Altcoin Market Update #131

Features analysis on Altcoins such as ETH LTC PENGU SUI SOL SPX

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Ethereum (ETH)

- Litecoin (LTC)

- Pudgy Penguins (PENGU)

- Sui (SUI)

- Solana (SOL)

- SPX6900 (SPX)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

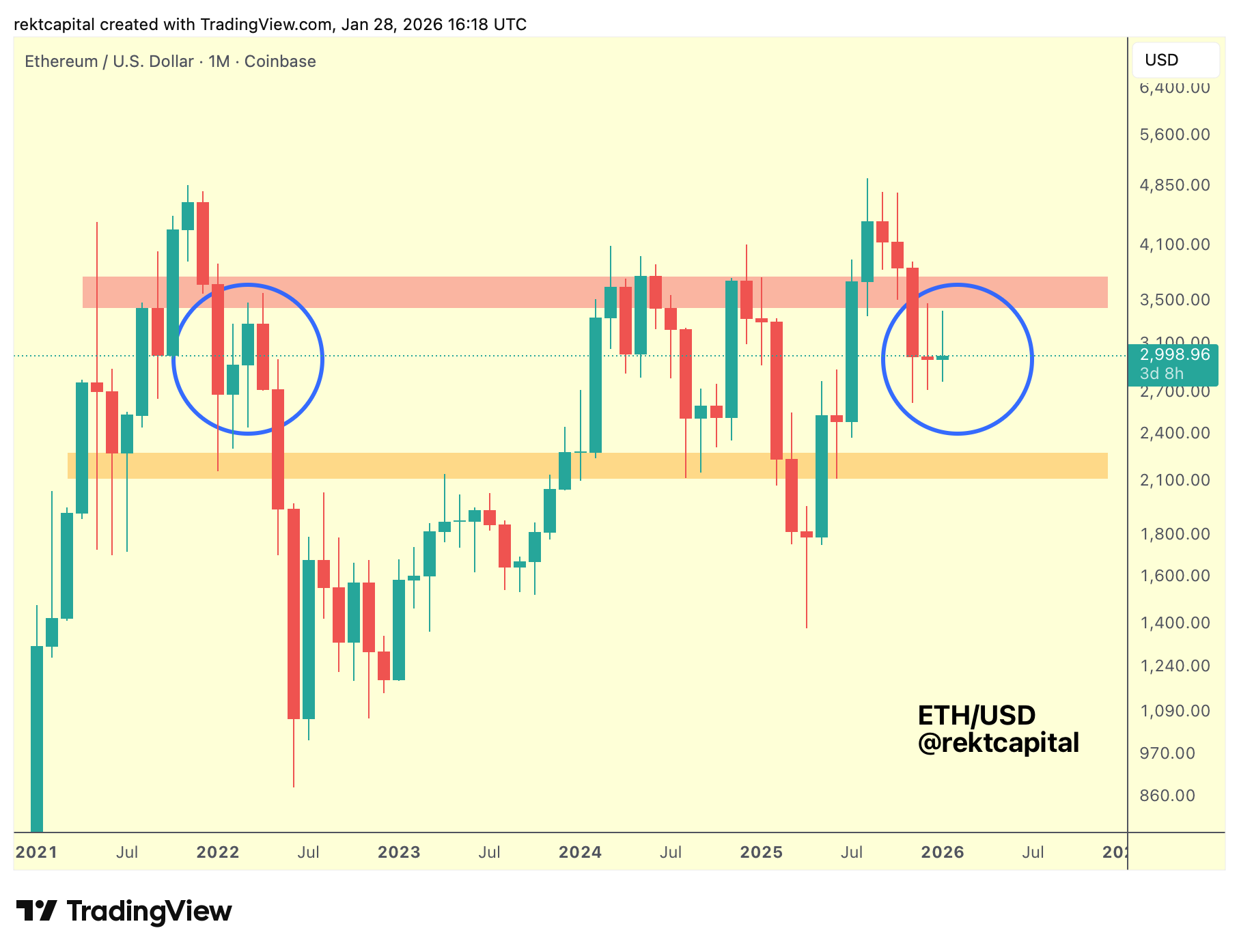

Ethereum – ETH/USD

Ethereum has always struggled with the red region around $3500-$3700.

In fact, whenever ETH has managed to break beyond it, it would spend very little time above the red region before failing to turn it into support and ultimately breaking down from it.

To put this into perspective, since 2021 ETH has only been able to stay above $3700 for approximately 160 days, with half of those days being red candles after rejecting from the ~$4000+ region.

It just shows how little strength ETH has been able to demonstrate beyond $3700 in 5 years.

Throughout that same time period however, ETH would otherwise reject from the $3500-$3700 resistance area (red).

So aside from brief upside deviations beyond $3700, generally ETH would simply reject from the $3500-$3700 area (red).

In fact, ETH has Monthly Closed below the red boxed resistance two months ago, and in the months since price has been upside wicking into said resistance and rejecting from it.

If this continues, then ETH could confirm positioning inside the orange-red macro range of $2000-$3700 and experience sideways movement here.

And if history is an indication, specifically 2022 history when ETH upside deviated beyond the red boxed resistance, over time price deviated below the orange boxed support (blue circle).

Could ETH be setting itself up for a repeat of 2022, seeing as it already upside deviated beyond the red resistance area?

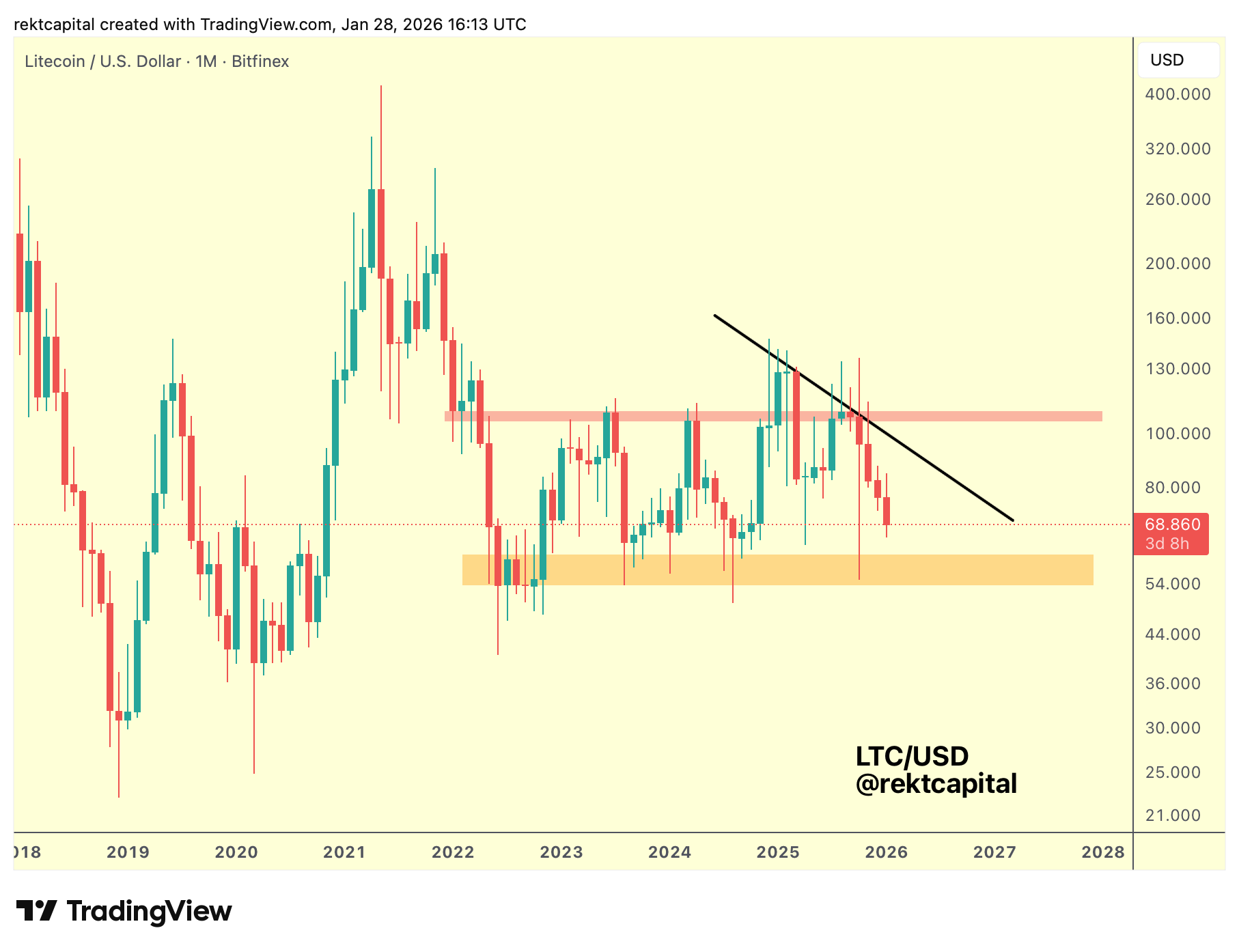

Litecoin – LTC/USD

Litecoin has been consolidating between the red and orange regions since early 2022, effectively being sideways for 4 years now.

LTC would rally from the low $50s to the low $100s, producing moves like that roughly once a year.

With the formation of the latest Macro Lower High (black), that now increases the chances of LTC dropping into the orange region for yet another support retest of that region.

Provided LTC finds stability there, that could set things up for another rally across the range, with the black Downtrend being a key resistance that could prove troublesome in LTC's reversal to try to revise the red Range High resistance over time.

In fact, if LTC manages to successfully retest the orange region as support but produces a weaker rebound from there than has historically been the case, then an argument could be made that LTC's orange support may be waning as a source of demand.

That's a story for another day however as LTC needs to first drop into the Range Low area to test it for strength and more crucially - stability.