Altcoin Market Update #100

Features analysis on Altcoins such as XMR SUI SPX GIGA POPCAT SAI

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Monero (XMR)

- Sui (SUI)

- SPX6900 (SPX)

- Gigachad (GIGA)

- Popcat (POPCAT)

- Sharpe AI (SAI)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

Monero - XMR/USDT

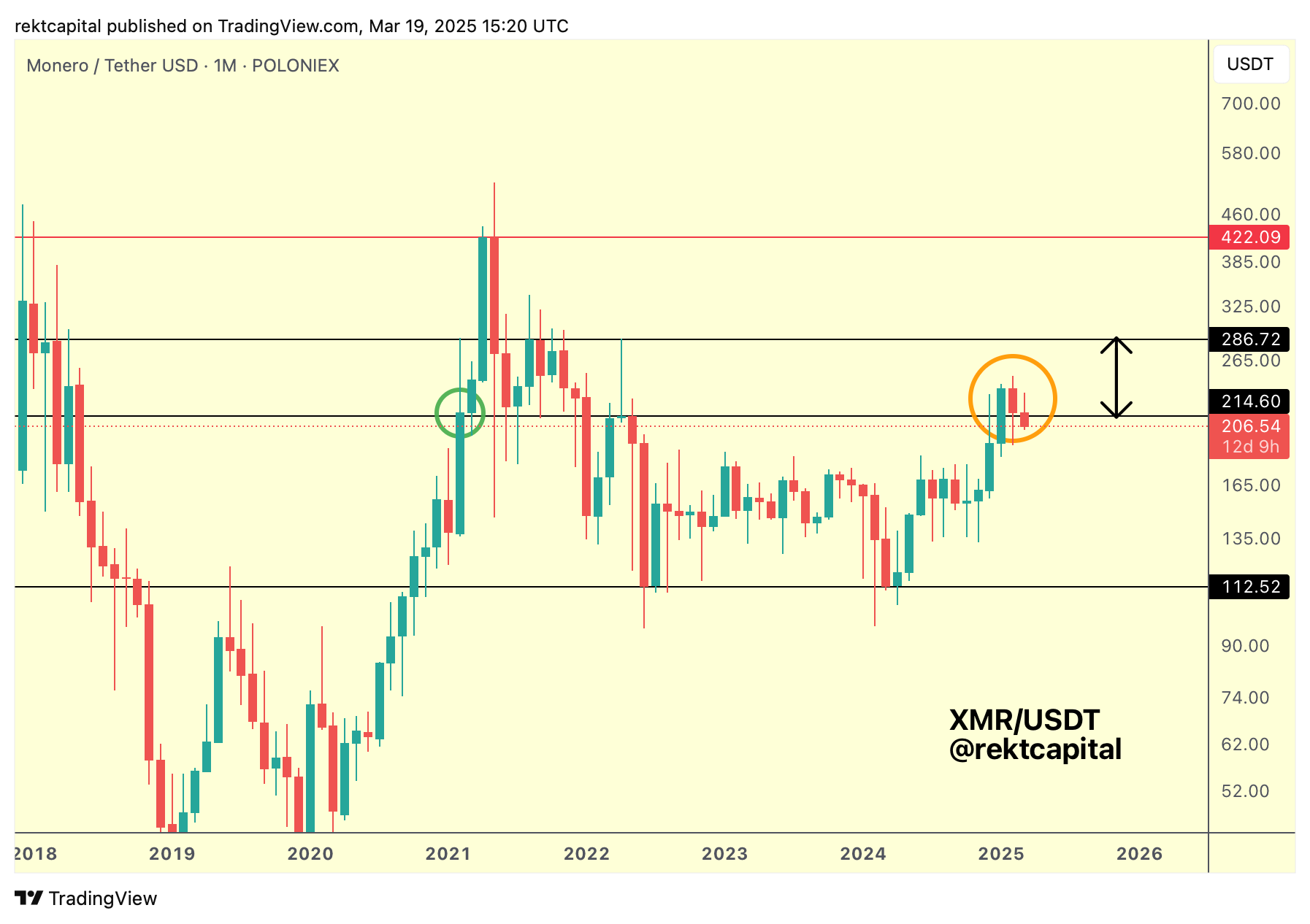

In mid-March, we spoke about XMR's retest attempt and its pursuit in trying to repeat late 2020, early 2021 history:

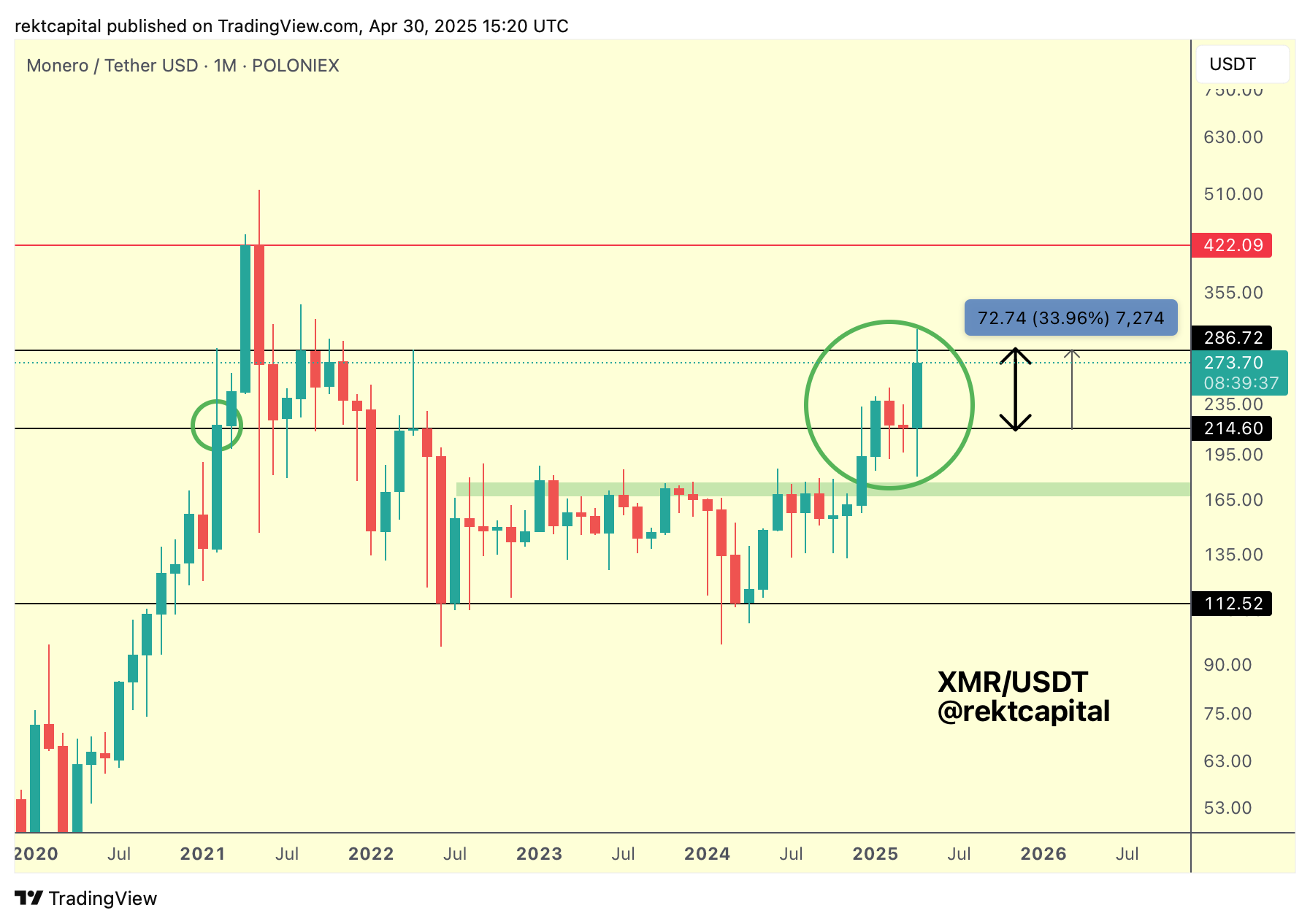

Here's late April's update showcasing how that retest was successful:

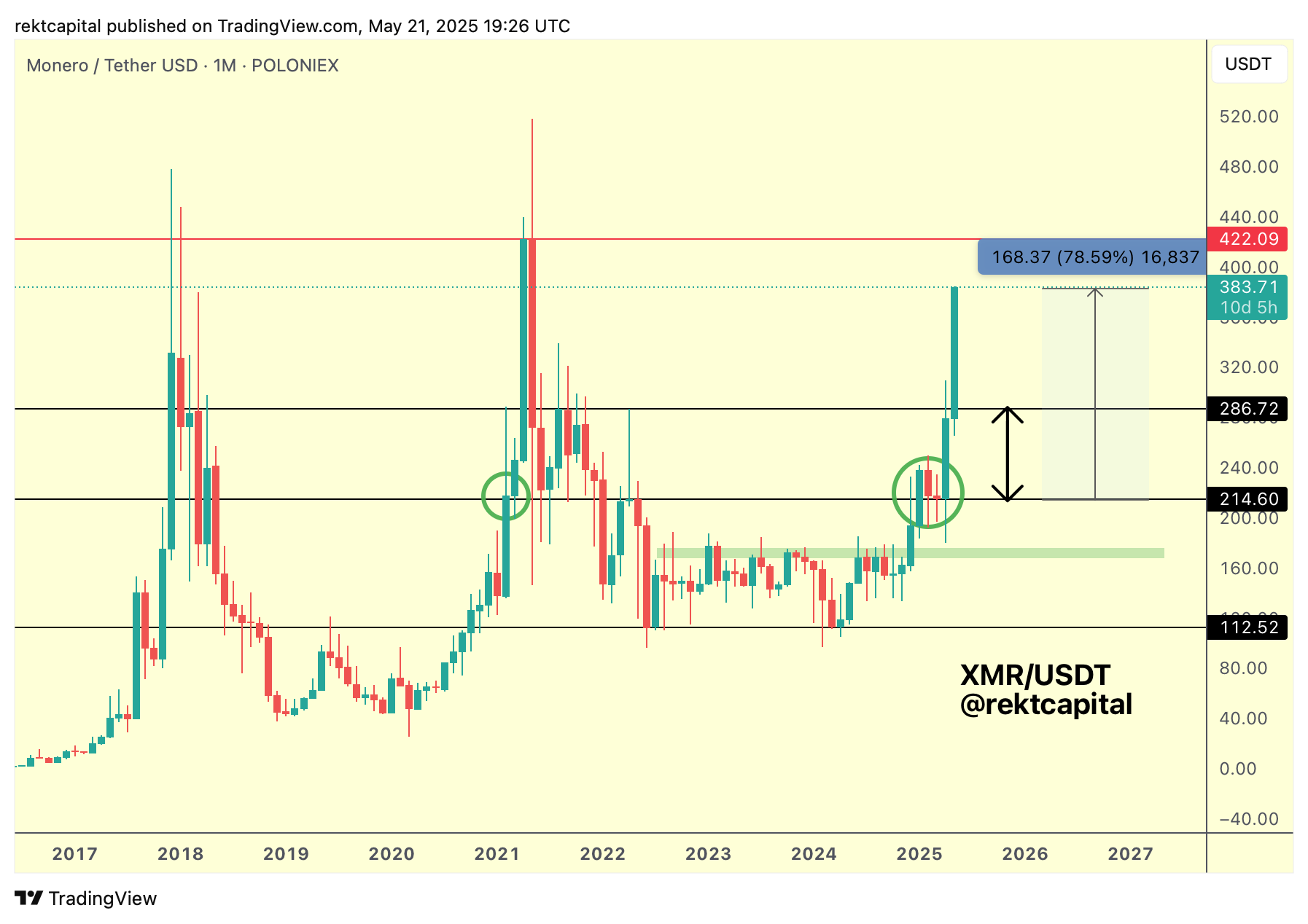

And here's today, showcasing how that retest has preceded 2021-like upside:

In fact, if you look closely, this sort of price action for XMR occurs once every four years, whereby price rallies into the red major resistance of $422, often briefly upside wicking beyond there.

And those green circled retests are a vital part of formulating that path for XMR to rally to revisit those old All Time Highs, and even challenge for new ones.

That said, it's key to note that in this 2022 Bear Market, XMR's price action retraced less than in the 2018 Bear Market.

As a result, could this mean that XMR could go higher than $422?

It's a compelling theory but to position for more upside than historically has been possible, it's absolutely crucial to protect the risk of downside in case XMR doesn't go against the grain of history.

As long as you manage the downside, the upside will take care of itself.

Sui - SUI/USDT

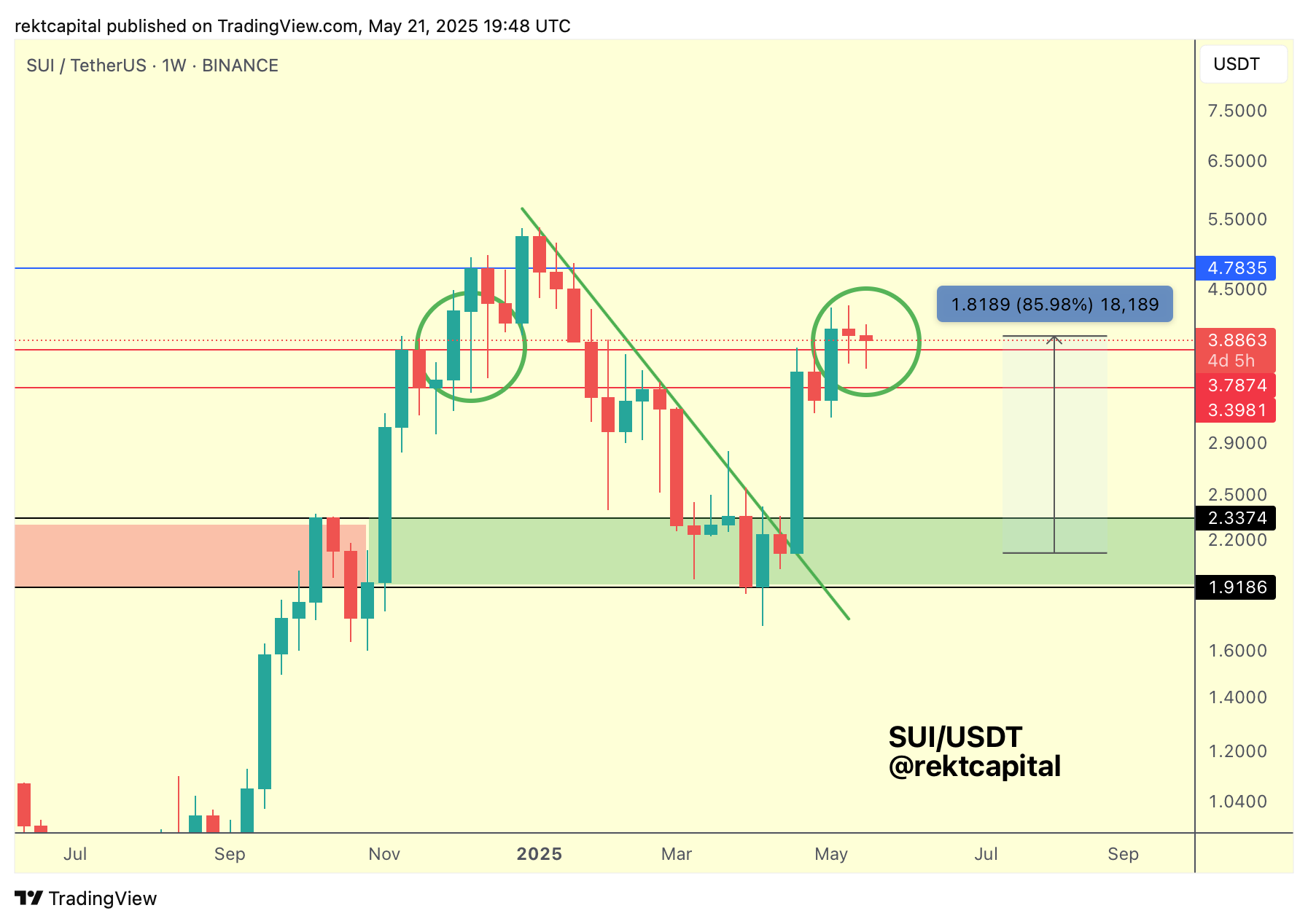

SUI is still in the process of retesting the top of this red-red historical Re-Accumulation Range.

This retest has been going on for the past two weeks or so and it has been successful thus far, despite the downside wicks into the Range itself.

In fact, if we look to the late 2024 post-breakout retest of this Re-Accumulation Range, the downside wicks were much more volatile to the downside, downside wicking even into the $3.39 Range Low for two weeks in a row.

So this current retest appears to be more controlled, less emotionally fervent, and more gradual and calculated.

Before, the emotion was much more extreme here.

Regardless of differences in emotionality across these two retests, the similarity is that both occurred/are occurring to achieve the same thing - a confirmed breakout to $4.78+ (blue).