Bitcoin - The Breakdown

Re-Accumulation Range Lost?

Welcome to the Rekt Capital newsletter, a resource for investors who want to better navigate the crypto markets with the help of cutting-edge crypto research and unbiased market analysis.

The Re-Accumulation Range

Most recently, Bitcoin has Weekly Candle Closed below the Range Low of $60600 of the Re-Accumulation Range that price has been consolidating in since late February 2024.

Across all Re-Accumulation Ranges in this cycle, Bitcoin would often downside wick below the Range Low support to grab liquidity before ultimately reclaiming the Range Low as support and Weekly Closing above it.

This was even the case on two prior occasions in this current Range however most recently, BTC performed its first Weekly Close below the Range Low.

Technically, this is the beginning of a breakdown, however it's important to emphasise that a confirmed breakdown would only occur if BTC were to now rally to the $60600 level and turn that level into new resistance to reject into downside continuation.

Until that second part of the breakdown occurs, this could very well still end up as a fake-breakdown and/or downside deviation below the Re-Accumulation Range.

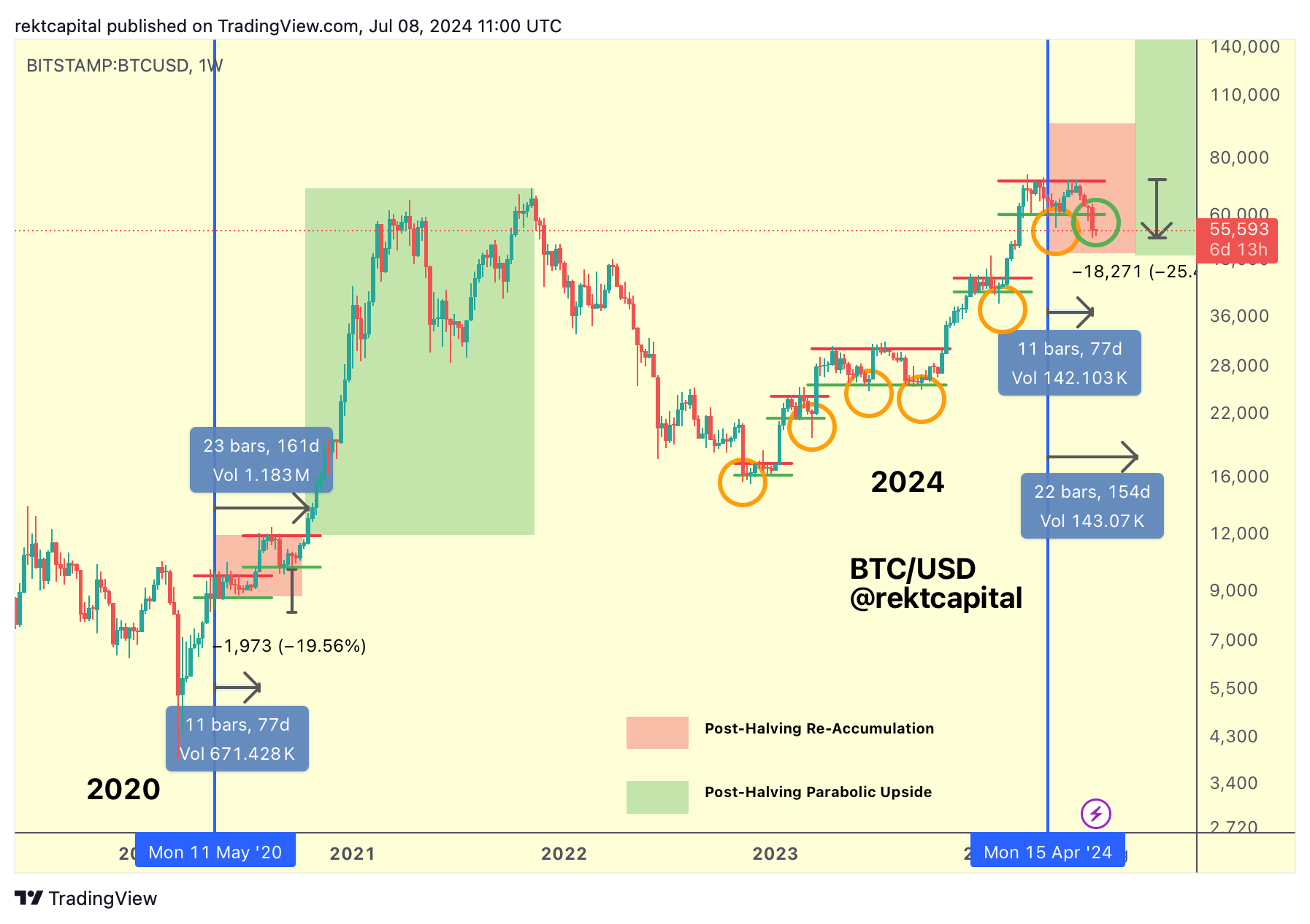

But not just throughout the cycle have we seen such Re-Accumulation Ranges form; we've also seen them develop in the Post-Halving period across the years.

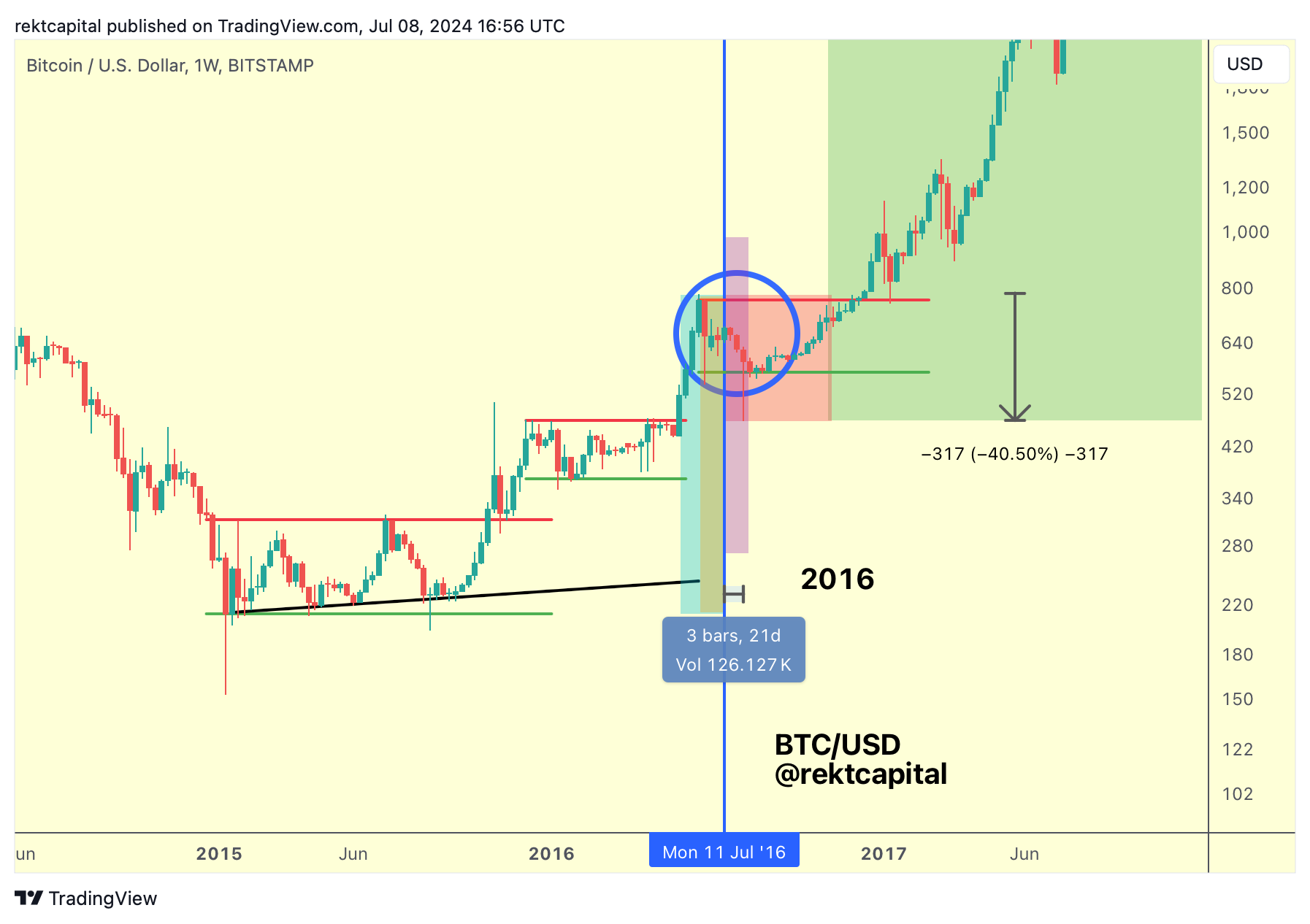

Most notably 2020 as depicted in the above chart but also 2016:

The general principles in the Post-Halving period is that Bitcoin tends to consolidate for up to 160 days after the Halving before breaking out from the Re-Accumulation Range into the Parabolic Phase of the cycle.

Bitcoin is currently only 80 days after the Halving and so technically, there is another 80 days ahead before a breakout in line with history could occur.

During that next upcoming 80-day period, BTC should've been able to retain its current $60600-$71500 Re-Accumulation Range; and maybe this could still become the case if price revisits $60600 and reclaims it as support in the coming days or even couple of weeks.

Historically, Bitcoin tends to make fantastic gains in the months after the Halving.

History suggests that, given that breakouts occur only some 160 days after the Halving, time-wise BTC isn't ready for a breakout yet seeing as we're only 80 days or so after the Halving.

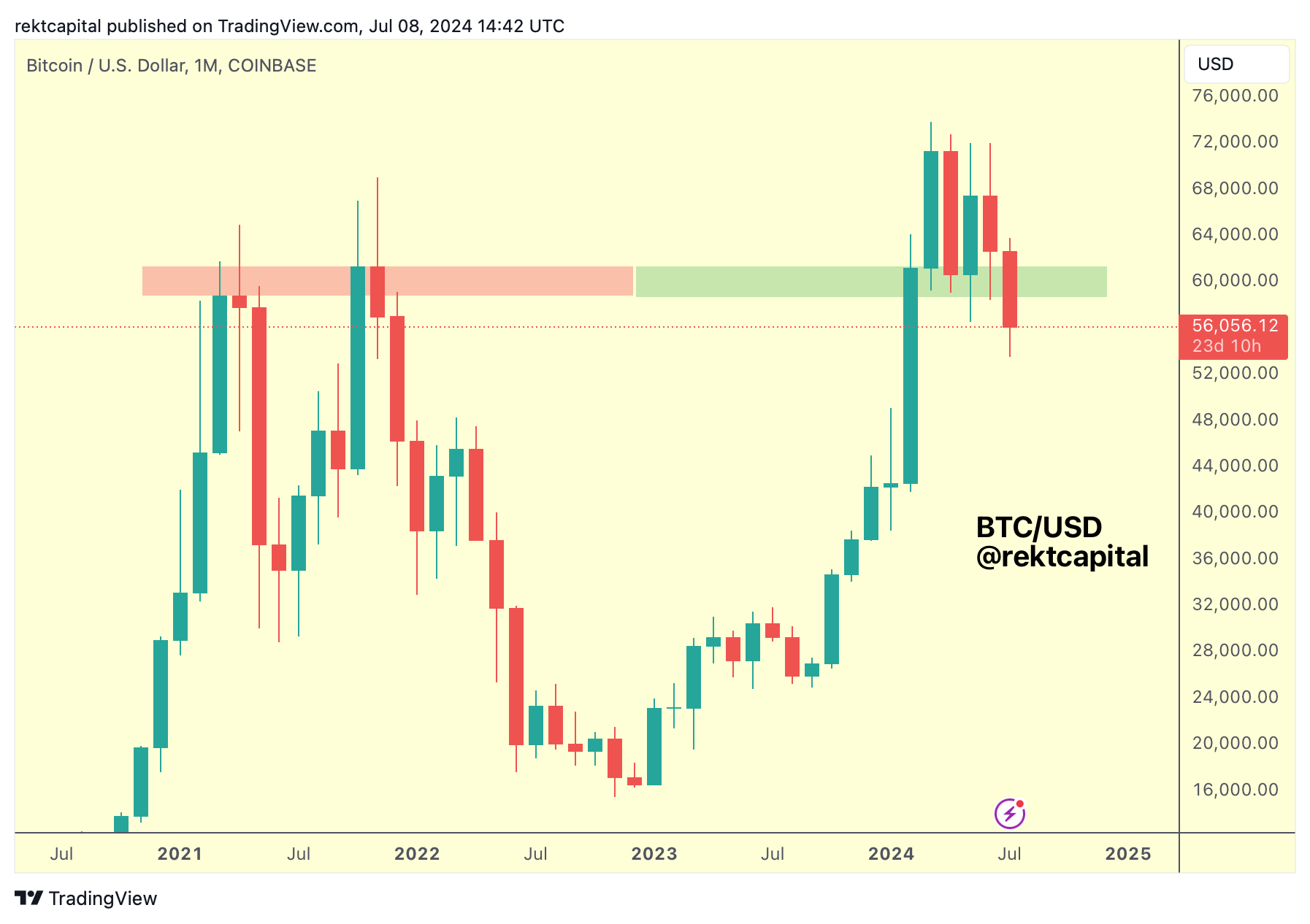

And while BTC has Weekly Closed below the Range Low, on the Monthly timeframe BTC could be retesting the old All Time Highs area as support in a volatile fashion:

BTC has been holding this green area as support for the past four months now and price is now deviating below this area, but there's still plenty of time for price to Monthly Close inside or above the green area to successfully retest it as support for a fifth consecutive month.

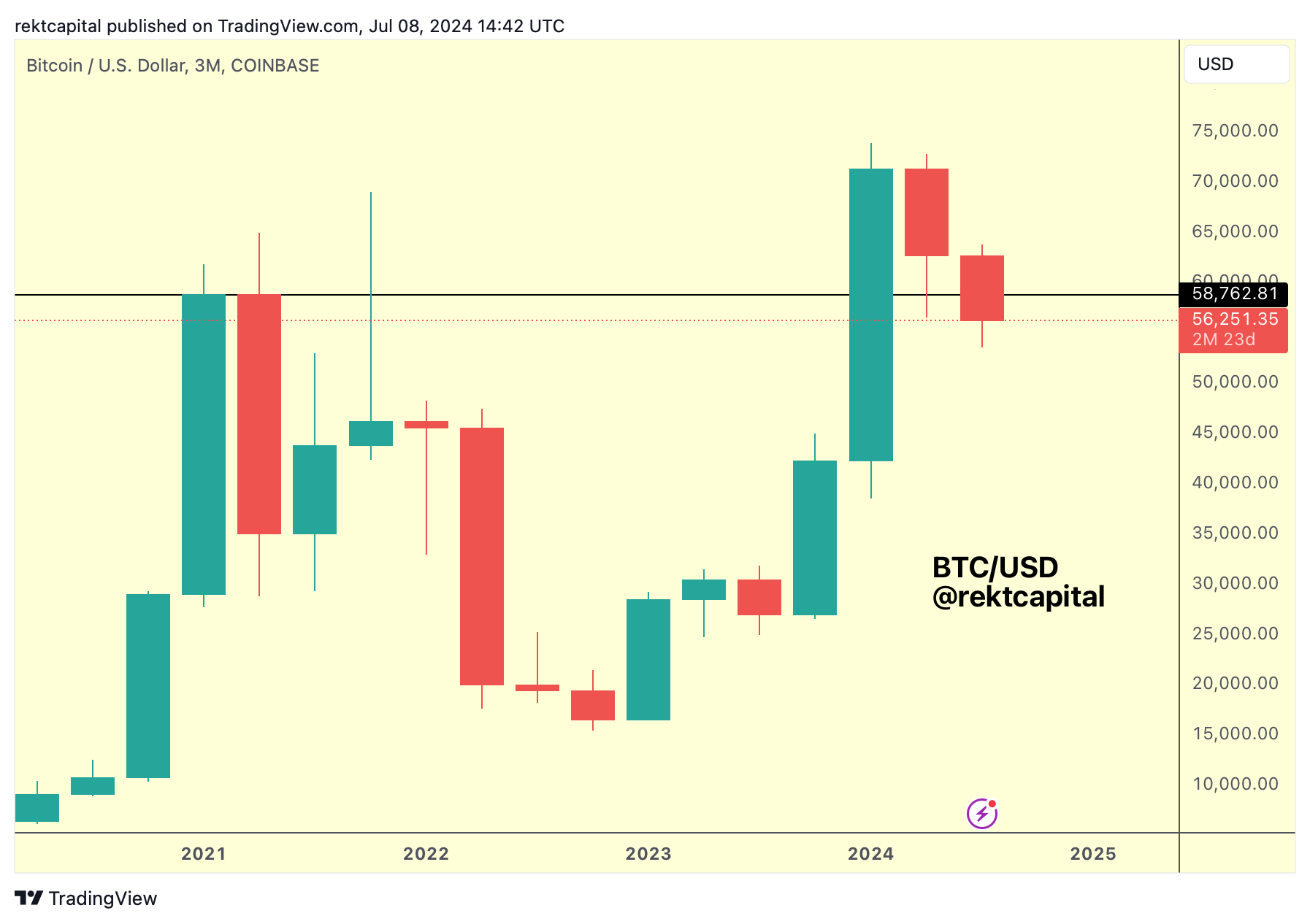

Not to mention the Quarterly timeframe where BTC is doing much of the same, effectively trying to retest the old All Time High major resistance on the Quarterly as new support:

Last Quarter, BTC successfully retested this level as support and now this Quarter it is trying much of the same, though evidently needs to go a little bit deeper to grab liquidity.

However, we are only 8 days into the current Quarter so while BTC has pulled back over the previous days, price still has over 2.5 months left until this pivotal Quarterly close is in; in the meantime, this could be just a volatile retest.