Altcoin Market Update #123

Features analysis on Altcoins such as TAO XMR DOGE LINK AVAX

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Bittensor (TAO)

- Monero (XMR)

- Dogecoin (DOGE)

- Chainlink (LINK)

- Avalanche (AVAX)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

Bittensor – TAO/USDT

TAO continues to hold up remarkably well despite the broader market retrace that saw Bitcoin revisit the $100k region.

Over the past few weeks, price has maintained relative strength while consolidating inside a narrowing wedging structure (purple).

A breakout from that wedge occurred recently, followed by a post-breakout retest that has now extended for three consecutive Weekly Candles.

So far, this retesting period has been successful, stabilising price action and enabling TAO to prepare for a transition into the wider blue-to-blue macro range between $449.36 (blue) and $678.13 (blue).

Last week, price achieved a Weekly Close above the diagonal resistance, confirming the breakout.

This week, TAO is positioning for a potential retest of $449.36, a level that previously defined the upper boundary of the wedge.

A Weekly Close and post-breakout retest above this level would confirm successful re-entry into the macro range and open the path toward the Range High near $678.13, roughly a 50 % distance across the structure.

However, the coming days will determine whether this retest holds.

If TAO Weekly Closes back below $449.36, that failed confirmation could turn the level into new resistance, invalidating the breakout and increasing pressure on the former retesting region near the top of the wedge.

Sustaining strength above the purple trendline will therefore be essential to preserve the breakout’s integrity and maintain positioning within the blue-to-blue range.

For now, TAO remains one of the stronger altcoins, with a constructive setup that hinges on whether this current retest evolves into a confirmed reclaim or slips into resistance once more.

Monero – XMR/USDT

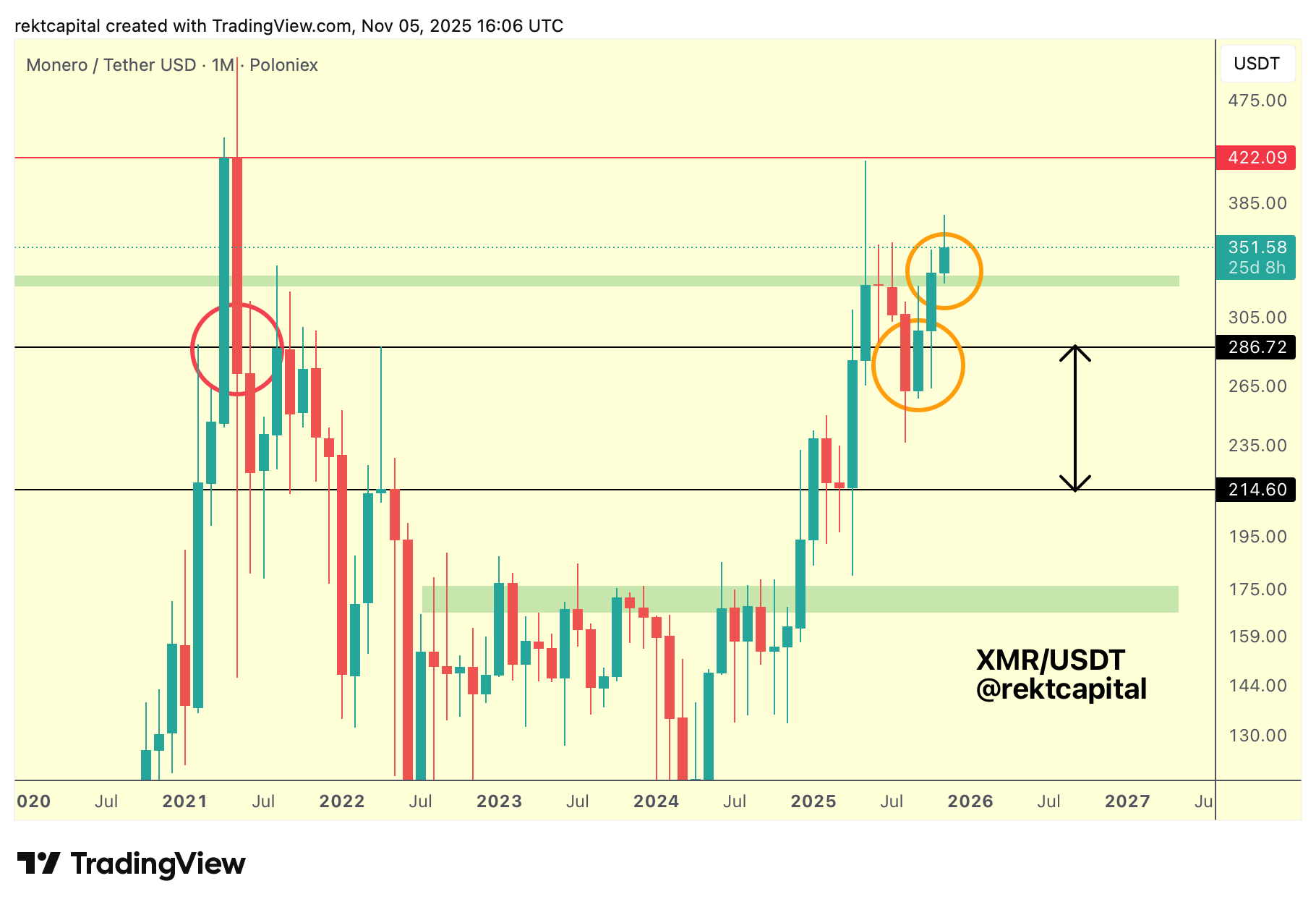

Historically, $422.09 (red) has acted as the major bull market top for XMR, serving as key resistance across previous cycles.

Price has revisited that level once again this year.

In earlier cycles, XMR rejected from $422 and later turned $286.72 (black) into resistance. This time, however, price Monthly Closed above that level and retested it as support, breaking from the historical pattern.

Price has also Monthly Closed and retested the green region as new support, moving back into the broader range between roughly $310 and $422 (red).

Sustained stability at this green base would allow price to continue expanding across this range over time.

Previous rejections from $422 have triggered deep bear markets, but this year’s retrace from the same level has been relatively shallow, suggesting that the supply in this area has not produced the same degree of downside pressure.

As long as the green region continues to hold as support, XMR may revisit the upper boundary of the range at $422.

On the Weekly timeframe, price continues to retest the green region successfully, forming consistent higher lows at this base.

That stability needs to persist to enable continuation within the $310–$422 range.

For now, both timeframes show alignment, with the Monthly confirming support at $286.72 (black) and the Weekly maintaining structure within the higher range.

Continued stability at this green region remains essential for further range-wide expansion.