Altcoin Market Update #130

Features analysis on Altcoins such as AVAX DOGE FARTCOIN LINK SPX DOT

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Avalanche (AVAX)

- Dogecoin (DOGE)

- Fartcoin (FARTCOIN)

- Chainlink (LINK)

- SPX6900 (SPX)

- Polkadot (DOT)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

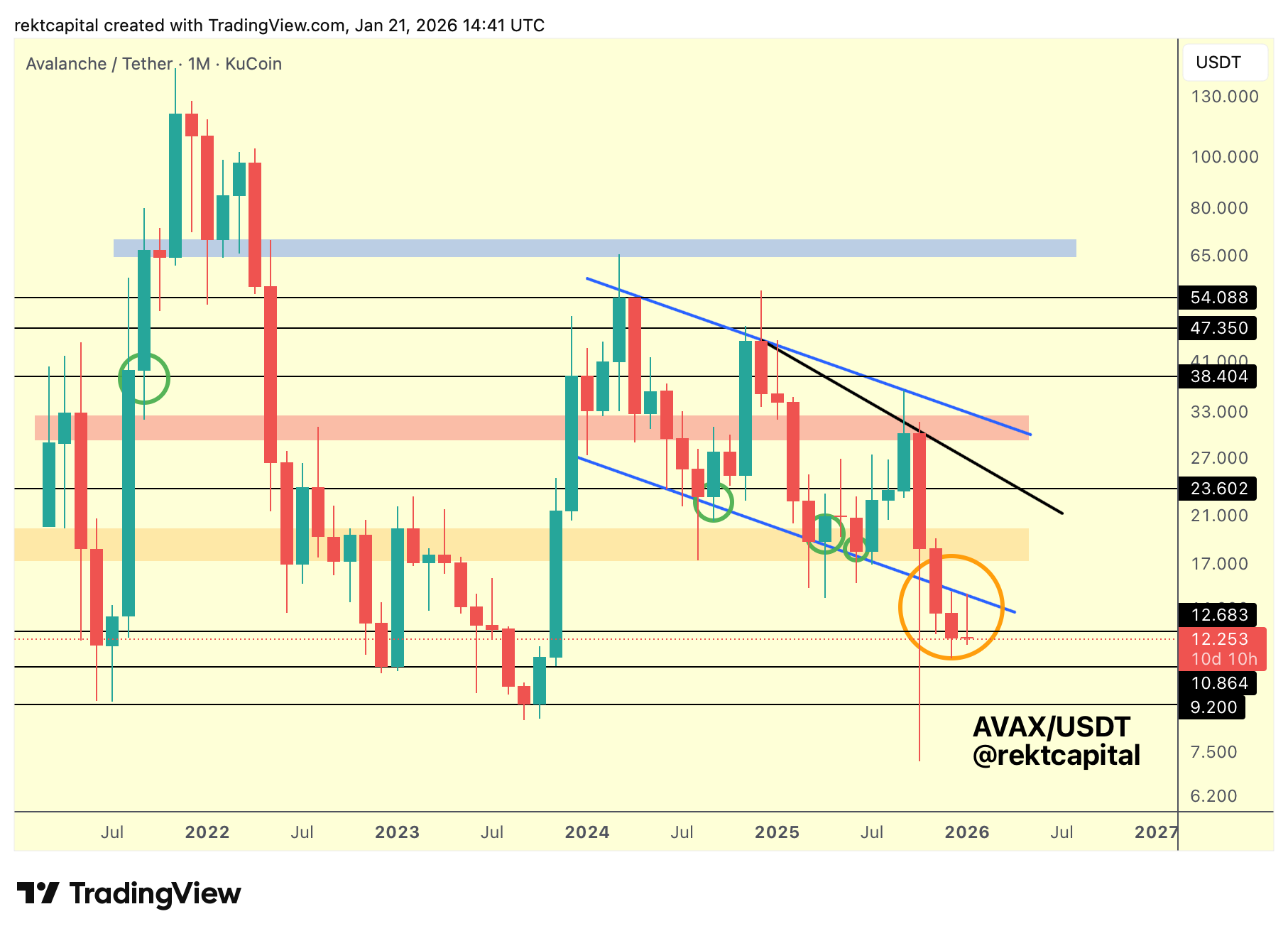

Avalanche – AVAX/USDT

On the Monthly timeframe, AVAX has lost its macro wedging structure.

Price has Monthly Closed below the macro wedging bottom (black diagonal) and, in the process, turning that former support into new resistance.

That breakdown has been reinforced by the most recent Monthly Close below $12.68 (black horizontal).

A level that has historically acted as an important trend continuation and trend reversal demand region for AVAX across prior cycles.

Rather than reclaiming it, price has upside-wicked into $12.68 and into the former macro wedge bottom, effectively double-confirming both as resistance, while also rejecting from roughly $12.50, further tightening the downside bias.

As long as this rejection persists, downside continuation becomes the dominant risk, with price likely to rotate toward $10.86 (black horizontal), another historical trend-continuation retest zone that previously mattered during uptrends.

AVAX is now firmly in a downtrend.

Sustained holding of that region would be unlikely, implying that any reaction there would probably remain limited, before that support gives way over time.

A confirmed loss of $10.86 would then expose the final major Monthly demand region at $9.20 (black horizontal), a level that has produced strong rebounds in past cycles.

This time, however, those rebounds have been weakening structurally.

And the presence of Lower Lows acting as resistance, alongside a developing cross-cycle macro downtrend, suggests that any bounce from that region would likely be far more muted than historical precedents.

That weakness is further underscored by the recent major liquidation event, which effectively tagged multiple historical demand regions without generating any meaningful upside response, signalling that the broader structure remains compromised.

As a result, AVAX appears to be in the process of confirming its breakdown.

Bearish continuation appears likely, raising the broader question of whether negative Price Discovery could emerge later in the bear cycle, unless clear signs of strength begin to develop.

At present, the market is not yet offering those signs.

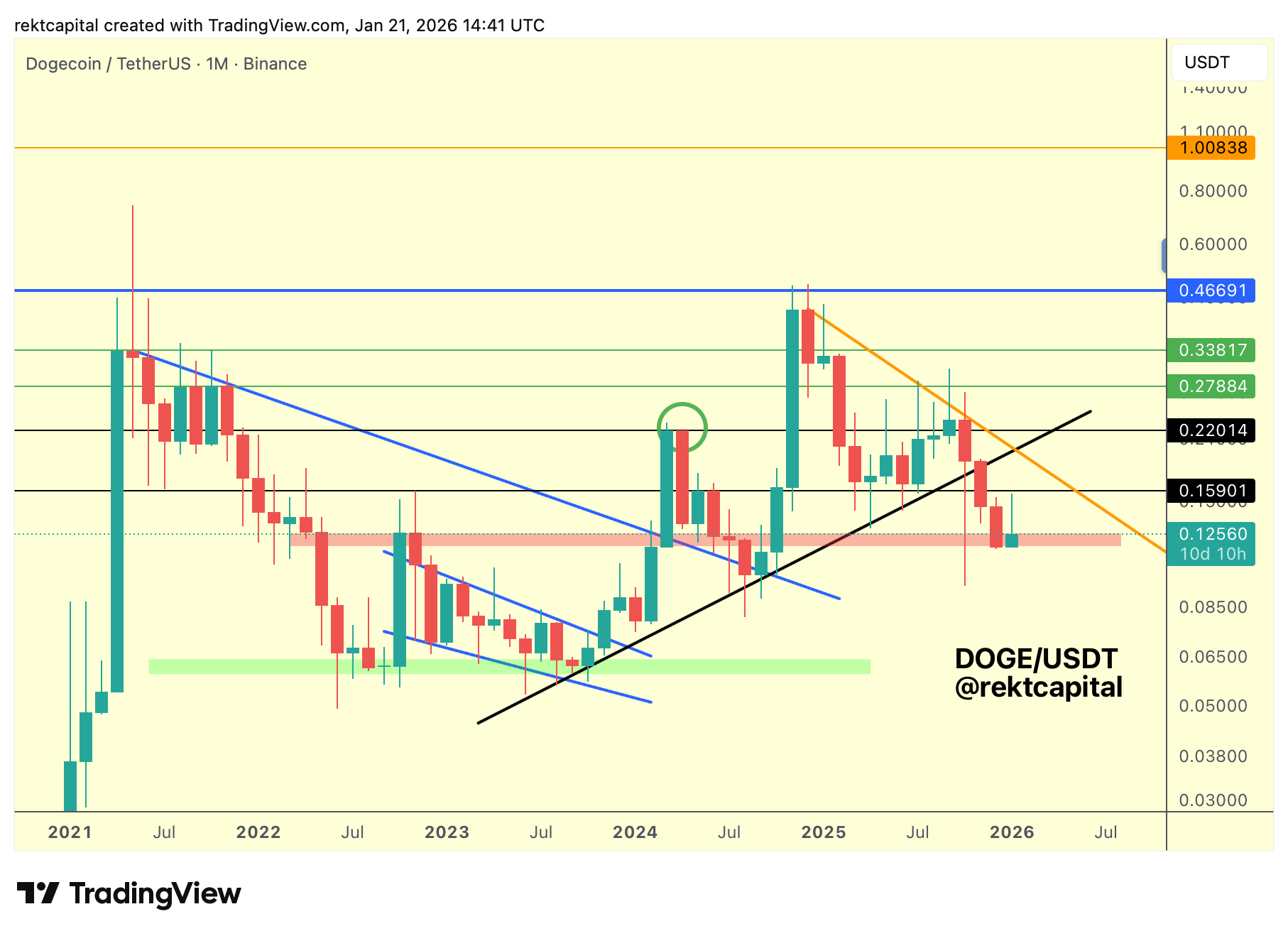

Dogecoin – DOGE/USDT

On the Monthly timeframe, Dogecoin has lost its multi-year uptrend.

A structure that had held for an extended period but has now failed, marking a clear deterioration in the broader trend.

That loss has been compounded by a breakdown of the $0.16 region (black horizontal), which previously acted as a trend-continuation demand zone, producing the rally toward $0.46 and a subsequent but limited reaction closer to $0.33.

Rather than reclaiming that region, price has since failed outright, with back-to-back Monthly candles showing $0.16 transitioning into new resistance, increasing sell-side pressure into the red region around $0.12.

Historically, the $0.12 area has been unreliable as support, briefly holding during the early-stage Bear Market of 2022, before breaking down and later acting as resistance into late-2022 and early-2023.

During the 2024 Bull Market, DOGE saw upside reactions around this region.

But those moves occurred without a proper reclaim, instead rebounding from the multi-year uptrend rather than establishing $0.12 as a durable base.

When price was required to hold this region as support in mid-2024, it failed again, mirroring behaviour seen during the early-stage bear market conditions of 2022.Which remains the closest historical analogue to the current phase.

That context aligns with the loss of the multi-year uptrend and the development of a macro downtrend (yellow), while $0.16 has weakened progressively, shifting from demand into persistent resistance.

Given how consistently unreliable this region has been, not only in bearish environments but even during bullish ones, the probability increasingly favours eventual breakdown rather than sustained support.

If this is indeed an early-stage bear market, expecting dependable support from such a fragile region becomes structurally inconsistent with the broader weakness now visible in DOGE.