Altcoin Market Update #110

Features analysis on Altcoins such as BONK HBAR DOGE LINK SOL

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Bonk (BONK)

- Hedera Hashgraph (HBAR)

- Dogecoin (DOGE)

- Chainlink (LINK)

- Solana (SOL)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

Bonk - BONK/USDT

Whenever BONK turns the green area into support in an uptrend, it tends to rally to at least the first black resistance (from which it is actually rejecting from now) or even overextend to the second black resistance via an upside wick (not to mention the outlier in late 2024 beyond said resistance).

But when BONK rejects from either of the black resistances, it tends to drop back into at least the green area... and unfortunately for BONK, price would fail the retest at the green area before dropping into the general blue levelled area.

The point here is this - history has been kind to BONK on the upside because price replicated a similar uptrend in recent weeks.

But history tends to also be not so kind on rejection from the black levels, and with the green area hardly ever acting as a reliable support in a downtrend, history suggests price could fail the upcoming retest of the green region.

So it will be up to BONK to actually rewrite history, go against the grain of it on this current pullback and somehow generate a successful retest of the green area as support if it wants to maintain its upside to try to revisit the black resistance above again.

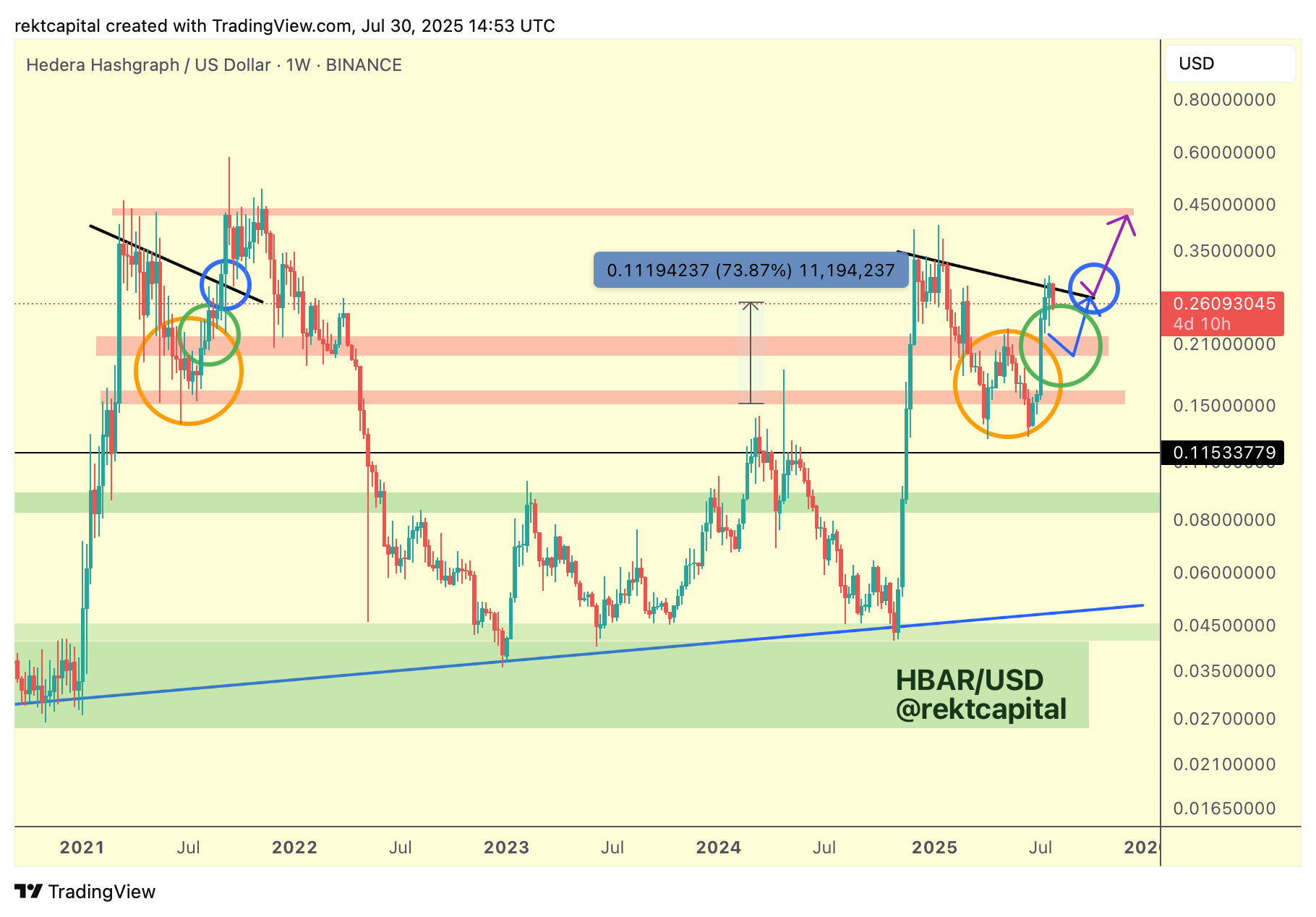

Hedera Hashgraph - HBAR/USDT

HBAR continues to repeat history from 2021 in striking fashion.

Price has recently rallied to the Lower High resistance (black) and in fact produced a Weekly Close above it.

This technically means that this current Weekly candle could be a volatile post-breakout retesting candle that is trying to retest the Lower High as support.

This is the technical milestone that needs to take place for HBAR to follow-through on the purple pathway to revisit the final major resistance at $0.45.

But the reality is that for as long as the Lower High (black) remains as resistance, price will be locked inside the range that is formed by the red region below and the Lower High resistance.

In 2021, price would bounce between these levels before finally Weekly Closing above the Lower High and turning it into new support to confirm the breakout.

HBAR needs to retest the Lower High as support - can it do it this week?

If not, the consolidation will continue but history suggests such a post-breakout retest is a matter of time.