Altcoin Market Update #104

Features analysis on Altcoins such as AERO TAO PHA SPX GIGA POPCAT

Hello and welcome back to the Rekt Capital Newsletter

In today’s edition, the following cryptocurrencies will be analysed & discussed:

- Aerodrome Finance (AERO)

- Bittensor (TAO)

- Phala (PHA)

- SPX6900 (SPX)

- Gigachad (GIGA)

- Popcat (POPCAT)

But before we dive in, this Friday I’ll chart your Altcoin picks in an exclusive subscriber-only TA newsletter and will cover as many as I can

So if you’d like to have an Altcoin charted, feel free to share max. two TA requests each in the comments below.

I’ll chart the Altcoins that get mentioned and ‘Liked’ the most

Click the button below to leave a comment with your TA request!

Let's dive in to today's Altcoin Market Update.

Aerodrome Finance - AERO/USDT

As a preface to today's analysis, let's recount the previous update shared here in the Rekt Capital Newsletter:

Here's today's update:

AERO successfully retested the green area in volatile fashion, actually Weekly Closing beneath the green area but ultimately reclaiming it in the end to rally via the blue path.

In following the blue path, AERO also Weekly Closed above the blue $0.71 level which positioned price for a move via the green path which is now in progress.

AERO has rallied +63% from the green area and +22% since following the green path.

Effectively, AERO simply needs to hold above $0.71 to maintain the blue-blue range of $0.71-$0.96 to predispose price for a move across the range entirely to conclude the green path altogether.

Technically, AERO is retesting the blue Range Low of $0.71 and a successful retest will see price bounce to the Range High of $0.96.

The retest is successful thus far, with price up +22% since that all-important reclaim.

Bittensor - TAO/USDT

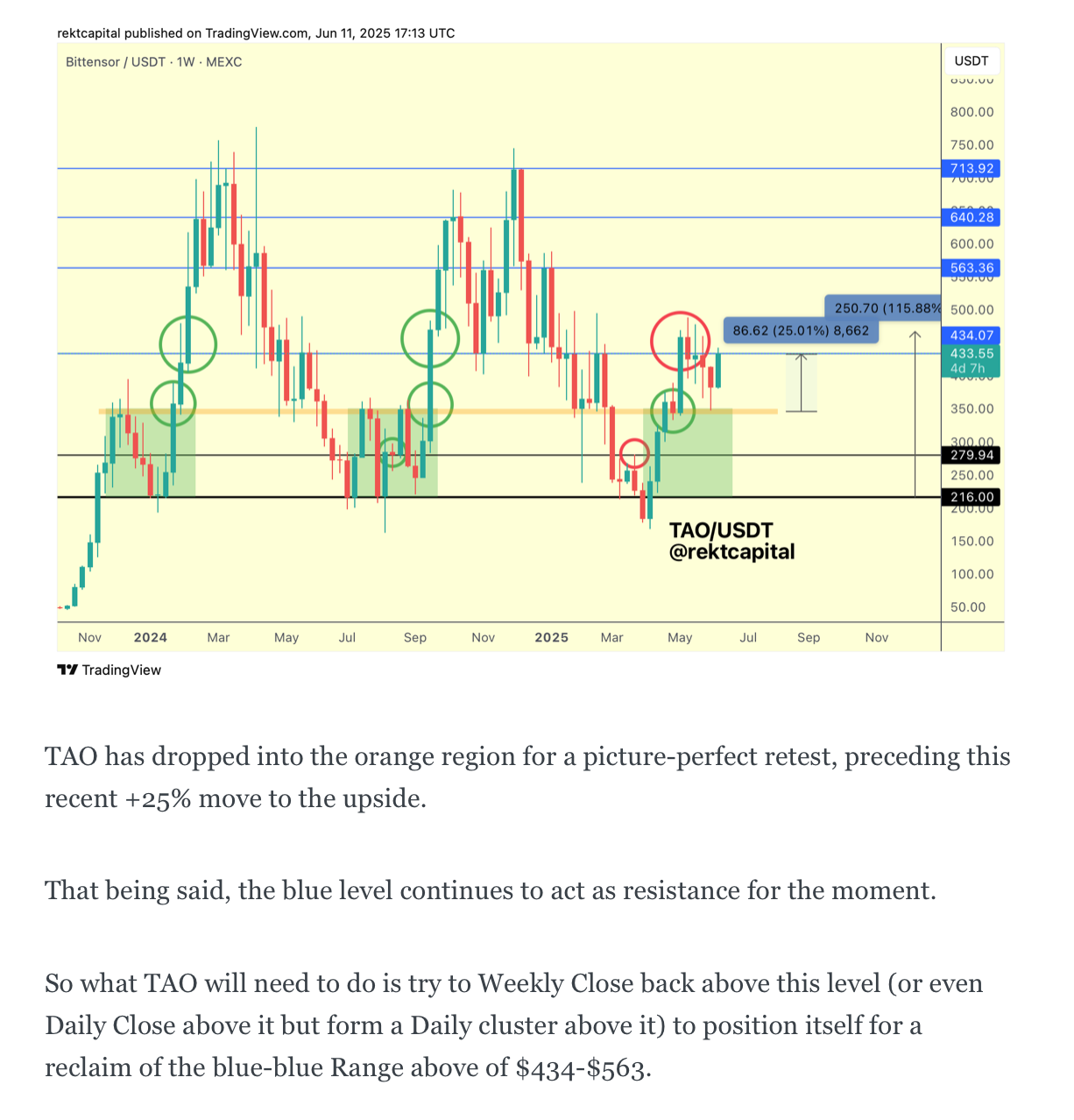

Here's last week's analysis on TAO:

And here's today's update:

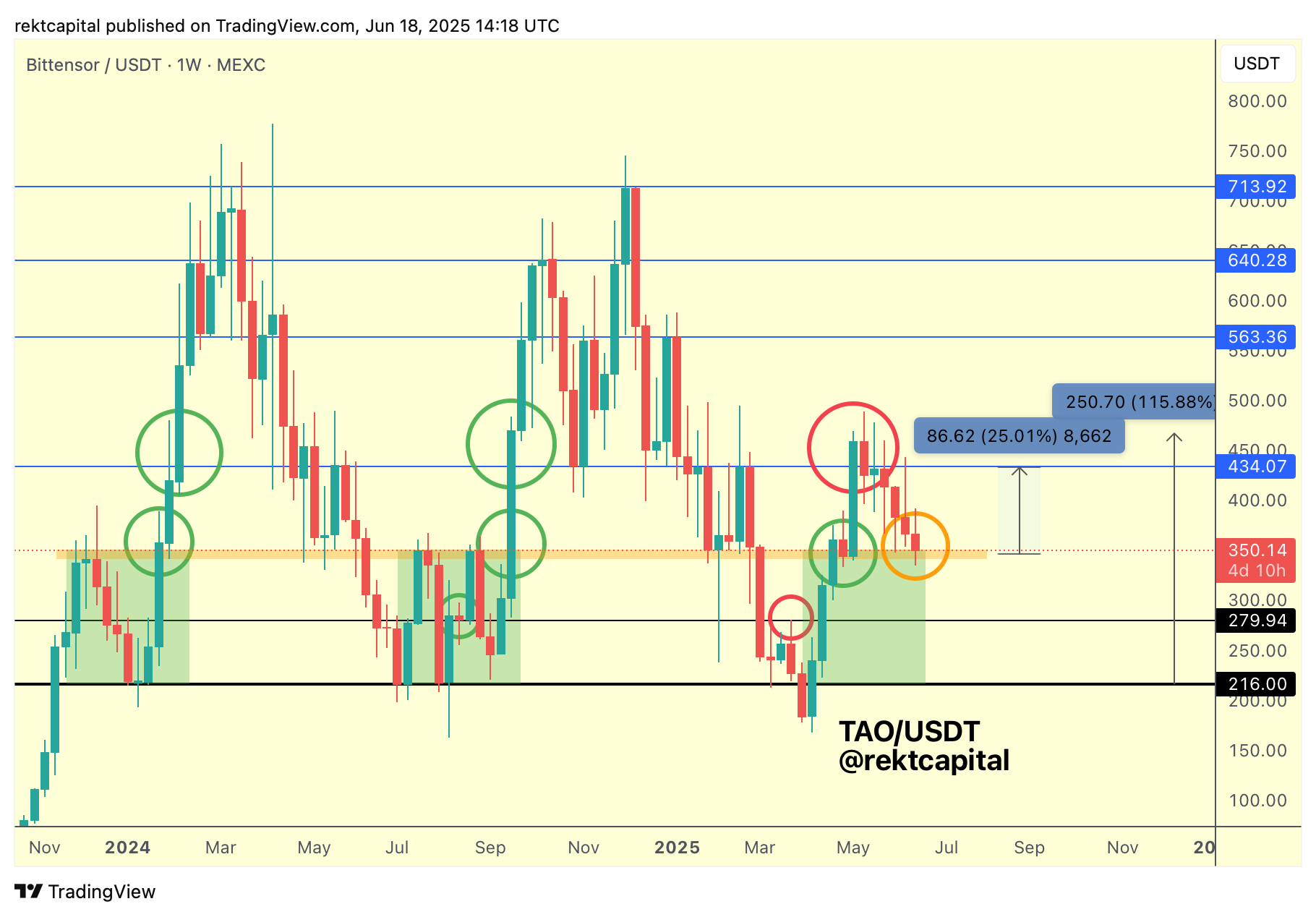

Much like many Altcoins as of late, TAO failed to Weekly Close above the blue $434 level; this level acted as resistance and in a moment when price needed to showcase strength, it instead demonstrated bearish confirmation and now ensuing downside continuation into the orange region.

This orange area has historically been a key retesting zone which has uplifted price across time, even as recently as this past April.

And once again, this is the area that need to hold strong for TAO to avoid further downside.

Generally, TAO is located inside this orange-blue range from $350-$434.

Successful retest here and TAO will be able to consolidate within this range further with a curl up to the Range High over time.

The worse case scenario however would be if TAO Daily Closed below the orange area and then turned it into new resistance as that has historically been a strong bearish sign that has seen price tumble into $216 on both occasions that this bearish confirmation took place.

When the market is dipping, it's easy to fall prey to bearish euphoria and immediately prepare for such levels but it's key to resist this emotional urge, especially since the orange area continues to hold as support and for as long as it does, then the orange-blue range will live on and the consolidation here will go on.