Altcoin Market Update #108

Features analysis on Altcoins such as BONK ALGO AERO POPCAT MOG

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Bonk (BONK)

- Algorand (ALGO)

- Aerodrome Finance (AERO)

- Popcat (POPCAT)

- MOG Coin (MOG)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

Bonk - BONK/USDT

As a preface to today's analysis, here is the BONK analysis from last week:

And here's today's update:

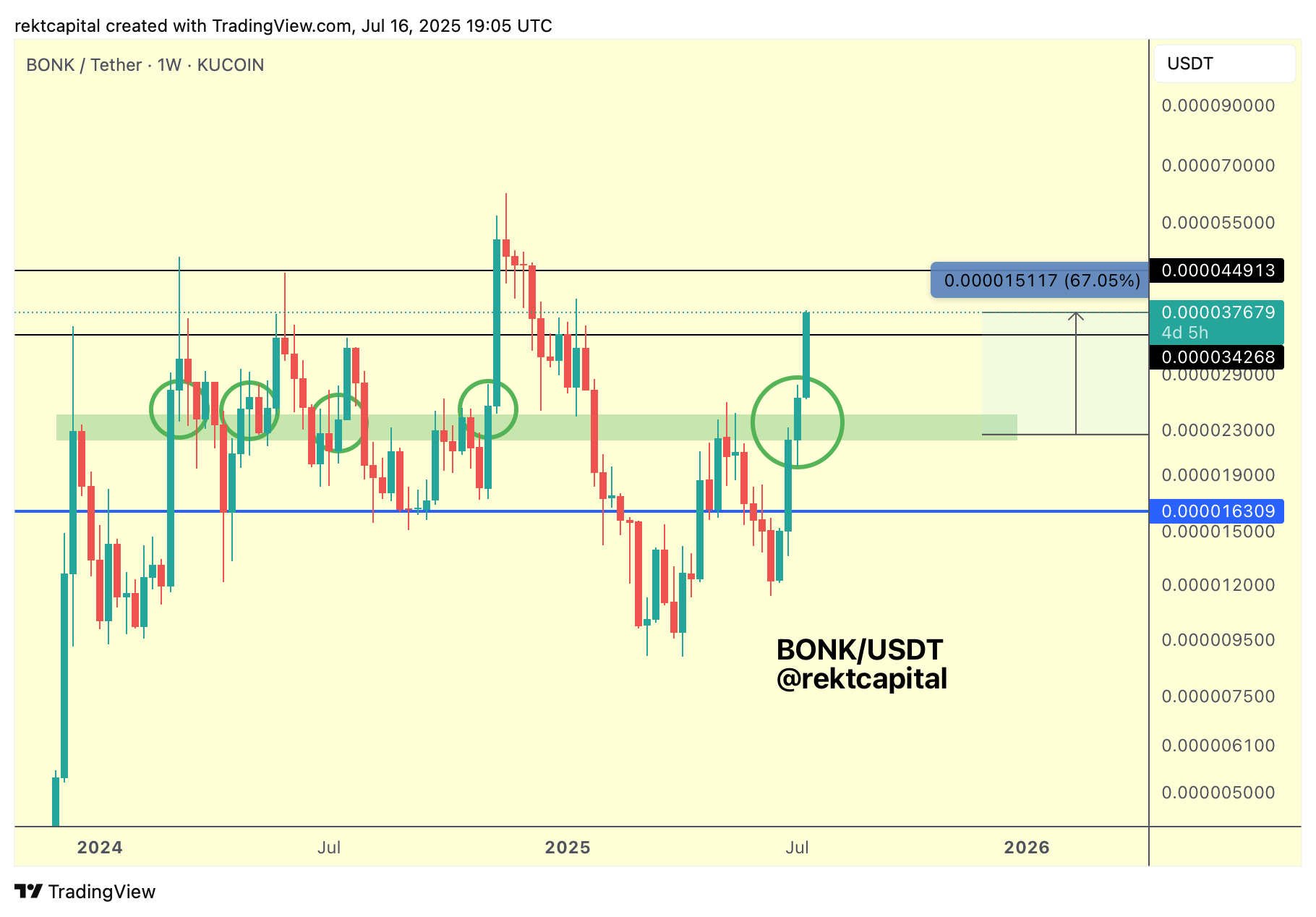

BONK has successfully retested the green region as new support last week, repeating history once again by turning this key green pivot point into a springboard.

Price has since rallied +67% and is now pressing closer into the black levels, which is also a sign of history repeating.

After all, after previous retests of the green region in the past, price more often than not would upside wick to either of these black levels.

With BONK now pressing beyond one of the black levels, it is now worth not just looking at how BONK can continue to repeat history, but how it needs to go against it to rally higher.

BONK would need to simply demonstrate stability at the local black level on at least the Daily timeframe and if BONK manages a Weekly Close above it, then it would be key for price to hold this level as support on the Weekly.

Because if BONK is able to hold the local black level as support like it has never ever been able to do successfully before, then that would be a very good sign of growing buy-side momentum at these levels for the first time.

Algorand - ALGO/USDT

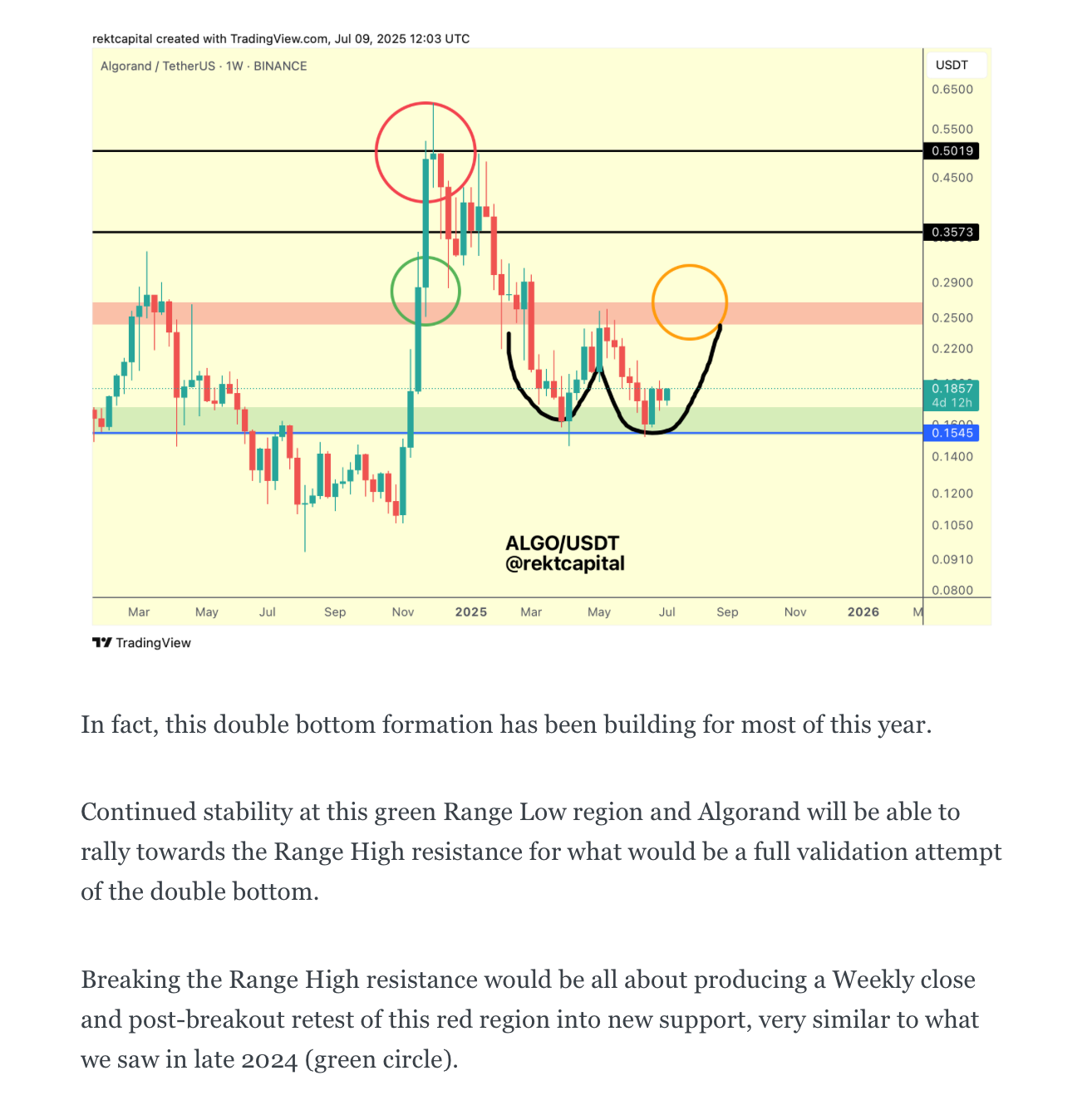

Last week, we covered Algorand and its Double Bottom formation:

And here's today's update:

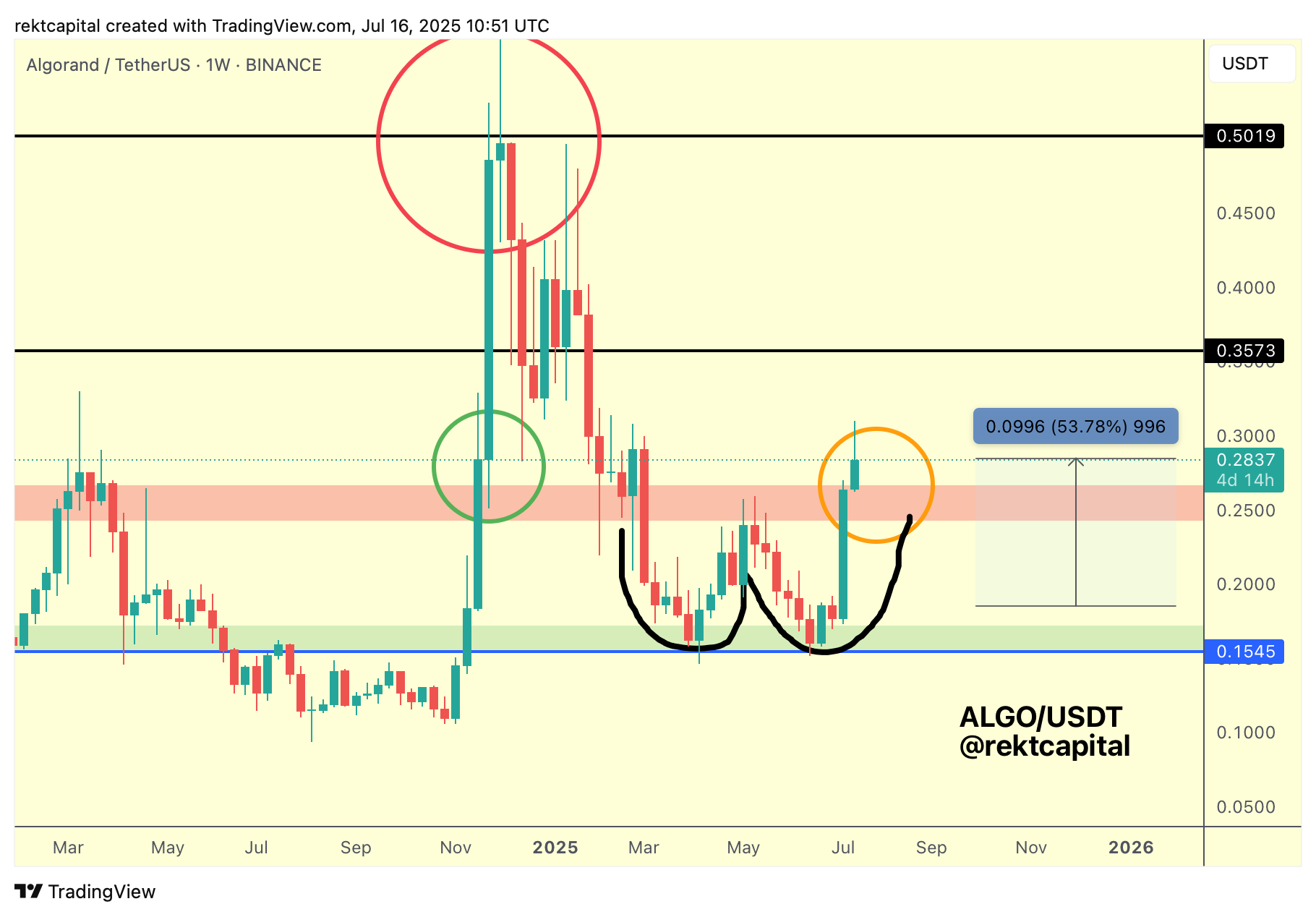

Algorand has rallied +53% to the upside since, completing the second portion of its Double Bottom and even breaking beyond the red Range High resistance to breakout from the pattern altogether.

In fact, ALGO is following the plan perfectly because price is positioned for a Weekly Close above the red resistance which is both the Range High and technically the validation point for the Double Bottom.

Generally, ALGO needs to stay above the red region to turn it into support; after all, this is what the historical Weekly Close back in November 2024 achieved (green circle).

In saying that, it wasn't just Weekly confirmation that was the recipe for success back then in late 2024; Daily confirmation in the same vein was also successful in enabling upside over time:

After breaking beyond the resistance in November 2024, ALGO produced a cluster of price action on the Daily timeframe atop it as part of the reclaim process, which is why both Daily and Weekly confirmations have proven viable.

Thus if history repeats with a Weekly Close above the red resistance (Daily clustering also permitted) followed by a post-breakout retest, then that will have fully confirmed the breakout from the Double Bottom formation to position price for subsequent trend continuation to the upside towards the $0.35 resistance (black) with the intent to break back into the $0.35-$0.50.