Altcoin Market Update #127

Features analysis on Altcoins such as AVAX SOL DOGE LINK ETH FET

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Avalanche (AVAX)

- Solana (SOL)

- Dogecoin (DOGE)

- Chainlink (LINK)

- Ethereum (ETH)

- Fetch.ai (FET)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

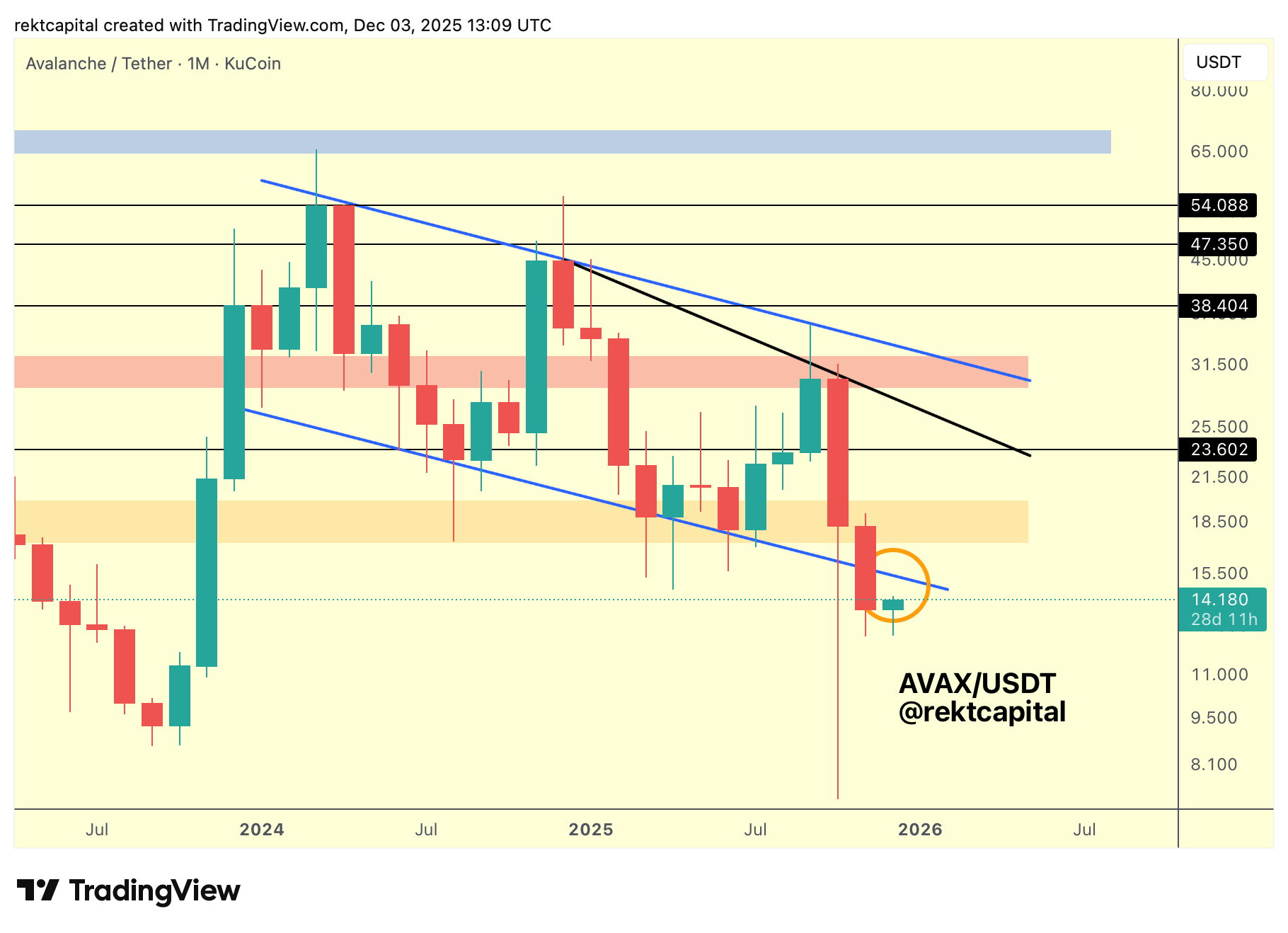

Avalanche – AVAX/USDT

Avalanche begins this update as one of the altcoins currently at an interesting moment in its price action.

On the Monthly timeframe, AVAX continues to move within its macro wedging structure, with price now deviating below the series of lower lows (blue diagonal) that define this pattern.

In the past, clusters of price action have formed beneath these lower lows. What is needed now is a Weekly Close and a post-breakout retest above this lower low, similar to the behaviour shown in the previous green circles.

Last week produced a rejection from this lower-low resistance, but price is still trying to follow through and recover this level (blue diagonal).

Because the rejection wasn’t too strong, there is still potential for AVAX to try to reclaim this lower low in the future.

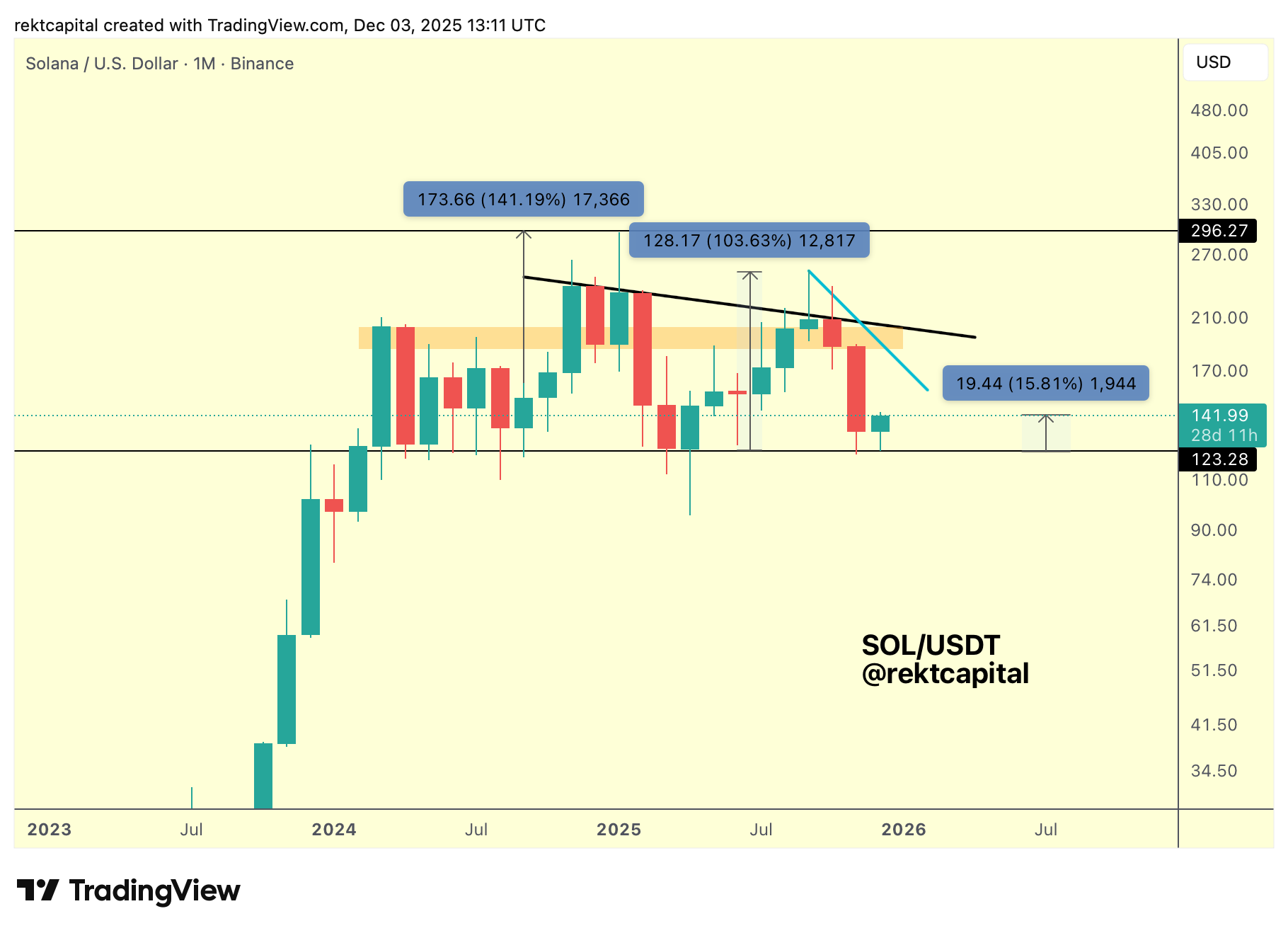

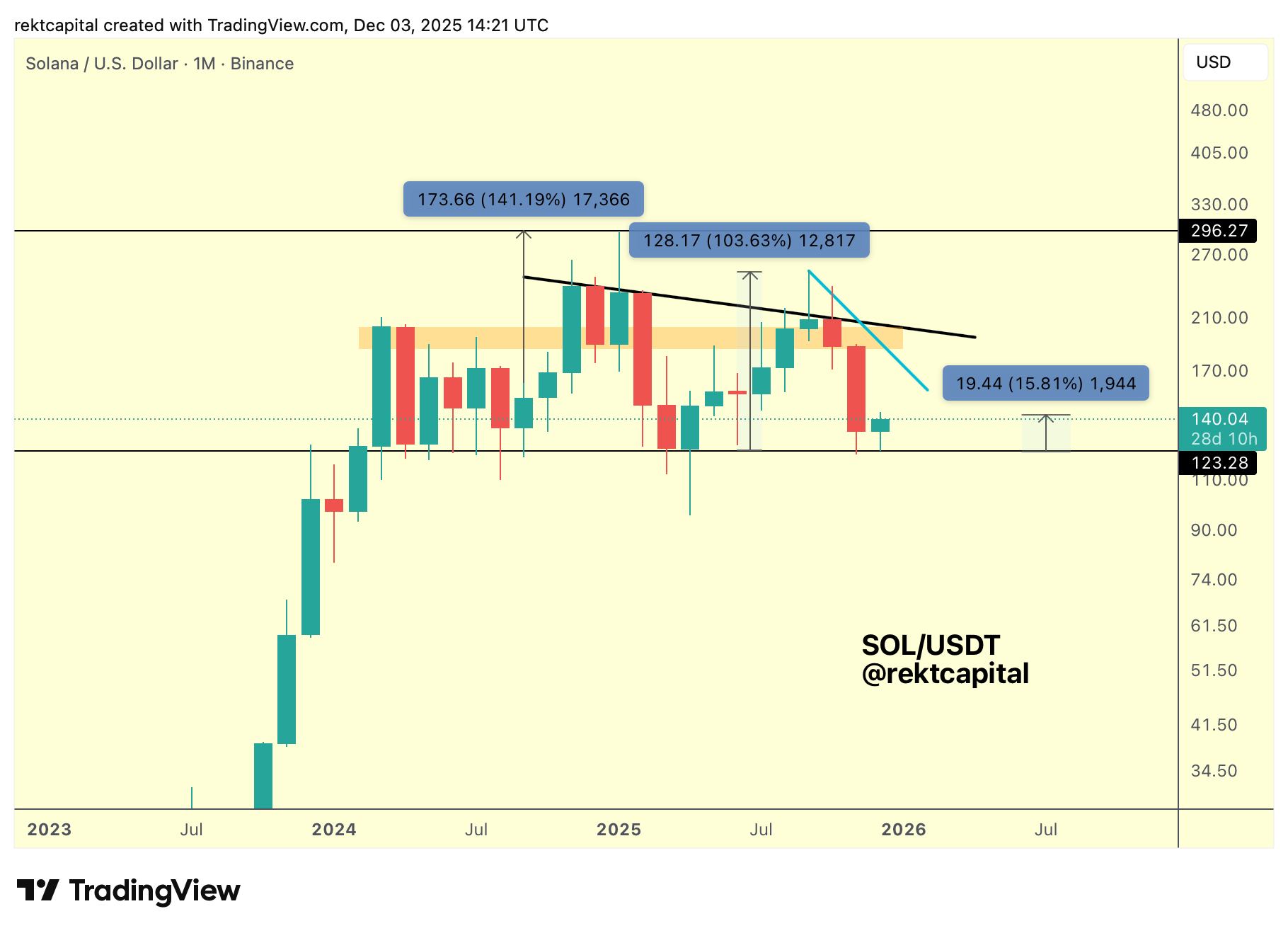

Solana – SOL/USDT

Solana is moving inside a clear macro range between $123.28 (black horizontal) and roughly $296.27 (black horizontal), and it has been clustering in this region since early 2024.

The longer this cluster continues, the less likely it becomes that this is functioning as a Re-Accumulation structure.

This cluster has been developing for an extended period, and the potential for distribution increases the longer this cluster persists.

Regardless of how long the cluster has gone on, the focus now is the support at $123.28 (black) and the reactions Solana has produced from it.

The first major rebound from this region rallied approximately 140%.

The next rebound from the same support was significantly smaller, rallying around 100%. Solana is now rebounding from this level again.

While it is positive to see this rebound, if the move turns into a weaker rebound than the previous ones, then questions will arise regarding the strength of this support.

Going forward, Solana needs to breach either the black downtrend or the multi-week downtrend (green) on the Weekly timeframe.

Failing to break either of these trendlines would produce a smaller rally because the prior rebound — the one that rallied around 100% — would fall short and reject from these downtrends instead.

In the absence of breaking the downtrends and the orange region of resistance, future rebounds from the $123.28 support are likely to weaken.

A sequence of progressively weaker rebounds would imply increasing weakness into that support, which in turn would favour the potential for distribution in Solana over time.