Altcoin Market Update #120

Features analysis on Altcoins such as APT BEAM MOODENG TAO CAKE TIA NEAR

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Aptos (APT)

- Beam (BEAM)

- Moodeng (MOODENG)

- Bittensor (TAO)

- PancakeSwap (CAKE)

- Celestia (TIA)

- Near Protocol (NEAR)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

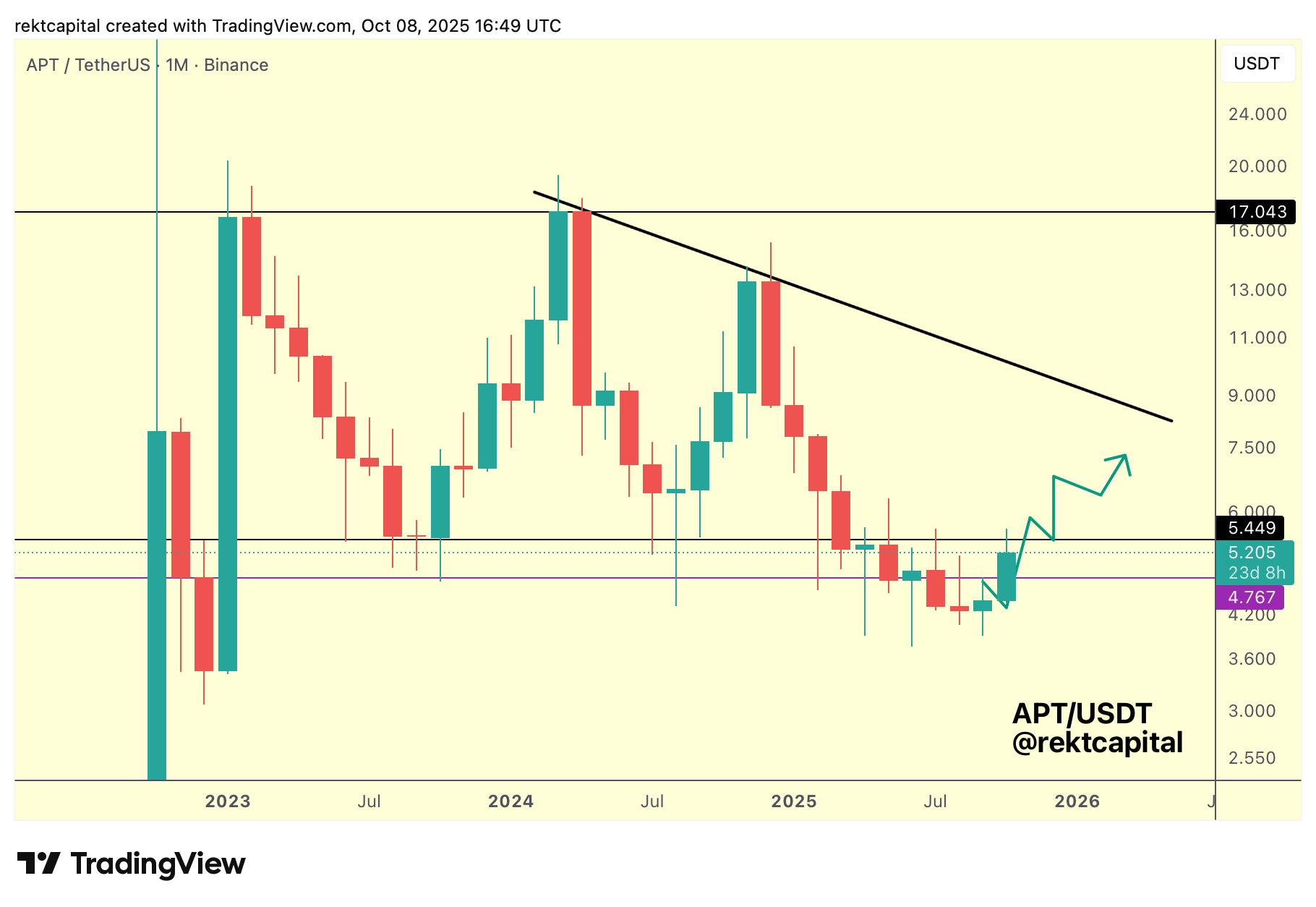

Aptos – APT/USDT

Aptos has recently broken out from a Falling Wedge structure that had been building for all of this year.

Price broke out and rallied right into a major resistance at $5.45 which we’ll later realise is the Macro Range Low of its Macro Range.

In fact, this entire clustering in price action within the confines of this Falling Wedge technically represents a downside deviation below the Macro Range:

This Falling Wedge breakout therefore represents Aptos’ efforts to try to resynchronise with this Range.

To do this however, price would need to reclaim $5.45 as support which APT doesn’t seem ready for at this time.

In the meantime, price could dip in towards the purple horizontal which figures as a key Monthly pivot point.

Historically, price tends to gravitate to this purple level, either testing it as support and downside wicking below it or testing it as resistance and upside wicking beyond it.

What’s interesting about a potential revisit of the purple level on this pullback is that any downside deviation below it could see price tag the top of the Falling Wedge for a post-breakout retest to fully confirm the breakout from the structure:

Whether price is able to reclaim $5.45 right away or needs to first post-breakout retest the Falling Wedge, APT looks poised to resynchronise with its Macro Range in an effort to kickstart upside across it, with the first major resistance within that Range being the black Downtrend within it.

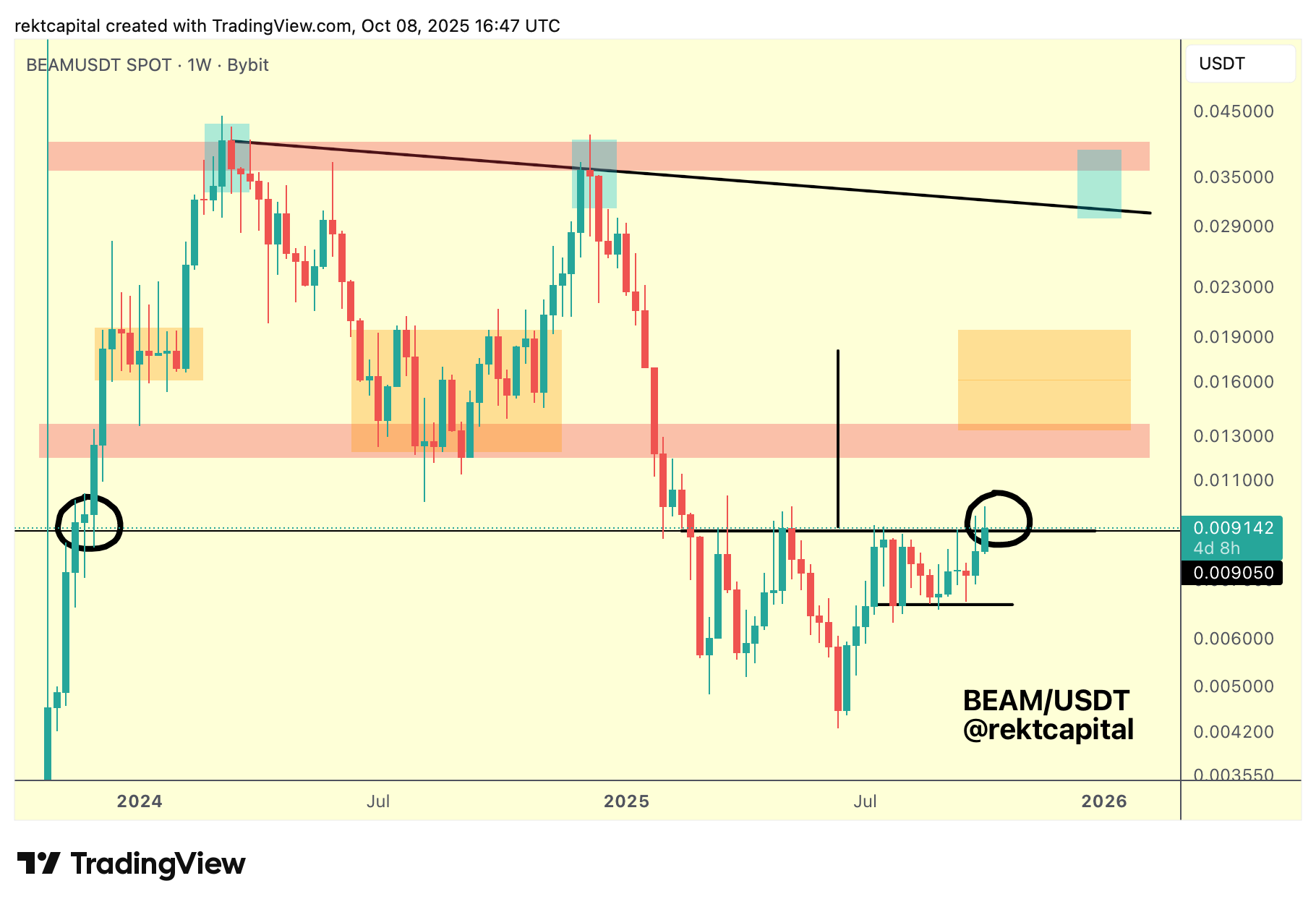

Beam – BEAM/USDT

BEAM is developing an inverse Head and Shoulders formation and is on the cusp of potentially breaking out from it.

It just so happens that the Neckline of this pattern represents a key historical pivot point for BEAM trends.

In fact, breakout confirmation beyond this point has historically been very clean in that Weekly Closes above this level followed by a retest of it has been enough to confirm trend continuation to the upside.

In this instance, such Weekly confirmation would validate the current inverse Head and Shoulders formation that price is evolving right now.

A successful validation of the formation would bring about a minimum Measured Move which would result in price breaking into its Macro Range.

More, it would see price position itself inside this Range for a potential repeat of the orange fractals that have historically tended to develop near the Range Low.

After all, this these historical fractals have either seen price develop Re-Accumulation structures not far above the Range Low which have preceded trend continuation in an already present uptrend or entire bottoming clusters of price action at the base of the Range Low to precede a full trend reversal to the upside after a prolonged pullback within the Range.

Therefore a breakout from the current inverse Head and Shoulders represents a key initial technical milestone BEAM needs to achieve in order to resynchronise with its Macro Range and from there BEAM would need to decide how it wants to build its base at the Range Low to prepare itself for launch across the Range altogether.