Altcoin Market Update #101

Features analysis on Altcoins such as XMR SUI SPX GIGA RENDER SAI

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Monero (XMR)

- Sui (SUI)

- SPX6900 (SPX)

- Gigachad (GIGA)

- Render (RENDER)

- Sharpe AI (SAI)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

Monero - XMR/USDT

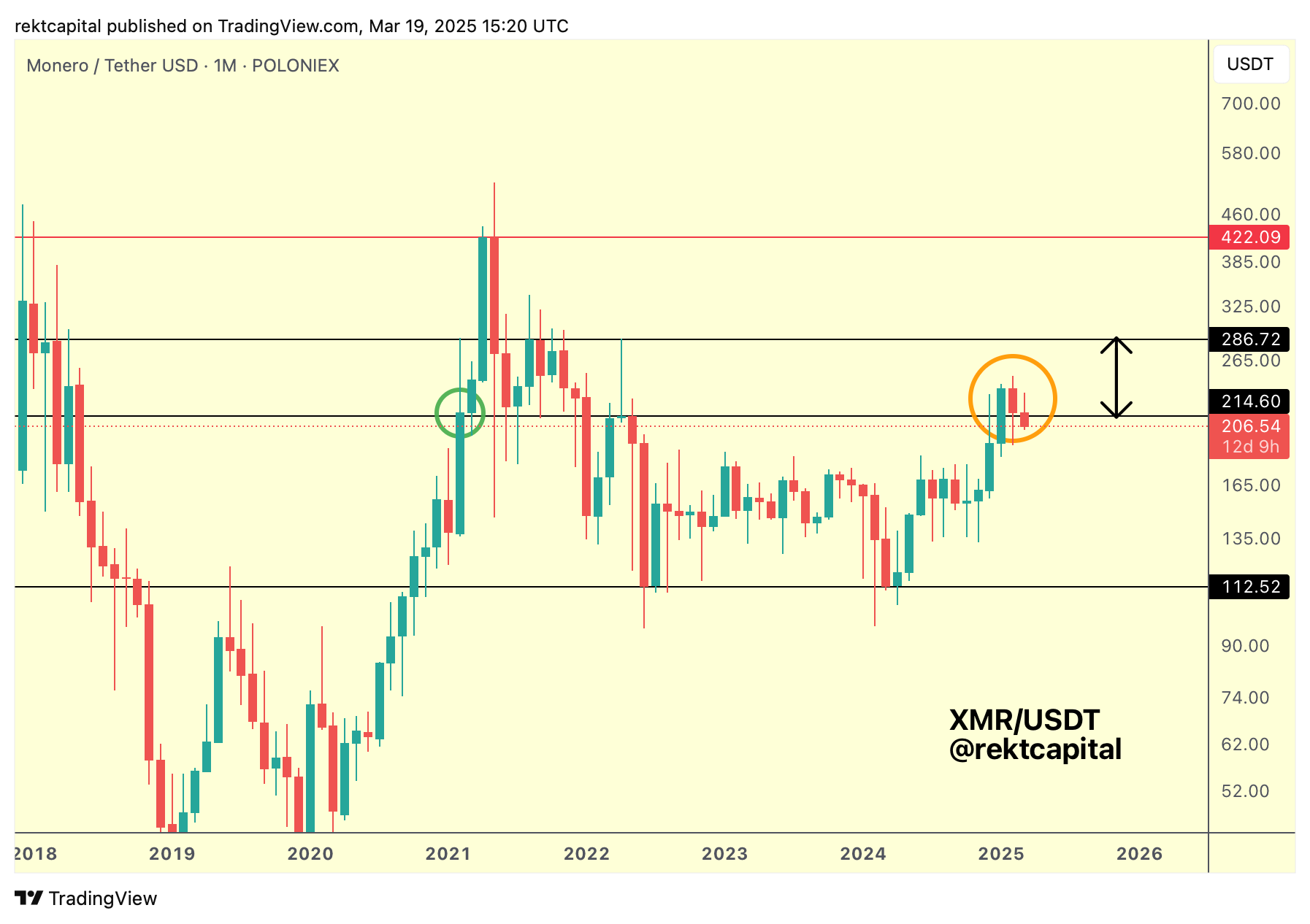

In mid-March, we spoke about XMR's retest attempt and its pursuit in trying to repeat late 2020, early 2021 history:

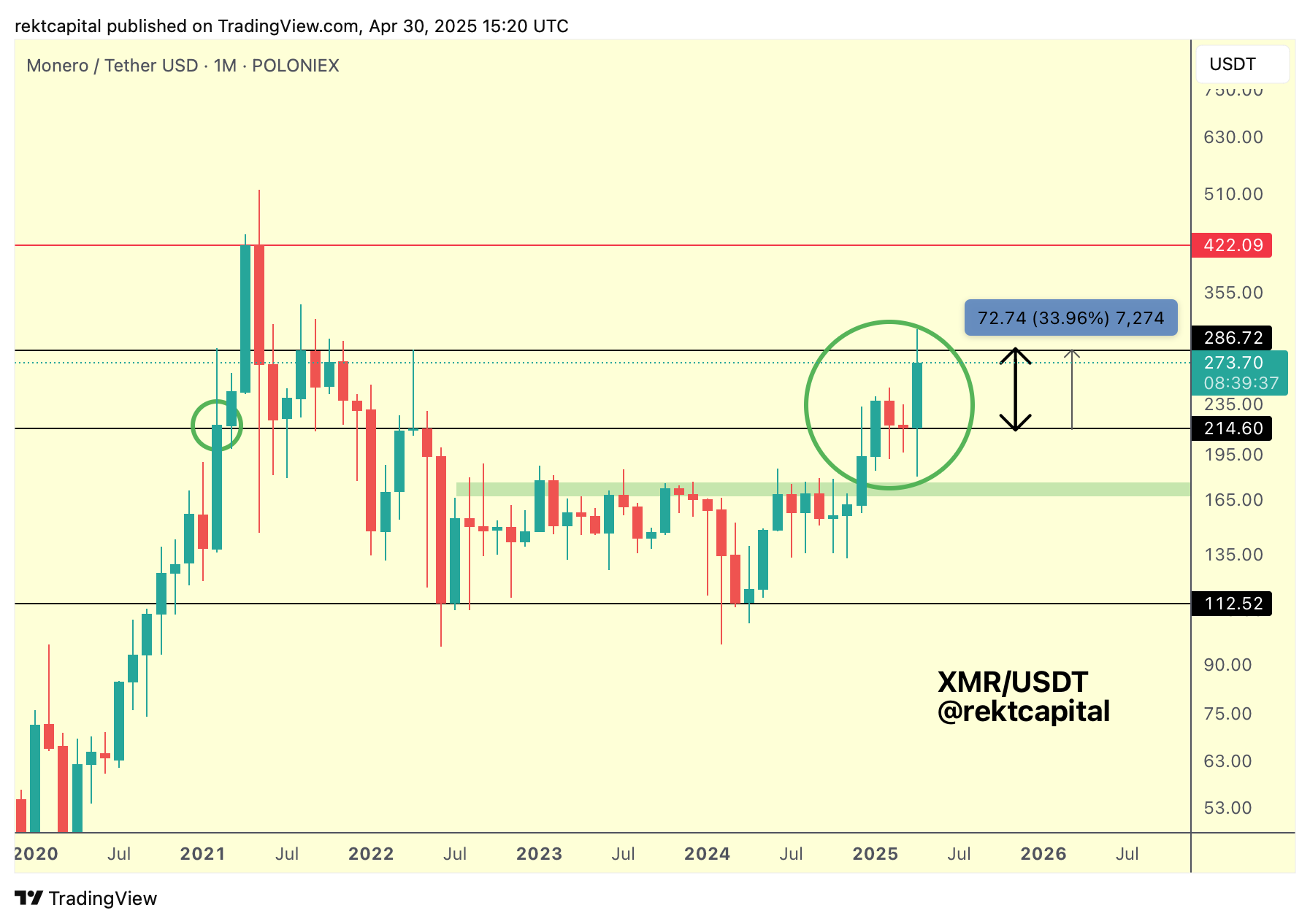

Here's late April's update showcasing how that retest was successful:

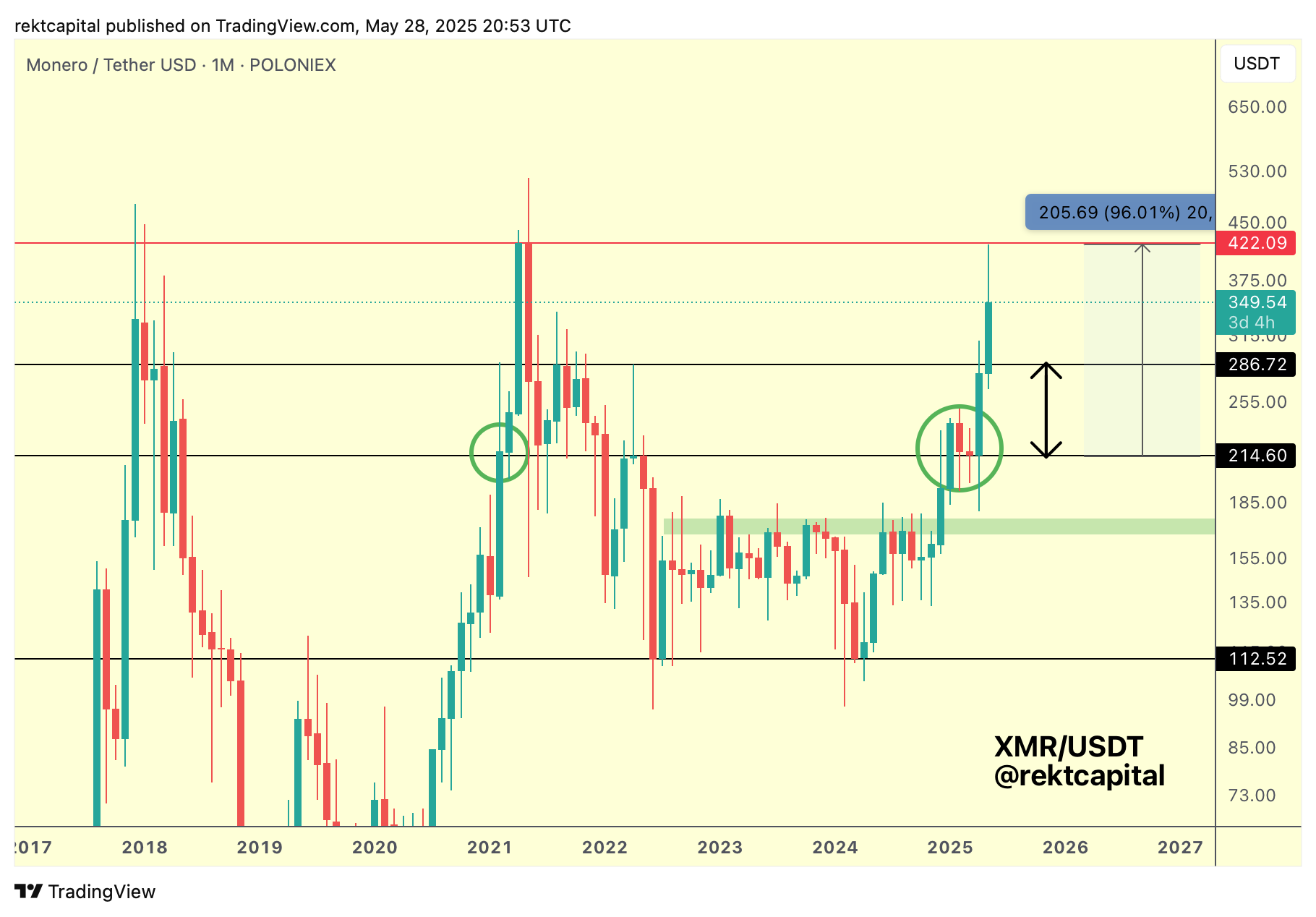

And here's last week's update, showcasing how that retest has preceded 2021-like upside, with scope for a revisit of the red $422 resistance:

Here's today's update:

XMR has indeed rallied to the red $422 resistance and rejected there.

Historically however, XMR has ended its Bull Markets at around the ~$422 resistance.

Is this time different?

If price wants to go against the grain of history and break the $422 resistance over time then it must hold these current highs.

And if it can't hold these highs, then it absolutely needs to hold the black $286 level as support (historically, this retest has always failed post-rejection from $422 so the odds don't skew in XMR's favour should this turn of events take place.)

Sui - SUI/USDT

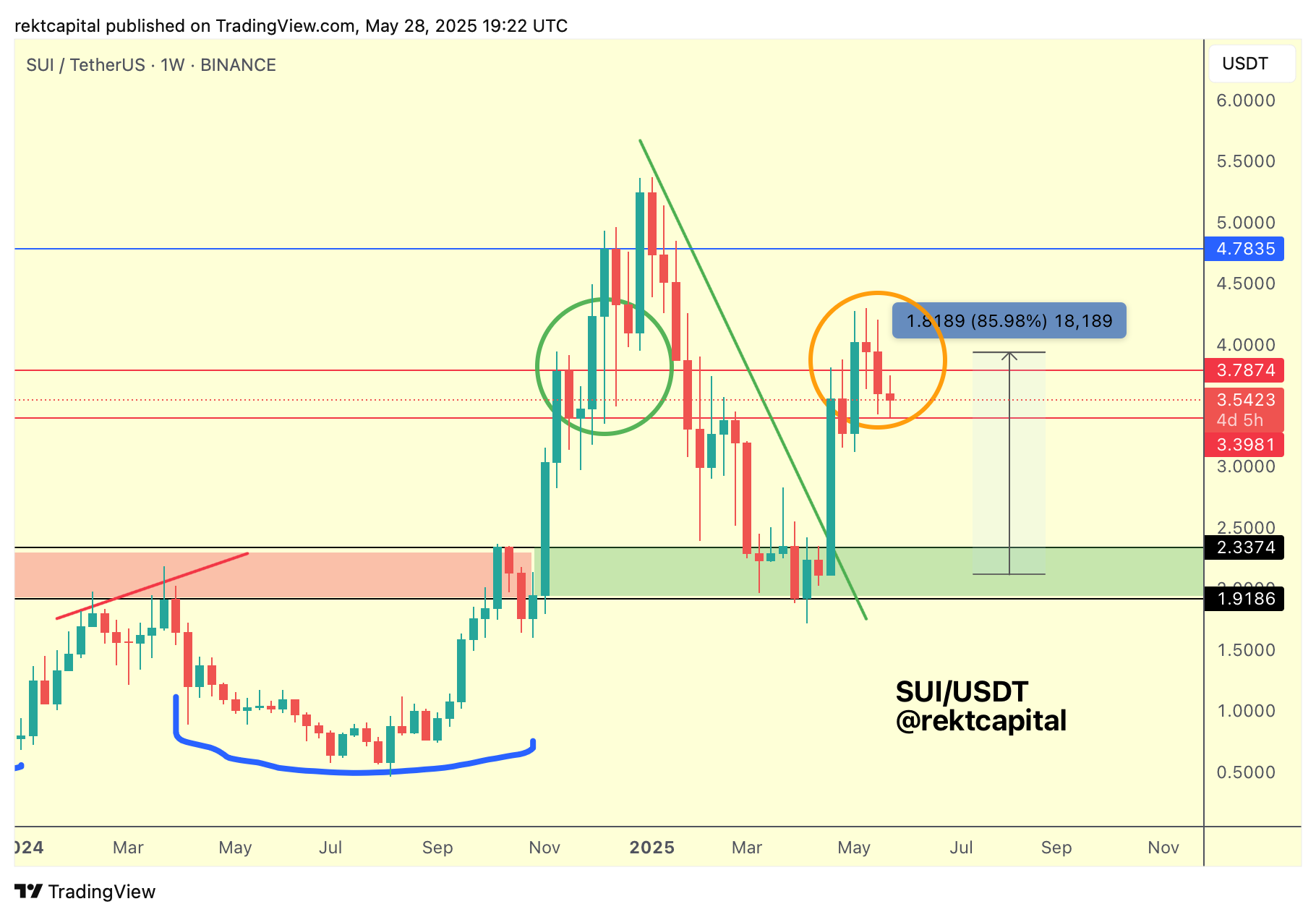

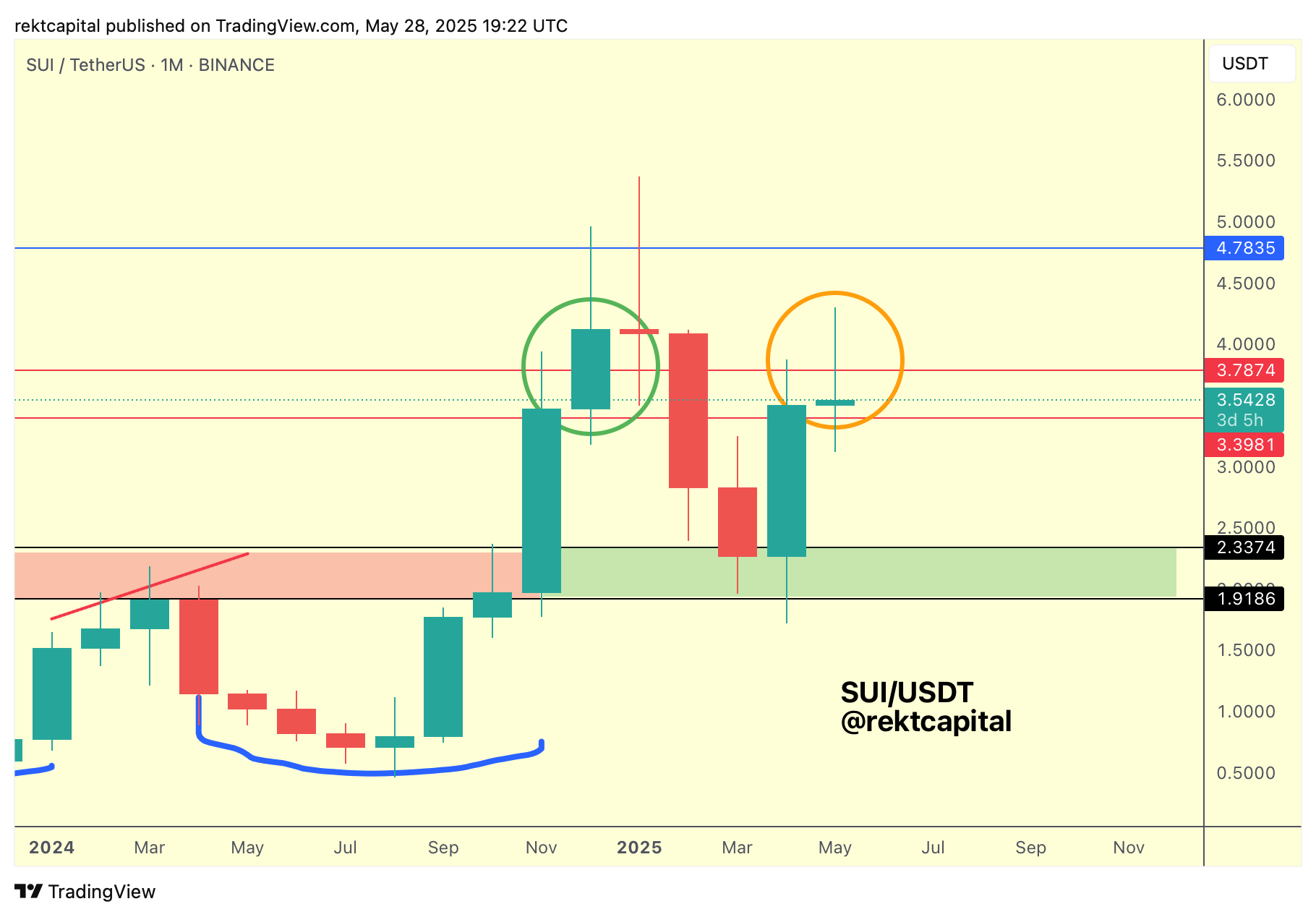

The retest is becoming a volatile one, however this time the volatility has occurred in candle-bodied format rather than downside wicks.

Nonetheless, this retest is still in progress and price is still generally holding this red-red re-accumulation range which is an area of historical buy-side liquidity.

The Weekly is showcasing that the price stability is here but the more important chart right now is the Monthly.

As we'll see below, the Monthly is showcasing a successful retest of this general red-red re-accumulation range as well, and will need a key Monthly Close to solidify that retest as successful:

Back in late 2024, SUI Monthly Closed above the red $3.39 level and then retested it successfully as support in the following month.

Just this past April, SUI Monthly Closed above this same level and once again price in the process of retesting this level as new support.

A Monthly Close just like this would render the retest as successful and so going forward stability here will be key to set SUI up for follow-through as per historical tendencies.