5 Facts About Bitcoin Corrections

Why you shouldn't worry about retraces in a Bull Market

Bitcoin is currently in a Bull Market.

But that doesn’t mean that price won’t pullback to lower levels.

In fact, corrections are a natural, healthy part in any growth cycle.

But once the correction is over, this is when Bitcoin’s price shoots back up and rallies to new highs.

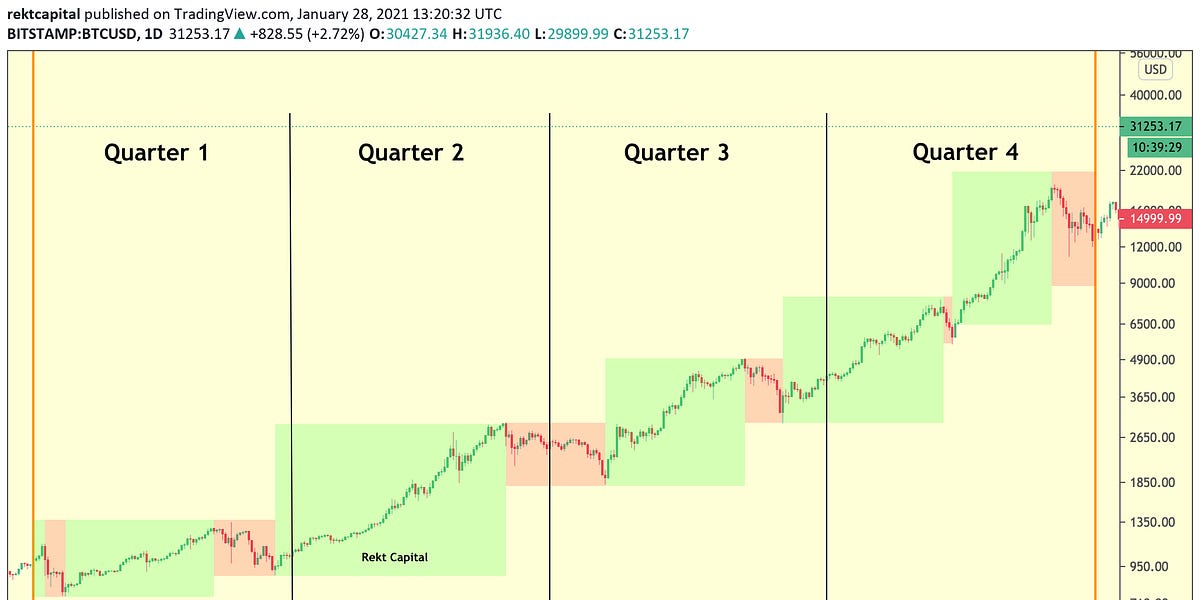

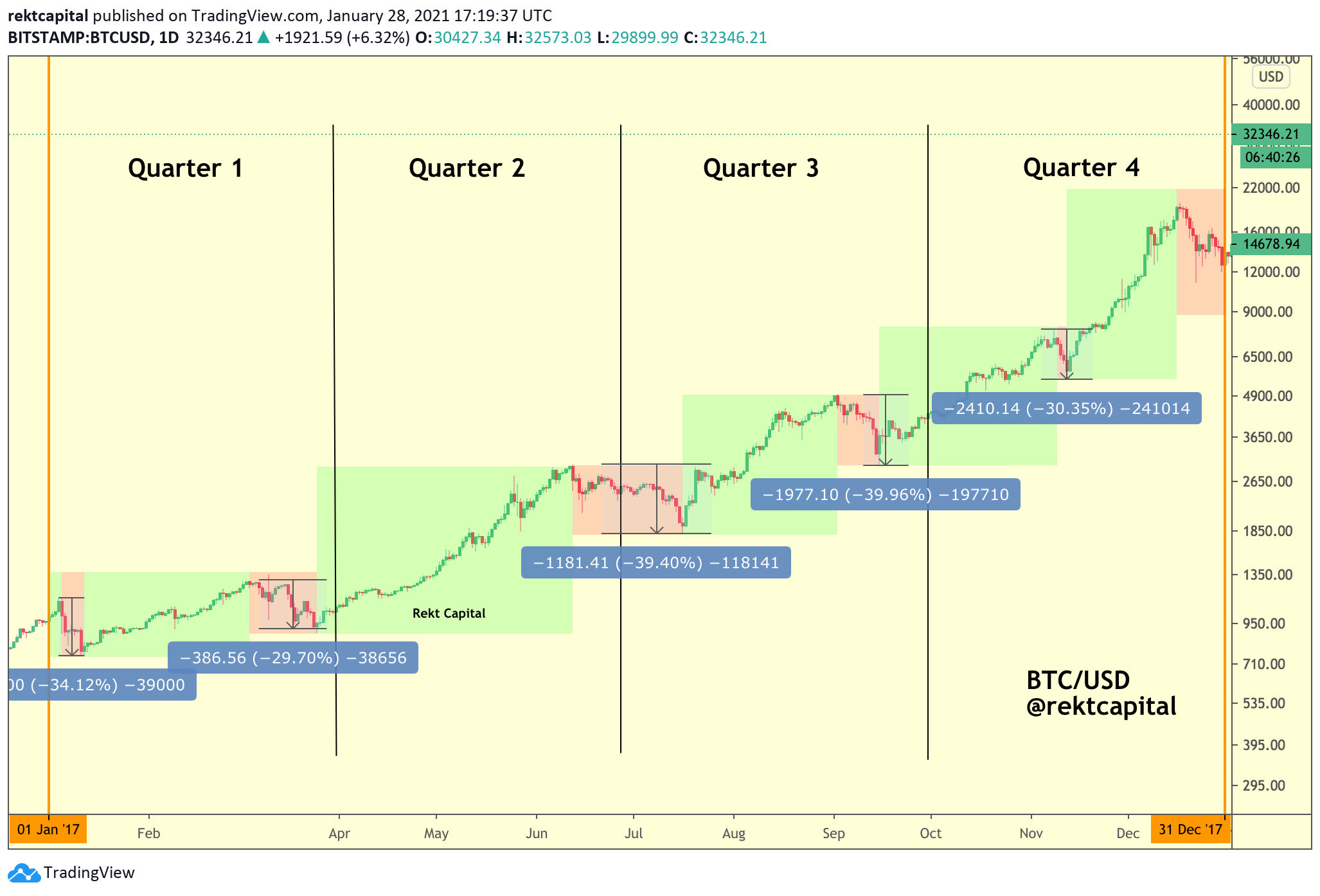

In this article, I will divide the 2017 Bitcoin Bull Market into Quarters to illustrate a variety of insights about Bitcoin corrections and the uptrends these tend to precede.

Here are five facts about Bitcoin corrections:

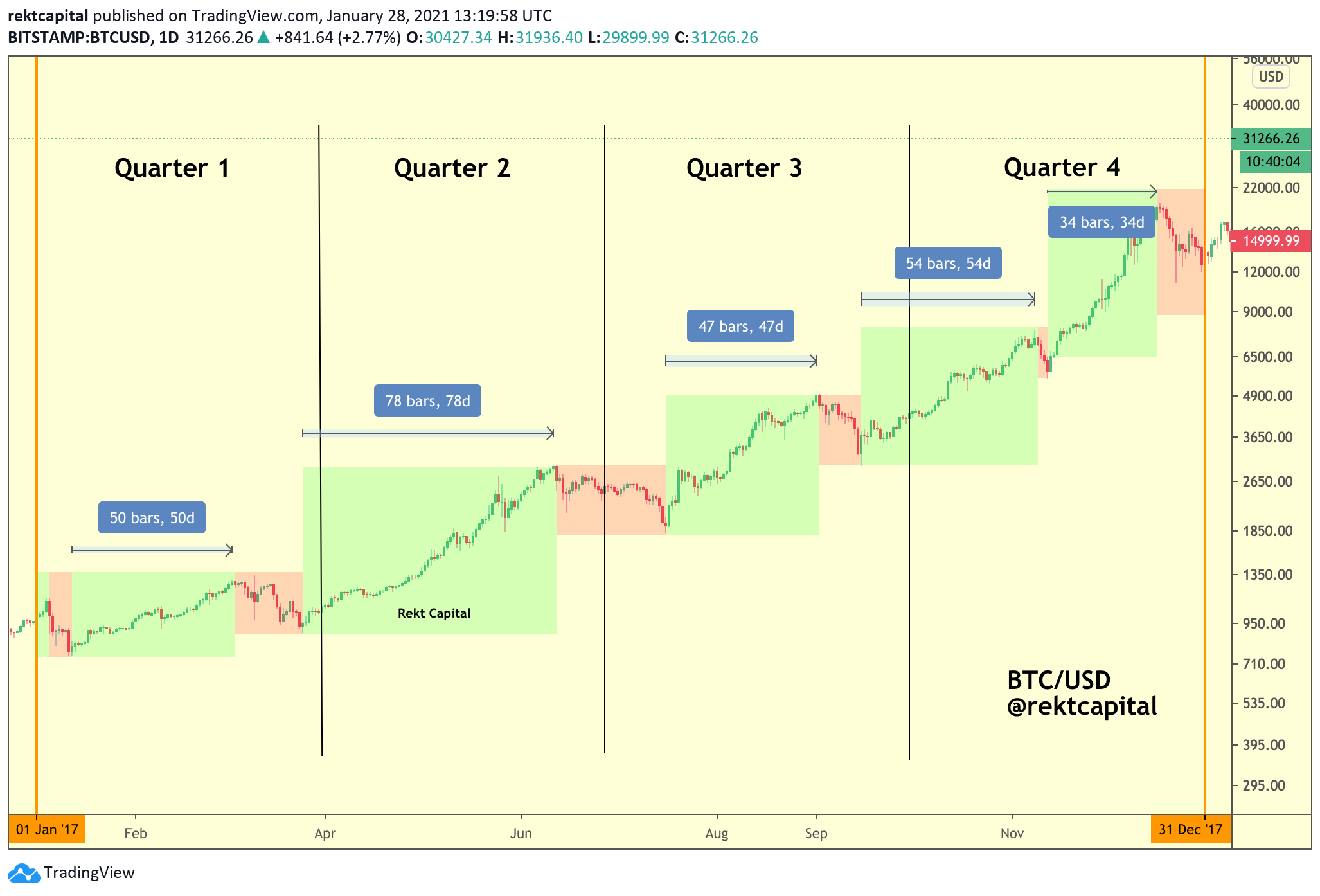

1. Uptrends are longer than corrections

Throughout its 2017 Bull Market, Bitcoin spent most of its time in an uptrend (green) compared to time spent in a correction (red).

In fact, throughout the 2017 Bull Market, Bitcoin spent a total of 267 days in an uptrend and only 98 days in a downtrend.

That means Bitcoin spent a staggering 73% of the entire year in an uptrend!

The average time BTC spent in an uptrend in 2017 was around 50 days.

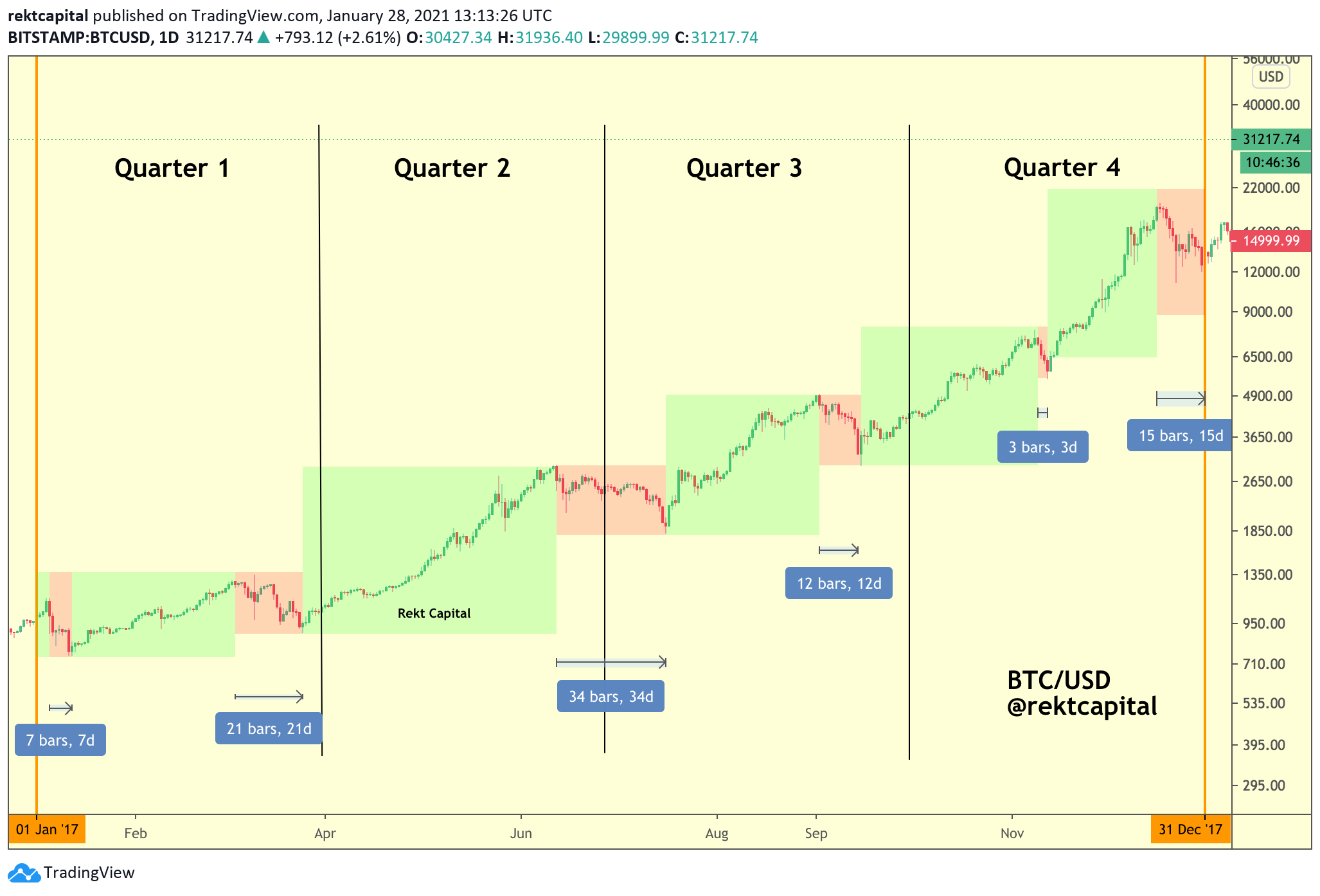

2. Corrections are normal

In 2017, Bitcoin experienced five major corrections.

While the shortest retrace took only three days, the longest correction lasted just over a month.

In fact, the average time Bitcoin spent in a retrace was about 16 days.

In 2017 overall, Bitcoin only spent 98 days in a corrective period, which is only 27% of the year.

Yes — corrections happen.

But they tend to act as a small pause before further upside.

They are a chance to join the next long uptrend but that said — they do tend to be quite short.

In fact, as the 2017 Bull Trend progressed, the retraces got even shorter.

Corrections arguably become more brief later in the year as the Bull Trend reaches euphoric proportions.

Later this cycle, having lots of time to buy on a retrace will be a luxury we won’t have.

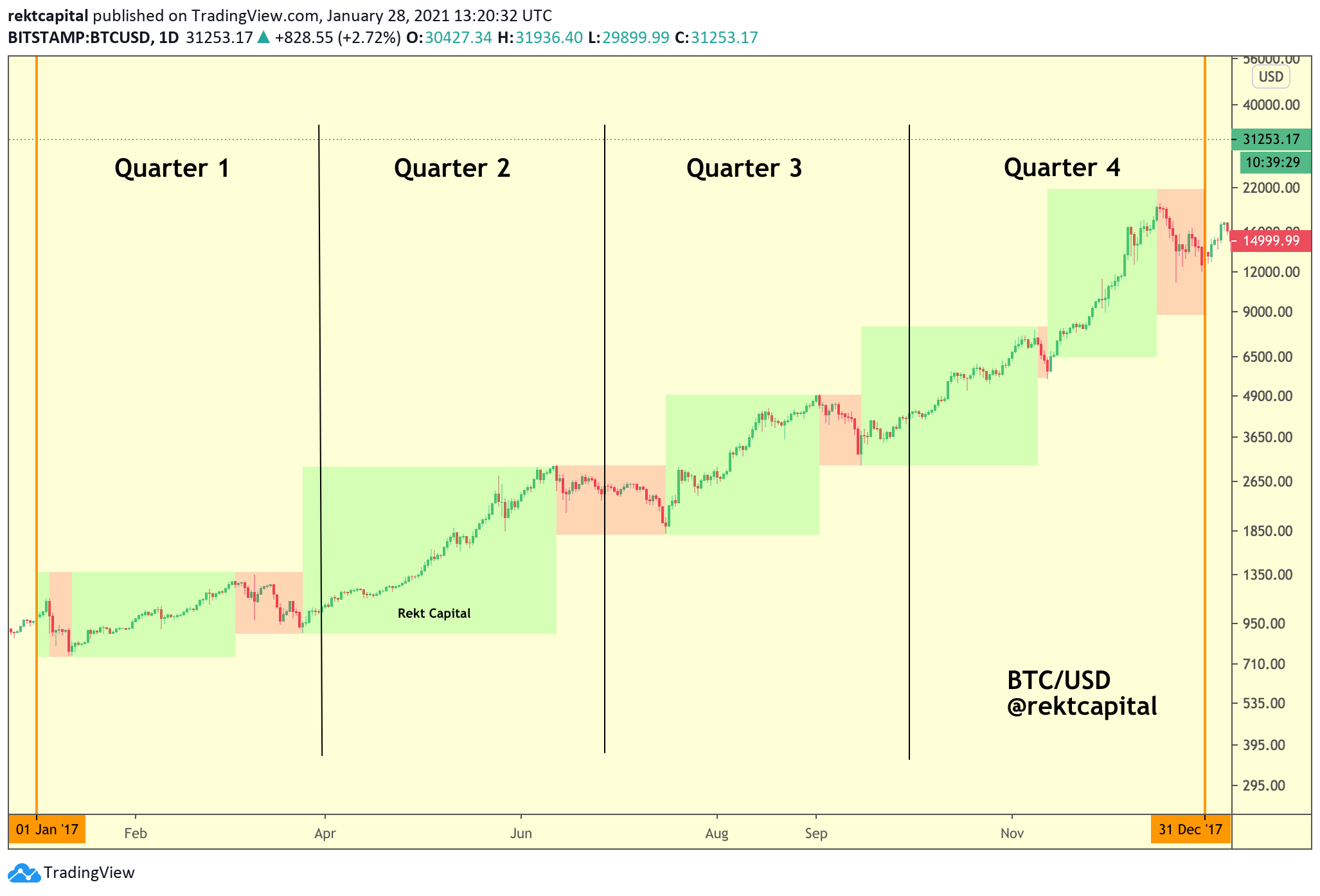

3. Every Quarter sees at least one strong Bitcoin correction

In 2017, Bitcoin would retrace at least once per Quarter.

However, it was actually more common for Bitcoin to experience two corrections during a Quarter (e.g. Q1, Q3, Q4)

The only Quarter that saw only one strong Bitcoin correction in 2017 was Q2.

Not only are corrections a common occurrence in Bitcoin Bull Markets, but they tend to take place cyclically.

4. Corrections tend to occur at the end of a Quarter

While some Bitcoin corrections began at the beginning of a Quarter (e.g. Q1 & Q3)…

Bitcoin corrected near the end of every Quarter in 2017.

The only time when BTC retraced mid-Quarter was in Q4, though it was very brief.

5. Corrections tend to be -30% to -40% deep

In the 2017 Bull Market, Bitcoin experienced 5 major pullbacks.

These pullbacks ranged between -29% to -40%.

The average Bull Market correction was about -35%.

That said, no matter how deep these retraces were, each of them preceded new All Time Highs for Bitcoin’s price.

Closing Thoughts

At the moment, Bitcoin is experiencing its first major pullback in this new Bull Market.

The retrace at the moment is around -31% deep which is normal by standards of history.

And while it would be healthy for Bitcoin to retrace even deeper, history suggests this correction will precede further exponential upside.

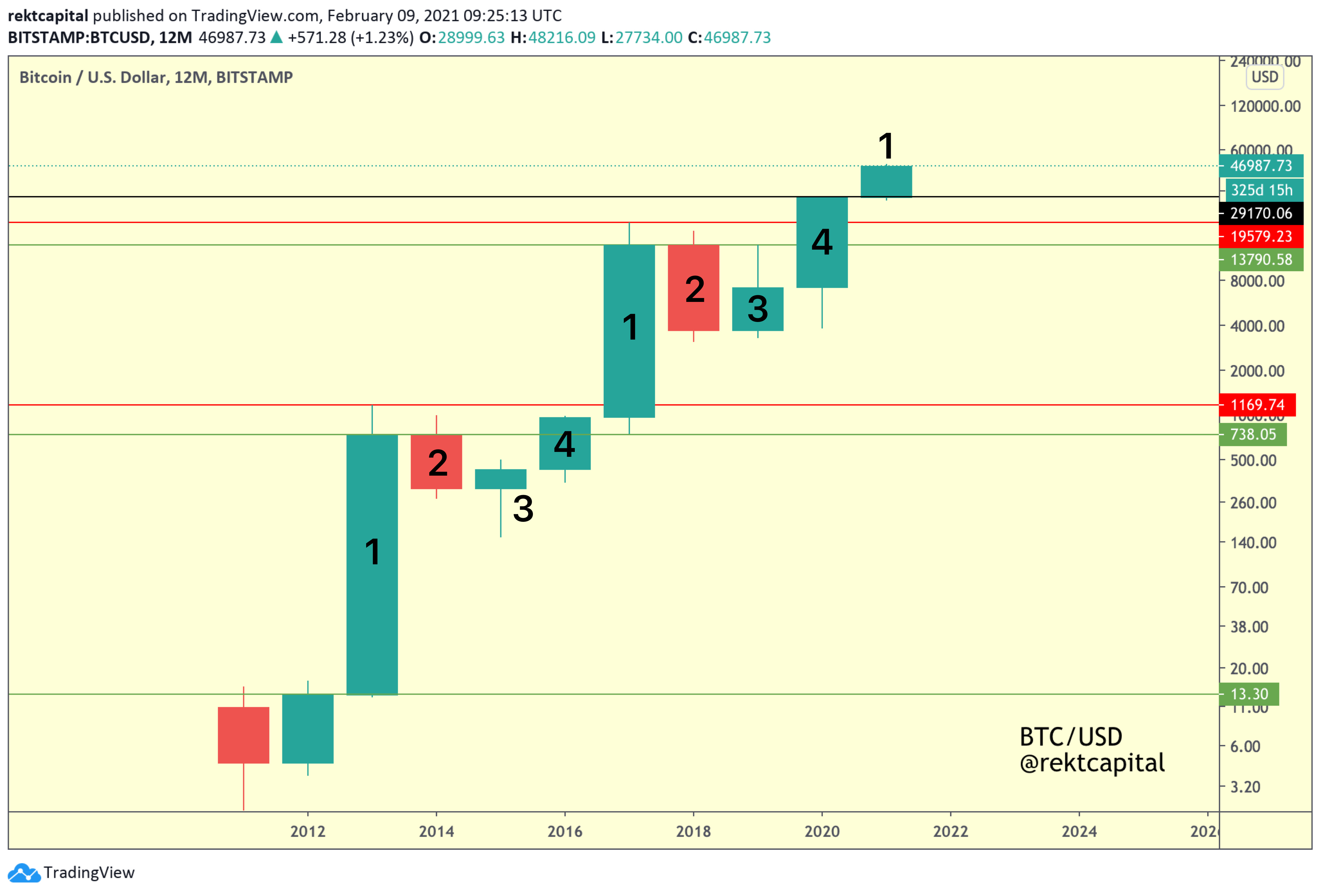

But perhaps more importantly — Bitcoin has begun a new Four Year Cycle:

In a Bitcoin 4-Year Cycle, the most exponential growth occurs in Candle 1.

The last time Bitcoin formed a Candle 1 was in 2017.

By standards of history, Bitcoin still has a lot more room to grow throughout 2021.

Technically, Bitcoin is still in an early Bull Trend, just like it was in Q1 of 2017.

Thank you for reading.

If you liked this nutshell of insights - I guarantee you’ll love the newsletter where I feature more extensive, in-depth analysis. Feel free to Subscribe today for $6.99 a month:

P.S. Want to learn more insights about Bitcoin Bull Market corrections?

Feel free to read Part 2 and Part 3 below:

Part 2 - An insightful analysis of the 2016-2017 Bitcoin Bull Market

Part 3 - How do Bitcoin Bull Market Corrections Affect Altcoins?