Altcoin Market Update #107

Features analysis on Altcoins such as BONK ALGO APT HBAR MOG XLM

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Bonk (BONK)

- Algorand (ALGO)

- Aptos (APT)

- Hedera Hashgraph (HBAR)

- MOG Coin (MOG)

- Stellar (XLM)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

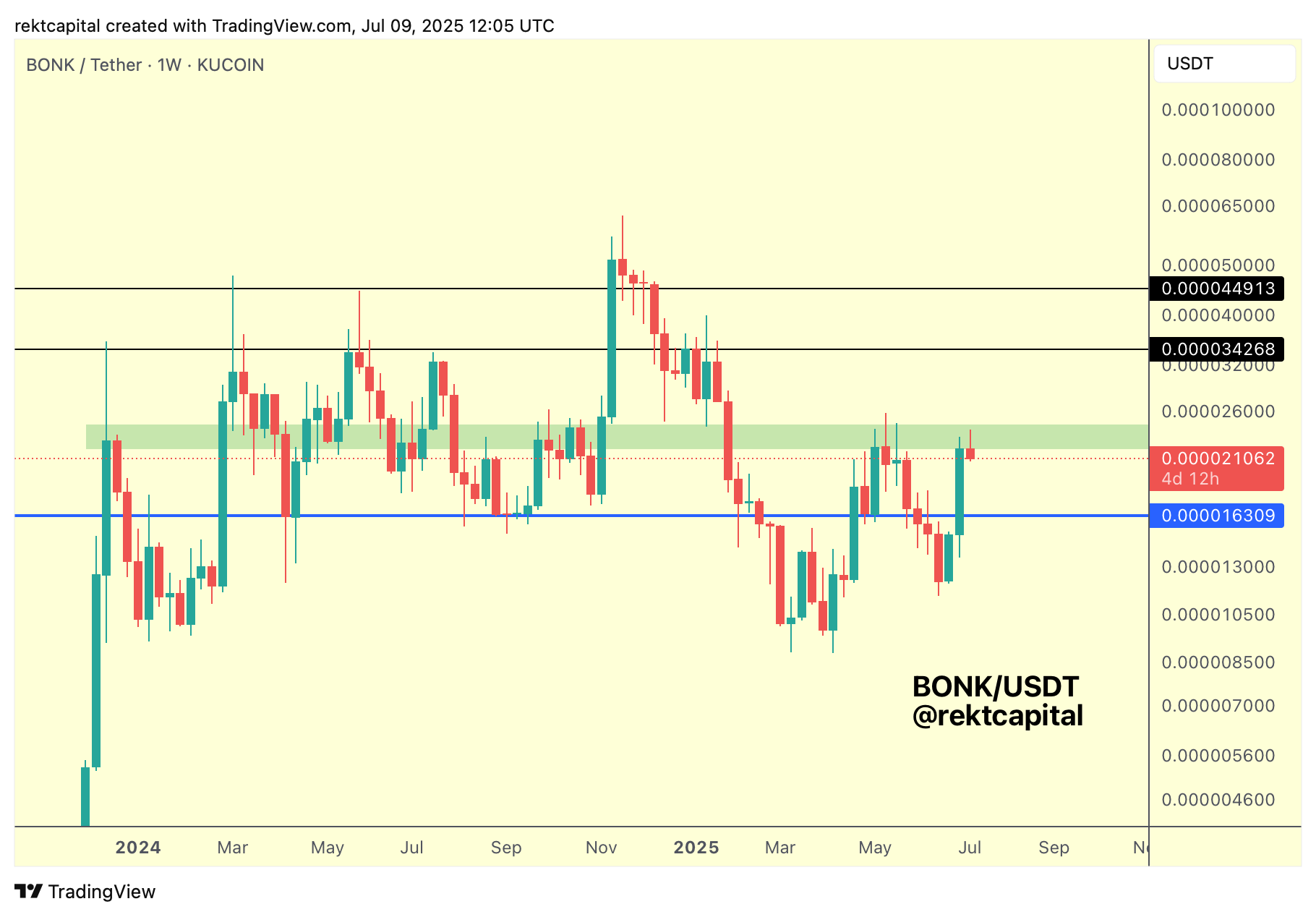

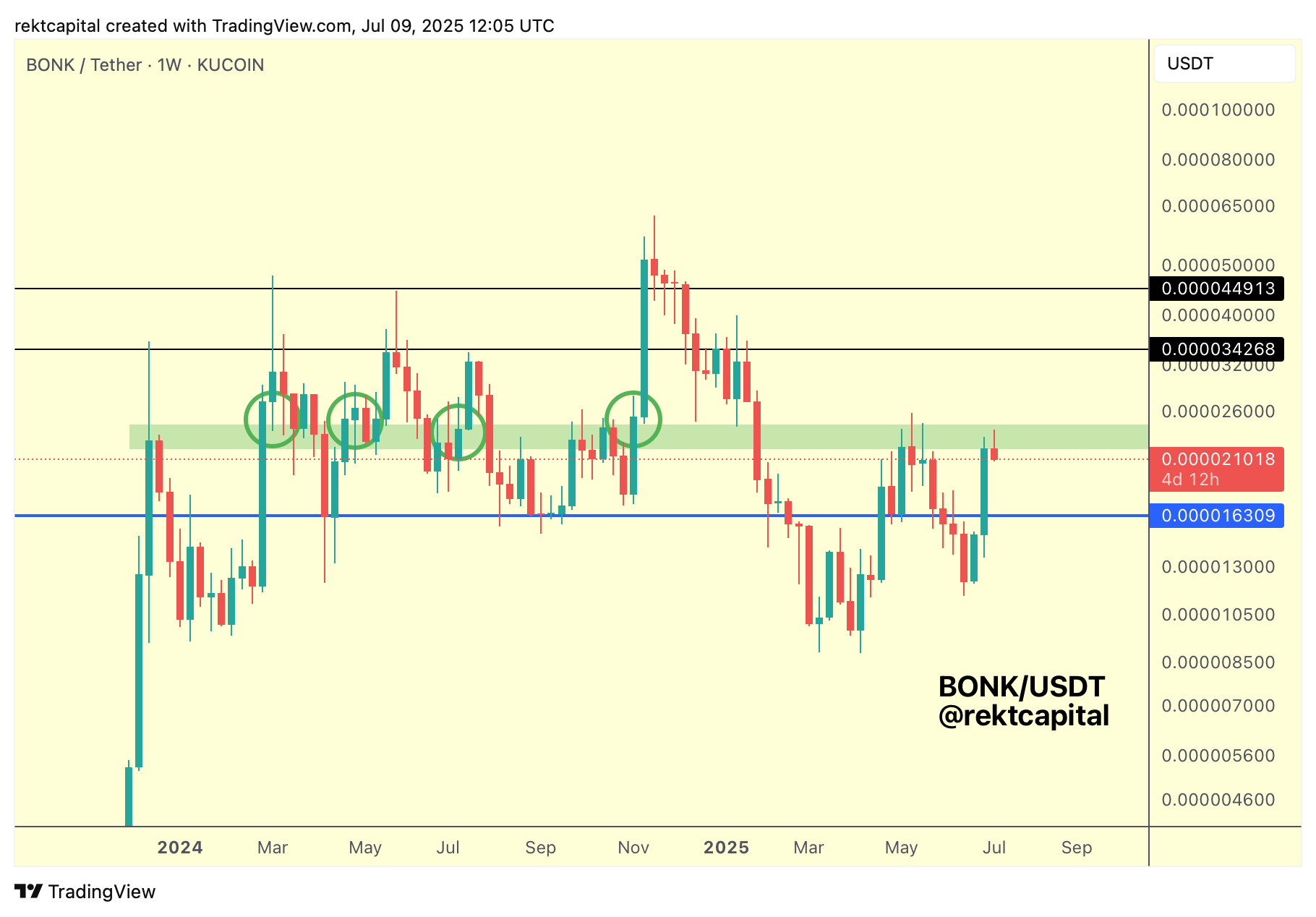

Bonk - BONK/USDT

BONK has been one of the standout performers in recent weeks however it has just reached this green region of resistance.

For price to break beyond here, it would need to replicate history as below:

Historically, these green circles showcase Weekly Closes above the green region followed by post breakout retests of it into new support enable upside moves to as high as the most highest black level.

In fact, the two far left green circles showcase that a retest of the green region into new support has enabled upside wicks towards that highest black level.

The mid-july 2024 green circle retest has shown a less volatile rally towards the upside to the lower black resistance.

Having said that however, late 2024 showcased that price can rally even higher than that by overextending beyond those two black resistances overall, though this has clearly been the historical outlier across time.

BONK needs to Weekly Close above the green region and retest it into a new support as that has historically been a reliable confirmation of price being ready to expand to the upside towards at least one of the black levels, if not towards the highest one and - in the most exuberant of cases - perhaps even over-extending beyond each of these resistances altogether.

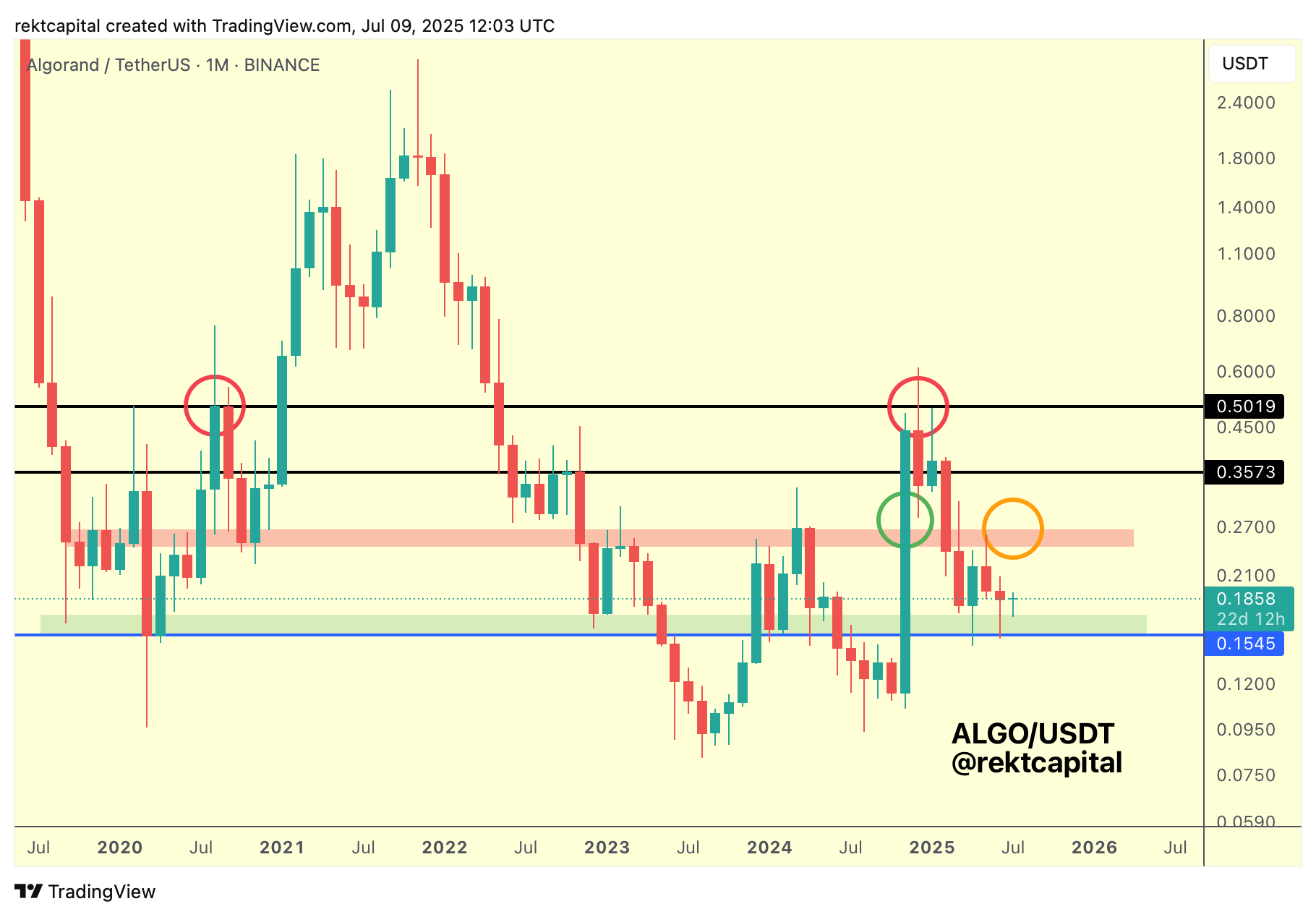

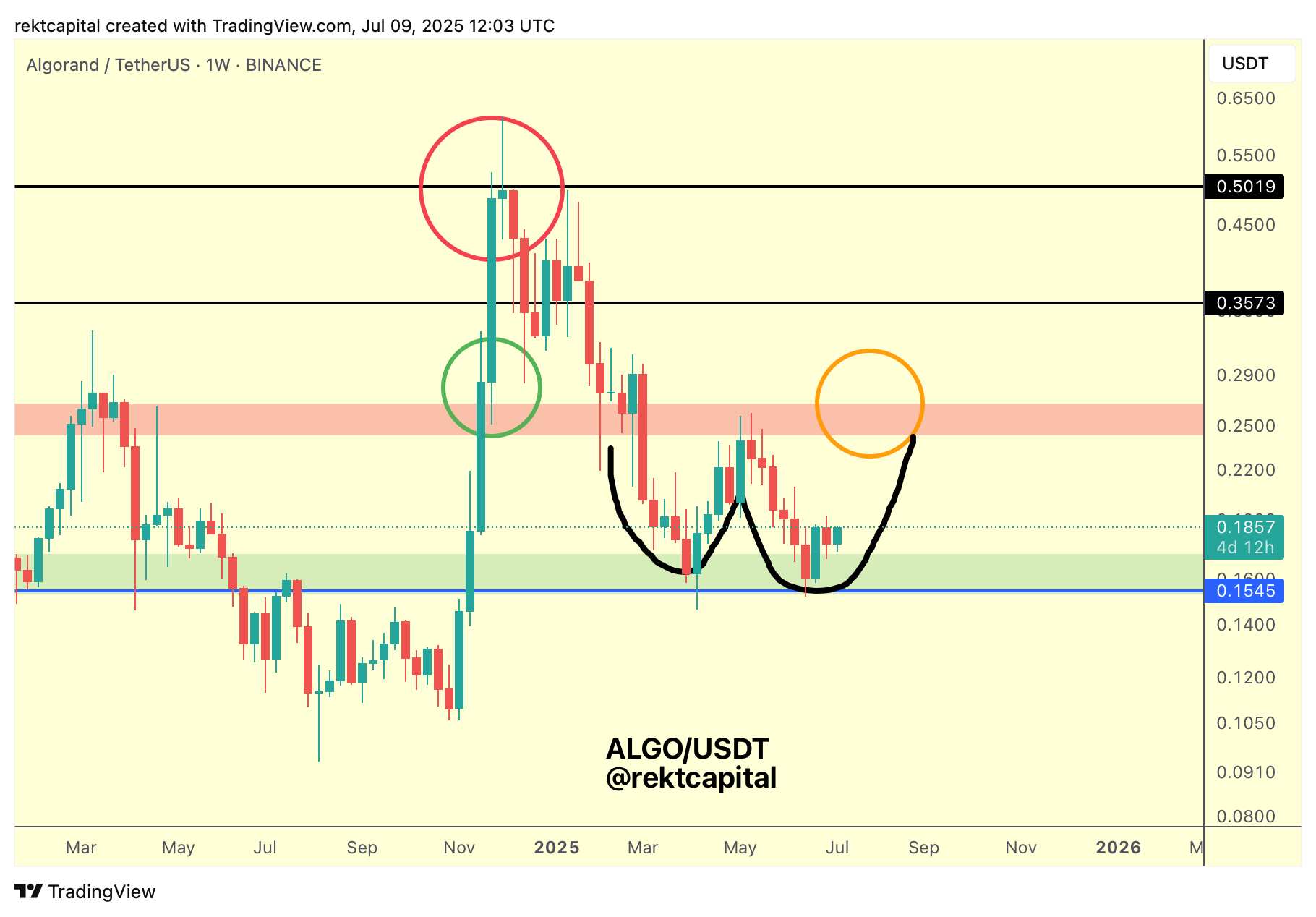

Algorand - ALGO/USDT

When it comes to Algorand's price action, price is trying to hammer out a base at the green region around $0.15.

This level is the Range Low of its current macro range (green- red), with red being the Range High at around $0.27 or so.

Price is trying to hammer out a base at this Range Low in an effort to build a springboard from which it can then rally towards the Range High resistance.

In fact, if we zoom in on to the Weekly timeframe, we will notice that Algorand is potentially building out a second bottom to its multi week double bottom formation:

In fact, this double bottom formation has been building for most of this year.

Continued stability at this green Range Low region and Algorand will be able to rally towards the Range High resistance for what would be a full validation attempt of the double bottom.

Breaking the Range High resistance would be all about producing a Weekly close and post-breakout retest of this red region into new support, very similar to what we saw in late 2024 (green circle).

More, breaking the red Range High resistance would enable a 1:1 Measured Move from the Double Bottom, unlocking upside initially to that first resistance of $0.35 and then perhaps even beyond to as high as $0.50.

First however, ALGO needs to further develop the second half of its Double Bottom and then validate it with a Weekly Close and post-breakout retest above the red Range High.