Altcoin Market Update #121

Features analysis on Altcoins such as AVAX TAO XMR IOTA WLD

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Avalanche (AVAX)

- Bittensor (TAO)

- Monero (XMR)

- IOTA (IOTA)

- Worldcoin (WLD)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

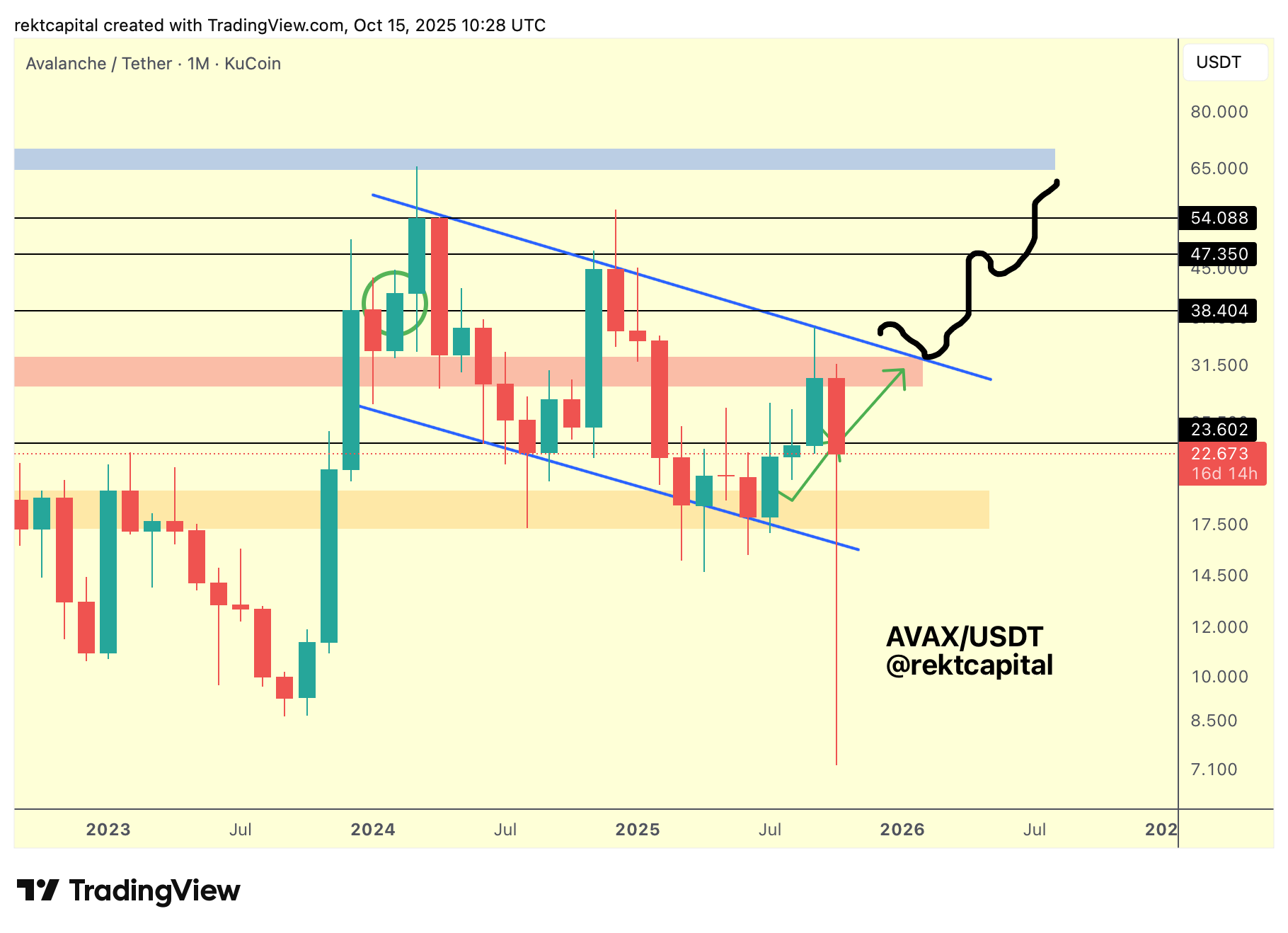

Avalanche – AVAX/USDT

Avalanche continues to move within its Macro Falling Wedge structure (blue).

Price recently had the opportunity to Monthly Close above the Downtrend resistance, but failed to do so.

Instead, this Monthly Candle rejected from that resistance and produced a significant downside wick, accentuated by the liquidation event.

Even so, price continues to hover around the midpoint of the structure at $23.60 (black horizontal line), a level that has consistently served as a pivotal gauge of strength within this wedge.

Holding $23.60 as support would enable the outlined green pathway to unfold once again.

This path, mapped out in prior analyses, remains the structural requirement for continuation towards the upper boundary of the pattern.

At the moment, Avalanche is battling to reclaim this key level.

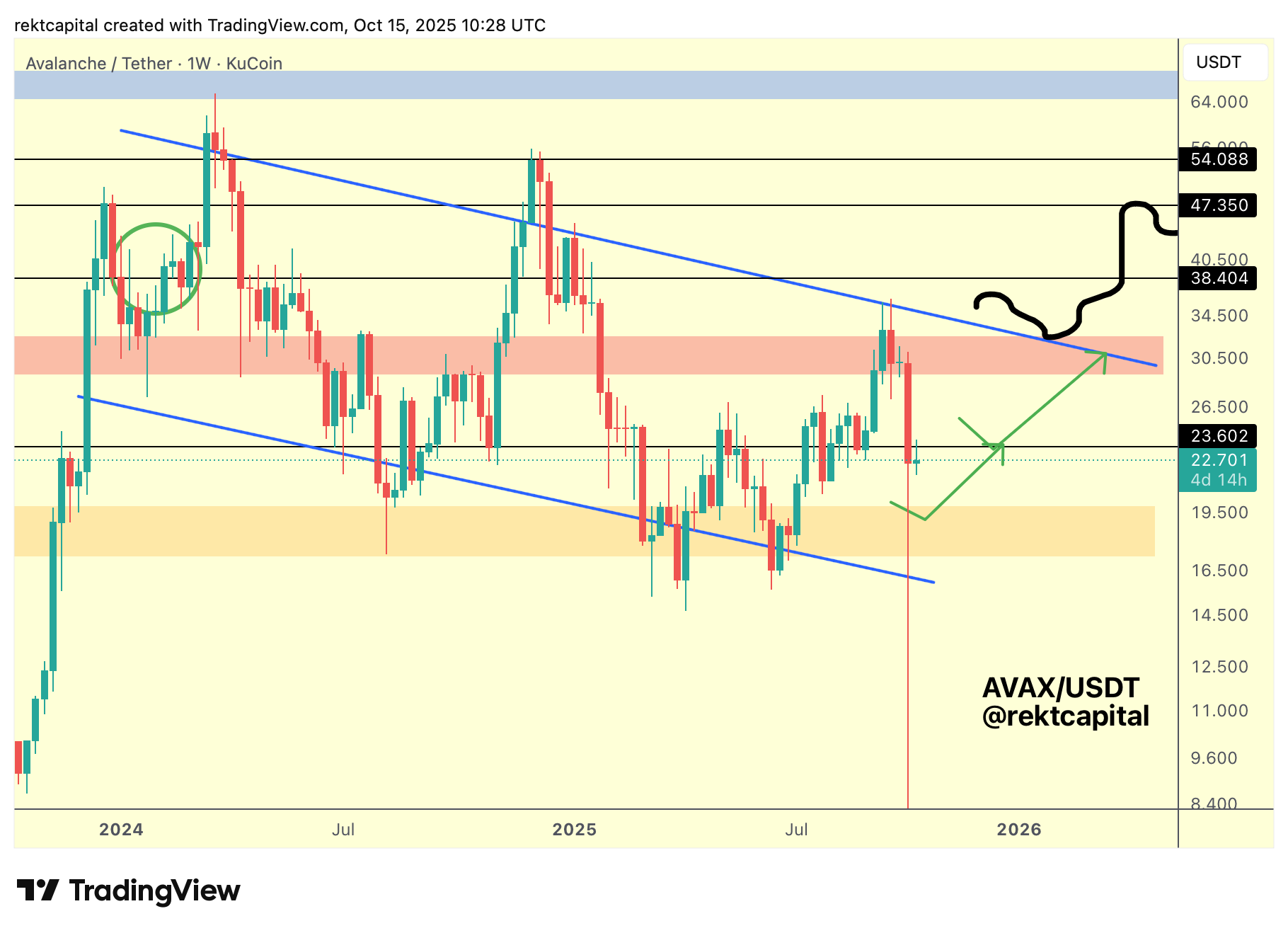

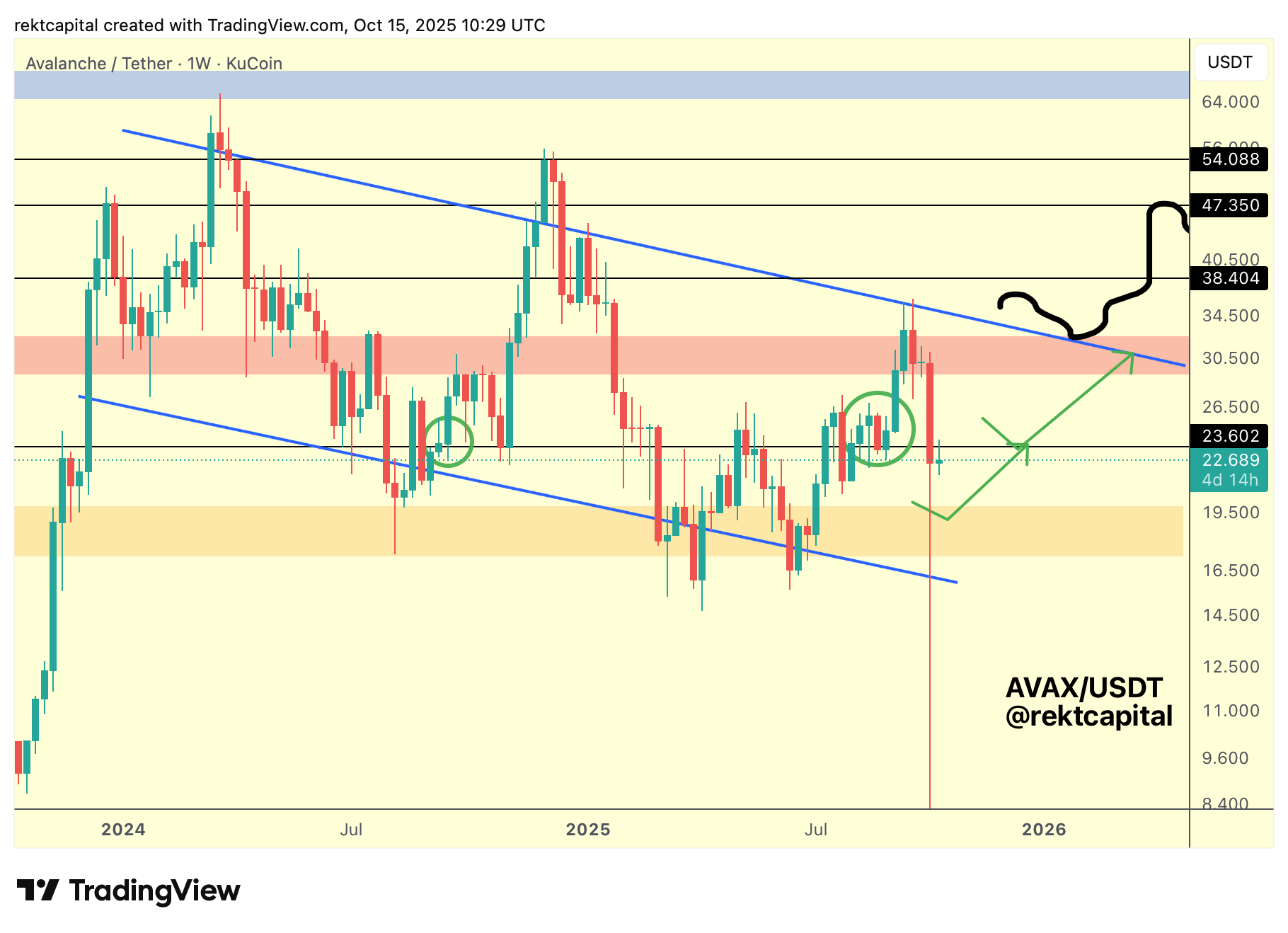

Price has recently Weekly Closed below $23.60, raising the question of whether this could evolve into a downside deviation.

If it does, then a Weekly Close back above $23.60 would re-establish the range equilibrium and confirm the deviation as false, setting the stage for a return to the wedge top.

This type of reclaim has historical precedent.

Similar deviations and recoveries occurred during the summer months (green circles), where Avalanche successfully reclaimed $23.60 after short-lived breakdowns.

Each confirmed reclaim catalyzed upside continuation towards the upper boundary of the wedge.

That’s why the next Weekly Close is critical.

A successful post-reclaim retest of $23.60 would mark a surefire sign of strength, enabling AVAX to build a higher base structure and rebound from it.

Historically, whenever Avalanche has confirmed this reclaim, it has progressed to test higher resistances and advanced towards the upper regions of the Macro Wedge.

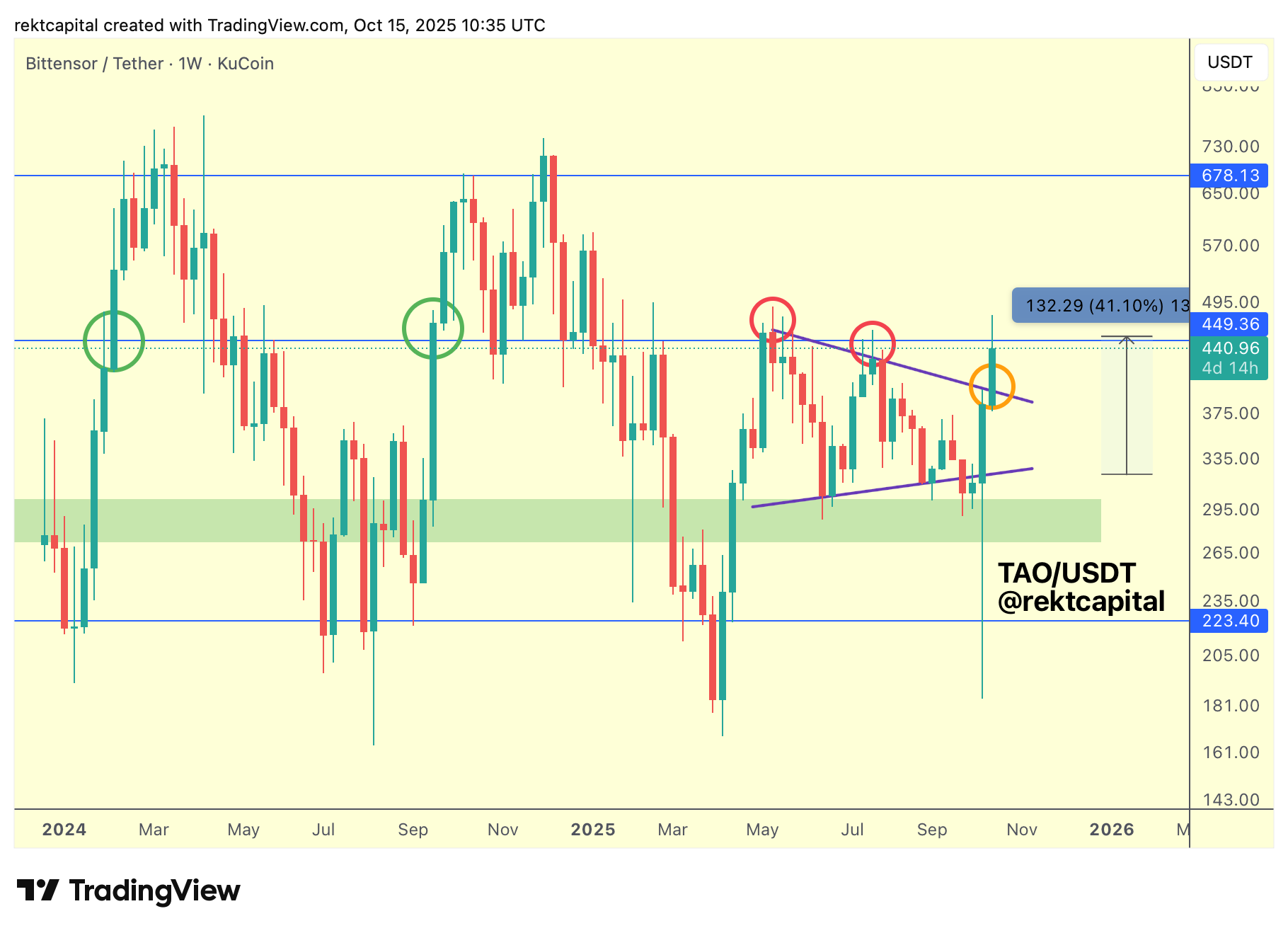

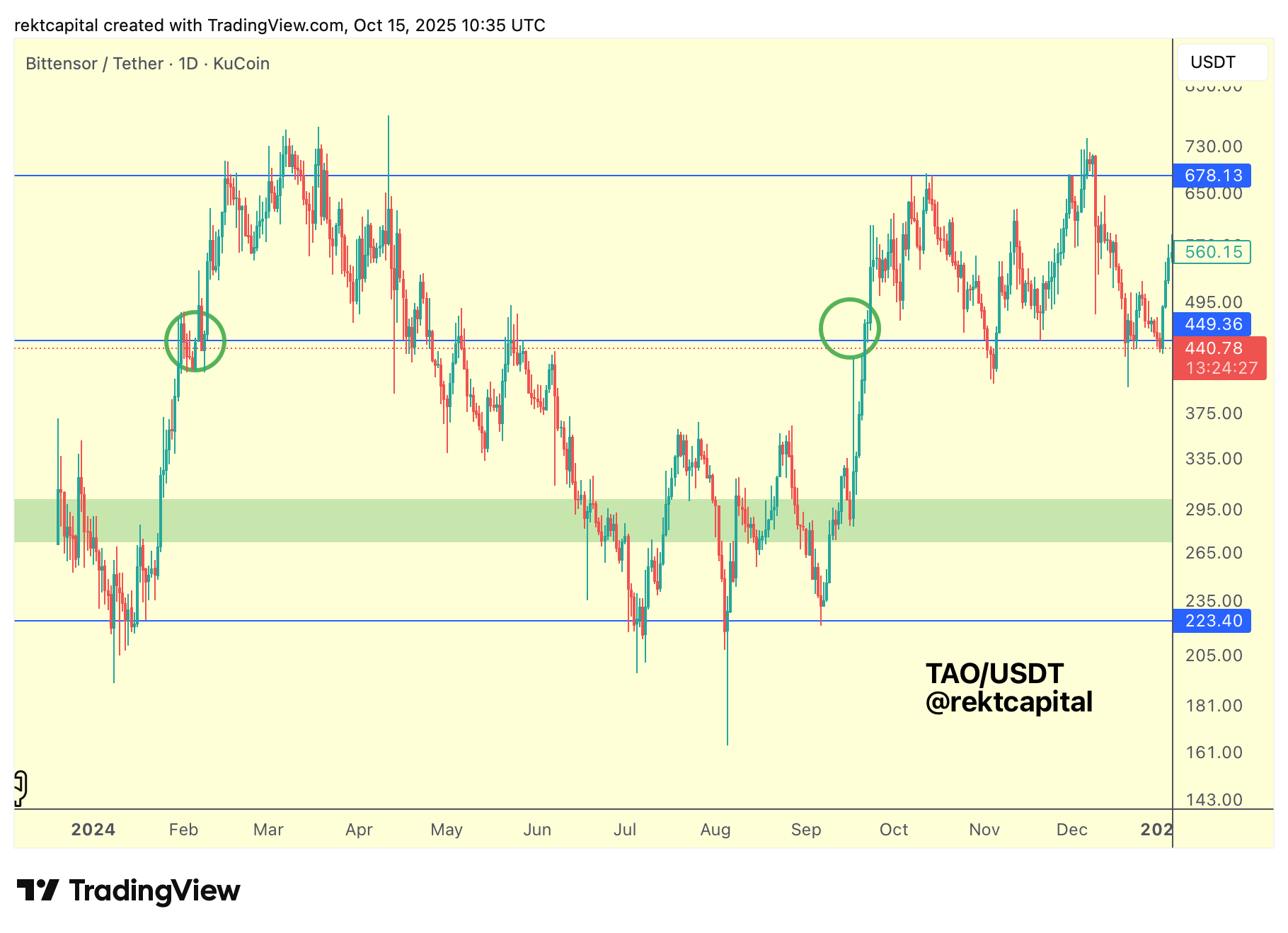

Bittensor – TAO/USDT

Earlier this month, we highlighted TAO in the newsletter, noting how price was approaching a key decision point.

Specifically, a Weekly Close above the recent Lower Low.

That milestone was the level to watch for confirmation of renewed strength within the structure, but instead we got something much quicker than that - Daily Closing and retesting:

Looking closer, we can see how daily closes began clustering around the recent Lower Lows, showing buyers defending the base of the structure.

These tight daily consolidations along the wedge bottom are often precursors to sustained recoveries, signalling accumulation before expansion.

Since that update, TAO has been one of the top performers despite broader market turbulence, breaking out from its Falling Wedge (purple).

This breakout underscores the coin’s structural strength and resilience amid uncertainty.

The next crucial step is a Weekly Close above the diagonal (purple) to confirm breakout continuation.

If TAO Weekly Closes above the diagonal but remains below $449 (blue), a post-breakout retest of that diagonal could occur before further upside.

However, if TAO Weekly Closes above $449, that would position price to re-enter its Macro Range between $449 and $678 (blue). The same range that defined prior expansion phases.

While Weekly Closes remain the most reliable signal, Daily Closes can also serve as early confirmations.

Two consecutive Daily Closes above the diagonal, followed by a small post-breakout retest, would already confirm early breakout behaviour.

Even if price briefly dips below the breakout line but forms Higher Lows just beneath it, that still qualifies as a potentially valid retest worth monitoring closely.

Ultimately, whether through Daily or Weekly confirmation, TAO is on the verge of breaking back into the Macro Range between $449 and $678.

At the moment, $449 (blue) is still resistance, but it wouldn’t take much for TAO to turn this level into new support and establish a higher base for further upside continuation.