Altcoin Market Update #115

Features analysis on Altcoins such as ETH AVAX CRO PENGU XMR

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Ethereum (ETH)

- Avalanche (AVAX)

- Crypto.com (CRO)

- Pudgy Penguins (PENGU)

- Monero (XMR)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

Ethereum - ETH/USD

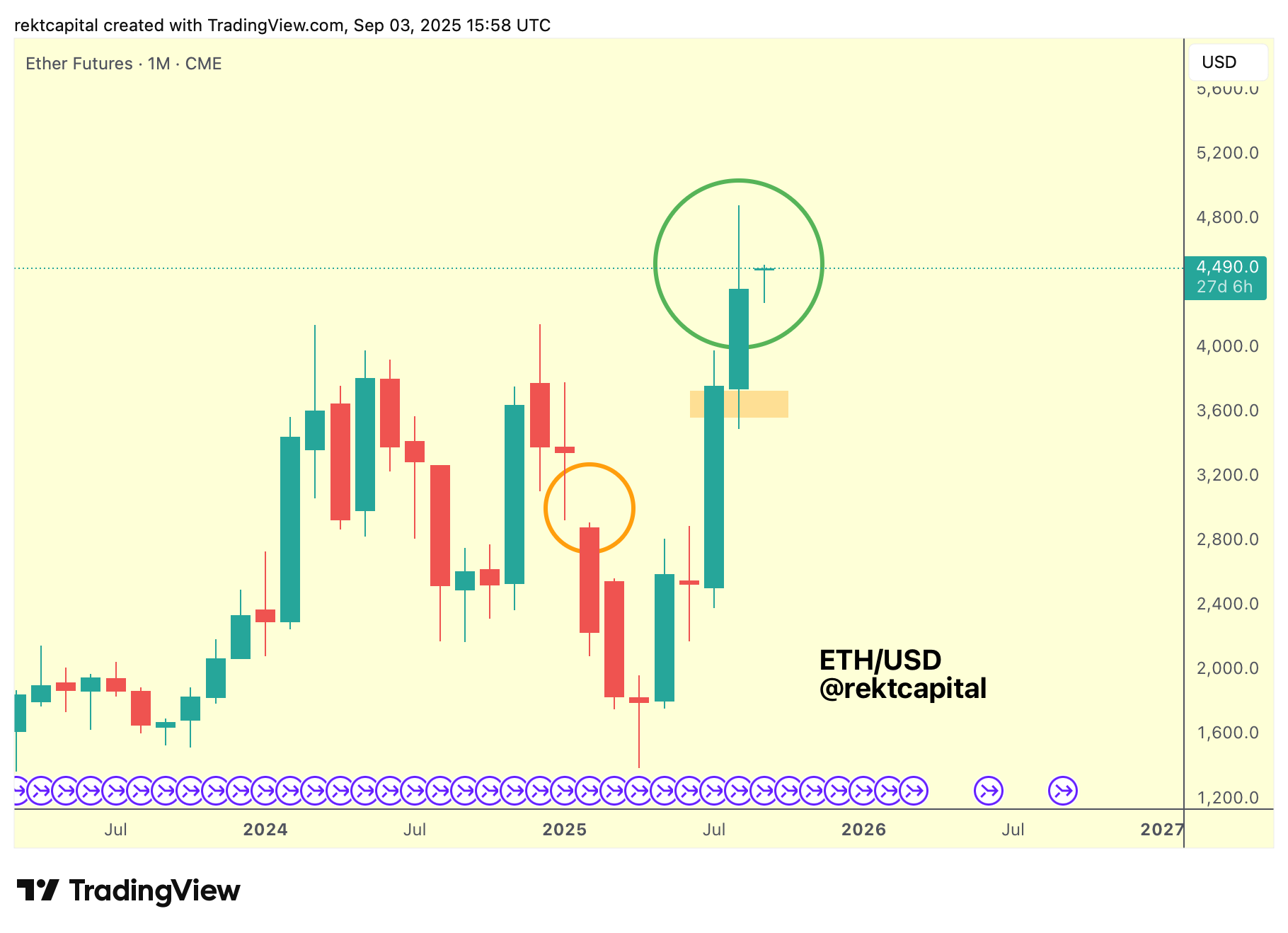

Ethereum has Monthly Closed below $4,600, which is the final major Monthly resistance. I had doubts we’d break it on the first time of asking.

This region initiated the prior bear market, so a rejection at $4,600 makes a brief pullback a reasonable expectation before anything else.

Several small Weekly CME gaps have technically been filled, yet gap zones often behave as dynamic support/resistance and can refill before trend resolution.

For this leg, the key is that the composite CME-gap support now spans down toward $4,000 and holds as support; if it does, it frames a constructive reset rather than a breakdown.

Interestingly, ETH has most recently also filled its newly formed Monthly CME Gap:

Going forward, it'll be important of course to break the $4.6k Range High:

And with all these CME Gaps just below, they need to continue holding as dynamic support for price to try to revisit the Range High for another challenge for a breakout from the Macro Range.

Overall, ETH exists within this Macro Range of $3.8k to $4.6k and consolidation here will continue and the CME Gaps will dictate which half of the Range will ETH inhabit for the time being; the upper half or the lower half of it?

For as long as the CME Gaps figure as support, the upper half will continue to be occupied during this consolidation period.

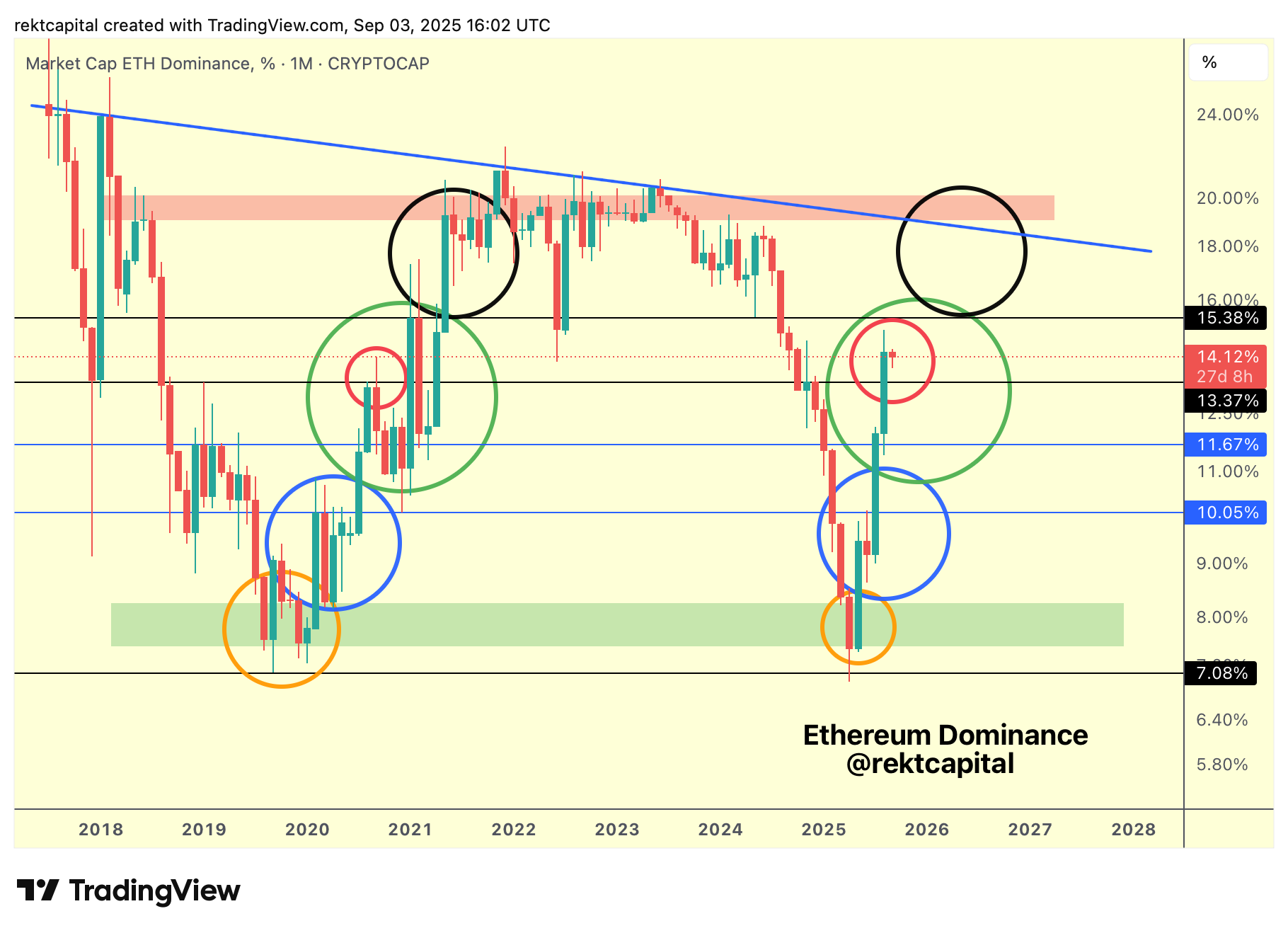

ETH Dominance has registered a Monthly Close above 11.5% last month and in August retested it into support.

With the latest Monthly Close above 13.37%, said level can also be retested into support before any move toward 15.4%; that implies scope for pullback in both ETH price and ETH Dominance.

Why 13.37%?

It’s a region that rejected previously in the prior cycle (red circle in 2020) but was never turned into support in this current cycle, and the market has been moving through phases quickly.

Holding above 13.37% will be quite important as that would signal strength at the 13.37% support which would increase the chances of breaking 15.4% in the future for what would be the final phase in the ETH Dominance cycle (black circle).