Altcoin Market Update #127

Features analysis on Altcoins such as AERO HBAR SPX SUI TAO XMR

🎄 Christmas Holiday Announcement 🎄

As we head into the holiday season, we’ll be closing our virtual doors December 22 - January 5 to give everyone time to rest, recharge, and enjoy some well-deserved moments in the warm company of family, friends, and significant others.

As a result, the last newsletter of 2025 will be published on Friday 19th of December 2025 and the first newsletter after the holidays will be published on Monday the 5th of January 2026.

Thank you for a phenomenal 2025 thus far and I cannot wait to see what 2026 has in store in the crypto markets for us.

Wishing you a Merry, Merry Christmas and a Happy New Year 2026!

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Aerodrome Finance (AERO)

- Hedera Hashgraph (HBAR)

- SPX6900 (SPX)

- Sui (SUI)

- Bittensor (TAO)

- Monero (XMR)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

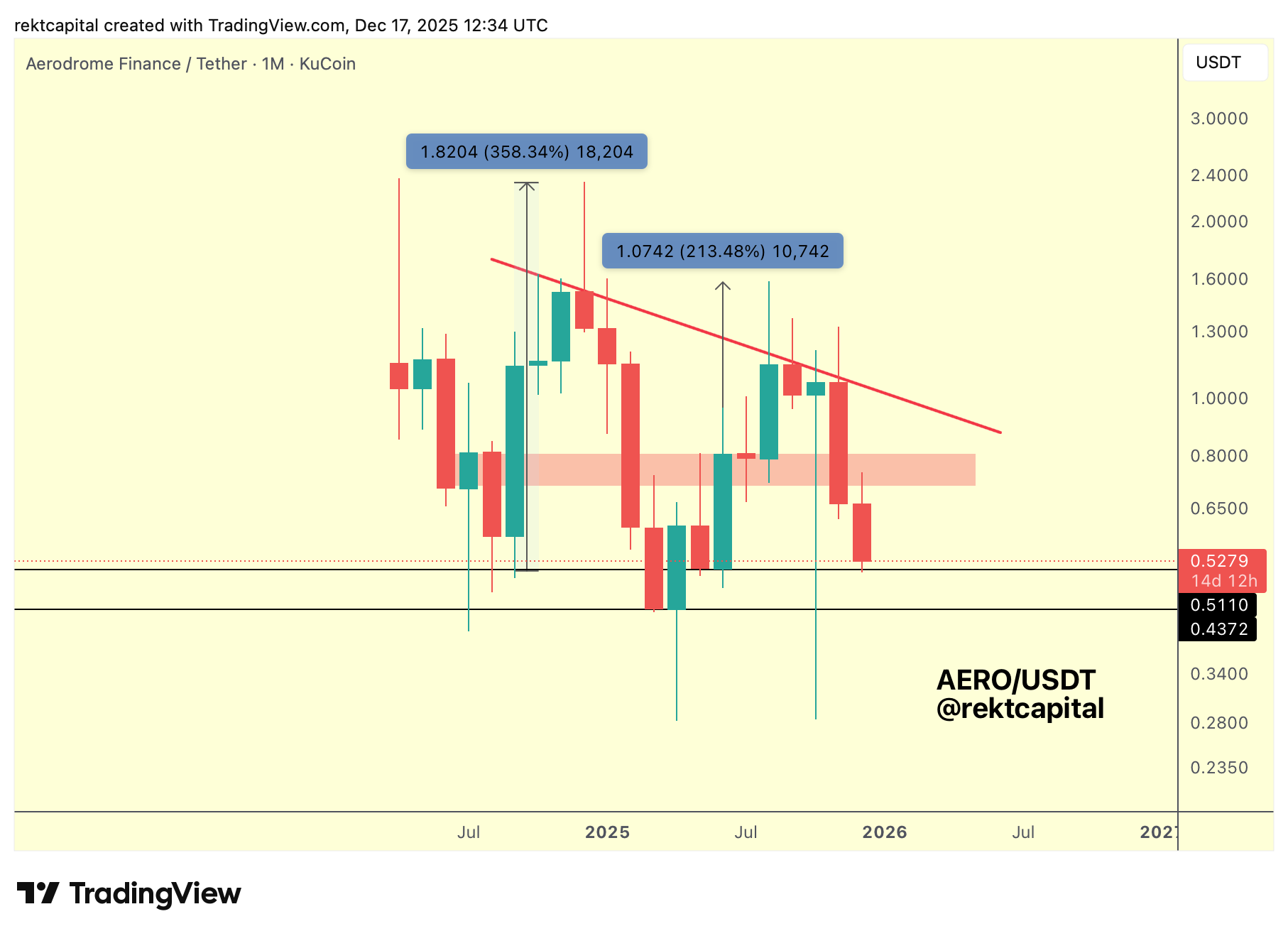

Aerodrome Finance – AERO/USDT

AERO has repeatedly rebounded and trend-reversed from $0.43 and $0.51 (black horizontals), forming a long-standing historical demand cluster that has defined price behaviour across multiple revisits.

But the reactions have changed.

While price continues to respond to this region, each rebound and trend reversal has been progressively weaker, signalling that buyers are struggling to generate the same follow-through seen earlier in the structure.

Historically, interactions with this demand zone have involved downside wicking, brief reaccumulation, and attempts to stabilise, and price is once again returning here to search for a base of support.

However, a recent Monthly Close and upside wick into the red region turned that area into resistance, adding overhead pressure that now weighs directly on any rebound attempt.

This pressure has been reinforced by the latest rejection from the red diagonal trendline, where sell-side momentum accelerated as sellers increasingly piled in around that structure.

Volatility is expected here.

As seen repeatedly, revisits to $0.43 and $0.51 have often involved downside wicks or downside deviations, and there remains scope for further instability around — and potentially below — this broader historical demand region.

For AERO to attempt another rebound, price stability around these levels will be essential.

Even then, any rebound would likely be weaker than those seen previously, and whether AERO can muster that reaction at all will be decisive for price behaviour into January and early Q1.

Hedera Hashgraph – HBAR/USD

HBAR’s current structure continues to echo the 2021 cycle closely, but with one decisive deviation that changes the outcome.

In 2021, the orange-circled region produced several weeks of downside wicking before reversing into the blue-circled area, breaking the Lower High and ultimately driving price into a macro Higher High near $0.50.

This cycle, the early sequence was similar, but it resolved differently.

The orange-circled region developed as a more prolonged cluster rather than downside wicks, and while it still produced a reversal, the move into the blue-circled area failed to break structure.

Instead of a macro Higher High, price formed a macro Lower High, marking the point where the historical mirroring ended.

That shift matters for what follows.

HBAR has now Monthly Closed below the red region, turning it into resistance, which aligns with the early stages of the 2022 distribution sequence.

If price also Monthly Closes below $0.115 (black horizontal), the historical analogue would point toward further distribution, with price gravitating toward the macro technical uptrend (blue trendline) over the coming months.

As long as $0.115 holds, HBAR can still attempt a bounce and potentially challenge the red region near $0.15.

But if the cycle continues to mirror history — as it has done for the majority of this structure — losing that level would reinforce the distribution phase and increase the risk of sustained downside.