Altcoin Market Update #123

Features analysis on Altcoins such as TAO VIRTUAL AERO PENGU XMR HBAR

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Bittensor (TAO)

- Virtuals Protocol (VIRTUAL)

- Aerodrome Finance (AERO)

- Pudgy Penguins (PENGU)

- Monero (XMR)

- Hedera Hashgraph (HBAR)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

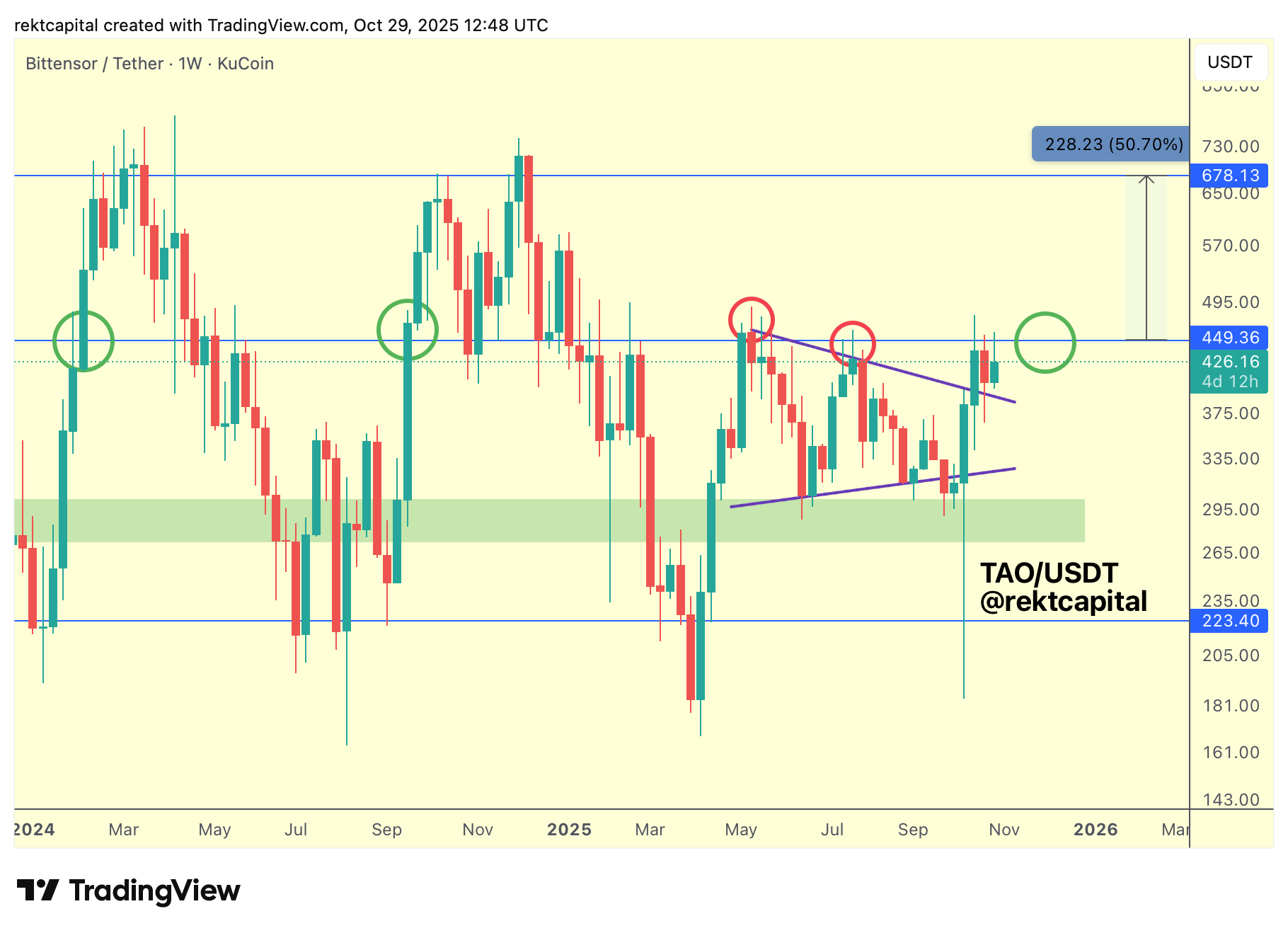

Bittensor – TAO/USDT

TAO has been trading within a wedging structure, with price recently deviating into the green historical demand region before recovering toward the wedge’s upper boundary.

That deviation served as a retest of the demand zone, helping price re-establish strength at the bottom of the wedge.

On the Daily timeframe, multiple retesting events occurred inside this zone, sending price across the entire channel.

A Weekly Close above the top of the wedge followed, initiating a post-breakout retest sequence that thus far has held successfully.

That retest enabled price to reach resistance at $449.36 (blue), where short-term consolidation may be forming a minor bull flag.

However, the more significant structure remains the macro range defined between $449.36 and $678.13 (blue).

The key objective for TAO now is to reclaim $449.36 as new support, since historical Weekly or Daily Closes above that level have preceded rallies across the wider 50 % macro range.

A confirmed Weekly Close and post-breakout retest of the Range Low would likely allow price to re-enter that macro range and position for continuation toward the Range High near $678.13.

For the moment, price continues to test resistance at $449.36, showing progressively shallower retracements after each rejection, a sign of strengthening demand following the successful post-breakout retest.

Sustaining this retest sequence could enable TAO to secure a Weekly Close above the blue level. Turning it into support would re-synchronize price with the overall macro range and open the pathway for range-wide expansion.

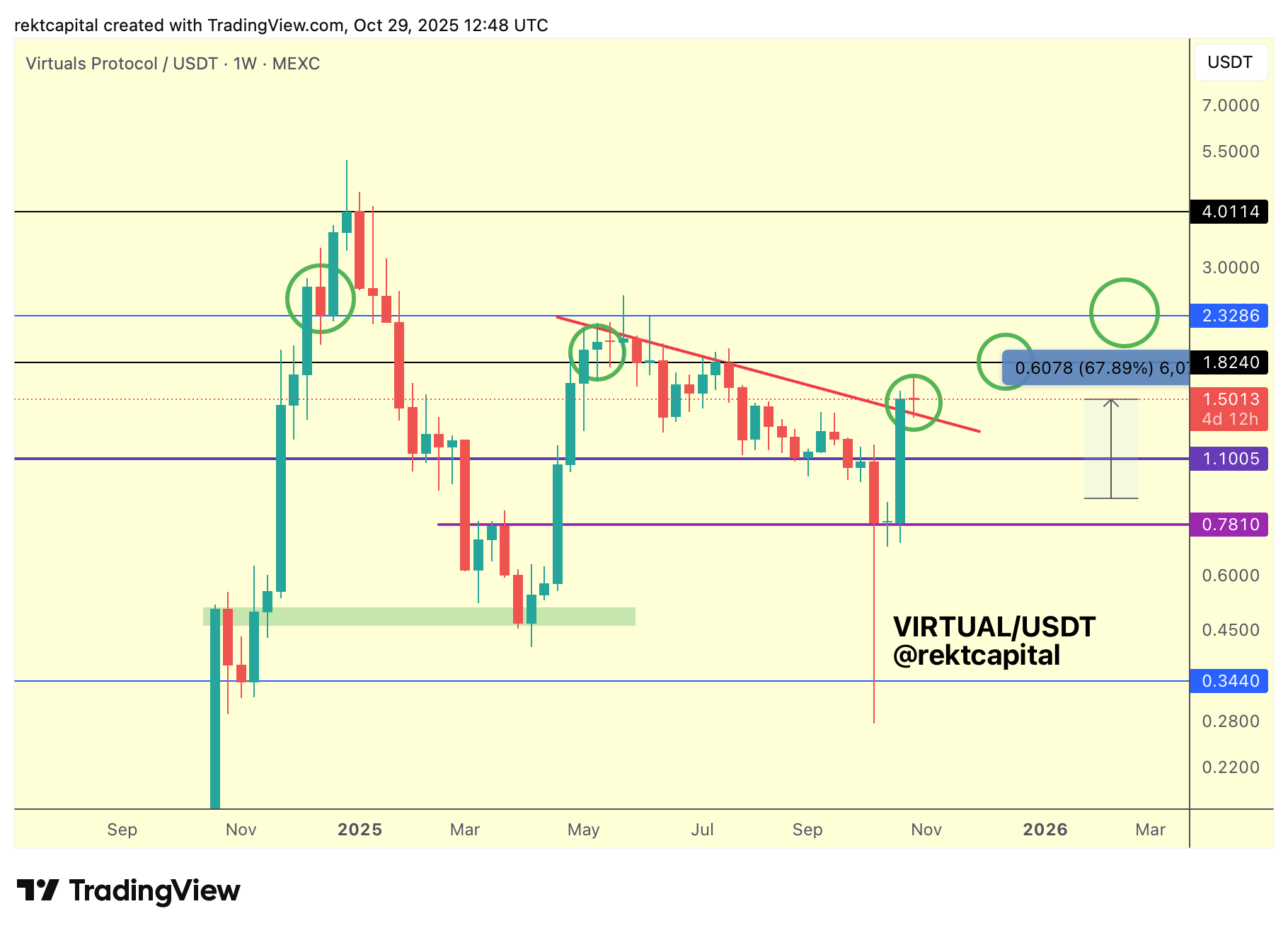

Virtuals Protocol – VIRTUAL/USDT

VIRTUAL has rebounded strongly from its Range Low at $0.7810 (purple), rallying across the short-term range toward $1.1005 (purple) and completing the move mapped last week.

That rebound translated into an approximately 60 % advance, carrying price directly into the red diagonal downtrend.

A Weekly Close above that downtrend now suggests the market is attempting a trend shift after months of downside.

The next technical step lies at $1.8240 (black), a level that, if reclaimed and retested as support, would confirm trend continuation and open the pathway toward $2.3286 (blue).

Each of these levels forms part of a staircase structure where successful Weekly Closes and post-breakout retests would re-establish a full sequence of higher-highs and higher-lows.

And since we lost cover VIRTUAL, it has rallied roughly 60 %, underlining the strong follow-through from last week’s setup.

Beyond $2.3286 (blue), continuation toward the psychological round numbers of $3 and $4 remains possible, but only if the current post-breakout retest holds.

For now, focus remains on confirming that retest to validate the emergence of a new technical uptrend following the completion of this multi-month downtrend.