Altcoin Market Update #117

Features analysis on Altcoins such as AVAX SOL DOGE FARTCOIN TAO

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Avalanche (AVAX)

- Solana (SOL)

- Dogecoin (DOGE)

- Fartcoin (FART)

- Bittensor (TAO)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

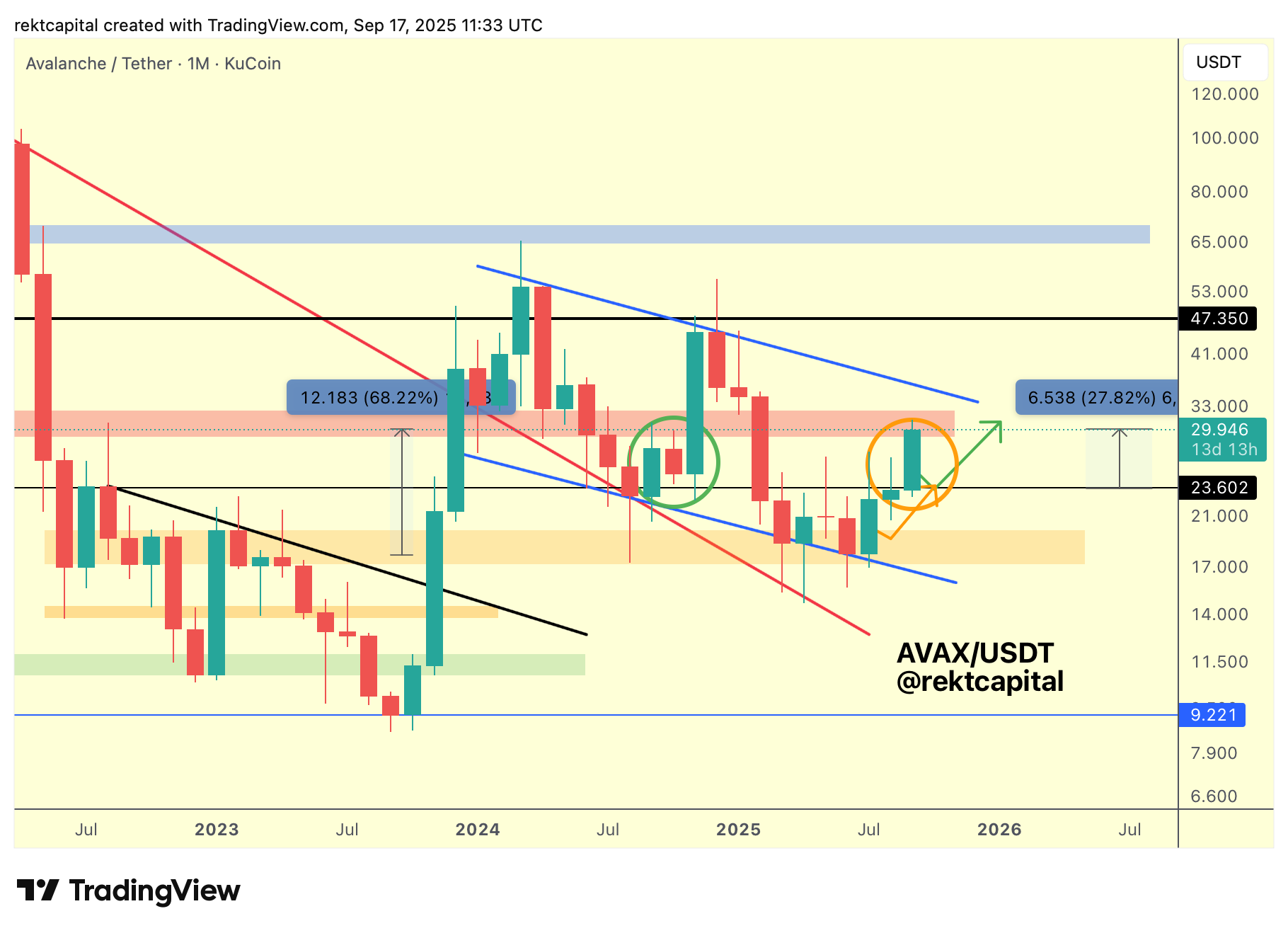

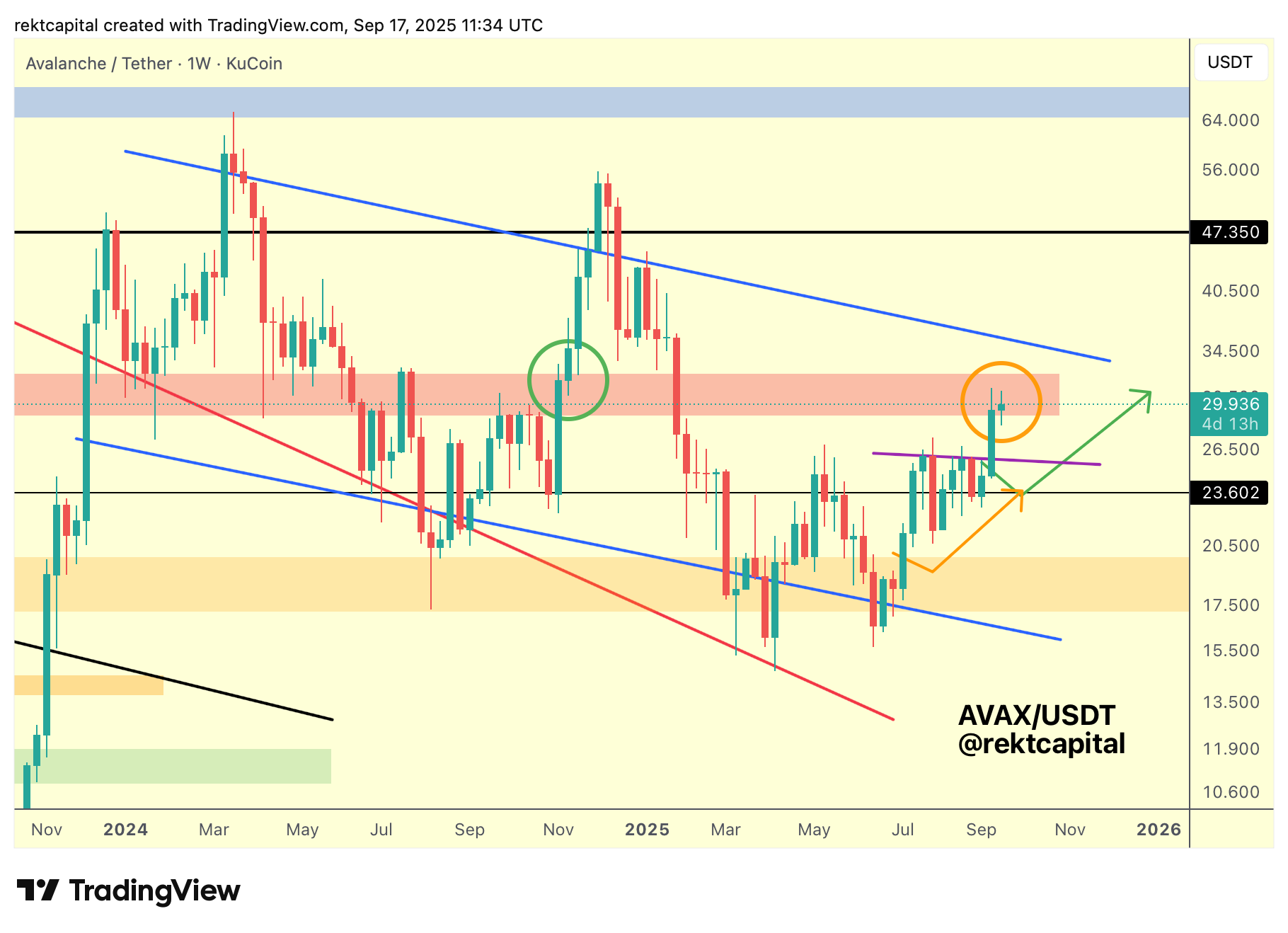

Avalanche – AVAX/USDT

AVAX has been trading inside the blue macro wedge for a long time, oscillating steadily from top to bottom in this downtrending channel.

From its most recent reversal at the wedge bottom, AVAX rallied toward $23.60 (black). This level, though not the exact midpoint of the blue Macro Wedge, has acted like a pivot, funnelling price into the red resistance region closer to the wedge top.

A breakout beyond the Macro Wedge Top remains possible over time.

Still, history shows upside wicks often occur beyond this point, and those false moves highlight the importance of caution.

The focus now is whether AVAX can transform the red resistance region into confirmed support:

Weekly Closes inside this area represent the critical first step of confirmation.

We already have a Weekly Close inside this zone. That was followed by a post-breakout retest, much like in late 2024 (green circle).

The difference is that last year’s retest formed at the top of the red region, while today’s is testing its very bottom of it.

Either variation can work. What matters is that AVAX stabilises here long enough to open the path toward the wedge top.

This zone was always likely to serve as a retesting point. After all, price recently broke a multi-week Lower High (purple).

If the retest of the red zone fails, AVAX may revisit the Lower High trendline for a post-breakout retest. But if the red area holds, continuation toward the wedge top becomes increasingly likely.

In saying that, history cautions us that Weekly Closes beyond the wedge top are not enough on their own.

We’ve seen them before — followed by initially successful retests — only for price to fail in the third week and roll into distribution.

That is why the staircase matters:

First comes the Weekly Close above the blue Macro Wedge Top.

Then comes the post-breakout retest of this Wedge Top into new support.

And finally, sustained support into weeks two and three. Only after those conditions are met can AVAX realistically fight for the crucial Monthly Close above the wedge top to confirm a breakout from it altogether to enter what would be Macro Uptrend Continuation.

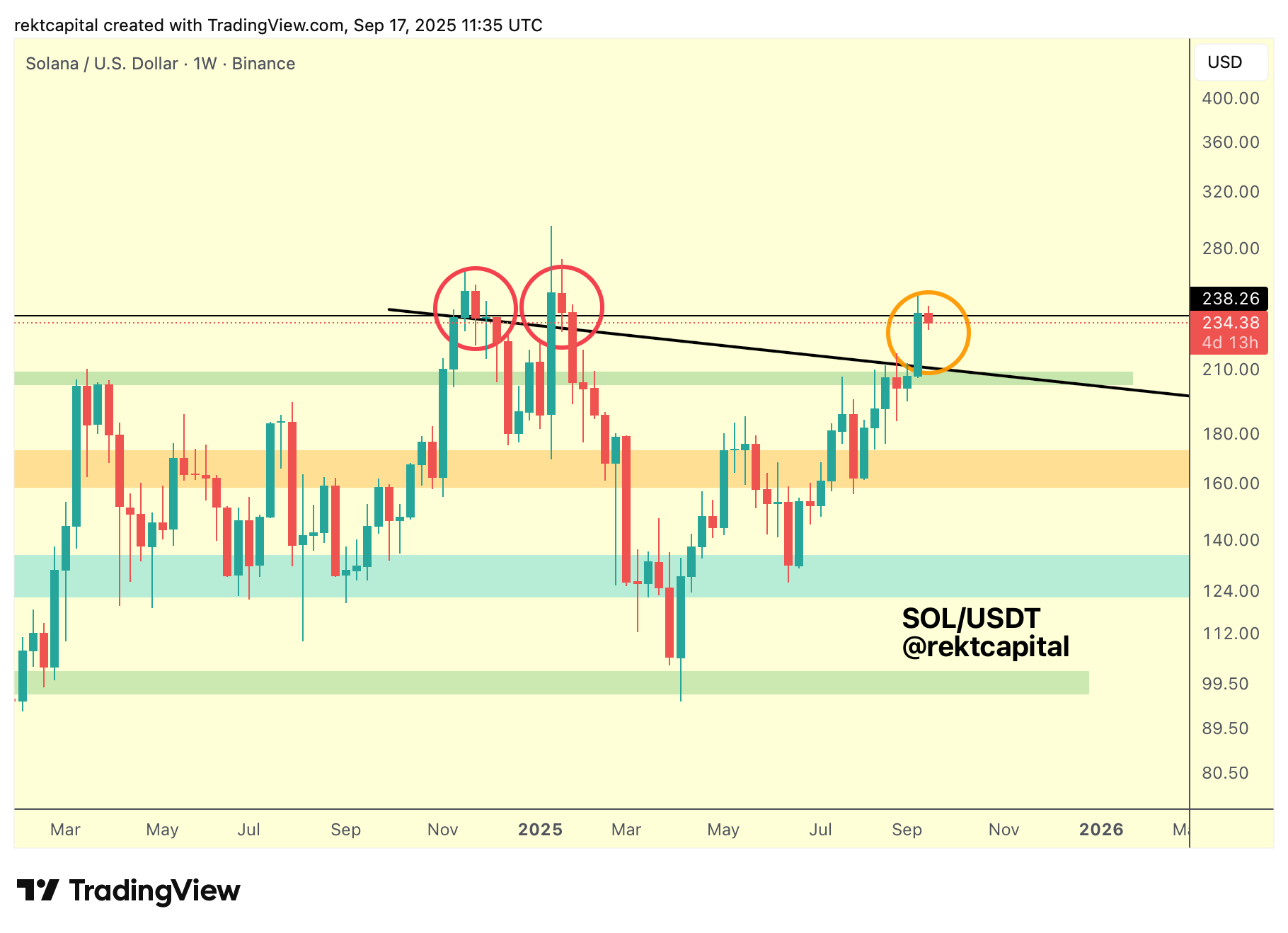

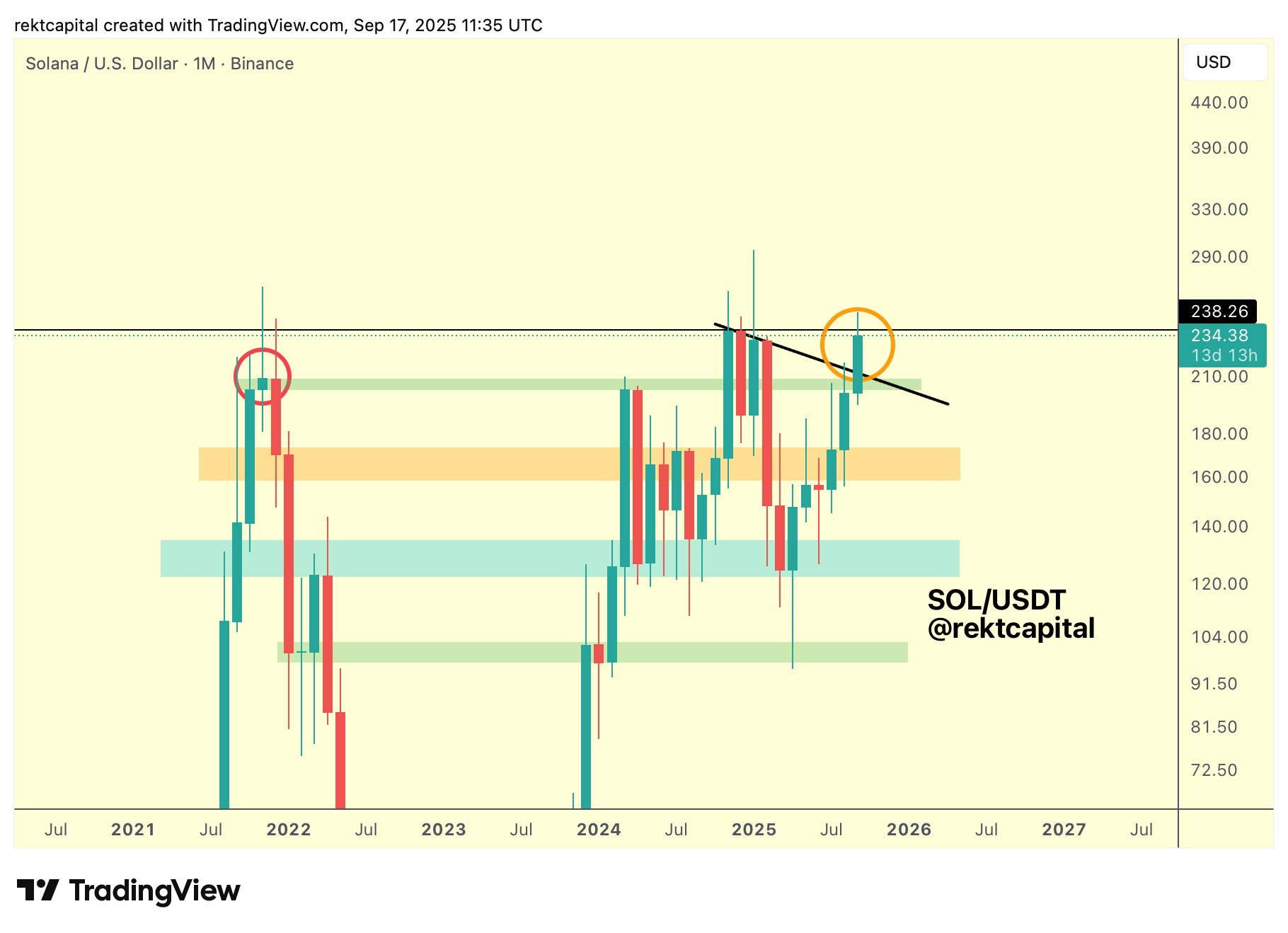

Solana – SOL/USDT

Solana’s price action closely mirrors AVAX, especially in how it interacts with a key diagonal resistance.

In the past, we saw Weekly Closes above this diagonal, followed by initially successful retests, but ultimately distribution.

That same pattern reappeared in early 2025. Which is why the current behaviour at $238 is so important. Yes, we technically achieved a Weekly Close just above this level, but it was unconvincing; it's a negligible Weekly Close after all.

Such a negligible close leaves $238 still functioning as resistance, and until a stronger reclaim occurs this level cannot be considered confirmed support.

If price fails to secure $238, the black macro downtrend line below becomes a key area to watch for a possible retest.

That could happen after one week of consolidation, though two weeks holding support here would provide far stronger confirmation.

Whether SOL can hold $230–$238 as support across consecutive Weekly Closes, or whether it dips into the trendline first, will define the next major move:

The Monthly timeframe reinforces this uncertainty. Price has already broken the macro downtrend (black), yet $238 continues to act as resistance.

The question now is straightforward:

Do we see a post-breakout retest of the macro downtrend before the Monthly Close, or does SOL manage to secure a convincing Monthly Close above $238 instead?

Both outcomes remain possible. A rejection here could trigger a retest of the macro downtrend around $210, while a reclaim of $238 would flip resistance into new support.

In effect, SOL’s immediate outlook is defined by just two levels: $238 above and the $210 trendline below.

A strong rejection at $238 would increase the probability of a pullback to the trendline, whereas sustained strength here would open the path higher.