Altcoin Market Update #134

Features analysis on Altcoins such as HYPE AVAX BNB TAO ALGO NEAR

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Hyperliquid (HYPE)

- Avalanche (AVAX)

- Binance Coin (BNB)

- Bittensor (TAO)

- Algorand (ALGO)

- NEAR Protocol (NEAR)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

Hyperliquid – HYPE/USDT

HYPE developed a rounding, topping macro structure, which it fully broke down from, confirming downside continuation into a multi-month downtrend.

Price then produced a recent upside move, but the most important structure remains the macro downtrend that began in September–October.

That macro downtrend continues to resist price.

At present, this diagonal downtrend is confluent with the bottom of the former rounding top, which had previously flipped from support into resistance and is now acting as resistance again.

This confluent resistance (red region) is weighing down on price and forcing it toward a retest of the listing price region (orange region).

That orange region represents the listing price zone, the resistance, the reaccumulation point from earlier this year, and resistance from late last year.

This becomes the retesting zone.

A successful retest here could see price revisit the macro downtrend.

However, given current market conditions, the macro downtrend is likely to persist.

If that downtrend continues to hold, then price could break down back into the range around $20.464 (orange region).

On a failed retest of this orange region, weakening of the $20 support would become increasingly visible, potentially resulting in clustering around that level.

But as long as the macro downtrend persists, the broader trajectory remains one of Lower Lows over time.

The rally in November 2025 and the recent rally may both represent relief rallies within an otherwise stable macro downtrend.

For now, that macro downtrend remains strong and may continue to dictate price behaviour going forward.

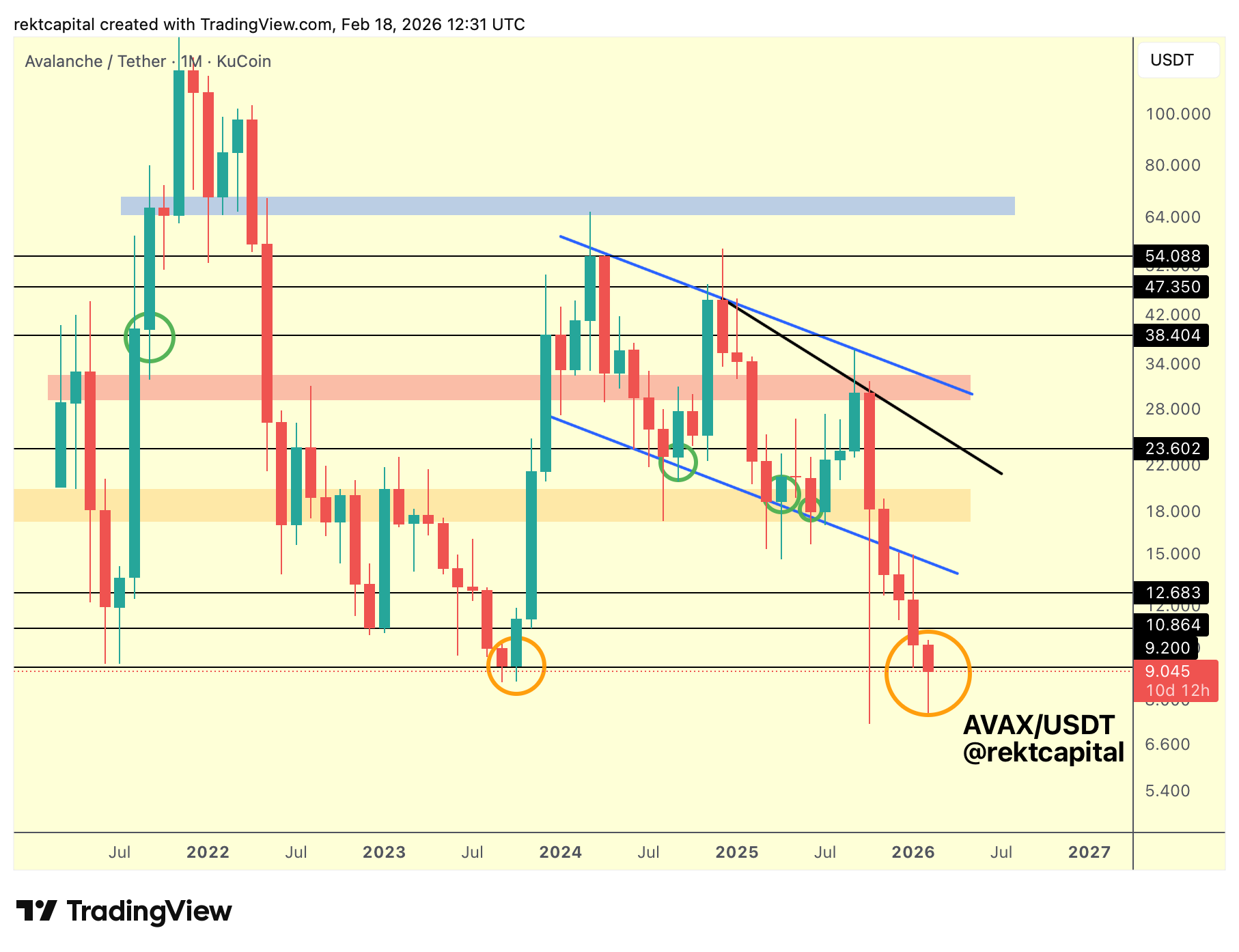

Avalanche – AVAX/USDT

AVAX is currently testing the old All Time Low region, which acted as major support in 2023.

Price is now slipping below that level and remains in active negotiation with it.

The key question is whether this region will be reclaimed as support or not.

If AVAX ultimately Monthly Closes below $9.200 (black horizontal, former All Time Low support), then a bearish retest would likely follow.

Such a retest could send price into the prior downside wicking regions to probe that liquidity.

However, the fact that price has already downside wicked deeply into this region following the liquidation event highlights the weakness of this support overall.

And that weakness increases the probability that AVAX may need to discover new All Time Lows over time.