Altcoin Market Update #133

Features analysis on Altcoins such as SOL TAO XLM LINK INJ FARTCOIN

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Solana (SOL)

- Bittensor (TAO)

- Stellar (XLM)

- Chainlink (LINK)

- Injective (INJ)

- Fartcoin (FARTCOIN)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

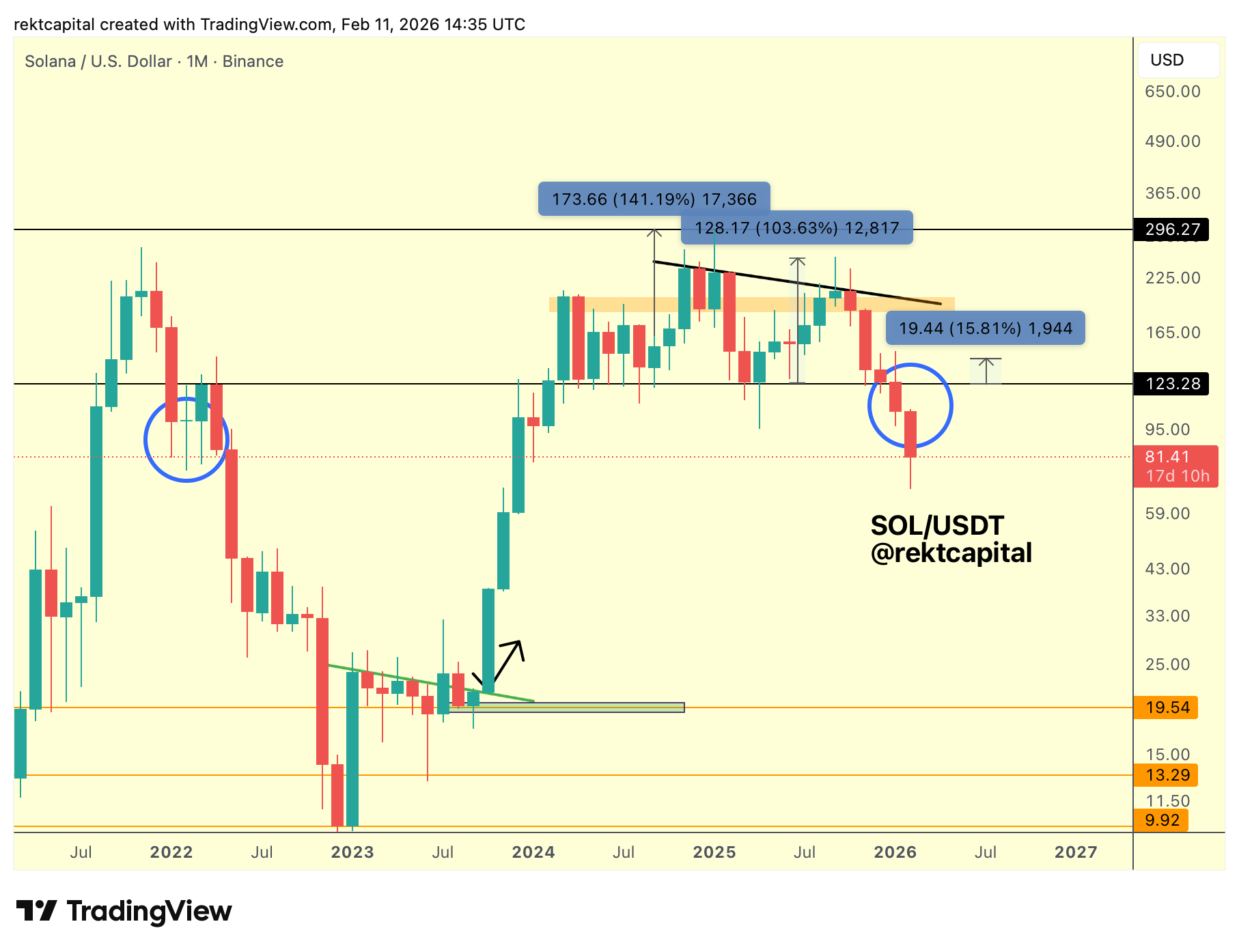

Solana – SOL/USDT

Over the past few months, Solana has continued to follow the weakening structure we’ve been discussing.

Each rebound from $123 (black horizontal, former Range support) became progressively weaker, culminating in a Monthly Close below $123, effectively confirming a breakdown from the Range.

Historically, losing $123 has enabled price to transition into a bear market post-breakdown relief rally stage, where former support turns into new resistance.

However, this time the reaction has been noticeably different.

In 2022, after losing $123, price was able to generate a meaningful relief rally and repeatedly stabilise around $99 (blue horizontal, psychological support).

That relief phase lasted roughly three months and included upside wicks into resistance before continuation.

Here, we are not seeing that same strength.

There has been no convincing attempt to flip $123 into resistance through a strong relief rally, nor has there been sustained price stability at the $100 region.

Technically, price is positioned for some form of relief after such compression, but the absence of strength is becoming the signal in itself.

The key now is the Monthly Close.

If SOL Monthly Closes below $100, then it would fail to replicate the 2022 relief structure entirely. In that scenario, $100 would likely shift from potential support to a ceiling for any future rebound attempts.

And if $100 becomes the new relief ceiling — whereas $123 was the ceiling during 2022’s relief — then that would represent a clear step down in structural strength.

That would be further evidence of growing macro weakness.

At this stage, $123 represents the maximum theoretical upside for any sharp wick-driven relief, similar to the 2022 blue-circle rejection.

But current market conditions are not conspiring toward that kind of strength.

Instead, if SOL struggles to reclaim $100 in a sustained manner, then the trend likely remains distributive and biased toward further downside continuation over time.

Bittensor – TAO/USDT

Bittensor is presenting a structure very similar to what we’ve just discussed with Solana.

Over the past several months, price has repeatedly rebounded from $217 (blue horizontal, former Range support), but each rebound has become progressively weaker.

The most recent bounce measured roughly +39%, which is noticeably lacklustre relative to prior expansions. That weakening structure has now translated into confirmation.

TAO has Monthly Closed below $217 and has even upside wicked into the level, showing retesting intent.

It is not a textbook rejection, but it is sufficiently close to confirmation to suggest that the breakdown is 95% actualised.

In other words, this Range has effectively been lost.

Price now appears to be transitioning from the former $217–$79 structure into a wider distribution range between $79 (black horizontal, Range Low) and $217.

The more time price spends failing to reclaim $217, the more this transition becomes structurally embedded.

And given that this Bear Market likely still has time left to unfold, deeper range exploration becomes increasingly probable.

If the breakdown is fully confirmed through continued inability to reclaim $217, then TAO would be expected to gravitate toward the lower end of this new Range over time, namely the $79 region.

It is not perfect confirmation by a fraction of a percentage point, but structurally, the breakdown is almost picture perfect.

And when breakdowns are confirmed 95% of the way, markets tend to complete the final 5%.