Altcoin Market Update #118

Features analysis on Altcoins such as AVAX DOGE ATOM CRO WLD

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Avalanche (AVAX)

- Dogecoin (DOGE)

- Cosmos (ATOM)

- Cronos (CRO)

- Worldcoin (WLD)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

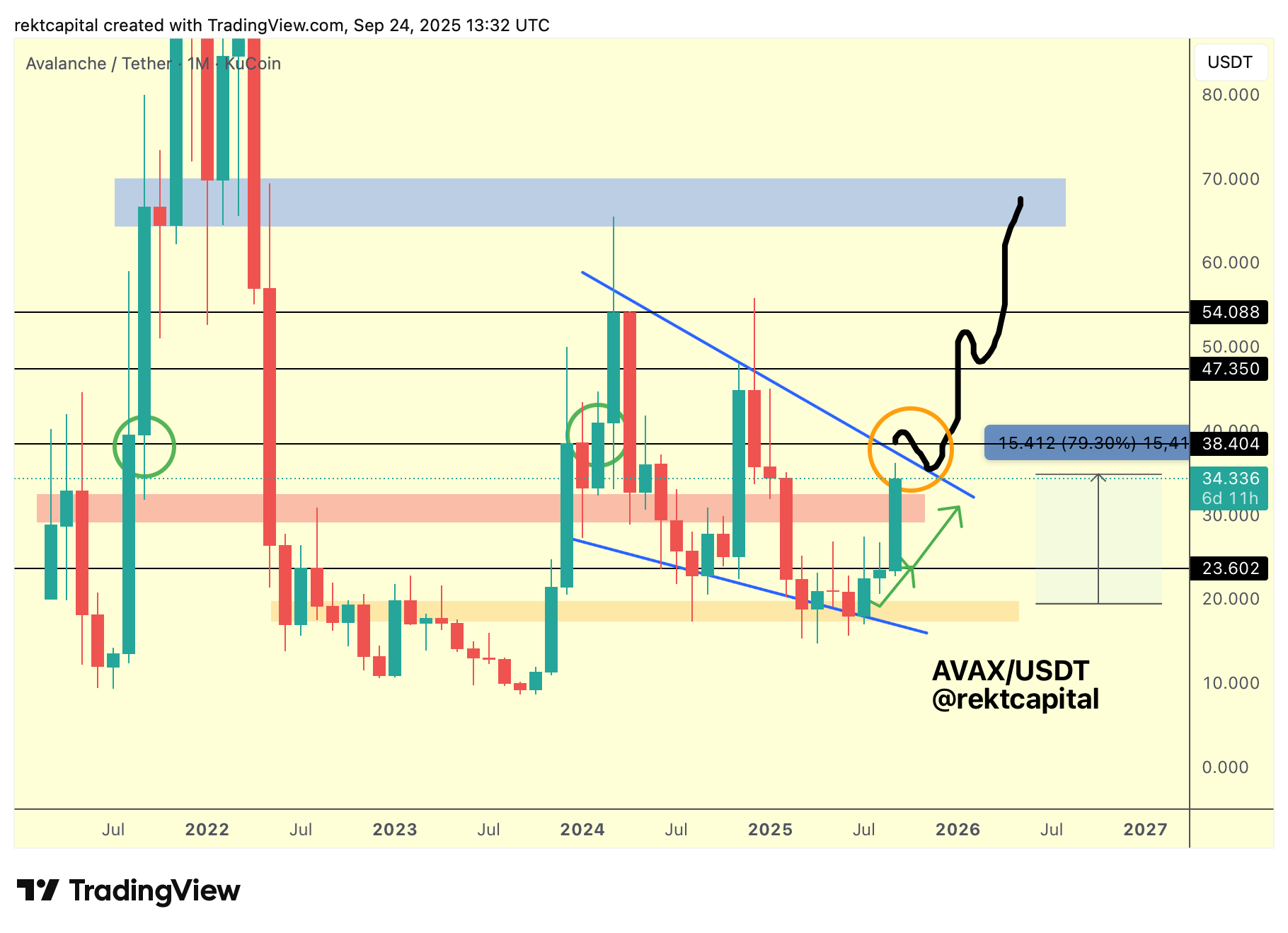

Avalanche – AVAX/USDT

Avalanche has enjoyed a strong three-month rally across its Macro Wedge (blue).

The next key step is a Monthly Close above the Macro Downtrend and a subsequent post-breakout retest of this level.

That would open the path toward repeating bullish history similar to mid-2021 and early 2024 (green circles).

Specifically, a Monthly Close above $38.40 (black horizontal) would position AVAX to attempt that repetition.

At present, however, price is trading around $34.33, leaving further work to be done before such confirmation.

If AVAX fails to secure that Monthly Close above $38.40, there remains scope for re-accumulation inside the red region. A retest there could extend base-building further into Q4, ultimately enabling a more sustainable breakout attempt later.

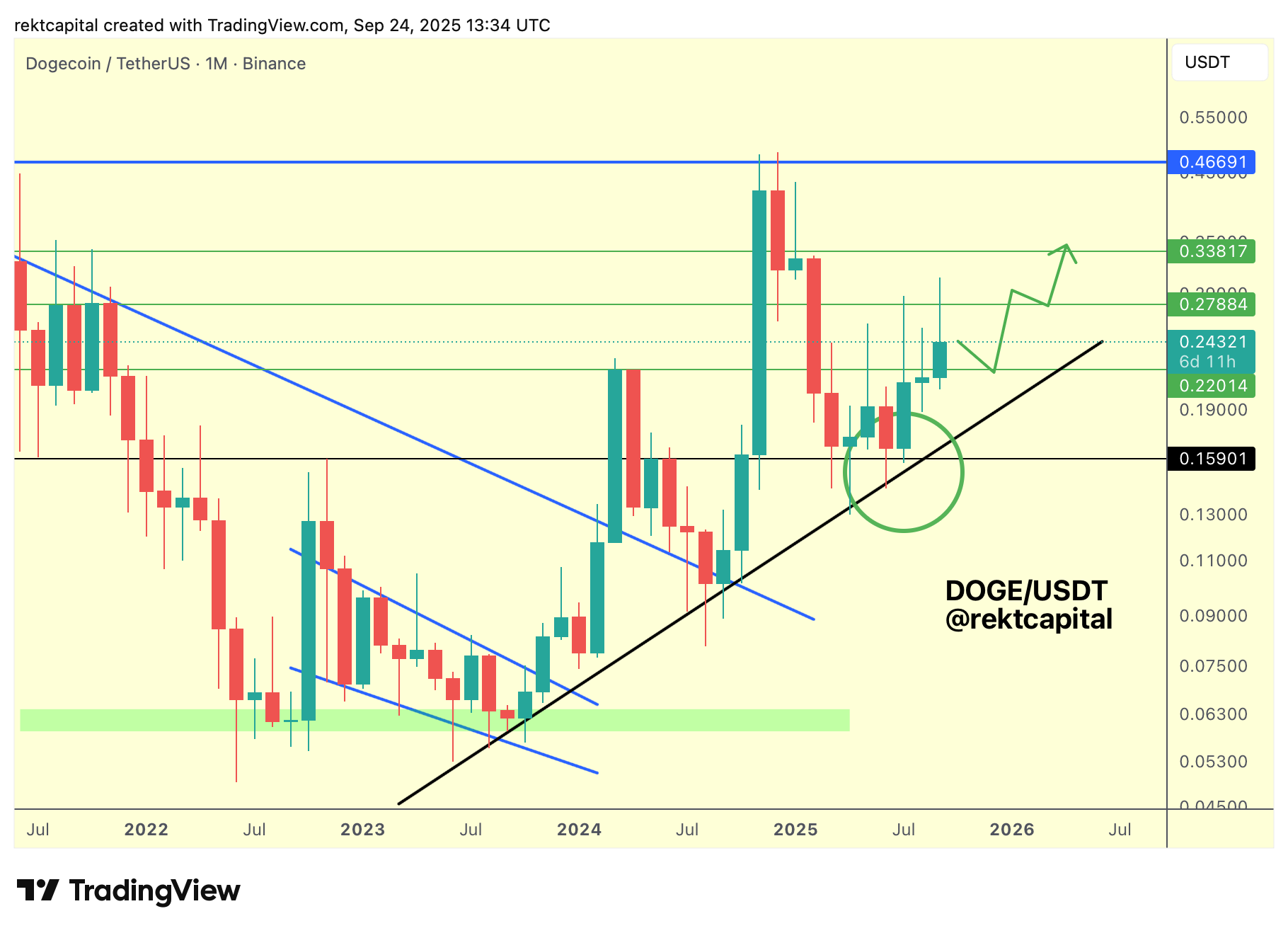

Dogecoin – DOGE/USDT

Dogecoin’s pre-halving highs at $0.22 (green line) have flipped into new support.

A Monthly Close above this level will confirm the breakout and any pullbacks into $0.22 would now serve to solidify this base going into October.

This process effectively transforms the pre-halving highs from resistance into support and a sustained hold here would confirm that DOGE is building fresh demand at this level.

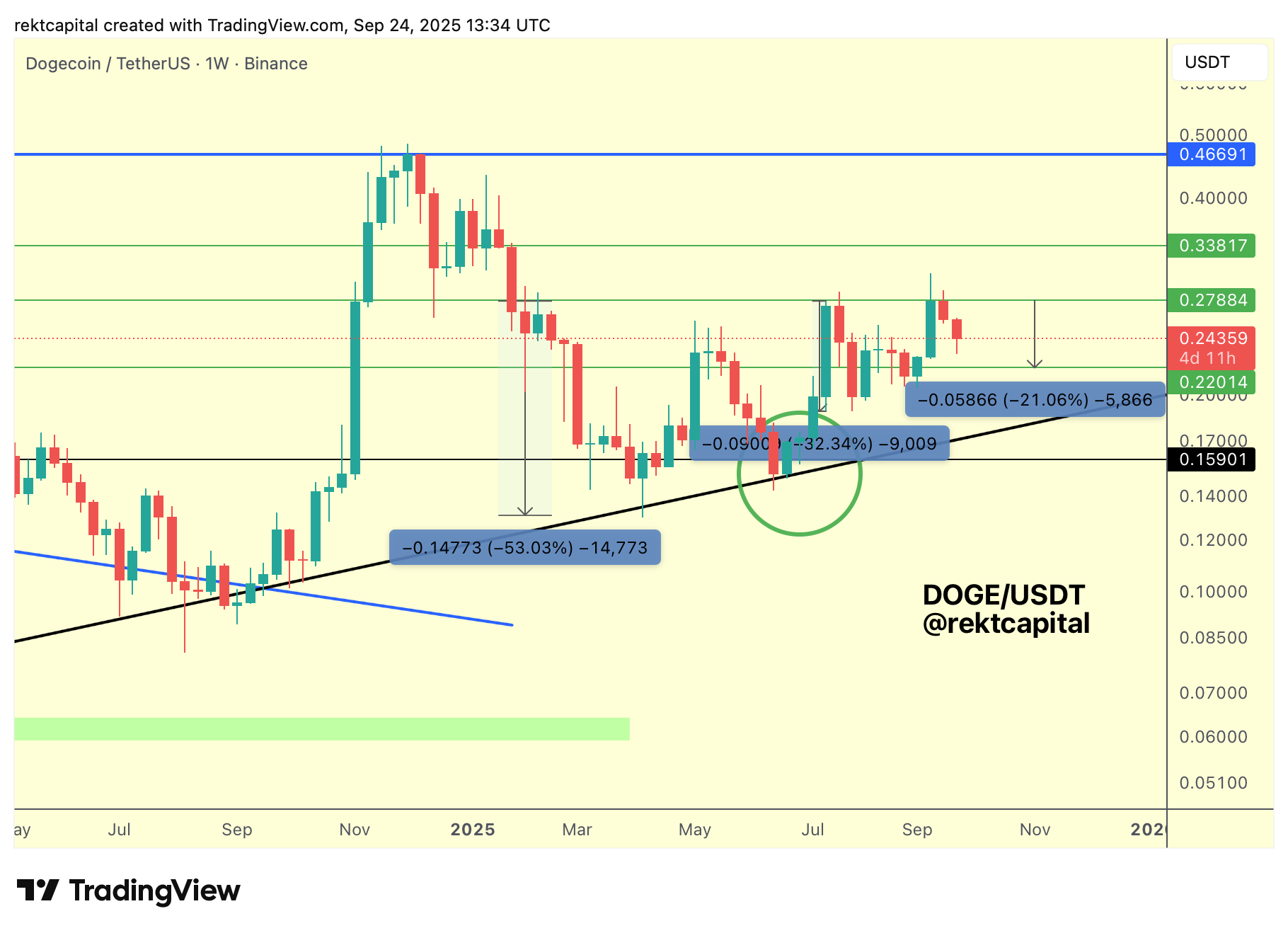

While $0.22 builds itself as support, on the Weekly timeframe, the $0.27 (green) region is demonstrating signs of progress weakening.

Earlier in the year, rejection from $0.27 produced a -53% decline, while a mid-year rejection triggered a -32% pullback.

Most recently, however, rejection at $0.27 produced only a -20% drawdown. This sequence of progressively shallower pullbacks highlights weakening supply at the $0.27 level.

In turn, the $0.22 region is strengthening as support, while $0.27 is slowly losing its role as resistance. Historically, in late 2024, $0.27 never functioned as a major barrier and while it is putting up more of a fight this year, it looks poised to fail at some point in the future.

Should $0.27 be reclaimed and retested as support, DOGE would be well-positioned to accelerate into $0.34 (green).

That level represents the next key trend-defining resistance, but for the moment, the focus is on the gradual shift of supply into demand around $0.27 which suggests that continuation may only be a matter of time.