Altcoin Market Update #125

Features analysis on Altcoins such as ASTER XNO UNI NPC TAO FIL

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Aster (ASTER)

- Nano (XNO)

- Uniswap (UNI)

- Non-Playable Coin (NPC)

- Bittensor (TAO)

- Filecoin (FIL)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

Aster – ASTER/USDT

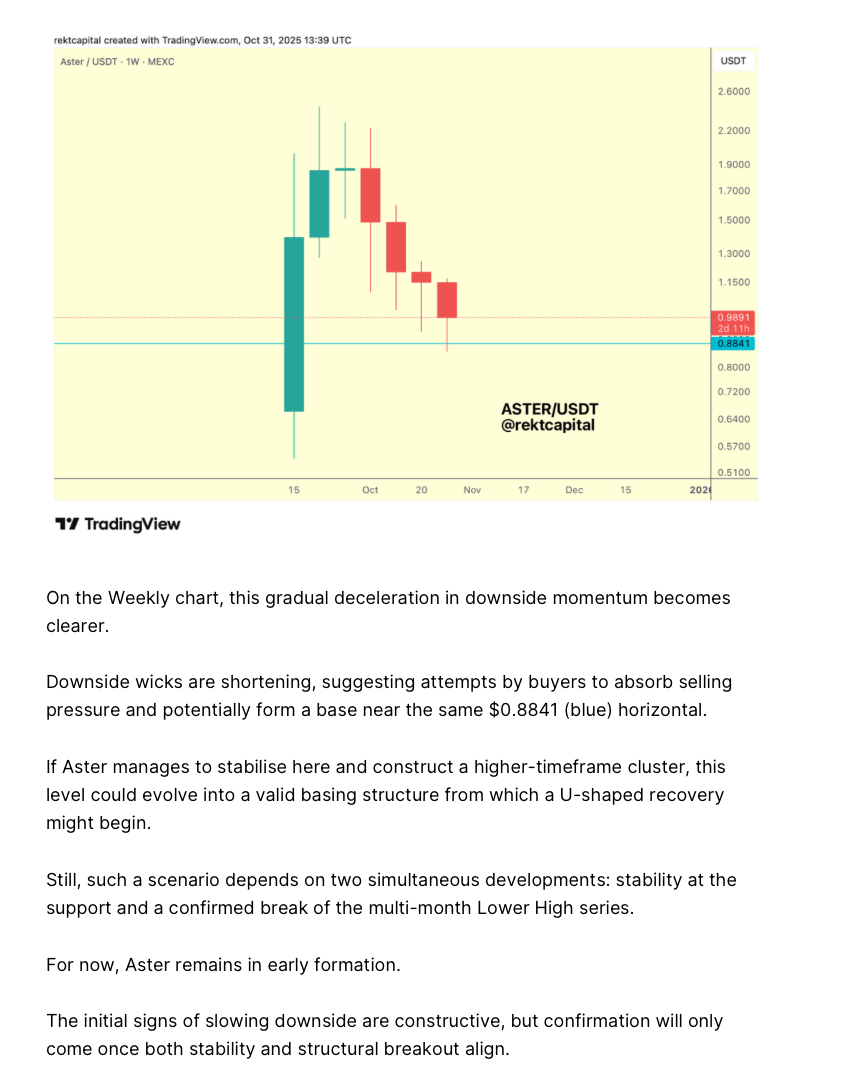

A few weeks ago in late October, I posted the following about ASTER:

Aster is a really good educational coin because we covered it almost a month ago, and at the time we were talking about how Aster was showing a slowdown in sell-side momentum.

The sharpness of its lower lows was decreasing as price pressed against this demand region, and —as we’ll see in a moment— this area was actually a Monthly level of support.

We noted a gradual lessening, softening, and curling of downside momentum against this demand region, and this behaviour was important in helping price begin building a base there.

The slowing was also visible in the downside wicks, which were shortening over time, showing waning sell-side intensity while Aster continued to curl against this Monthly level.

This was the exact area where the basing structure developed and from which Aster ultimately springboarded.

This sort of reduction in sell-side momentum is always a useful candlestick-analysis trigger to monitor.

Once Aster began stabilising at the Monthly level, the downtrend break aligned with a shift in downside momentum.

This is where the base completed and the springboard effect became apparent, as price rallied away from the demand region.

That developing slowdown and curling we highlighted in prior weeks is what allowed price to finally transition from persistent lower lows to a stabilising structure that enabled the first major rebound.

After springboarding from the Monthly support, Aster rallied into the next region—the top of the prior cluster around $1.50.

This cluster formed the ceiling of the basing structure, and price is now trying to post a breakout retest of this cluster to fully confirm the breakout.

The next leg of continuation would see Aster attempt to rally into the overhead region, and that is exactly where price is rejecting at the moment.

A Weekly Close and retest of the top of this cluster —around $1.50— is what is essential to get price into the larger old All Time High cluster that sits above.

At the same Monthly support level, the confluence became even clearer in RSI: price produced lower lows while RSI formed higher lows, creating a Bullish Divergence.

That divergence developed precisely at the key Monthly support level, aligning with the slowing downside momentum and helping confirm the base that formed here.

Looking at the entire cluster, price is trying —and in many ways has already succeeded —in breaking out from the structure, but still needs to post a successful breakout retest of the $1.50 level to fully confirm it.

A dip into this area could make sense, but maintaining stability around and especially above this $1.50 region is crucial.

If Aster holds here, it can rally and build continuation into the final cluster of old All Time Highs above.

That $1.50 cluster is ultimately the key to enabling that next expansion.

Nano – XNO/USD

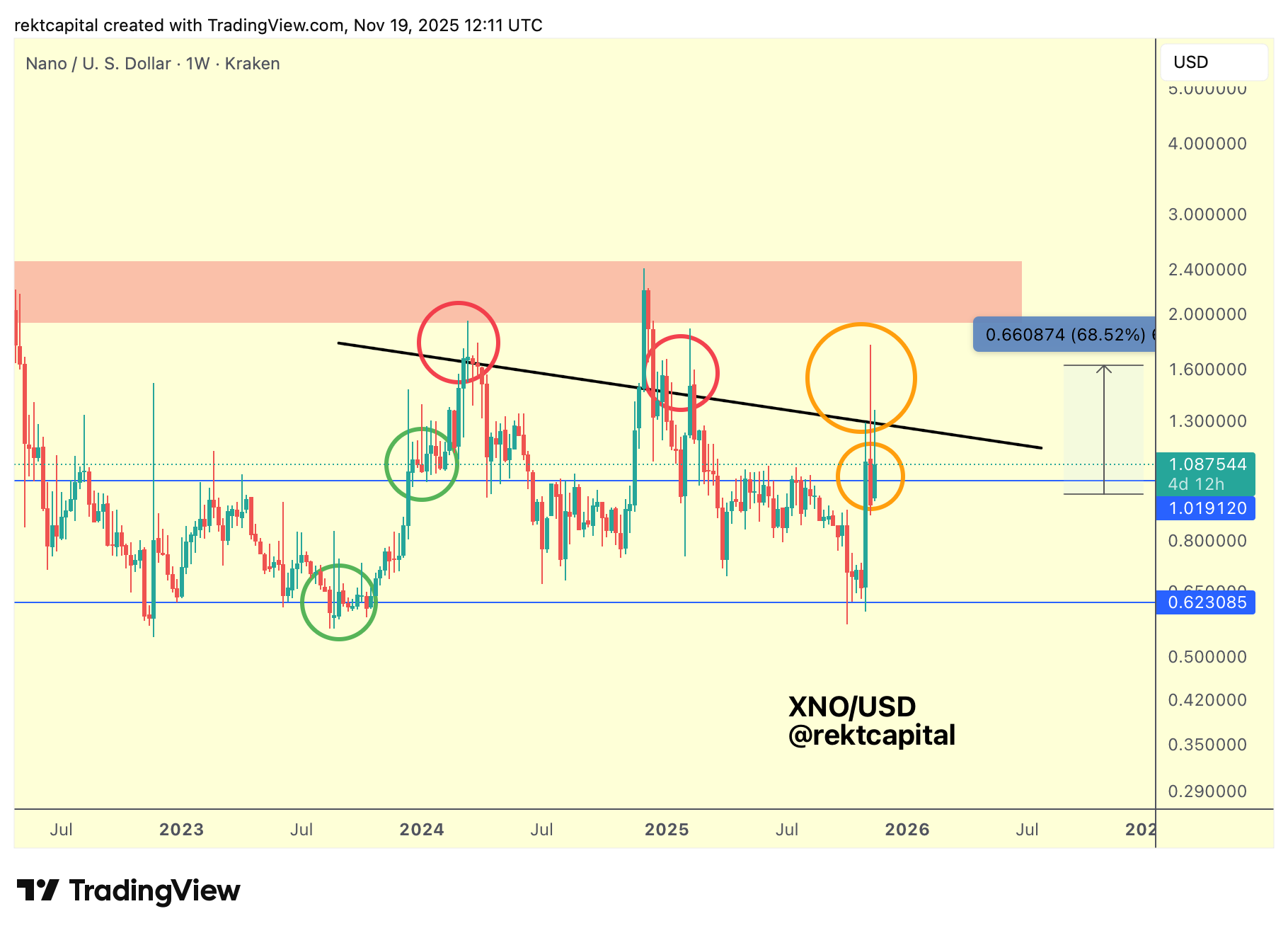

Nano has been a coin we’ve been covering for a while.

Recently, it broke out into an upside wick beyond the black diagonal trendline, effectively repeating the same behaviour it showed during previous breakout attempts.

But as mentioned earlier, if price isn’t able to perform a successful post-breakout retest of this level, the breakout will lack confirmation.

Right now, Nano is entering the next region for a potential post-breakout retest, as price interacts with both the diagonal trendline and the blue–blue Range High it is trying to break beyond.

This is the area where price needs to establish support.

At the moment, we may be seeing the early stages of a multi-week Bull Flag developing, though the pattern itself is secondary.

What truly matters is the behaviour of price: it is trying to retest the old range High as new support.

This sort of clustering and retesting is exactly what we want to see develop here, because such a retest would confirm a breakout from the range.

A successful retest would also place price in a position where it could begin to challenge for stability above the diagonal trendline resistance.