Altcoin Market Update #111

Features analysis on Altcoins such as XMR XRP LTC CRO ENA

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Monero (XMR)

- Ripple (XRP)

- Litecoin (LTC)

- Crypto Com (CRO)

- Ethena (ENA)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

Monero - XMR/USDT

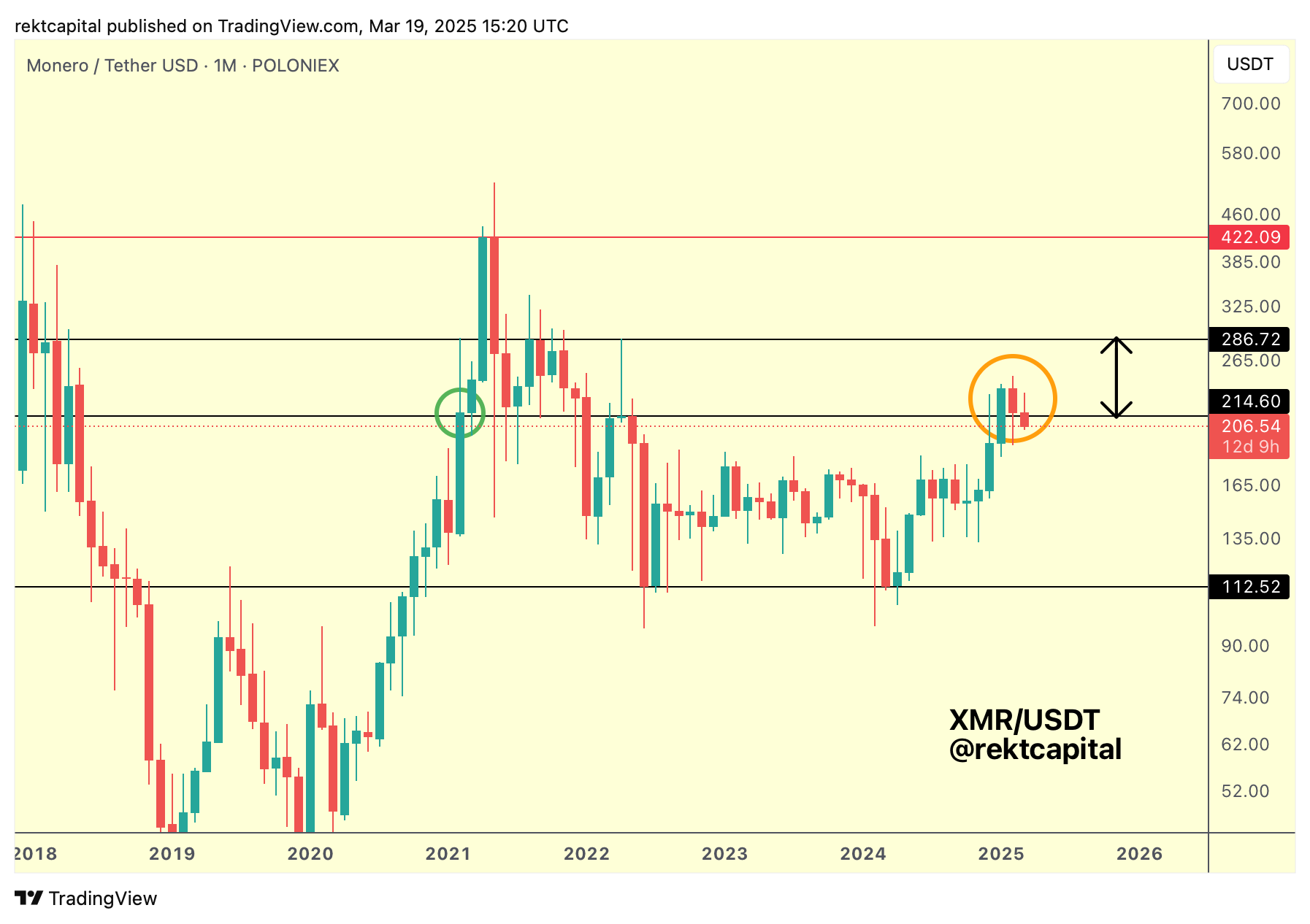

In mid-March, we spoke about XMR's retest attempt and its pursuit in trying to repeat late 2020, early 2021 history:

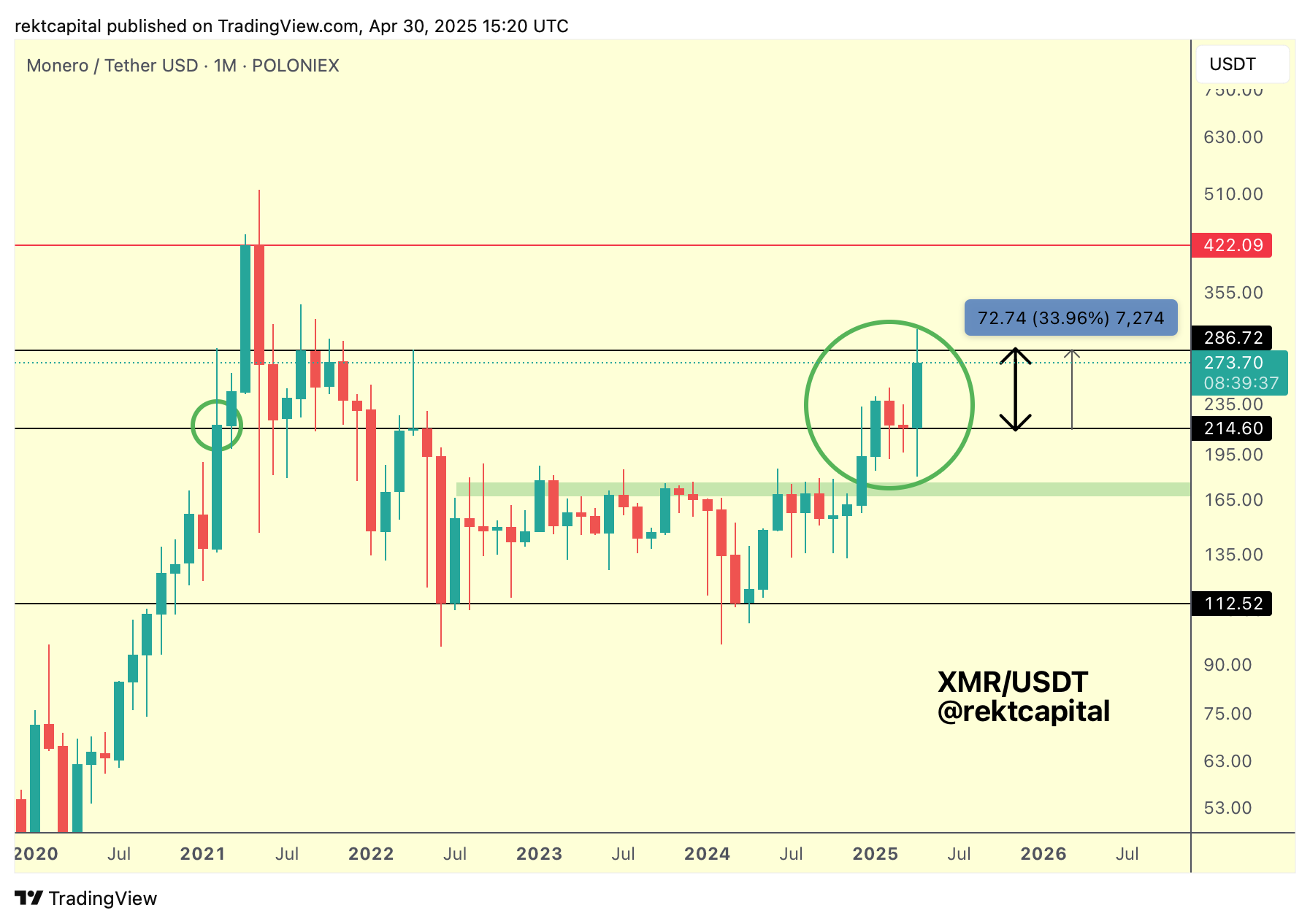

And in late April's update, price showcased a successful retest:

A by mid-May, that retest preceded 2021-like upside, with scope for a revisit of the red $422 resistance:

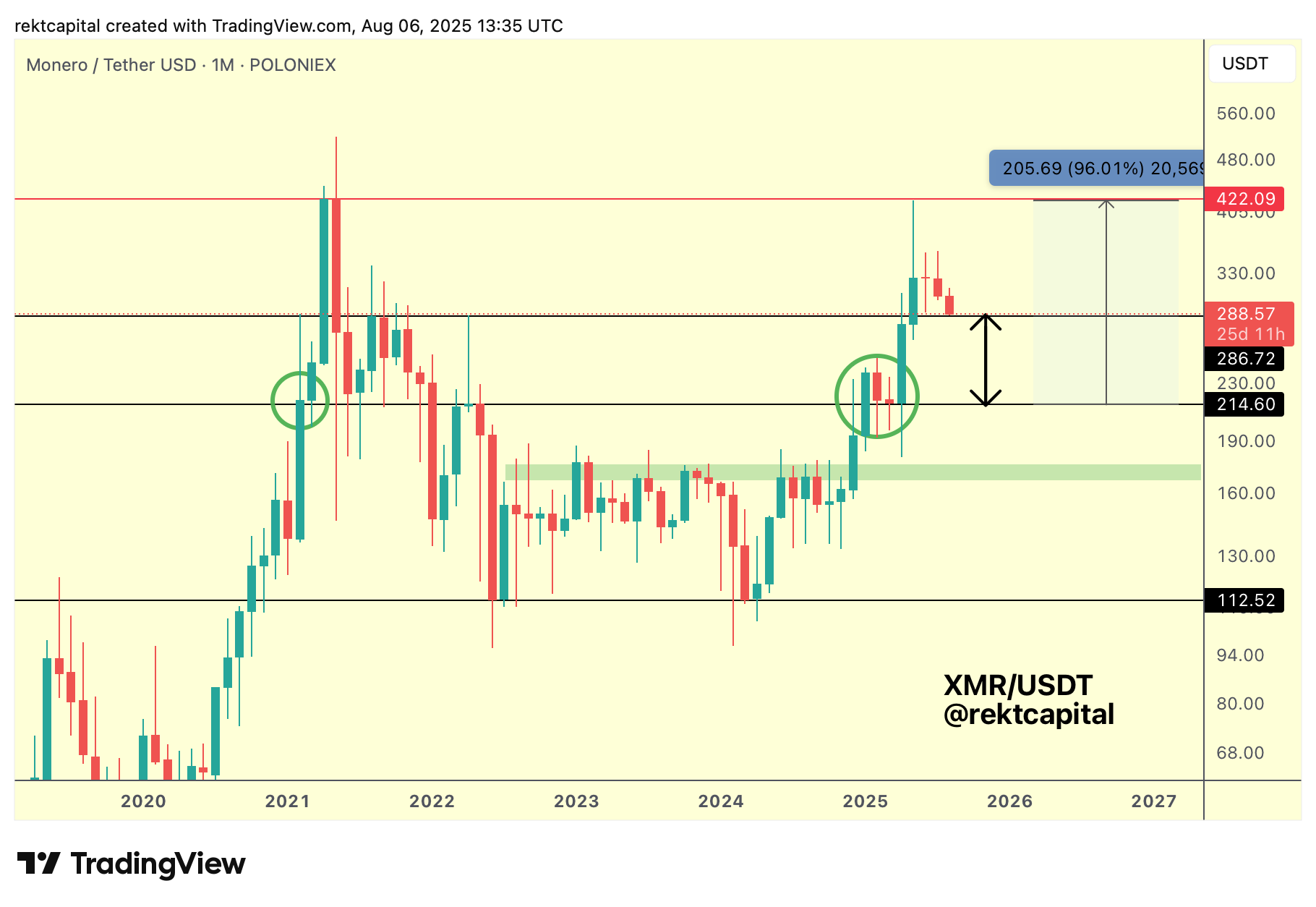

And so by late May, it was clear that XMR was displaying all the signs of repeating history, which could've indicated an ending uptrend.

Here's the analysis from late May:

Here's today's update:

XMR must absolutely hold the $286 level as support (black); as mentioned in late May, the odds of a successful retest here are slim so XMR will need to go against the grain of history to maintain its uptrend.

In fact, the worst thing XMR could do at this point is Monthly Close beneath the black level and turn it into new resistance from the underside; a successful retest here is critical if Monero is to try to re-challenge $422.

Ripple - XRP/USD

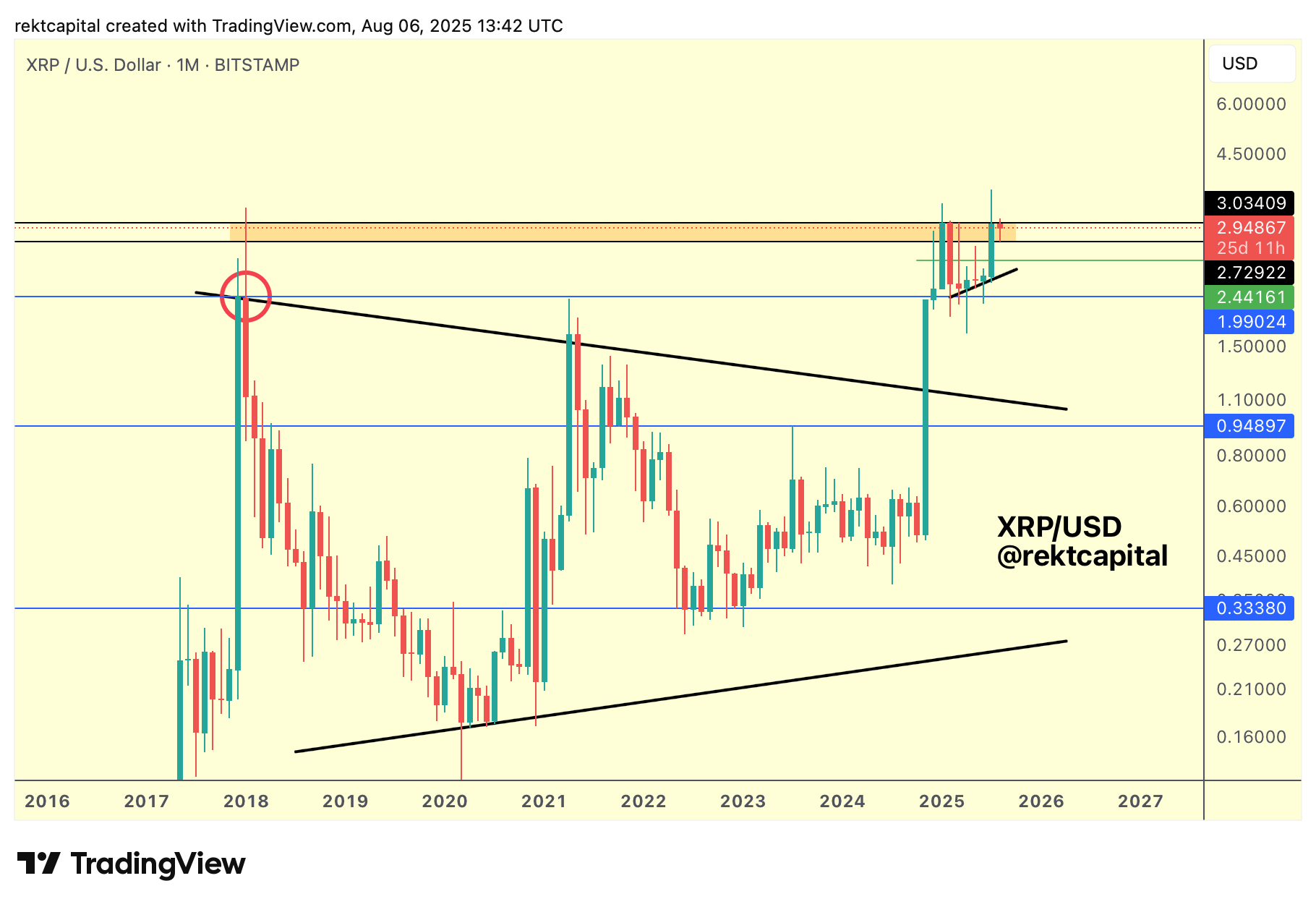

XRP has been holding its highs relatively well, rejecting from the final Monthly resistance at $3.03 but not pulling back too much as a result of that rejection, at least thus far.

Generally, there are signs that this rejection may be rather limited and shallower compared to previous rejections from this same region.

If we look to previous rejection from this orange resistance, the first once occurred in 2017 and spawned a -96% Bear Market whereas when XRP revisited this region of resistance 7 years later, the rejection that followed was -46% deep.

Those two rejections, 7 years apart, are telling in of themselves, because the first rejection was more than 2x deeper.

And if we look to this most recent pullback, though still in progress, it is only -10% thus far, with signs hinting this will be much shallower than the -46% correction from just a few months back.

The main takeaway here is that this region of resistance is weakening as a point of rejection which is an encouraging sign for XRP to finally break that resistance over time, provided it indeed offers a shallower retrace to demonstrate this progressive weakening.

So far, so good.