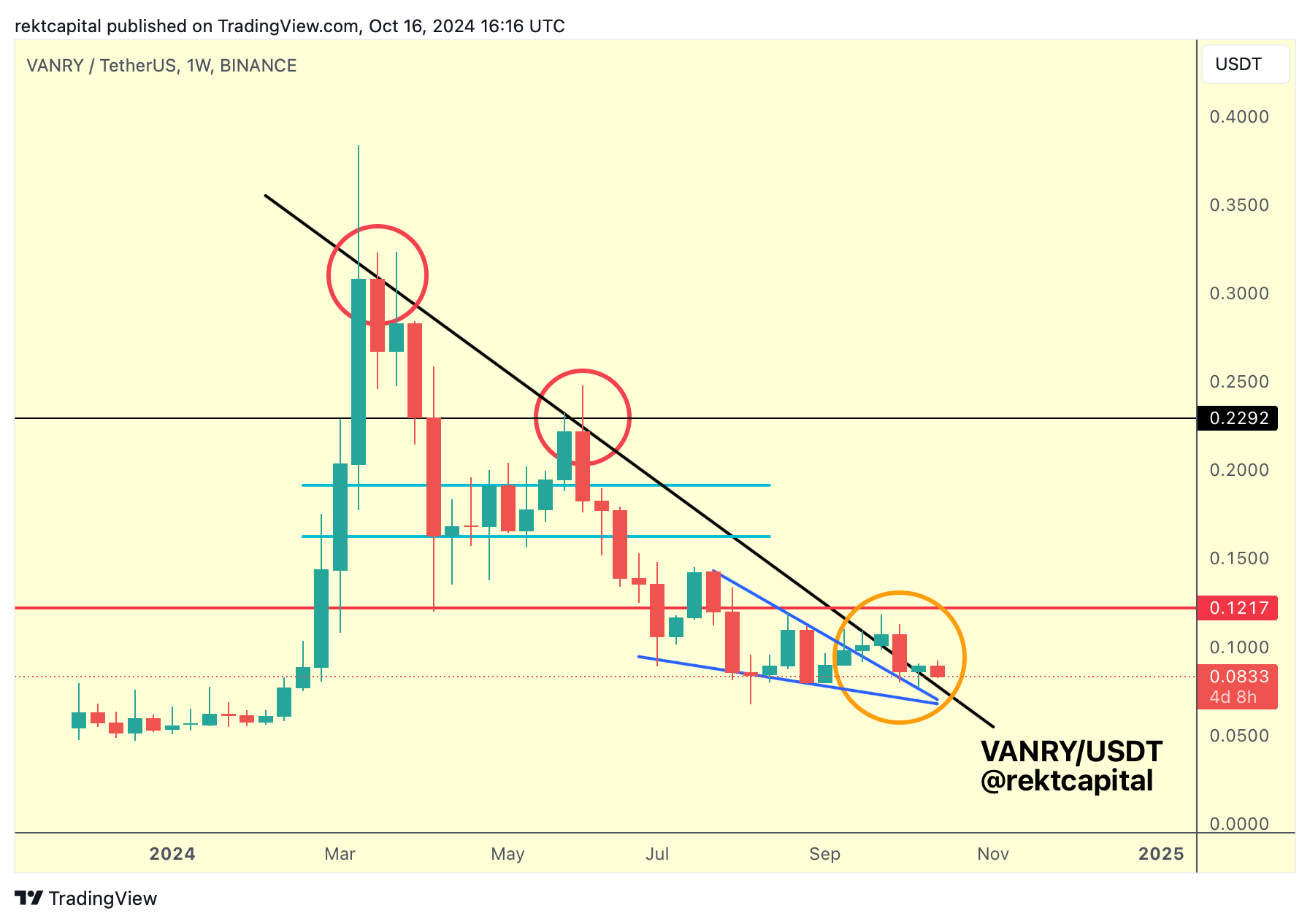

Vanar Chain - VANRY/USDT

Ever since breaking its Macro Downtrend (black), VANRY has been in the process of retesting it into new support.

Three weeks ago, VANRY broke the Macro Downtrend.

Two weeks ago, VANRY pulled back into the Downtrend for a retest but actually Weekly Closed below the diagonal instead.

Last week however, VANRY succeeded in Weekly Closing above the Downtrend yet again, thus positioning price for another retest attempt of it in the future.

Technically, VANRY could soon dip into the Downtrend yet again for another retest attempt, but what's interesting about that is that the Downtrend is representing a lower price compared to last week, for example.

Nonetheless, VANRY is trying to find its footing in establishing a base before launching into its new Macro Uptrend.

It just needs to fully confirm first that the Downtrend is over.