Altcoin Market Update #122

Features analysis on Altcoins such as CPOOL AVAX TAO SUI SOL AERO

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Clearpool (CPOOL)

- Avalanche (AVAX)

- Bittensor (TAO)

- Sui (SUI)

- Solana (SOL)

- Aerodrome Finance (AERO)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

Clearpool – CPOOL/USDT

CPOOL has been consolidating inside a well-defined Monthly Range between $0.11598 (red) and $0.16058 (blue) for several months, oscillating between these boundaries with intermittent FOMO wicks and capitulation wicks at each extreme.

A Monthly Close above $0.11598 remains the key structural requirement for maintaining this range.

As long as the base holds, CPOOL continues to build a stable foundation for a future retest of $0.16058, the Range High resistance that has repeatedly rejected price in previous attempts (red circles).

If price Monthly Closes above $0.16058, the next technical objective would be to flip that level into new support, completing the reclaim sequence highlighted by the orange circle.

Such a development would validate the outlined green pathway, paving the way for an expansion toward the upper part of the macro structure around $0.32345 (black).

Conversely, a Monthly Close below $0.11598 would likely force price to revisit the underlying order-block region just beneath the range, where historical accumulation occurred following the 2023 Falling Wedge breakout.

This area would serve as the next logical zone for rebuilding strength before any renewed attempts at range recovery.

For now, the focus remains on preserving the Range Low and sustaining consolidation between these levels, a process that continues to compress volatility and prepare CPOOL for its next decisive Monthly Close.

Avalanche – AVAX/USDT

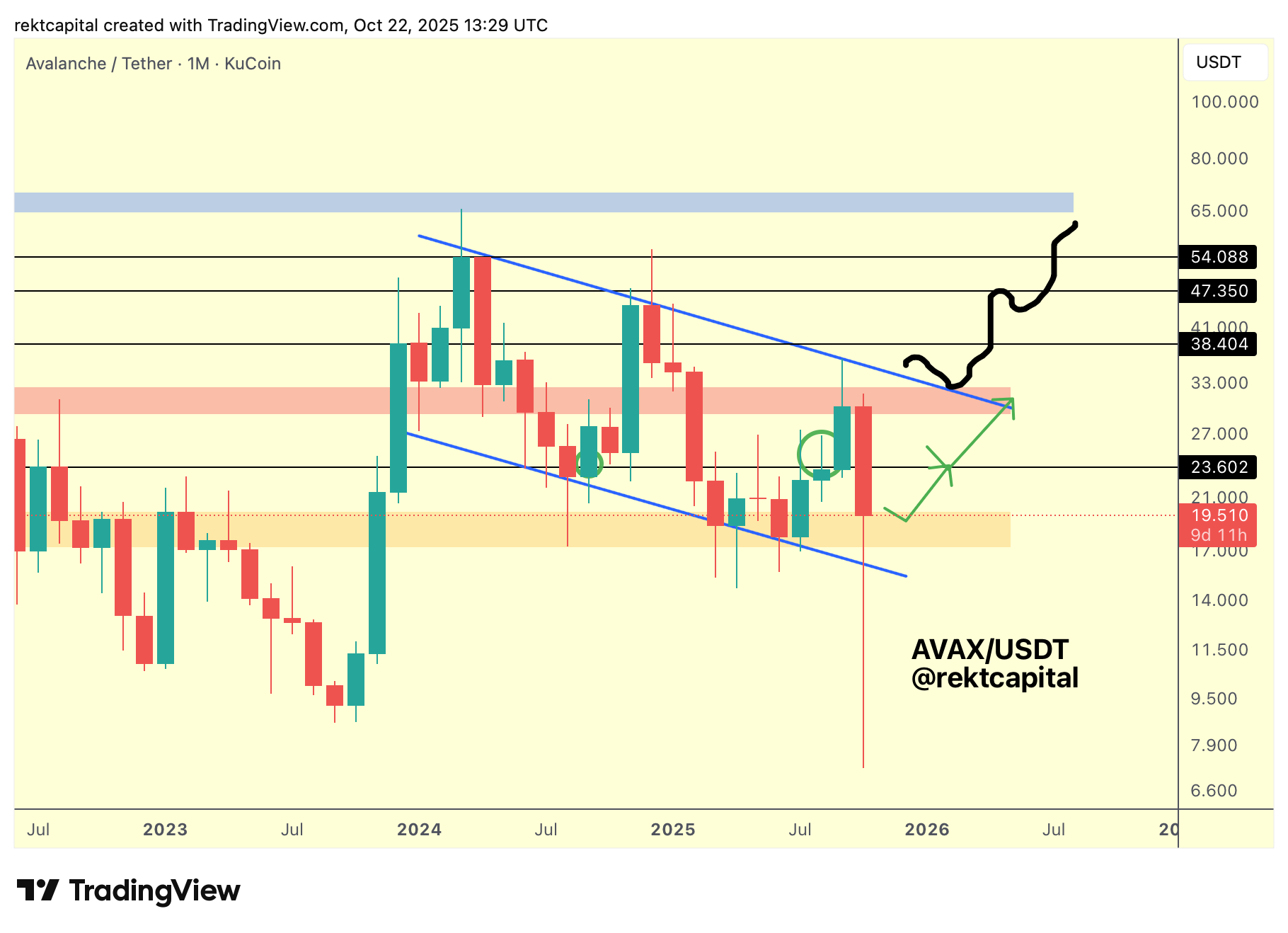

AVAX continues to fluctuate within its Macro Falling Wedge (blue trendlines), oscillating from the bottom boundary to the top and back again over consecutive months.

The most recent Monthly rejection from the wedge top produced a strong downside reaction, sending price back toward the historical demand region (orange) that has repeatedly generated rebounds over the past year.

This region now coincides with the wedge bottom, forming an important confluence support zone.The midpoint at $23.602 (black) remains the key pivot within this pattern.

On the Weekly timeframe, price failed to hold above it, turning the level into resistance.

However, if AVAX revisits this midpoint and successfully reclaims it on the Monthly timeframe, that would confirm renewed strength and validate the green path scenario.

Holding this confluence of the historical demand region and wedge bottom will be crucial for establishing a base from which AVAX could rally toward the upper boundary of the structure.

A Monthly Close and post-reclaim retest above the midpoint would signal continuation and set the stage for a potential move into the $27–33 region, followed by a broader challenge of higher resistances at $38.404, $47.350, and $54.088 over time.

For now, AVAX remains at a critical pivot where structural preservation is essential.

Maintaining support at this confluent zone would keep the wedge intact and sustain prospects for eventual upside rotation toward the pattern’s upper boundary.