The Key Bitcoin Reclaim

Does a post-breakout dip need to occur again?

Welcome to the Rekt Capital Newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis

Bitcoin Is Back Above The Range

In last week's newsletter, we spoke about how Bitcoin had performed a Weekly Close below the $104400 Range High of its ReAccumulation Range, losing it as support, however price had not turned that level into new resistance.

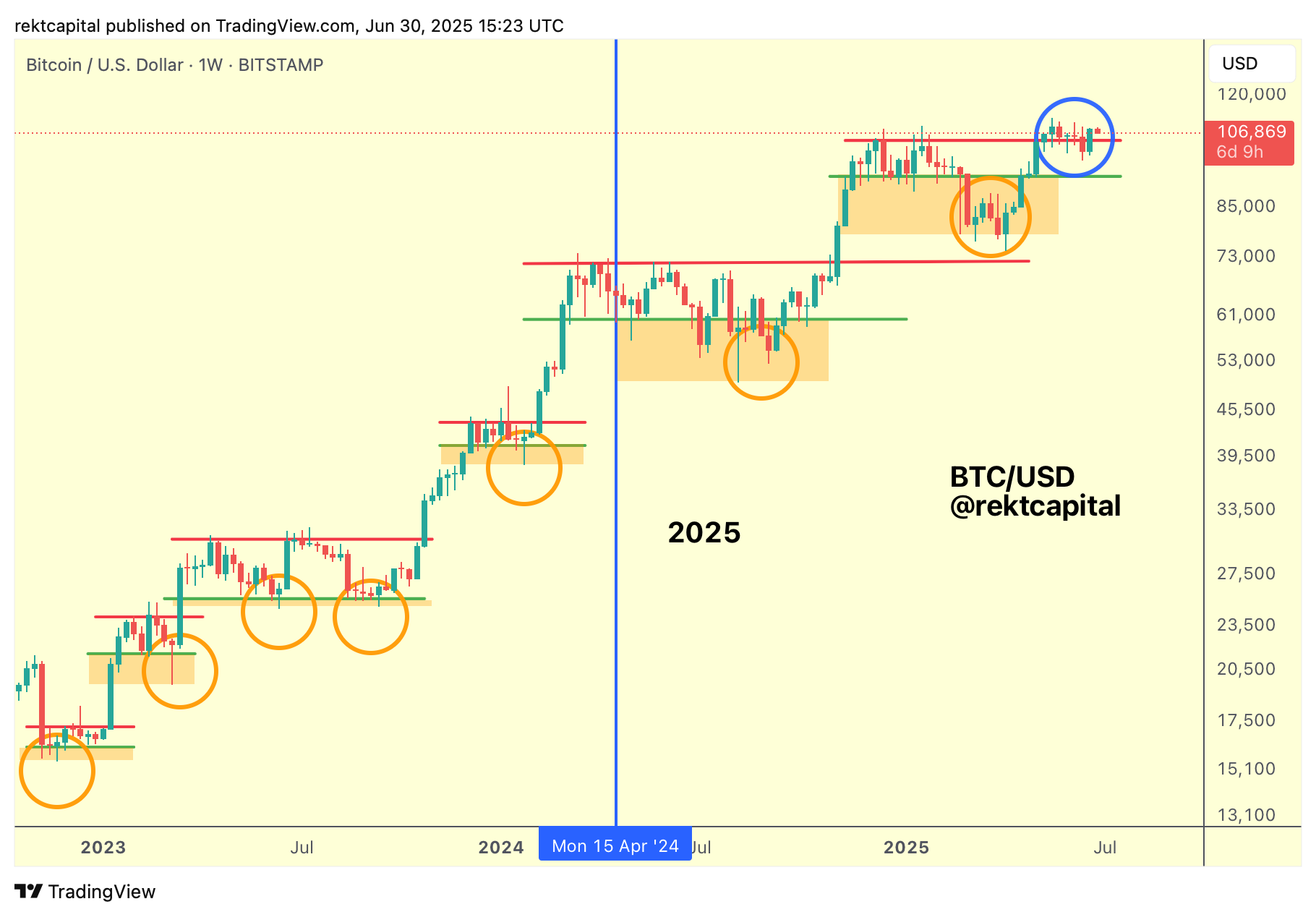

More, we spoke about Bitcoin's history of downside deviations in this cycle and that price may be developing a downside deviation below the Range High resistance.

With the new Weekly Close now in, Bitcoin has officially Weekly Closed above the Range High of $104400, which has shown that this level never flipped into a point of rejection, a resistance.

In fact, with this new Weekly Candle Close, Bitcoin is now back to trying to finish the business it had started and continued doing over the past several weeks; that is, Bitcoin was successfully retesting the 104400 Range High as support for almost 6 full weeks before briefly losing it.

Now, Bitcoin has effectively resynchronised with that process, which all resolves around price trying to post-breakout retest the Range High of the ReAccumulation Range into new support so as to confirm a breakout from this Range.

Bitcoin - Range High Retest Incoming?

Now that Bitcoin has broken back above the $104400 Range High (red), BTC may need to retest it into support on dip in the market; at least, that would be the perfectly healthy technical thing to do.

But in saying that, we must always consider the Monthly Retest that is ongoing as well.

As a preface, here's the late May analysis detailing an impending-at-the-time retest which has since occurred:

And here's today's update:

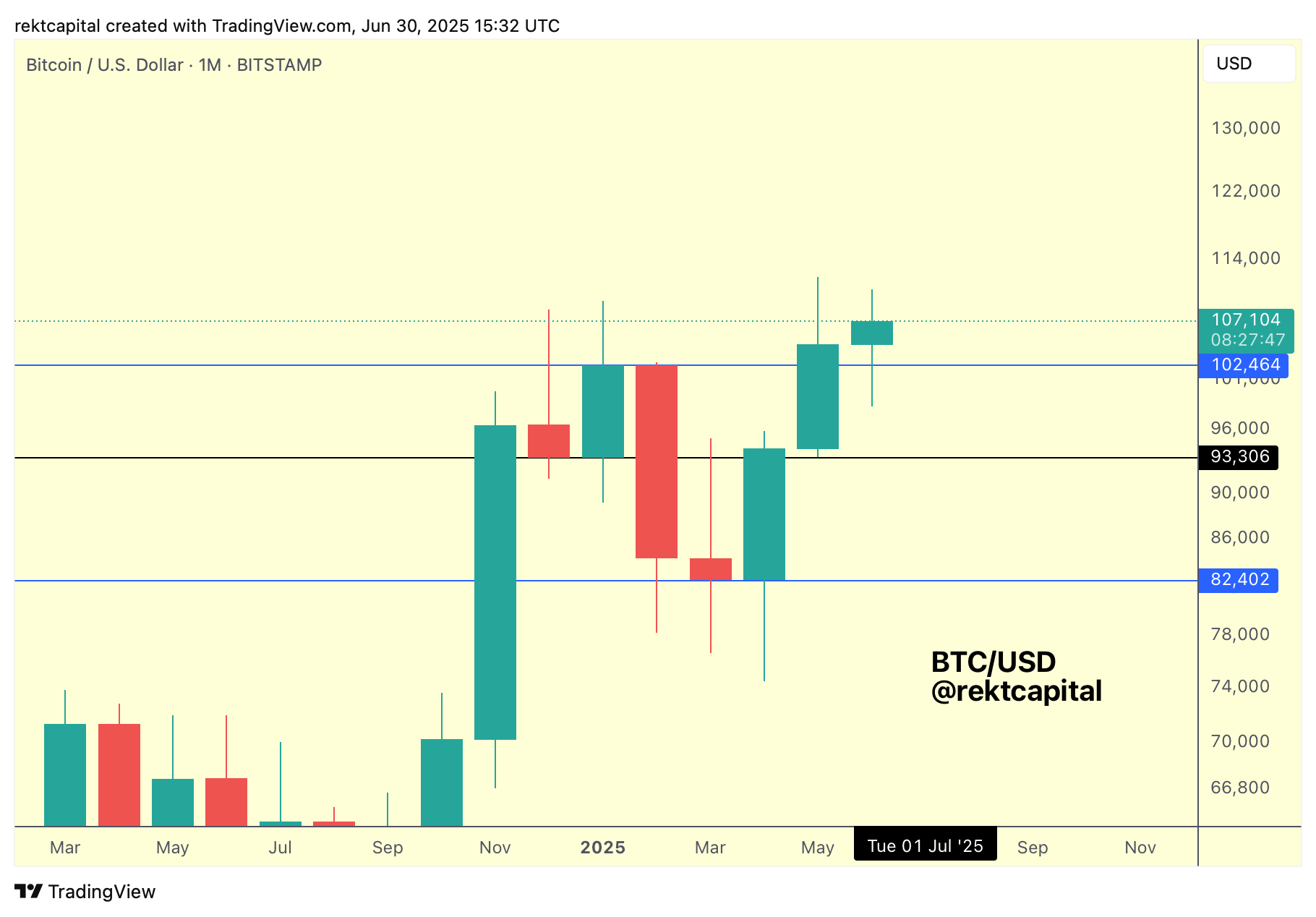

Bitcoin is successfully holding the $102464 (blue) level as support, effectively positioning itself for a successful post-breakout retest of the Monthly Range.

So if the Weekly Range High hasn't yet been given a role since the most recent break-back above it (i.e invalidating it as resistance, but not yet confirming that it is a support), the Monthly Range High here is clearly acting as support.

And with the upcoming Monthly Candle Close just around the corner, Bitcoin simply just needs to Close above $102464 to confirm that said level is figuring as support, and technically price should be ready for continuation to the upside.

That being said, it's unclear if BTC will need to dip into the $102464 in July to further solidify itself at that region of support.

For example, if we look at the retest of $82402 (blue) in to support earlier this year, that retest took 3 months, but generally price kept holding it, even if downside wicking below the level frequently occurred.

So therefore going forward, Bitcoin needs to maintain the $102464 Monthly Range High level and the $104400 Weekly ReAccumulation Range High level, but in doing so - downside wicks could always be a possibility.

But as long as price holds above this general demand area, then Bitcoin is technically positioned for additional upside over time.