Altcoin Market Update

Features analysis on Altcoins such as ETH DOGE UNI THETA VET CRO KNC

Welcome back to the Rekt Capital Newsletter.

In today’s edition of the Rekt Capital Newsletter, the following cryptocurrencies will be analysed & discussed:

- Ethereum (ETH)

- Dogecoin (DOGE)

- UniSwap (UNI)

- Theta Token (THETA)

- VeChain (VET)

- Crypto Com (CRO)

- Kyber Network (KNC)

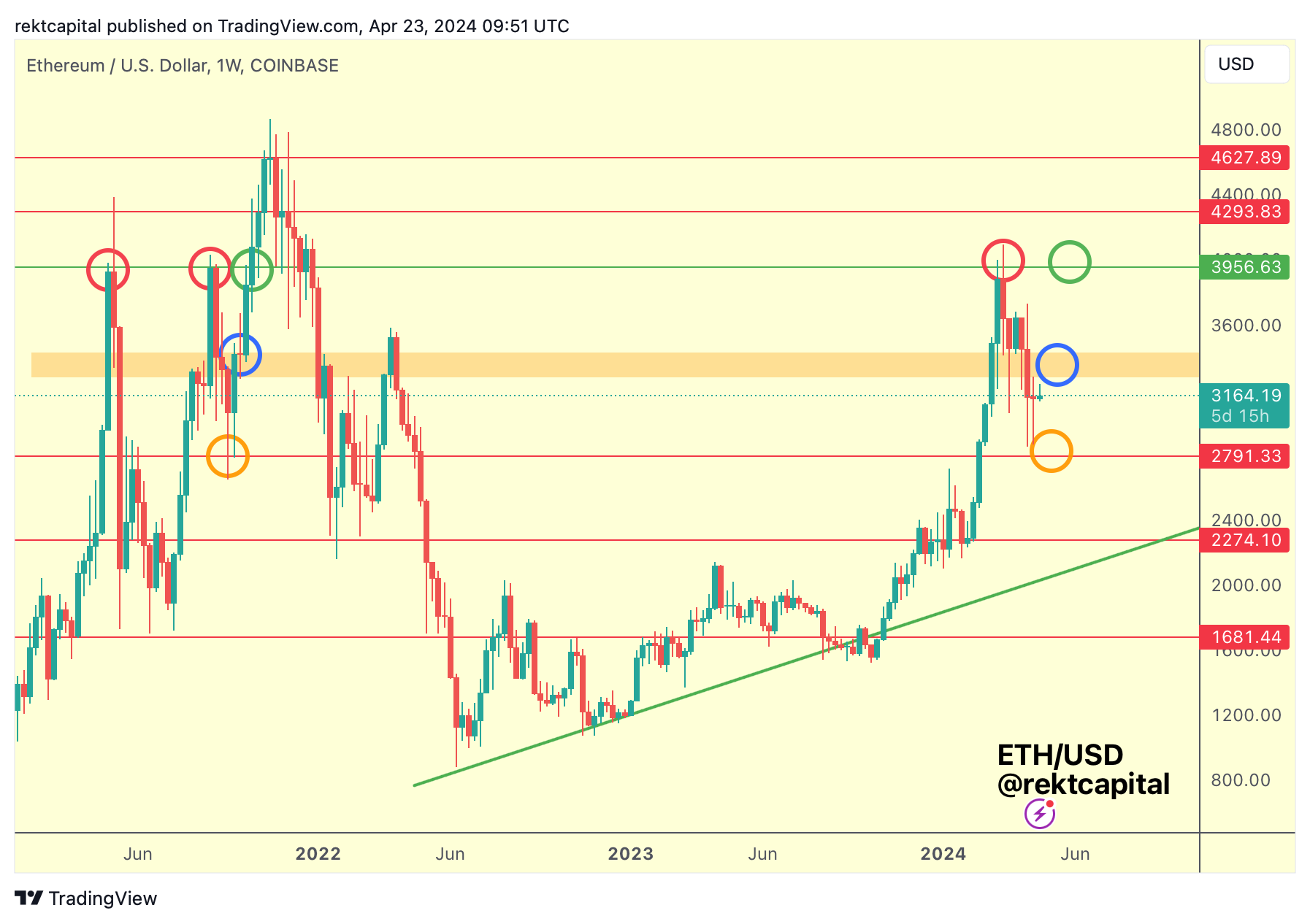

Ethereum - ETH/USD

Two weeks ago, Ethereum Weekly Closed below the orange area, beginning the first step to confirming the breakdown process from this old support.

And over the past two weeks, ETH has been downside wicking into the $2791 (orange circled) support level but has been rejecting from the orange box area which now may be figuring as resistance.

Essentially, ETH has broken-down into the $2791-$3300 range, with the orange circled area being the Range Low support and the orange boxed region acting as the Range High resistance.

Right now, ETH is at the very top of the range but struggling to break beyond it, which will always predispose price to a bearish bias; that is, as long as this orange boxed area continues to act as resistance, then there will always be a chance ETH could drop lower into this aforementioned range.

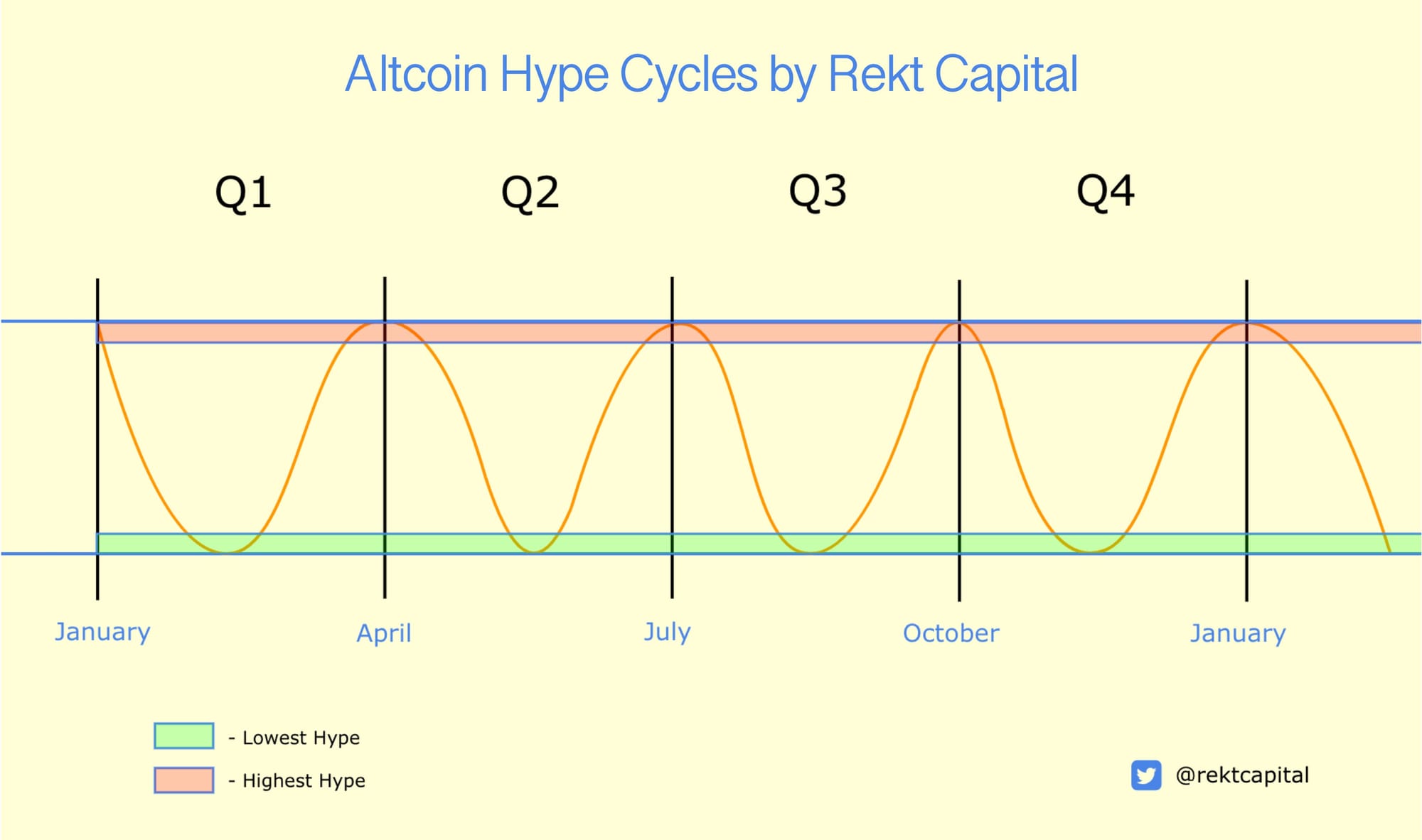

The Halving has historically been a bearish event for the Altcoin Market and this is even accentuated more so by the Altcoin Hype Cycle theory:

The hype still needs to dissipate after a fantastic Q1 and whether that means that ETH's price needs to continue to dwindle within this range and consolidate here, perhaps that is what the upcoming weeks may hold for crypto's second biggest asset by market cap.

However, this also means that Altcoins should bottom out on their retraces in the coming several weeks in preparation for the new Q2 Altcoin Hype Cycle.

This would translate into Altcoin bottoming in as early as mid-May, more realistically end of May, early June.

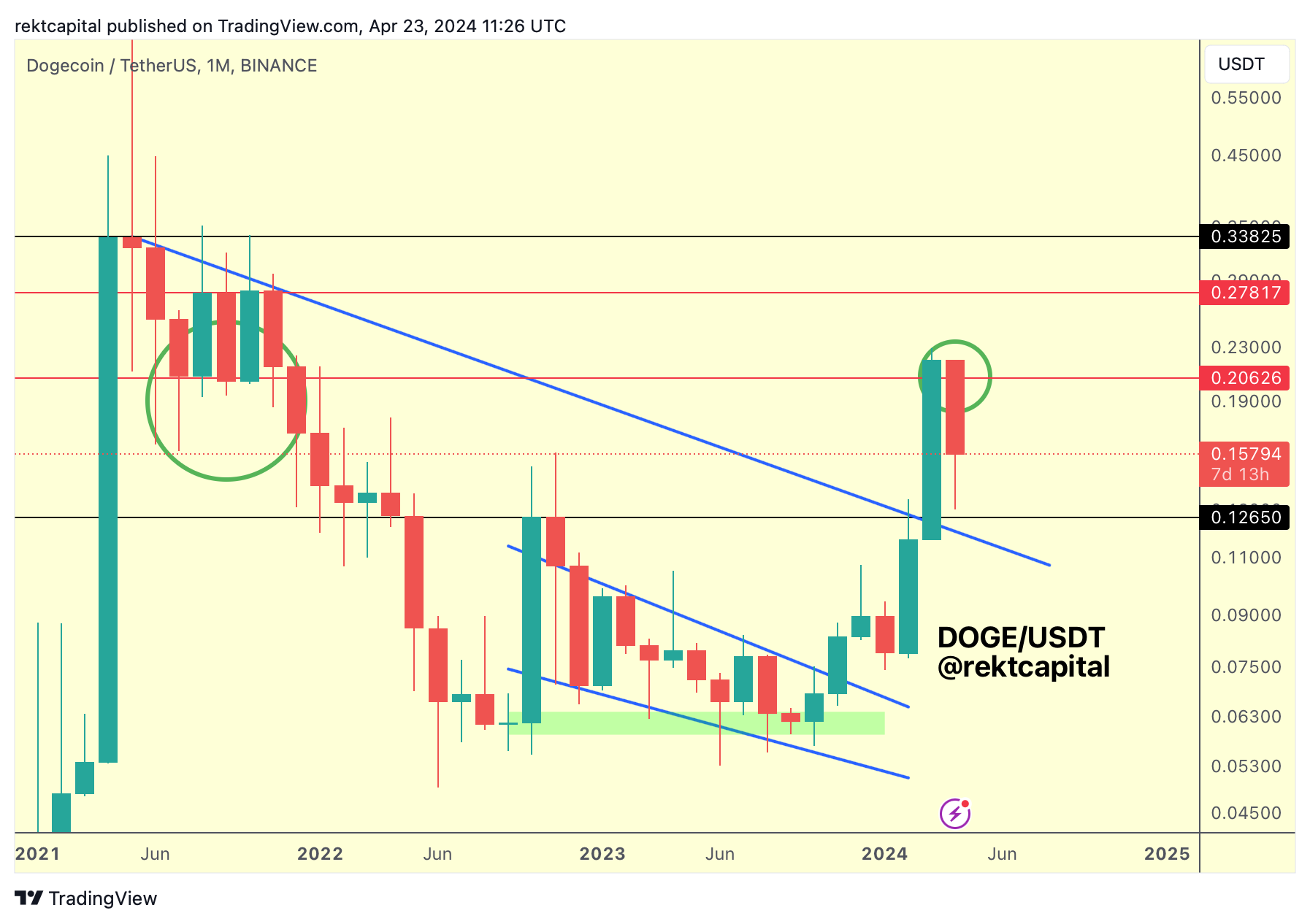

Dogecoin - DOGE/USDT

We know that DOGE has failed its Monthly retest of the red $0.20 level and dropped back down into a confluent support area that is the Range Low of $0.12 and the Macro Downtrend that price broke out from last month.

DOGE has dropped into the Range and though there is still time for price to technically recover about the Range High, the chances for that occurring look slim.

It looks like DOGE will be sentenced to consolidating inside this black-red range for the time being, with the Range Low area providing the best bargain opportunity.

The Weekly showcases that the Range Low is acting as a strong support and has been doing so for the past several weeks:

On the Weekly, many downside wicks into the Range Low and Macro Downed have occurred, indicating strong buy-side interest in that confluent area of support.

This buy-side pressure at the Range Low has enabled for DOGE to reclaim the bottom of the Bull Flag it had broken out from many weeks ago.

Losing this old Bull Flag bottom would see DOGE drop closer into the Range Low area but for a loss of this level to even occur, DOGE would need to Weekly Close below the Bull Flag bottom.

That hasn't occurred.

But one scenario to keep an eye on is a potential Head and Shoulders formation developing here:

If DOGE were to soon rebound from old Bull Flag bottom to old Bull Flag top but reject to form a Right Shoulder, then a loss of the old Bull Flag bottom (i.e. Neckline) could enable this H&S formation and see price drop into the Range Low but this time as candle-bodies rather than wicks.

Breaking beyond the Bull Flag Top would invalidate this H&S formation, whereas losing the Bull Flag Bottom (neckline) after rejecting from the Bull Flag Top would validate it.