Altcoin Market Update #132

Features analysis on Altcoins such as ETH SOL INJ XLM XRP NEAR

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Ethereum (ETH)

- Solana (SOL)

- Injective (INJ)

- Stellar (XLM)

- Ripple (XRP)

- Near Protocol (NEAR)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

Ethereum – ETH/USD

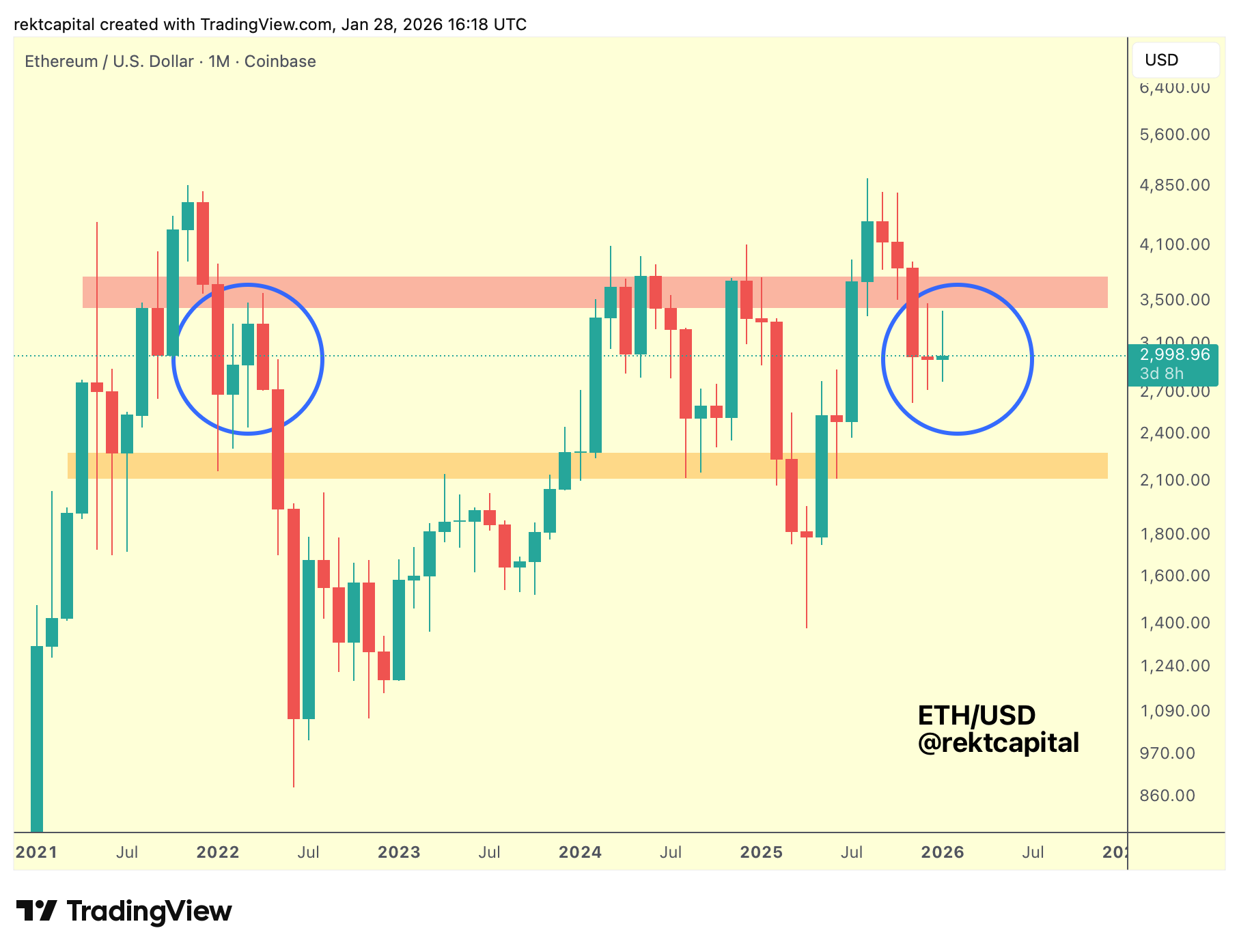

Just last week, we spoke about Ethereum dropping into the low $2000s to repeat 2022 history.

Here is the chart from last week:

And here's an excerpt from that analysis:

Generally, you can read last week's analysis here, because things have since played out perfectly:

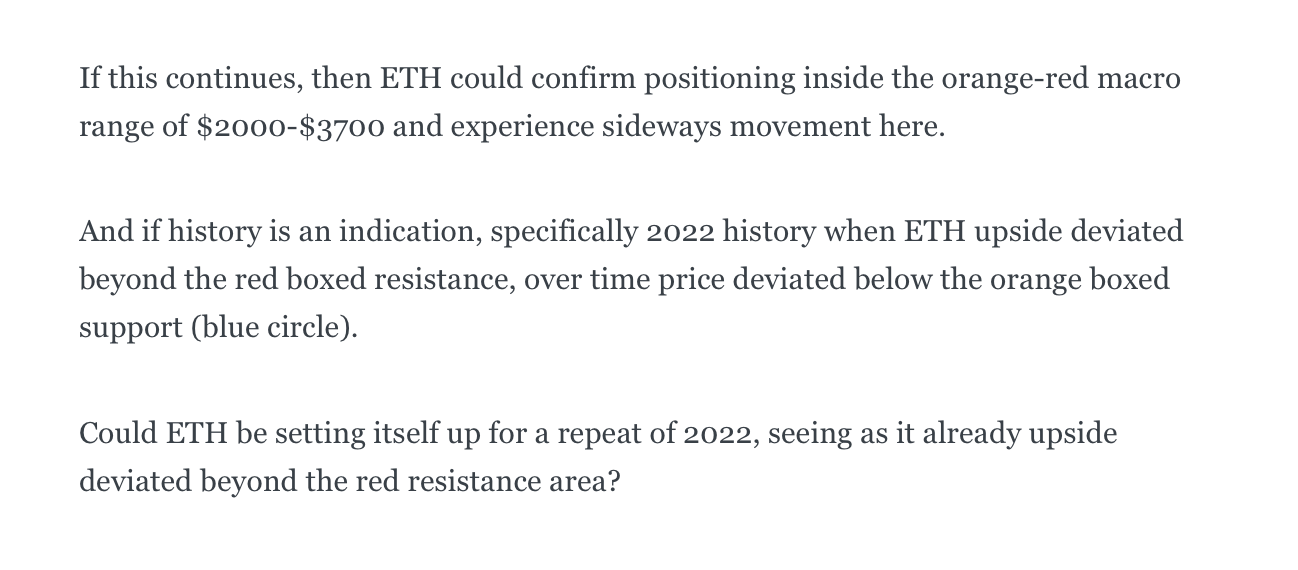

Ethereum has dropped into the low $2000s into the orange/green region, having confirmed the red resistance as a point of rejection for yet another time, leading to 2022-like downside.

Now, ETH is technically at support and soon approaching a multi-year uptrend (green trendline) for an all-important, cycle-defining retest.

And if ETH Monthly Closes below the green box and turns it into new resistance, then price would indeed pose seller pressure on that Uptrend, to really test if there are any buyers left there.

That Uptrend will be make or break.

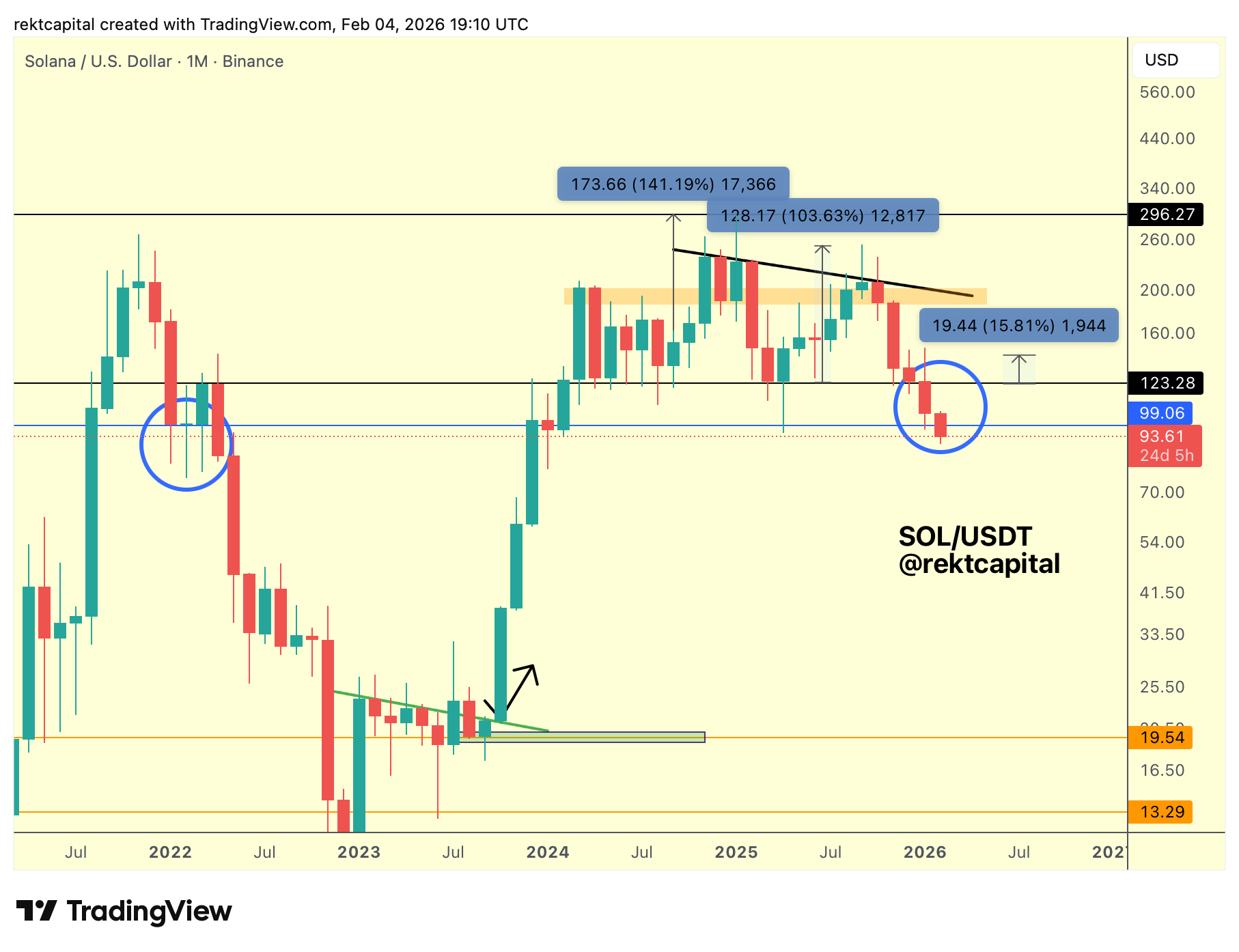

Solana – SOL/USDT

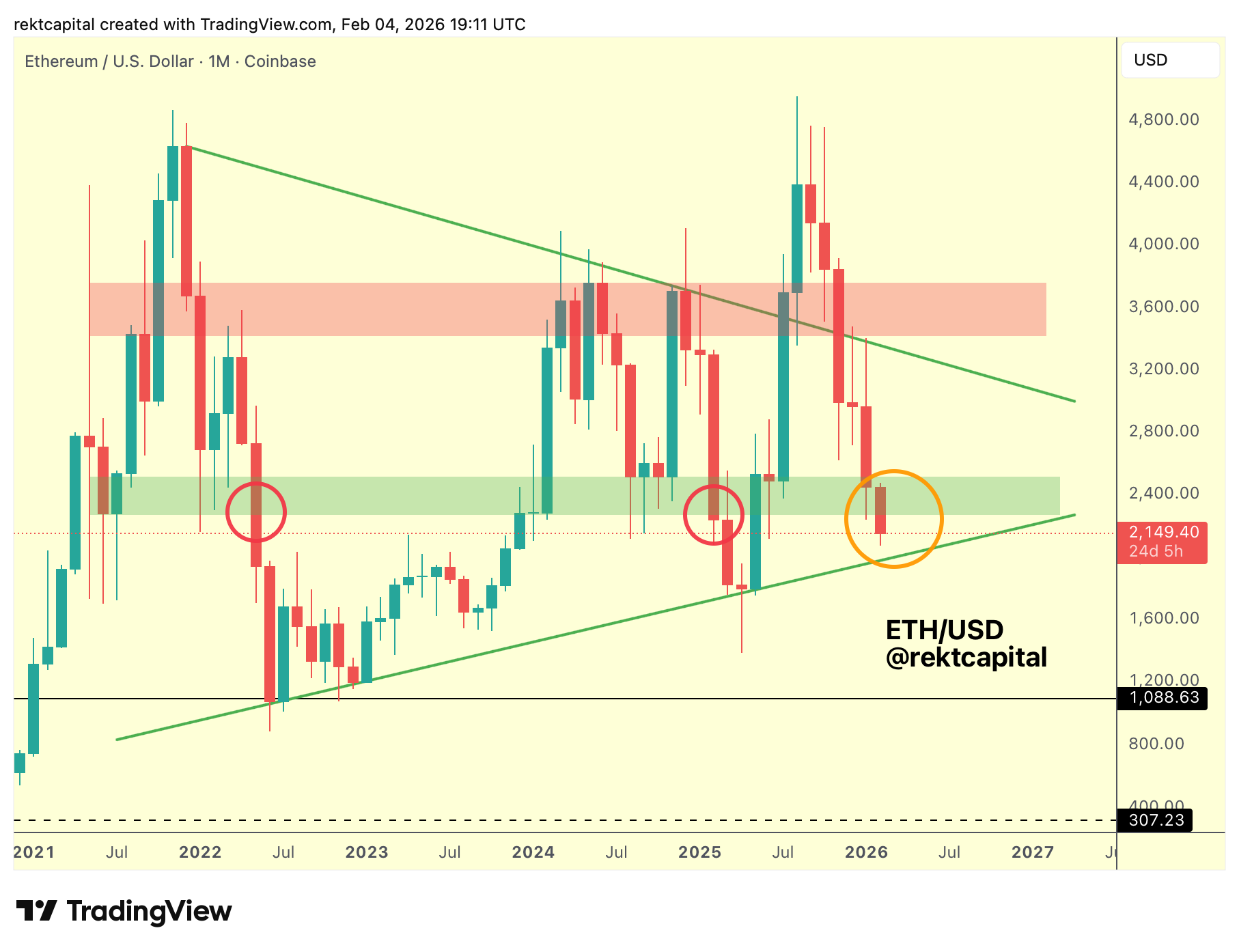

We've been talking a lot about Solana's mounting weakness over the past months, most recently last week, and that weakness has since translated into price.

Last week, we spoke about the weakening rebounds from the key $123 support:

And this week, at long last - price has broken down from the $123:

After a meagre +15% move to the upside from a once-strong support, the writing was on the wall for a future breakdown.

The future is here, as price has lost $123 as support, convincingly.

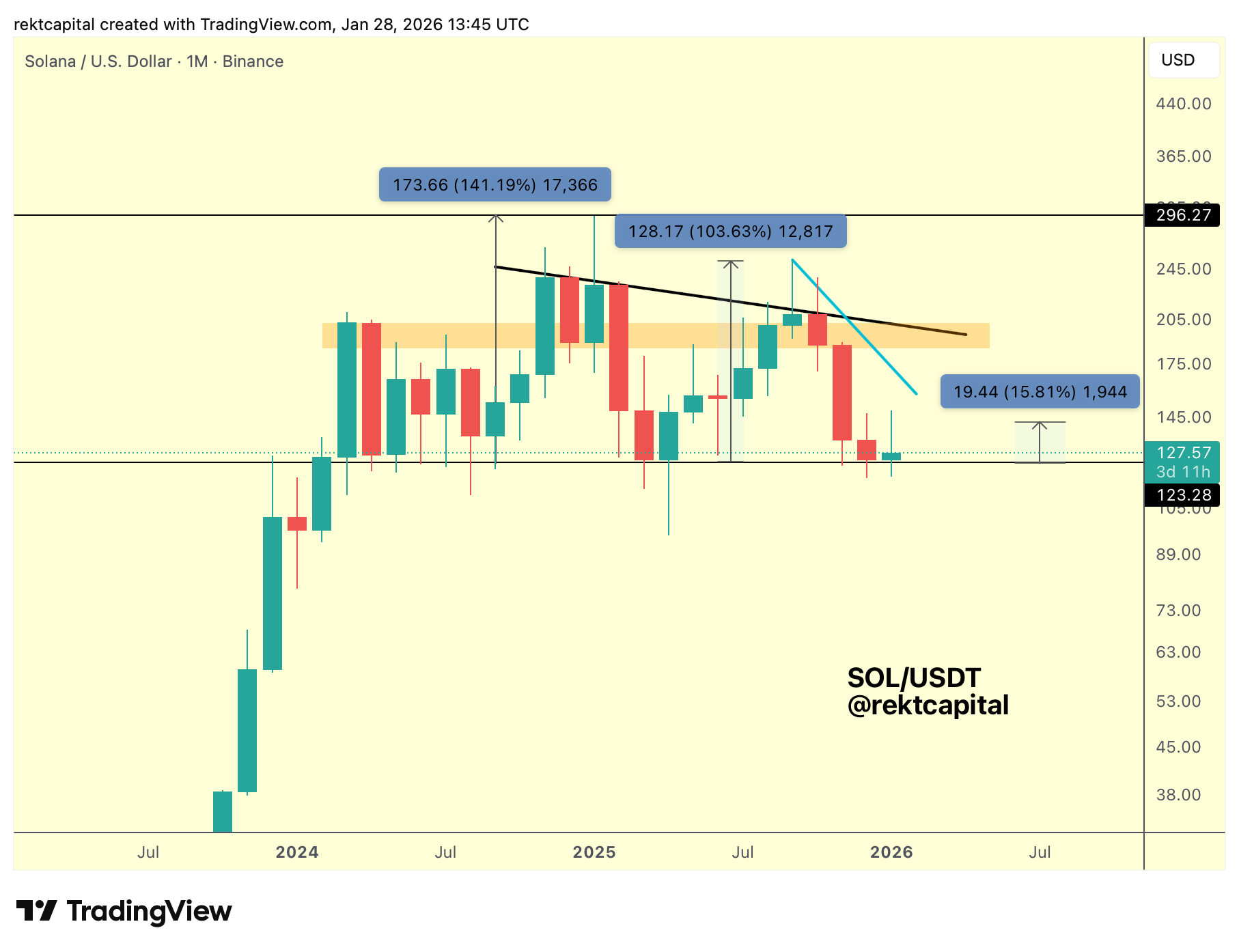

Now, it will be all about whether SOL can repeat 2022 history with a price-stability at ~$100:

After all, in 2022 after losing $123 as support (black), SOL was able to build a brief support at around the psychological level of ~$100 ($99 to be exact, blue horizontal), violently downside wicking below it for an entire quarter and turning the $123 convqnginly into new resistance, before finally resolving itself to the downside with a Monthly Close below $99 and then performing a post-breakdown upside wicking retest to fully confirm the breakdown into accelerated downside continuation throughout the latter months of 2022.

If history were to repeat then SOL has a chance of holding the $99 as support, but this hinges entirely on BTC; in the BTC Newsletter, we spoke about how Bitcoin was on the cusp of Bearish Acceleration.

So if that Bearish Acceleration were to transpire for BTC, SOL wouldn't be able to withstand that and remain stable at these levels.

Macro-wise, it looks like Solana will continue to trend lower over time, even if the short-term may offer some volatility; Monthly Close below $99 this month however and we'll see that distribution take place sooner rather than later.