Altcoin Market Update #103

Features analysis on Altcoins such as SUI TAO SPX GIGA APU POPCAT

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Sui (SUI)

- Bittensor (TAO)

- SPX6900 (SPX)

- Gigachad (GIGA)

- Apu Apustaja (APU)

- Popcat (POPCAT)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

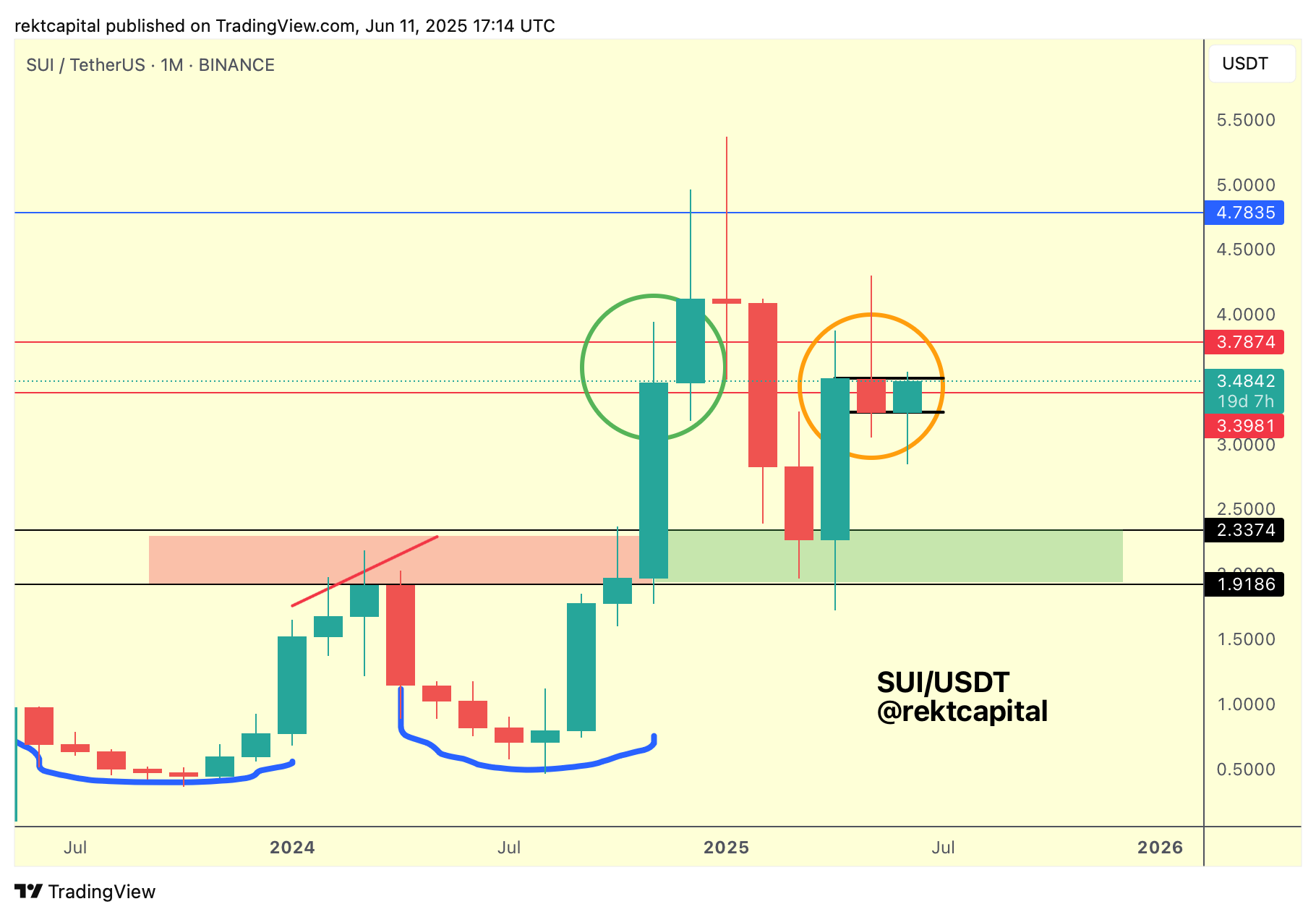

Sui - SUI/USDT

As SUI continues to maintain its highs, it's worth understanding it price positioning on the Weekly and the Monthly to gain a better idea of what sort of structures it's potentially forming.

Let's take a look at the Monthly:

Back in late 2024, SUI Monthly Closed above the red $3.39 level and retested it into support in the following month before rallying higher.

What's happening now is that SUI Monthly Closed above the same red level back in April but has been seemingly failing the retest, meanwhile developing a Monthly support just below the red level, to potentially bring about a Monthly Bull Flag (black).

As long as SUI can maintain this Bull Flag, price will be able to reclaim this red-red re-accumulation range.

To facilitate this reclaim, SUI will need to perform a key reclaim on the Weekly:

A Weekly Close above the red level followed by a retest of it into new support (with scope for deviation below the level) would position price well for a reclaim.

Generally, SUI has been consolidating at these highs in a less clean fashion compared to the last time SUI was here in late 2024; this time, SUI is downside deviating below the red Range Low and upside deviating beyond the Range High.

But as long as price maintains itself here and keeps the Monthly Bull Flag, this noisy consolidation may precede clear uptrend continuation.

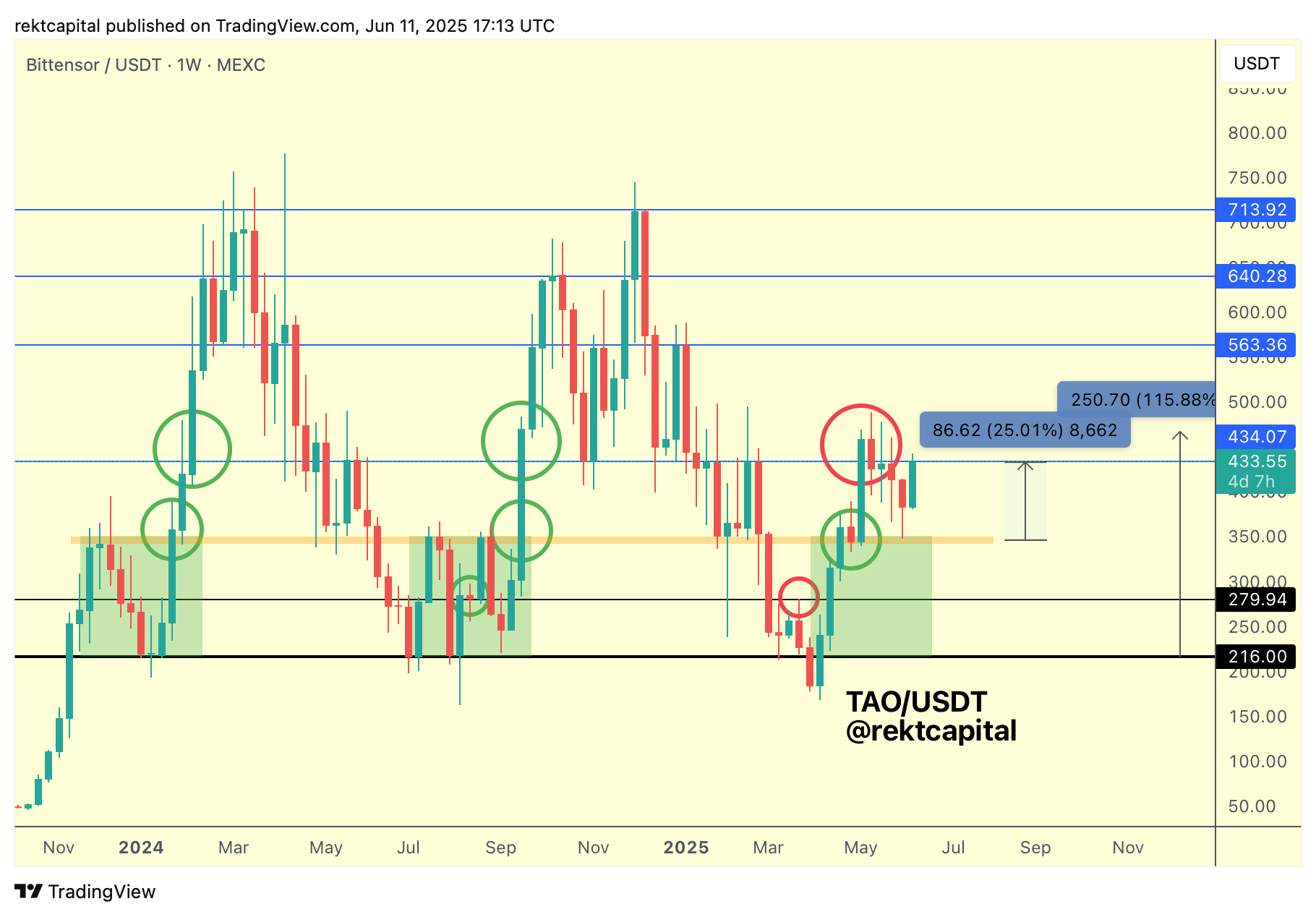

Bittensor - TAO/USDT

Here's last week's lengthy analysis on TAO to better understand the technical sequence of events that got price to where it is today:

Here's today's update:

TAO has dropped into the orange region for a picture-perfect retest, preceding this recent +25% move to the upside.

That being said, the blue level continues to act as resistance for the moment.

So what TAO will need to do is try to Weekly Close back above this level (or even Daily Close above it but form a Daily cluster above it) to position itself for a reclaim of the blue-blue Range above of $434-$563.

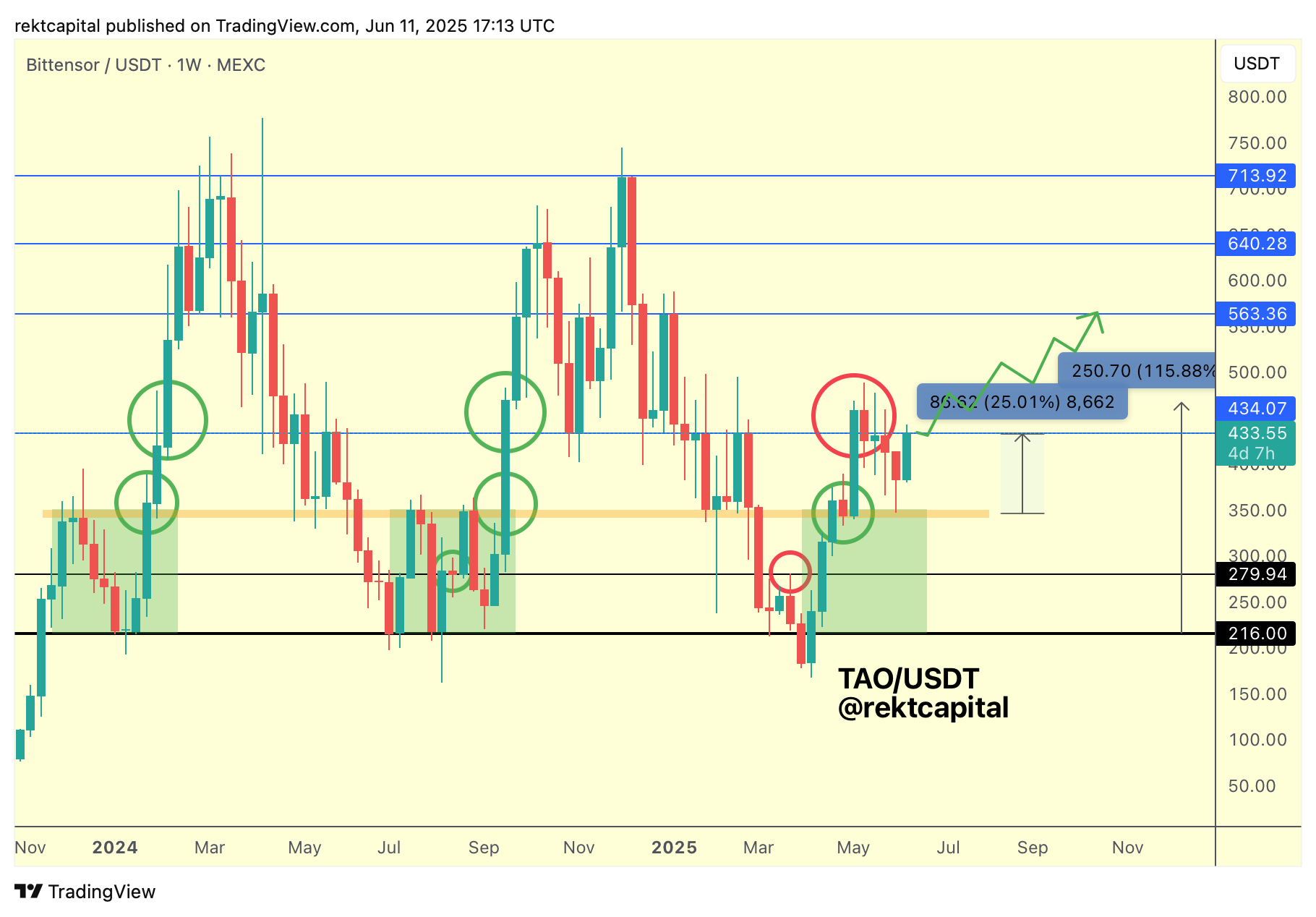

Effectively, reclaiming the $434 level as support could position TAO for a move via the green path:

That reclaim will be pivotal and first Daily Closing above $434 followed by price-stability of it into new support would facilitate a Weekly Close above $434.