Altcoin Market Update #126

Features analysis on Altcoins such as LINK NEAR NPC SOL XLM XMR XRP

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Chainlink (LINK)

- NEAR Protocol (NEAR)

- Non-Playable Coin (NPC)

- Solana (SOL)

- Stellar (XLM)

- Monero (XMR)

- Ripple (XRP)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

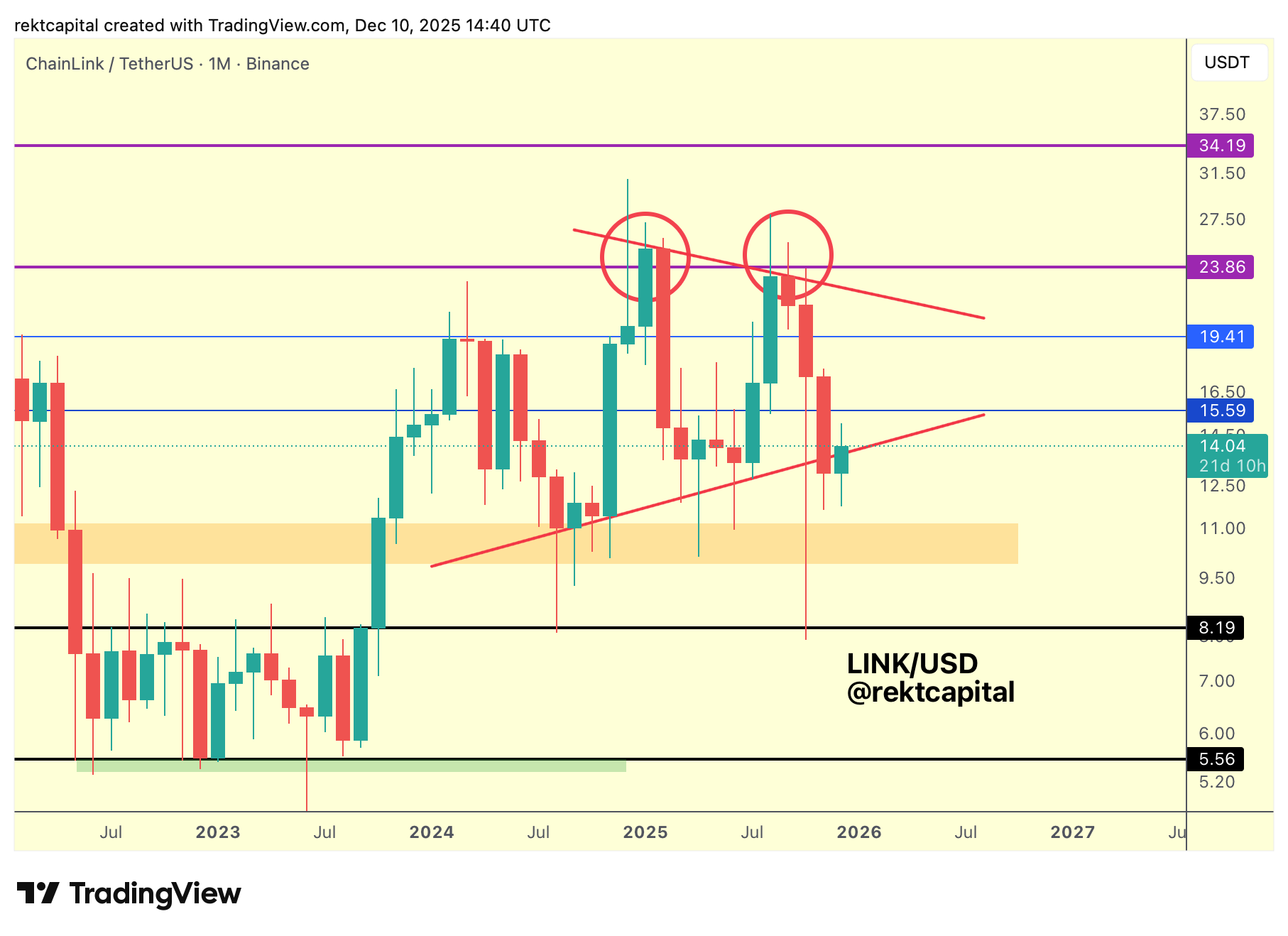

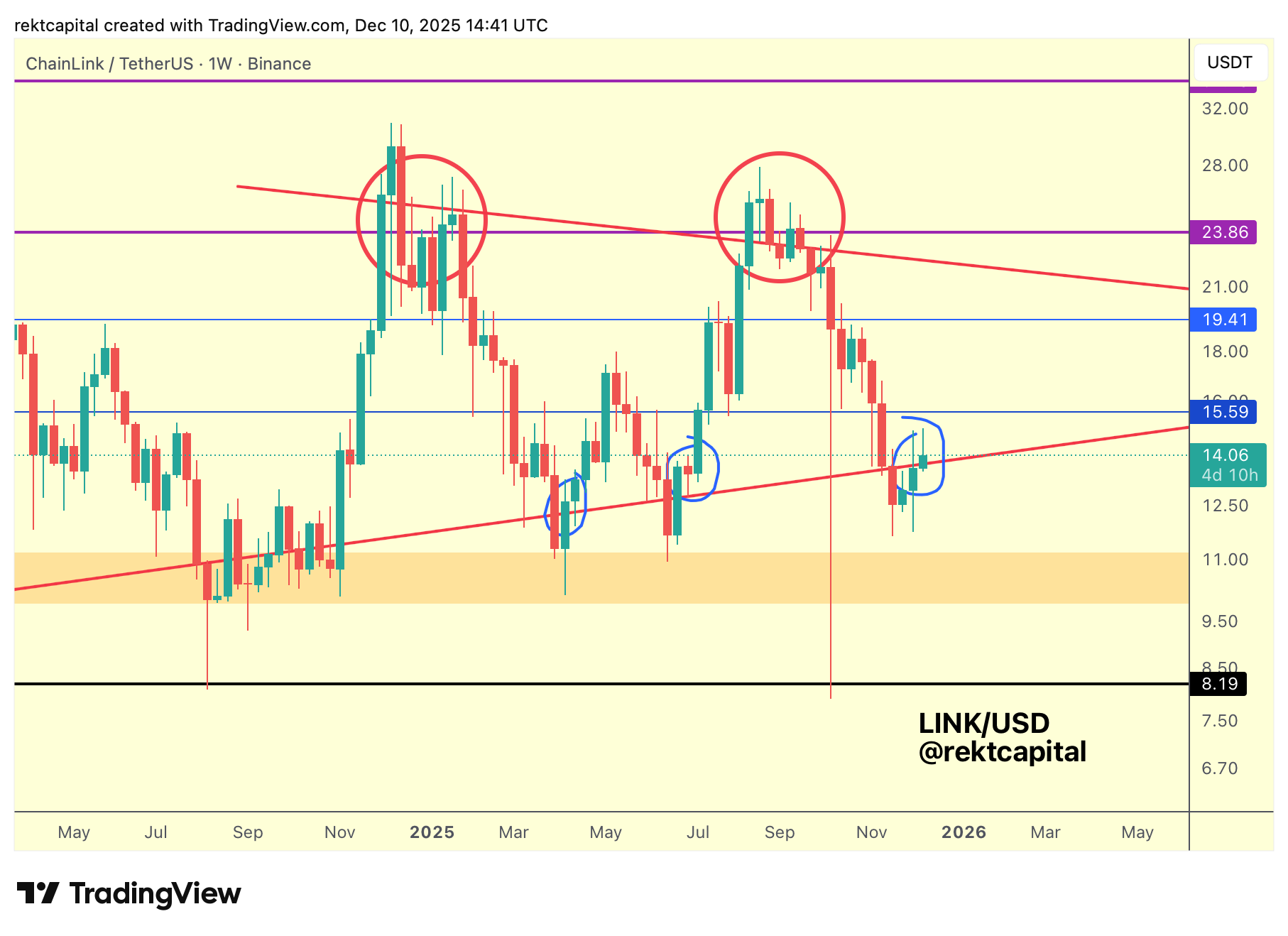

Chainlink – LINK/USDT

Chainlink has performed a Monthly Close below its technical uptrend line (red diagonal), placing this trendline at risk of being lost.

However, price is already attempting to reclaim this level.

If LINK can Weekly Close and later Monthly Close back above the red uptrend, it could begin turning this trendline into new support.

A successful Weekly Close above the red uptrend would allow LINK to resynchronise with its broader market structure, similar to the behaviour highlighted by the earlier blue circles.

At the moment, price is positioned favourably for that Weekly Close, which sets the stage for next week’s focus: attempting a post-breakout retest of the technical uptrend to establish it as support.

If LINK can achieve both the reclaim and the post-breakout retest, the macro structure remains intact, and the pattern re-synchronisation continues to develop going forward.

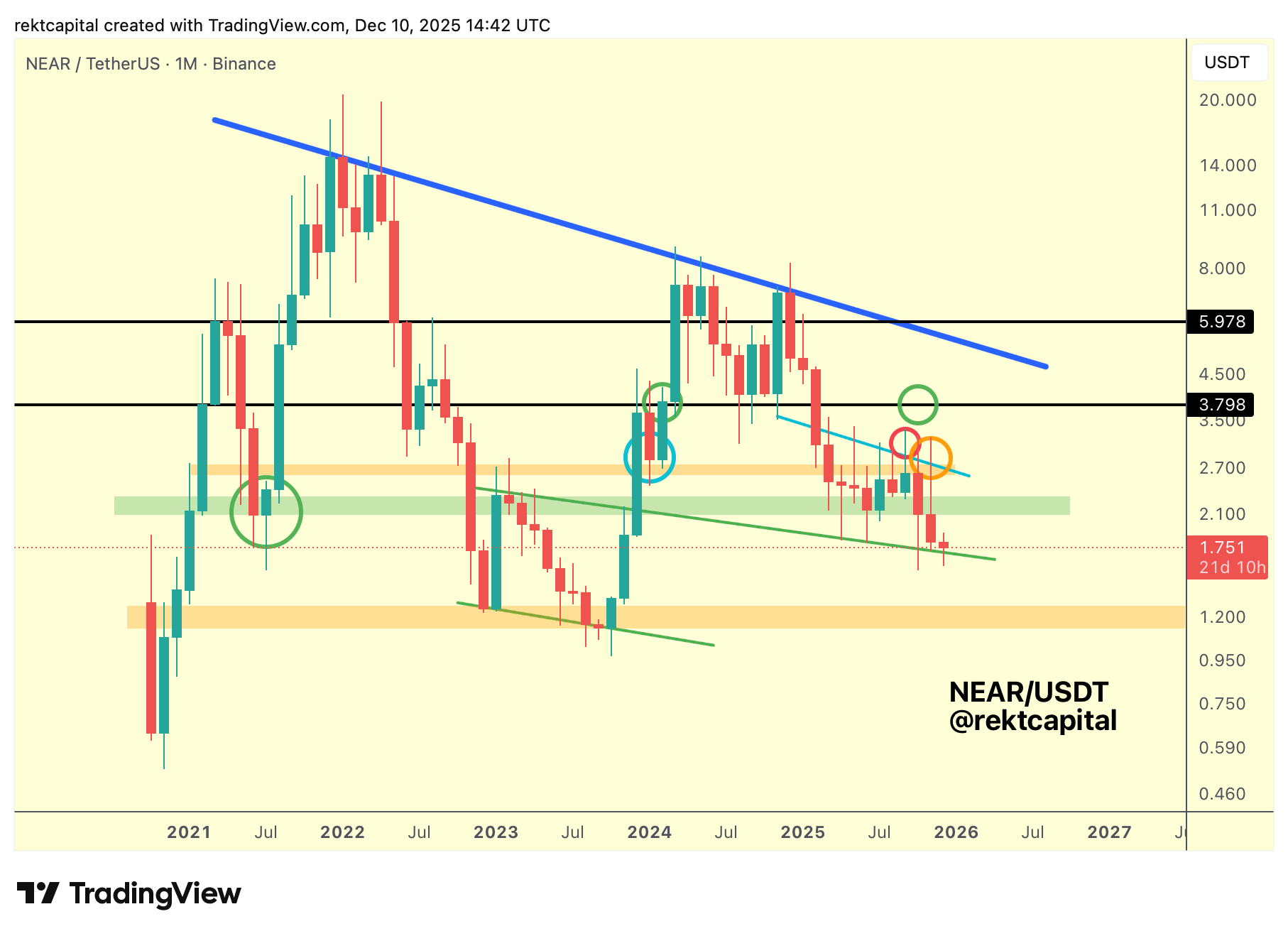

NEAR Protocol – NEAR/USDT

NEAR has been losing levels of historical demand one after another, and price has now returned to its long-standing technical uptrend (green diagonal).

This trendline has historically provided strong reactions, but recent rebounds from it have been progressively weaker.

The latest rejection from the upper portion of the green diagonal pushed price into lower regions again, continuing a sequence of diminishing upside responses.

Earlier in the cycle, breaking beyond this green trendline produced a strong uptrend, but every subsequent rebound has shown reduced strength, signalling that this trendline may be losing its ability to generate meaningful reversals.

Last month’s Monthly Close turned the nearby resistance level into new overhead supply, and while a short-term rebound toward the green region is still possible, it would likely serve only to reaffirm that resistance.

Given the consistent weakening of reactions from the green trendline, there is a real risk of this structure being lost over time.

A confirmed breakdown would open the path toward NEAR’s listing-price demand zone (yellow), which is where prior major reversals and continuation candles have formed.

If the trendline fails, returning to that historical demand area becomes the mid-term likelihood for NEAR.