Altcoin Market Update #102

Features analysis on Altcoins such as SUI TAO SPX GIGA POPCAT

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Sui (SUI)

- Bittensor (TAO)

- SPX6900 (SPX)

- Gigachad (GIGA)

- Popcat (POPCAT)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

Sui - SUI/USDT

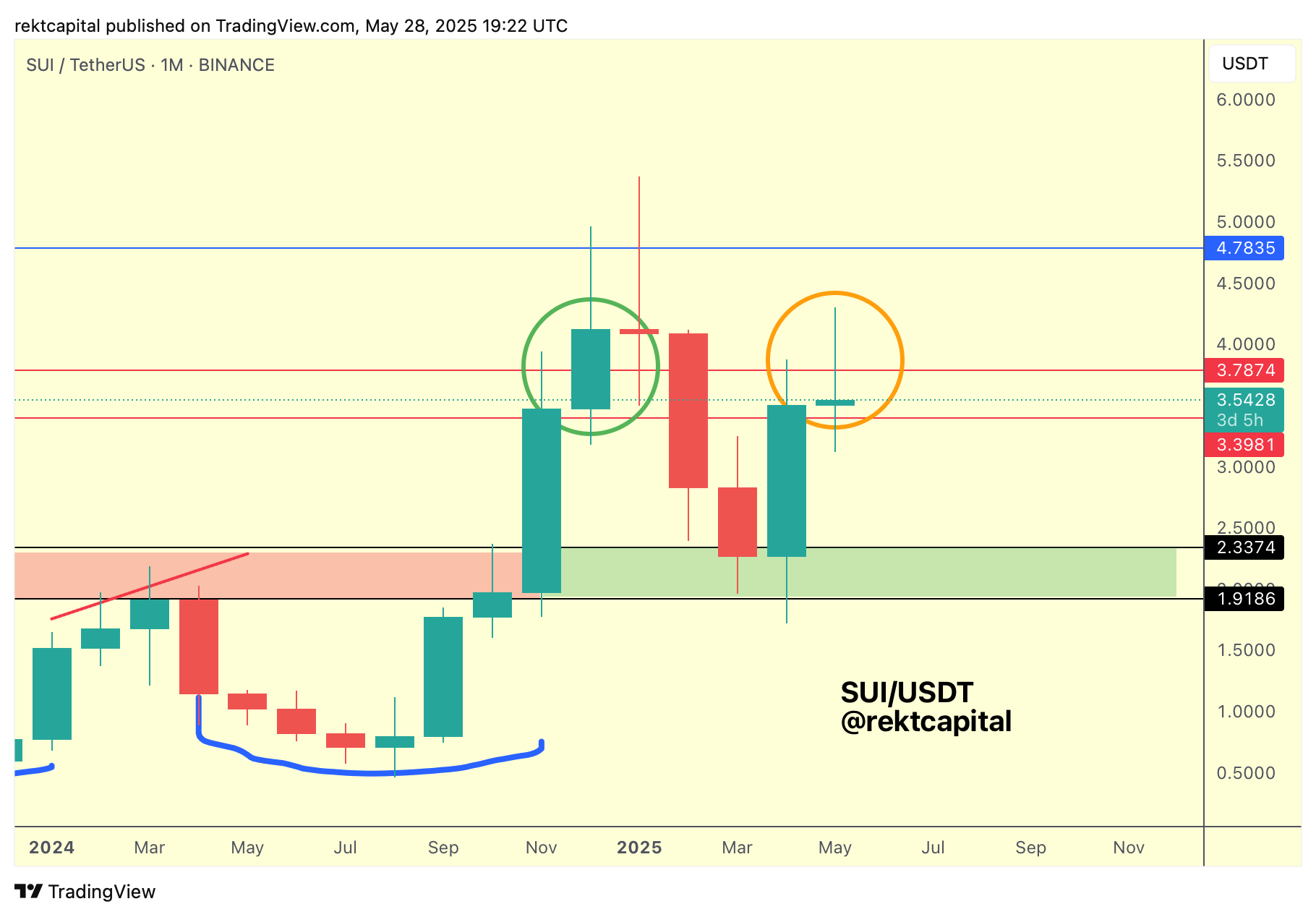

Late this passed May, SUI had a very real opportunity to position itself a repeat of a bullish Monthly Candle Close.

Here's a chart from May 28th to demonstrate this promising positioning:

SUI was positioned for a repeat of a late 2024 Monthly retest where price was retesting the red $3.39 level which would act as a springboard.

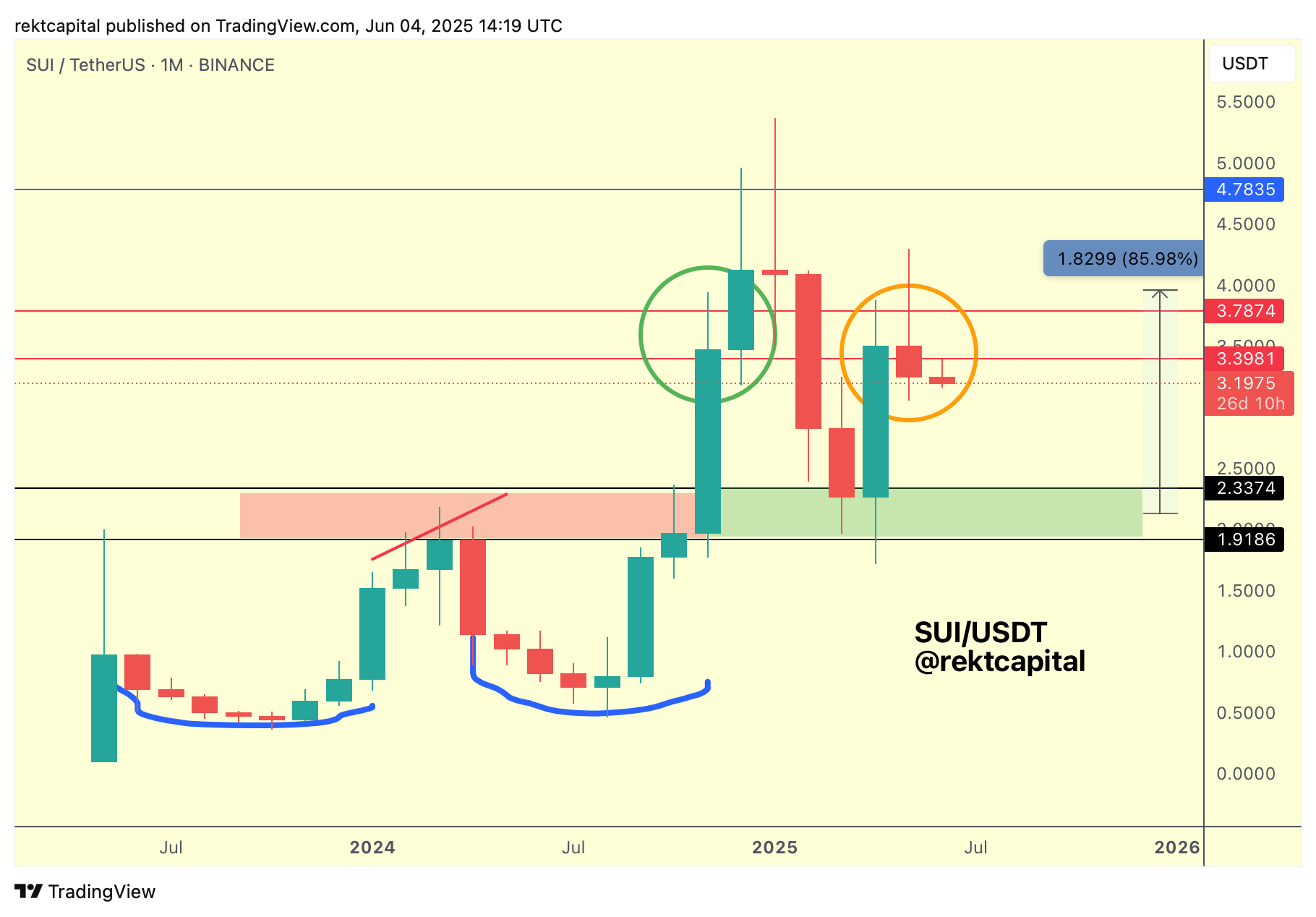

But the recent Monthly Close in the end actually occurred below the red $3.39 level:

SUI Monthly Closed below the red level and this month price is showcasing very early signs of upside wicking into said level to turn it into new resistance.

It is too early in the month to definitively say that price is now going to reject from here but if things don't change over the course of this month of June then that could indeed becoming a possibility.

Effectively, SUI is located inside the $2.33-$3.39 Range (green-red) and so SUI is trying to position itself for a reclaim of the Range High to facilitate a breakout.

At the moment, that reclaim of the Range High isn't going very well and as long as SUI continues to float here without covering additional ground, it could indeed face rejection into lower parts of the Range.

Obviously the Range Low would be the lowest price could consolidate towards as part of normal range-bound behaviour but there is also the $2.81 level which figures as the Mid-Range that has acted as both weak support and weak resistance earlier this year of 2025.

If SUI fails to show signs of reclaiming $3.39 as support (at least on the Daily timeframe via Daily Closes above $3.39), then sub-$3 regions could be on the cards.

Bittensor - TAO/USDT

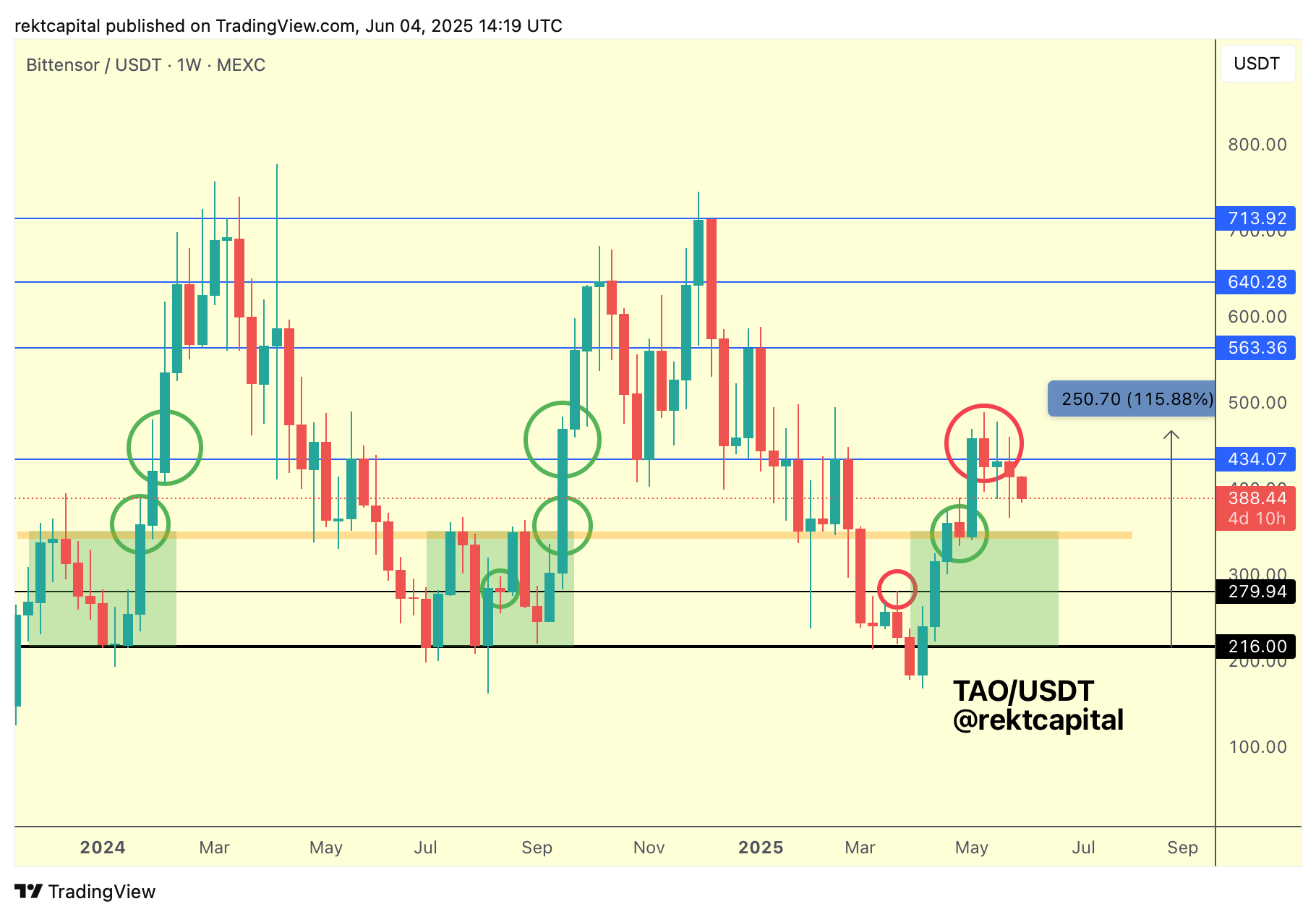

Across time, TAO has had a history of Weekly Closing above the orange boxed region and often post-breakout retesting it in the following week to confirm a breakout to the blue $434 resistance.

On reaching the blue $434 resistance, TAO would also Weekly Close above this level and even retest it on the Daily timeframe as support before launching into trend continuation to the upside.

On this occasion in recent weeks, things were setting themselves very similarly as per history.

However, in recent weeks TAO failed its retest and Weekly Closed below the $434 level and over the past two weeks or so price upside wicked into the level to turn it back into resistance, rejecting price into the downside continuation we are seeing today.

Technically, if this downside continuation persists then price would drop into the orange region for another retest of that area.

Generally, TAO has confirmed a breakdown into the Range formed by the orange boxed Range Low and blue $434 Range High and thus price is technically consolidating here.

But because price has also just rejected from the Range High, if price isn't able to hold these highs and actually muster a Weekly Close above the blue $434 level soon, then the downside continuation would probably see TAO drop into the orange Range Low for another retest attempt.